Jason Frankl and Brian Kushner are Senior Managing Directors at FTI Consulting. This post is based on their FTI Consulting memorandum. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

Intro and Market Update

Despite the continued fluctuation of COVID-19 cases and emergence of variants, the world does seem to be returning to some semblance of normalcy. Vaccinations and testing have allowed for increased travel and a return to the office for many, including FTI’s New York City colleagues. In addition, consumer spending increased by ~0.4% from Q2 to Q3 and we witnessed strong market performance from early-July to the beginning of September. [1] In recent months, the U.S. equity markets reverted back to the winners of the initial COVID era with large-cap equities outperforming both mid- and small-cap equities and growth equities outperforming value equities. [2] [3] While year-over-year inflation reached a 30-year high of 6.2% in October and supply chain disruption worries shook investor confidence, the major indices remained resilient through the third quarter, though they have come under pressure following the emergence of the Omicron variant. [4] [5] Year-to-date through November 30th, the S&P 500 Index had returned 21.6%, while the Nasdaq Composite Index and the Dow Jones Industrial Average had returned 20.6% and 12.7%, respectively. [6]

Corporate profits have been a key catalyst for the continued strength of the equity markets; the S&P 500 Index reported the third highest year-over-year growth in earnings since Q2 2010 at 41.6%, far above the pre-pandemic Q3 2019 growth rate of -2.2%. [7] Small-cap equities, measured by the Russell 2000 Index, also demonstrated earnings strength with forward EPS forecasts reaching five-year highs. [8]

Year-to-Date Performance (2021) [9]

Activism Update

With robust fundamentals and inexpensive capital as a backdrop, third quarter M&A activity in the U.S. remained strong, though slowing from the frenzied pace of deal-making seen in the first half of the year. When compared to Q3 2020, deal volume in Q3 2021 remained steady, while deal value increased 38% year-over-year, amounting to $609.8 billion and was driven largely by deals in the range of $5 to $10 billion. [10] Lazard reported that scuttling or sweetening M&A deals remained a frequent tactic of activist investors and represented 53% of M&A-related activism activity in the first three quarters of the year. [11] There was also a resurgence in Special Purpose Acquisition Company (“SPAC”) activity, following a reduction in the second quarter of 2021. In the U.S. alone, there were 88 SPAC issuances, which raised $16 billion for targeted investing in Q3 2021, an increase of 38% in volume and 28% in value over the previous quarter. [12]

Continuing a trend seen in Q2 2021, the third quarter experienced a slowdown in activist activity relative to historical quarterly activity. Within the U.S., 11 campaigns were launched in the third quarter, compared to 52 campaigns in the first half of the year; the third-quarter has historically been seasonally-slow, with an average dating back to 2017 of 17 campaigns launched per third quarter. [13] However, total capital deployed did increase by nearly 78% from $2.7 billion in Q2 2021 to $4.8 billion in Q3 2021. [14] At the end of the third quarter, brand-name activist investors began to make noise, with some funds shifting focus to foreign targets. Elliott Management and Starboard Value both took stakes in Willis Towers Watson at the end of September; in November, the Company announced that it would replace four of its non-executive directors following discussions with Elliott. [15] Further, Third Point Partners initiated three new campaigns within two weeks at the end of October and beginning of November (Royal Dutch Shell, Ventyx Biosciences and Richemont). [16]

Through the third quarter, shareholder activism in the United States comprised 54% of campaigns launched globally, mainly focused on targets with less than $5.0 billion in market cap (71% of total campaigns) and with an emphasis on the technology, industrials, and financial services sectors. Notably, targets within financial services represented 16% of all capital deployed in U.S. by activists year-to-date, well above the 4% historical average for the sector. [17] It is possible this increase is related to the Federal Reserve’s relaxation of restrictions regarding activist investing in the financial industry. [18]

