Maureen McCarthy is an ESG Analyst at ISS ESG, Institutional Shareholder Services, Inc. This post is based on her ISS memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) and Will Corporations Deliver Value to All Stakeholders?, both by Lucian A. Bebchuk and Roberto Tallarita; For Whom Corporate Leaders Bargain by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita (discussed on the Forum here); and Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy—A Reply to Professor Rock by Leo E. Strine, Jr. (discussed on the Forum here).

Key Takeaways

- Investor attention on sustainability issues has increased in recent years and shows no sign of abating.

- While the demand for ESG information is increasing, variation in the quality of data is a major headwind.

- Of over 7,000 ISS ESG-rated corporate entities, data indicates that the quality of most Sustainability Reporting is suboptimal, leaving stakeholders with opaque views of company performance.

- Sustainability Reporting will continue to improve, and should evolve to be standard business practice.

ESG and the New Normal

A common misconception about Environmental, Social and Governance (ESG) investment practice is that, along with the many other sustainability acronyms, it is a hot topic driven by the media. The terminology might be trending and evolving, but the fundamental convictions behind sustainable value, transparency, and accountability to stakeholders are the new business as usual.

Demand for ESG Disclosure and the related ecosystem has grown exponentially in recent years. The COVID-19 pandemic exacerbated social issues such as occupational health and safety and supply chain labor, and now urgent global disruptions are giving way to investors finding solutions to understand and catalyze corporate responsibility. Extra-financial measures are increasingly integrated into investor decision making; the number of investor PRI signatories has increased by 29% in the last year alone.

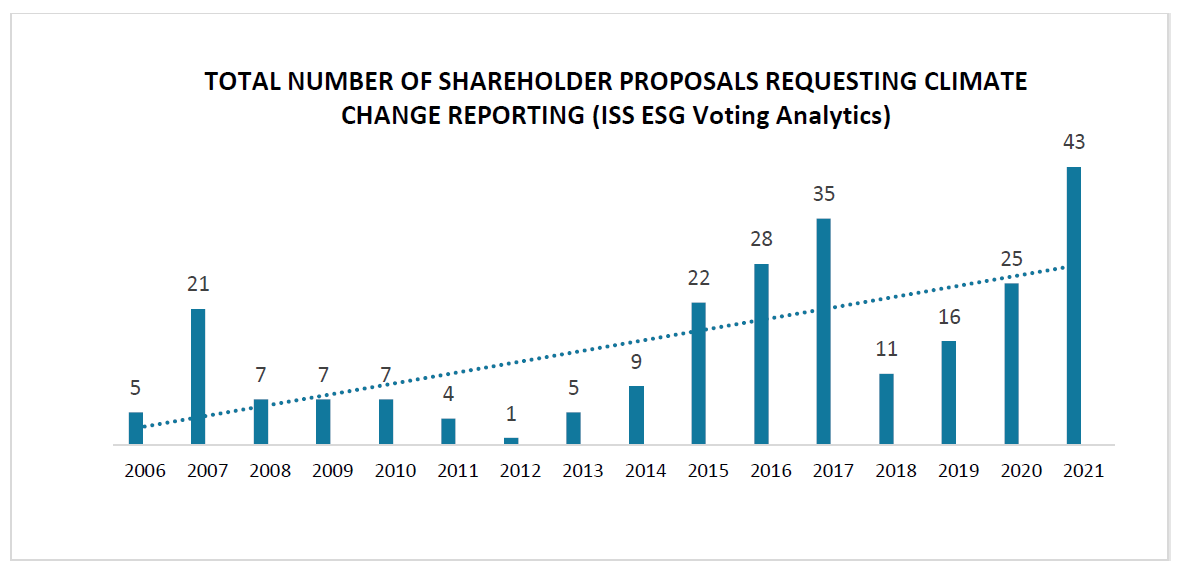

Since 2006, ISS ESG has seen an increase in shareholder proposals requesting that companies report their climate change performance. Institutional investors are seeing the connection between long- term business health and systematic management of ESG issues such as climate.

Source: ISS ESG Voting Analytics Data

While the appetite for ESG disclosure is strengthening, it is still held back, not least by a lack of high quality data.

Sustainability Reports allow issuers to communicate extra-financial measures and present themselves as responsible corporate citizens. They rarely provide a comprehensive picture of sustainability performance, however. Given the complex nature of societal issues such as climate change and human rights, companies are struggling to meet the needs of stakeholders while also positioning themselves as a sound investment.

