Rodolfo Araujo is a Senior Managing Director and Garrett Muzikowski is a Director in the Strategic Communications segment at FTI Consulting, Inc. This post is based on their FTI Consulting memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); Companies Should Maximize Shareholder Welfare Not Market Value by Oliver Hart and Luigi Zingales (discussed on the Forum here); and Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee by Max M. Schanzenbach and Robert H. Sitkoff (discussed on the Forum here).

Against a backdrop of pandemic- and climate-related concerns, ESG emerged as a top concern for today’s investors—and boards are being held accountable.

A tectonic shift in the focus toward environmental and social topics occurred during the 2021 proxy season, reflecting the importance for organizations to successfully manage environmental, social and governance (ESG) risks and opportunities. Large institutional investors not only backed environmental and social shareholder proposals like never before, but they also voted against the reelection of directors at portfolio companies where ESG management was perceived as ineffective. As a result, companies are beginning to feel a sense of urgency in developing sound ESG programs that meet shareholders’ evolving expectations.

Investors Leading the Charge

ESG’s prominence among stakeholders is nothing new. Companies and their investors, employees, suppliers, customers, communities—along with nongovernmental organizations (NGOs) and regulators—have been analyzing ESG topics in some capacity for years. However, for many stakeholders, the past year served as a catalyst to hyper-focus on ESG-related topics. Organizations navigated a lot of uncharted territory since the onset of COVID-19: pandemic-related health concerns, civil unrest from social injustice, economic inequalities and climate change all amplified the importance of a well-run ESG program.

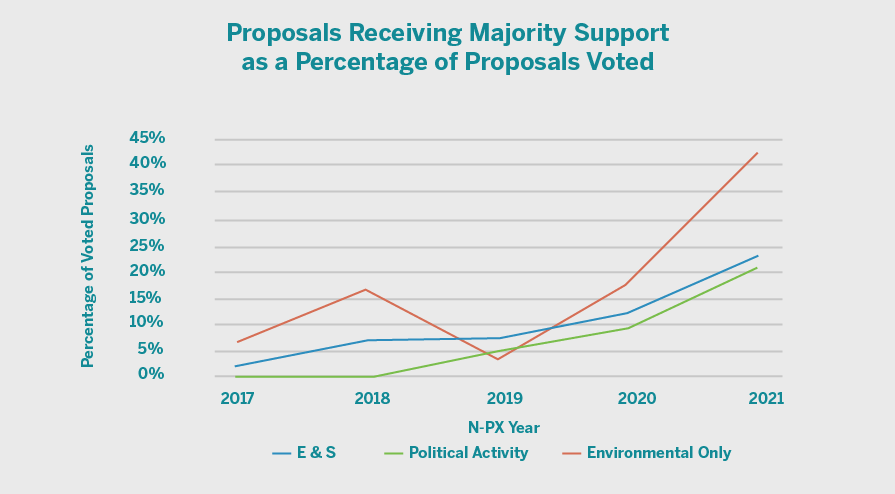

Out of all stakeholder groups, investors were arguably the ones to shift their attention most drastically toward ESG—applying significantly more pressure for change at their portfolio companies than in years past. This change is noticeable when looking at trends of environmental and social (E&S) shareholder proposals and the largest asset managers’ voting behavior. For example, 29 E&S shareholder proposals received majority support in this year’s proxy season, up nearly double from the 16 that received majority support the year prior. The 2021 proxy season saw nine political activity proposals pass; an additional five proposals related to climate lobbying passed. In 2020 only five political activity proposals passed, and a mere one related to climate lobbying. [1]

The increase in number of passed proposals was not the result of a sheer increase in proposals. In fact, there was a general decrease in the number of E&S proposals voted on over the past few years. More so, this is reflective of a change in investor behavior, especially when analyzing environmental issues. The graph below outlines the number of proposals that passed as a percentage of proposals that went to a vote: [2]

A factor contributing to the decrease in number of proposals voted on and increase in pass rates is the greater frequency with which filed shareholder proposals are being withdrawn from the ballot. Companies are increasingly engaging with shareholder proponents to reach a compromise of some form on the proponent’s request in exchange for withdrawing the proposal.

As You Sow’s Resolutions Tracker serves as a strong example of this. Excluding blocked proposals by the company at the SEC and proposals at AGMs yet to take place, As You Sow has filed 71 shareholder proposals in 2021—but only 22 have made it to vote. As You Sow has withdrawn 49 proposals in 2021 and indicated that an agreement was reached on 42 of these proposals, compared to 13 in 2018. This represents reaching an agreement on 59 percent of proposals that were not blocked in 2021, compared to 37 percent in 2018.