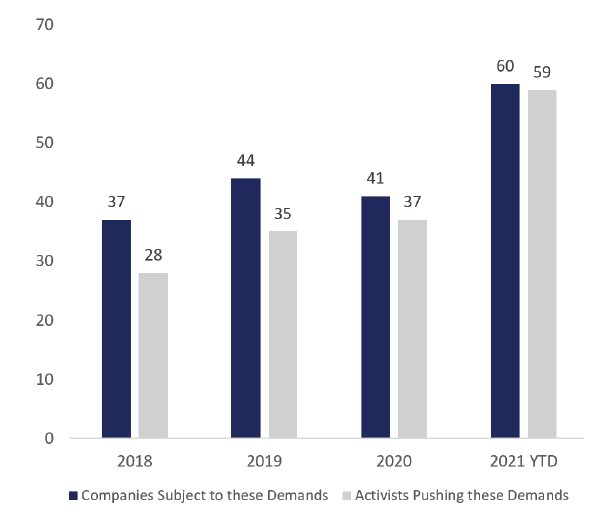

Another trend witnessed in the third quarter, and throughout 2021, was the uptick in ESG-related activist interest. Activist Insight data shows that 61 companies across the globe have been subject to “Climate Change & GHG Emissions” demands, and 60 activists have pushed these resolutions, both of which represent all-time highs. [19] Such resolutions include the desire for greater disclosure of climate plan reporting, setting of greenhouse gas reduction goals, and demonstrations regarding how a company’s business model is compatible with a net zero economy. [20]

Climate Change & GHG Emissions Demands [21]

In a recent development that is likely to dramatically affect the activism industry, the Securities and Exchange Commission (“SEC”) has adopted a new rule for proxy contest voting, which will go into effect in September 2022. Through a universal proxy card, shareholders will now have the power to “pick and choose” their preferred combination of nominated directors, regardless of whether they are physically present at the meeting, from a menu of company-nominated and dissident-nominated directors. With the new rule, the SEC did not impose minimum ownership requirements for shareholders to nominate a dissident slate. [22]

Regional Bank Activism

Regional banks have been a driving factor in the uptick in Financial Services activism throughout 2021. The industry has come into focus this year following a significant regulatory change in the second half of 2020, which relaxed restrictions on activist investors targeting banks. Prior to the 2020 changes, the legislation in question (the Bank Holding Company Act), placed considerable “passivity” restrictions on investors owning more than a 5% position in a banking company, as related to board nomination and representation, and proxy solicitation. The new rule increased the level of ownership of voting stock that is presumed to be noncontrolling to 10%. It largely eliminated restrictions on an investor’s ability to solicit proxies in opposition to management, the number of investor representatives allowed on the board of directors, as well as on the representatives’ ability to serve as the chairman of the board or of a board committee. Following the change, activist investors will be allowed to make larger investments in, and exert greater influence on, banking companies. [23]

Two funds—Driver Management and Stilwell Value—have been particularly active in campaigns against regional and community banks, targeting three and two banks this year, respectively. Both activist funds have launched one proxy contest since the rule change, in which they initiated positions greater than 5% and solicited proxies for a director in opposition to the management slate. Beyond the two aforementioned proxy contests launched by Driver Management and Stilwell Value, there have been two additional proxy contests launched against the regional banks through September 2021. Comparatively, there were only two proxy contests launched against the regional bank industry from the beginning of 2019 to the end of 2020. [24]

Given a longstanding trend toward consolidation within the banking industry, a “push to sale” thesis often has been embraced by activists. Considering the similarities in operating models and corporate strategies across regional banks, we suspect the industry will remain in focus for activist investors.

Sustainability Policies & Credit Risk

In a recent Moody’s report, researchers outline a connection between a delay in the implementation of environmentally sustainable policies and an increase in the probability of default. [25] As the evaluation of company-level environmental sustainability continues to become intertwined with long-term business strategy, the link between environmental policy and disclosures and credit risk may hurt a company’s valuation and therefore increase its vulnerability to engagement with activist shareholders. Increased borrowing costs stemming from potential credit rating downgrades due to lack of environmental disclosures, eat into cash flows and increase the total cost of capital, both of which negatively impact firm value.

When combining a tangible effect on cost of capital with the level of focus from major institutional investors like BlackRock and Vanguard, as well as the sizable increase in funds managed with a specific ESG mandate, environmental disclosures and net-zero strategies may be an obvious lever for outside shareholders to pull in the presence of management inaction. In recent months, this has taken place within the energy sector, as supermajor energy producers ExxonMobil and Royal Dutch Shell were both targeted by activist investors who referred to the added risks and valuation impacts in their campaign theses. [26]

Engine No. 1, in its ExxonMobil investor presentation from May 2021, cites the market’s view of the industry’s medium to long-term risks as a contributor to increases in cost of capital and a drag on company performance. [27] Similarly, Royal Dutch Shell faces pressure from activist Third Point to separate its legacy oil & gas business from its natural gas & renewables business, partially because of the major differences in cost of capital between the two segments. [28] Engine No. 1 was successful in its attempt to gain board seats at ExxonMobil, in large part due to support earned from BlackRock and others, while it remains to be seen what comes of Third Point’s engagement with Royal Dutch Shell.