What is the hold-up?

While investor interest in the ESG performance of companies continues to grow, the quality of disclosure remains one the biggest challenges. ESG disclosure faces multiple headwinds when investors seek to making an apples-to-apples comparison, including:

- variations in quality and comparability of data between companies;

- size and geography of a company, and the accompanying footprint;

- market maturity; and company leadership’s understanding of ESG materiality.

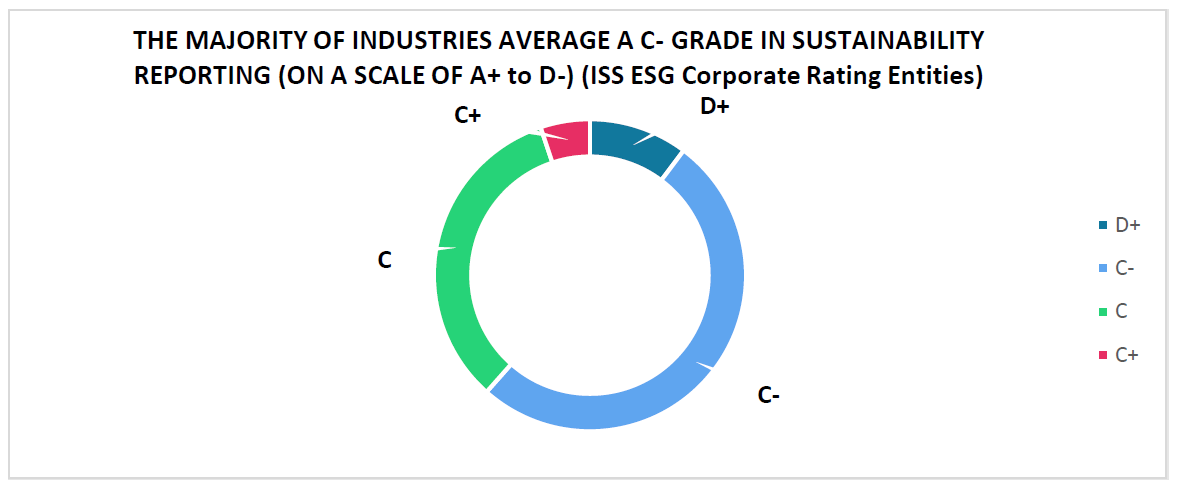

ISS ESG rates issuers not only on performance, but also on the quality of Sustainability Reporting itself. This includes whether the company discloses balanced information on both positive and negative impacts; the clarity of meaningful information provided; and the ability to compare data over time for trend assessments. Among the corporate entities rated by ISS ESG, more than half average a C- grade for Sustainability Reporting. According to the methodology, most reporting either does not cover enough material ESG topics, or is not sufficiently clear, balanced or comparable.

Source: ISS ESG Data

One of the most notable of findings in this review is the lack of high scores for reporting, namely any grade above a C+. The grading process for the Sustainability Reporting topic requires high standards to be met, including (among others):

- independent verification;

- balanced and comparable data; and

- transparency on negative impacts or controversies.

Companies tend to struggle to consistently address some of these key metrics for transparency. ESG reports tend to have a positive tone with pictures of trees or a blue sky with colorful charts. Yet they often lack important the details on quantitative measures, data, and policies to comprehensively manage ESG issues that would reassure investors that they are going to reap long-term benefits.