Most Influential Asset Managers Behind This Trend

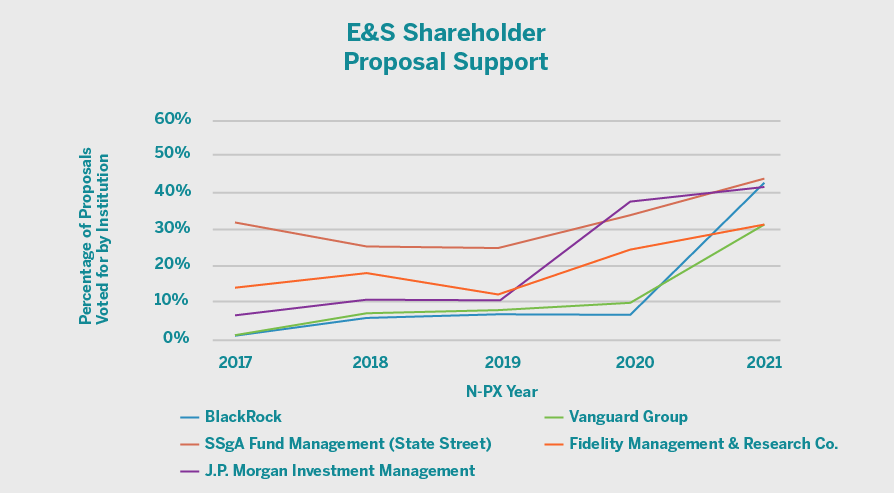

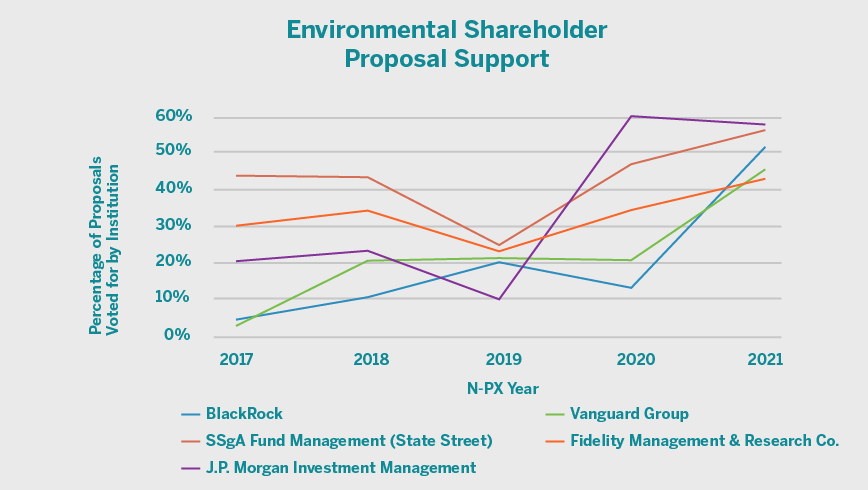

Investors, especially large passive investors with long-term investment horizons, have recognized the importance of successful ESG management at their portfolio companies. Their stewardship teams’ external communications and evolving engagement priorities have reflected such focus. Still, some of the world’s largest asset managers have faced criticism for not consistently supporting E&S shareholder proposals or managing climate change–related risks.

This past proxy season served as a tipping point for investors when looking at newly available 2021 proxy season [3] voting behavior at the largest asset managers. Whether caused by the aforementioned global events, pressure from critics or other factors, large asset managers significantly increased their support levels for E&S shareholder proposals this past proxy season, which in turn increased the average support level of these proposals:

Board Accountability on ESG Issues Is Here to Stay

Beyond specifically voting on shareholder proposals, investors are beginning to vote against directors for poor ESG oversight. For example, during the 2021 proxy season, BlackRock voted against 255 directors for climate-related concerns, according to their Voting Spotlight. Other investors also took this approach, in addition to voting against directors for issues at the board level, like voting against directors for a lack of racial/ethnic or gender diversity.

BlackRock’s approach to board accountability in the 2021 proxy season was not an anomaly, but rather evidence of a tipping point in how asset managers are evolving their approach to board accountability on E&S topics. Further, a stronger stance on ESG issues has provided a competitive edge to asset managers. Investors are increasingly looking for asset managers whose investment and stewardship strategies align with their personal interests, beliefs and work to address broader societal challenges. The money invested in ESG funds more than doubled in 2020 and is expected to reach $1 trillion by 2030.

Asset managers who have led the push for portfolio companies to successfully manage E&S topics are now able to market themselves as aligned with shifting investor interests and responsible stewards of capital. Given this scenario, competition for funds and the fear of being an outlier among peers will likely continue to drive investors to support stronger ESG management at their portfolio companies.

Don’t Forget About Activists

For activist investors, including ESG demands can increase the likelihood of a successful campaign through multiple channels. Large asset managers made the importance of ESG clear, so any well-structured activist campaign that highlights ESG failures as part of the rationale for board refreshment will immediately resonate with large investors to some degree.

Beyond this, society’s focus on environmental and social topics is another medium for an activist’s campaign to gain momentum. For example, this year’s Engine No. 1 campaign against ExxonMobil was widely covered in the media, oftentimes with little effort by the activist fund itself. Political organizations, NGOs and other investors that agreed with Engine No. 1’s views on climate change were often discussing the campaign, which put added pressure on investors to vote on the dissident slate.

Activists’ inclusion of ESG into campaigns is likely to become more frequent—and why wouldn’t it? At its worst, an activist is simply throwing one more argument for board refreshment against a target company and hoping it sticks. At its best, incorporating ESG into activist campaigns can provide free advertising and win over large, long-term-focused investors who are needed to successfully win a proxy contest.

Stay Ahead of the Curve

The 2021 proxy season was a tipping point for ESG, and asset managers’ message was loud and clear: Any company that is not staying ahead of the ESG curve will face additional shareholder scrutiny. Further, shareholders consider poor ESG programs reflective of poor oversight at the board level and poor risk management techniques.

Endnotes

1Data available from Proxy Insights, 2021(go back)

2Data collected from Proxy Insight reports by FTI Consulting was used to produce the information contained in the three graphs in this article.(go back)

3Proxy season recognized here as the N-XP year which in 2021 accounts for the votes cast between July 1st 2020 and June 30th 2021.(go back)

Print

Print