It may be easy to believe that this blend of environmental and financial activism is limited to the energy sector and its peripherals. However, as the Moody’s report indicates, this may be a harbinger for interest in other areas as the risks begin to permeate the broader economy. As the race to a carbon neutral economy heats up, those without clear strategies to get there could end up leaving the door open for others to drive that strategy for them.

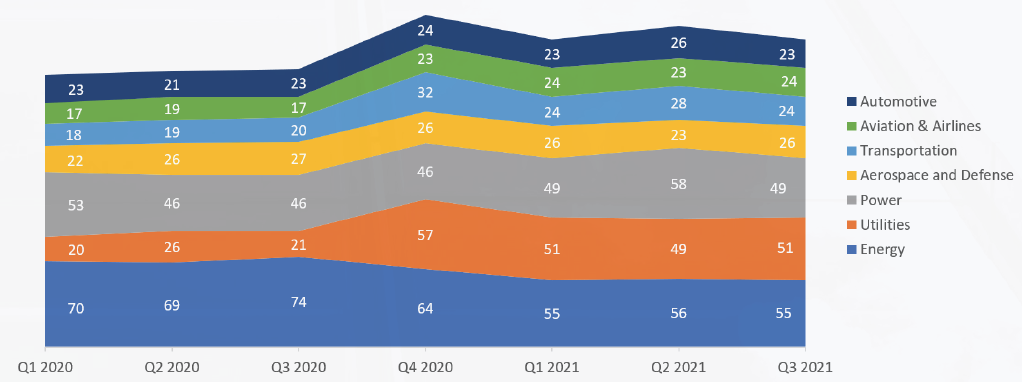

FTI tracked the number of companies with a vulnerability score above 50 in several relevant, oil-intensive industries. For the majority of these industries, we found that our Activism Vulnerability Screener had captured an increasing number of vulnerable companies. Not all oil-intensive industries experienced this trend, however, with both the Energy and Power industries witnessing a decrease in the number of vulnerable companies, falling by 15 and 4 companies, respectively. Since Q1 2020, the number of companies which have received a vulnerability score above 50 has increased from 223 companies to 252 companies.

Notably, this graphic represents only the most vulnerable companies within a given industry and should be viewed in isolation of broader industry vulnerability scores and trends discussed below.

Evolution of Vulnerable Companies in Oil-Intensive Industries

Q3 2021’s Most Vulnerable Industries

The table below shows the Total Vulnerability Scores for the 36 industries:

| Rank | ▲ Rank QoQ | FTI Industry | Q3 2021 Vulnerability Score | Q2 2021 Vulnerability Score |