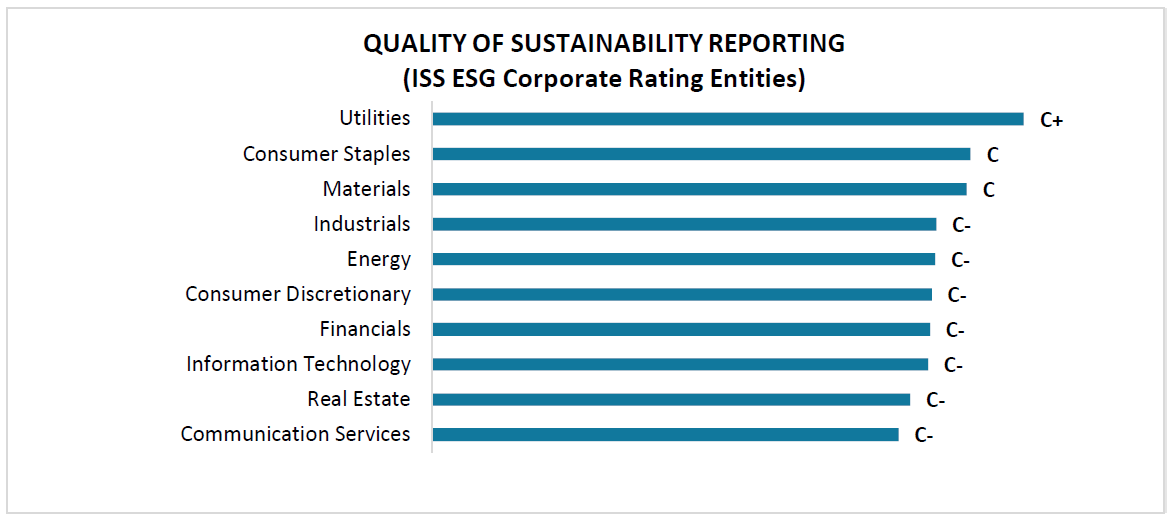

Industries with more tangible value chains such as Utilities and Materials tend to have higher quality sustainability reporting. This is likely due to a combination of issues such as regulatory oversight; public awareness of the connection between climate change and products or operations; and increased physical risk from climate change. Industries where the ecological footprint is further removed from operations, such as Financials and Information Technology, tend to disclose less or have lower quality reporting.

Source: ISS ESG Data

ISS ESG research revealed that across the combined Russell 1000 and S&P500, over 57% of companies are considered to be either not, or only partially, disclosing on the global initiative the Task Force on Climate-Related Financial Disclosures (TCFD). Given the TCFD has been in place for over five years now, it is disappointing to see a continued lack of disclosure in this critical area.

The state of sustainability reporting today is suboptimal. While there is undoubtedly increased engagement on the topic, the information being reported by companies frequently omits coverage of key information. Without these metrics, sustainability reports will not give stakeholders a holistic view of a company’s ESG impacts and performance.

Where to for sustainability reporting?

With COVID-19 still threatening the health of the global population, stakeholders and clients are starting to pay more attention to social issues, namely racial inequality and human rights. In a survey posed by ISS to institutional investors, 44% of respondents expected extra attention to be paid to workplace safety, diversity and inclusion, and supply chain labor. Companies are also beginning to tie sustainability targets to executive compensation (as set out in Topic 10 of this year’s Volatile Transitions: Navigating ESG in 2021 paper), which is likely to result in increased accountability.

Meanwhile, the ESG ecosystem is moving toward greater harmonization on the topic of disclosure. Efforts to collaborate between frameworks could result in more standardized reporting practices and therefore improved comparability of data. Consolidation such as that between the SASB and IIRC initiatives will result in a more unified approach to materiality and value creation.

While disclosure, data availability and standardization can and should be further improved, research solutions exist today to help investors make meaningful assessments that inform sustainability- related decision making. To make the most of these solutions, however, investors will need to keep up the pressure through increased engagement. Other stakeholders such as regulators also bear the responsibility of requiring increased transparency, as ISS ESG’s Max Horster noted in his Chapter 1: It’s the Regulator, Stupid! of his paper A Little Less Conversation, A Little More Action: 10 lessons learned from 10 years of helping investors to tackle climate.

ESG is a work in progress. In order to improve, sustainability reporting and the surrounding ESG ecosystem will need to transform. New data standards and improved ESG frameworks could pave the way for a more integrated approach to transparency. In the lead up to the Conference of the Parties (COP) 26 meeting in Glasgow, world leaders are committing to increasingly stringent climate change measures, which will inevitably flow on to increased regulatory pressure on corporations. The need for genuine action on climate change has never been more urgent. As investors price these issues into their portfolio valuations, they will be sending a message to companies that managing and reporting on extra-financial measures is no longer a separate, nice-to-have competitive edge. Good disclosure is a key element in the integration of sustainability practices at all levels of business, operations, and products, and is therefore a key element in the coming generation of standard business practice.

Print

Print

One Comment

How do we balance financial reporting and wide corporate disclosure in an entity. I believe wide strategic disclosures could undermine ESG financial disclosures as most lack social appeal than strategic disclosures.