|---|---|---|---|---|

| 1 | ▲ 2 | Utilities | 63.51 | 58.38 |

| 2 | ▼ 1 | Aviation & Airlines | 59.46 | 60.25 |

| 3 | ▼ 1 | Media & Publishing | 58.78 | 59.68 |

| 4 | ▲ 4 | Savings Banks | 58.05 | 54.85 |

| 5 | ▲ 5 | Aerospace and Defense | 57.48 | 54.27 |

| 6 | ▲ 7 | Insurance | 56.86 | 53.25 |

| 7 | ▼ 2 | Biotechnology | 56.15 | 56.08 |

| 8 | ▼ 2 | Regional Banks | 56.04 | 55.41 |

| 9 | ▲ 8 | Healthcare Services | 55.74 | 52.40 |

| 10 | ▲ 1 | Telecommunications | 55.67 | 54.20 |

| 11 | ▲ 5 | Pharmaceuticals | 54.88 | 52.95 |

| 12 | ▲ 2 | Restaurants | 54.82 | 53.21 |

| 13 | ▼ 9 | Power | 54.56 | 57.86 |

| 14 | ▲ 4 | Agriculture & Chemical Products | 54.49 | 52.30 |

| 15 | – | REITs | 54.26 | 53.02 |

| 16 | ▼ 9 | Automotive | 54.19 | 55.32 |

| 17 | ▼ 5 | Hospitality & Gaming | 52.59 | 54.19 |

| 18 | ▲ 3 | Consumer Non-Durables | 52.14 | 51.87 |

| 19 | ▲ 4 | Financial Conglomerates | 51.81 | 50.83 |

| 20 | – | Real Estate | 50.96 | 52.03 |

| 21 | ▼ 2 | Consumer Finance | 50.58 | 52.05 |

| 22 | ▲ 3 | Business Services | 50.50 | 50.46 |

| 23 | ▲ 6 | Banks | 50.29 | 47.74 |

| 24 | ▲ 3 | Construction | 49.97 | 49.53 |

| 25 | ▼ 1 | Chemicals | 49.11 | 50.56 |

| 26 | ▼ 4 | Transportation | 49.01 | 51.03 |

| 27 | ▲ 3 | Consumer Durables | 48.40 | 47.42 |

| 28 | – | Professional Services | 47.94 | 49.41 |

| 29 | ▼ 3 | Industrial Distributors | 47.83 | 49.76 |

| 30 | ▲ 1 | Industrial Equipment | 47.65 | 47.34 |

| 31 | ▲ 1 | Technology-Software | 46.84 | 46.01 |

| 32 | ▼ 23 | Energy | 45.91 | 54.71 |

| 33 | ▲ 1 | Life Sciences | 45.74 | 44.59 |

| 34 | ▼ 1 | Investment Managers | 44.73 | 45.37 |

| 35 | – | Mining | 42.85 | 44.06 |

| 36 | – | Technology-Hardware | 41.39 | 42.91 |

After a one-quarter reprieve, the Utilities industry reclaimed the title of most vulnerable industry to shareholder activism, as defined by FTI’s Activism Vulnerability Screener. Prominent activists including Elliott Management and Carl Icahn returned to the industry, launching (or relaunching) campaigns at Duke Energy and Southwest Gas Holdings, respectively. Both campaigns argued for a break-up and/or sale of current business units. [29] [30] The Insurance, Healthcare Services and Telecommunications industries all entered the top ten most vulnerable industries in the quarter; Healthcare Services experienced the largest increase in the vulnerability rankings for the quarter, moving up eight spots.

The Energy industry, on the other hand, experienced the largest decrease in the vulnerability rankings, moving lower by 23 spots. The S&P Energy Select Sector Index is the top performing sector index year-to-date by a significant margin, after a challenging 2020 in which it was the worst performing sector index. The Energy industry was adversely impacted by COVID-19 and the ensuing dampening of demand for oil. However, in 2021, the industry has benefited from a strong appreciation of oil prices.

Observations and Insights

Automotive & Electric Vehicles

“The automotive industry has been undergoing dramatic transformation, driven by several key mega-trends: (1) electrification, (2) autonomous driving, (3) connected vehicles, and (4) a significant increase in the software content in vehicles today. These mega-trends have shaken up the traditional automotive value chain and the potential revenue and profit pools that industry players are trying to capture. As a result, the term “Industry Players” today encompasses a much broader set of companies that just the traditional car makers (Automotive OEMs), component makers (Auto suppliers), dealers, and independent aftermarket players.

Today, in addition to these “traditional incumbents,” the “ecosystem” includes new (mature or startup) technology players in automotive software and most significantly, companies that are part of the transformation to Electrification and Electric Vehicles. This value chain includes players from upstream miners of battery materials (e.g., Lithium, Cobalt, Graphite), battery manufacturers, several new “pure EV” OEMs, charging networks, Big Tech companies, and a slew of startups, especially, in battery technology, EV manufacturing and charging/services.

This transformation has fueled two key trends. First, there is an abundance of invested capital being deployed to fund the developing EV value chain, coming from a variety of sources including government incentives, SPACs, traditional automotive company’s R&D budgets and private venture and growth equity. According to Reuters, EV makers are planning to spend collective $515 billion over the next five to 10 years to improve electric vehicles and EV-related technology, as well as expand battery and EV production around the world. This influx of capital has fueled euphoric levels of startup and SPAC activity throughout 2020 and 2021 that saw EV-related companies, public and private, balloon in value, and EV SPAC deals reach valuations of $24 billion.

Second, the rapid transformation has created a “valuation dichotomy” in which legacy automotive companies continue to be valued at historical levels, while most of the new players focusing on EV products, infrastructure and autonomous/ connected technologies have been valued at significantly higher multiples, reflecting the enormous potential growth trajectory. This is occurring despite many traditional incumbents possessing all of the right elements to compete for this growth, including software electrification capabilities and autonomous technologies on top of decades of automotive experience.

Investors in the automotive space must gauge the likelihood between incumbents successfully pivoting or the startup EV pure-plays successfully living up to their exponential growth requirements. Similar to the energy space, this could be a precursor to investor engagement with legacy companies requesting a hastening of that transition. Meanwhile for EV companies, drawing a parallel to another nascent space, could see investors agitating for consolidation as the top operators separate from the pack.”

—Neal Ganguli, Senior Managing Director and Todd Eddy, Managing Director; Automotive & Industrial Business Transformation Leaders

Advisor Spotlight: Wachtell, Lipton, Rosen & Katz

“Activist hedge funds—and institutional investors who choose to act like activists—have become increasingly emboldened and are developing new playbooks across industries for public company targets, building economic stakes in excess of their voting position and working with other investors and partners in new forms of wolfpacks. Despite a short dip at the outset of the pandemic, activism has rebounded and now continues at an ever-growing intensity, with companies under pressure to change their boards and management teams, launch sales processes, commence public reviews of their asset and business portfolio, capital return and allocation policies and to accelerate margin improvement plans, sometimes at the expense of growth and market share.

EESG (employee, environmental, social and governance) imperatives are now part of the activist toolkit too, but also provide opportunities for companies to play offense in solidifying relationships with major shareholders and key stakeholders and creating sustainable value. That being said, companies executing clearly articulated, updated and credible strategies and strong substantive approaches to corporate governance can prevail against an activist and, more importantly, avoid, defuse and resolve activism. Corporate playbooks for engaging with major and minor shareholders, including index funds, portfolio managers and stewardship teams, and deploying Investor Days need to be refreshed, and boards of directors are putting takeover defense, activism readiness and proactive governance reviews back on the agenda.

As long expected, the SEC has mandated new rules for proxy fights with the adoption of universal proxy cards, which was never before required in U.S. markets, and there are a few limits on abuse and misuse. In some cases, this may make it easier for activists to elect their candidates and increase what activists demand in settlements, and in other cases, companies may be able to use the new rule thoughtfully and move forward with less concern for the unintended consequences of the current system. Companies who face proxy fights however should expect that activists will not wait until 2023 to demand a universal proxy card, but will do so sooner, now that the SEC has given the green light, and boards and management teams should prepare accordingly.”

– Sabastian V. Niles, Partner—Shareholder Activism, M&A and Corporate / ESG Governance; Wachtell, Lipton, Rosen & Katz

What This Means

Despite a relatively slow quarter for activist engagement, the end of 2021 represents a pivotal moment for the activism industry as newly announced rules have the potential to change the game. In November, the SEC approved rules to require the use of universal proxy cards in proxy contests, beginning on September 1, 2022. Within the U.S. currently, both the management team and the dissident party are required to submit their own proxy card. Unless a shareholder is physically present at the contested meeting, the shareholder can only vote on one proxy card. As such, a shareholder may be unable to vote for the exact combination of directors that it prefers.

Under the new “universal proxy voting” rules, all director candidates (nominated by either the management team and the dissident party) will be presented on the same proxy card, which will allow any shareholder to vote for any combination of directors. The rule change represents a substantial shift of power towards shareholders and away from corporations, seemingly making it a simpler process for activist investors or their director nominees to be elected.

This change will likely require significant focus from activist investors, public corporations, and both activism and proxy advisors.

With the rise of shareholder activism, as well as the increased focus on the “G” of ESG, shareholder rights have evolved significantly over the past decade. Following the rule change, Amy Borrus of the Council of Institutional Investors said, “This should be called the investor-choice rule. This small but significant reform ensures that investors voting by proxy card—as the vast majority of institutional and individual investors do—can vote for whichever combination of director nominees they think best serves their interests.” [31]

Shareholders can now be more strategic in their selection of directors and truly elect the board that they feel will best guide a given company and its corporate strategy and oversight. We expect both the absolute number of proxy campaigns launched by activist shareholders and the number of directors appointed by activist shareholders to increase in the coming years.

Endnotes

1https://tradingeconomics.com/united-states/consumer-spending(go back)

2FactSet, Market Data as of November 30, 2021; FTI Analysis(go back)

3https://www.reuters.com/business/finance/growth-funds-among-q3-winners-us-investors-covid-worries-grew-2021-09-30/(go back)

4https://tradingeconomics.com/united-states/inflation-cpi(go back)

5https://www.bloomberg.com/news/articles/2021-08-25/the-world-economy-s-supply-chain-problem-keeps-getting-worse?sref=p5QwRxCz(go back)

6FactSet, Market Data as of November 30, 2021; FTI Analysis(go back)

7https://insight.factset.com/sp-500-earnings-season-update-october-29-2021(go back)

8https://www.ftserussell.com/research/russell-us-indexes-spotlight-report-third-quarter-2021(go back)

9FactSet, Market Data as of November 30, 2021; FTI Analysis(go back)

10https://www.cravath.com/a/web/bmp7hi7k8Ly1tcsKNhhGie/3e2FkF/manda-newsletter-cravath-quarterly-review-2021_q3.pdf(go back)

11https://www.lazard.com/media/451867/lazards-q3-2021-review-of-shareholder-activism.pdf(go back)

12https://www.cravath.com/a/web/bmp7hi7k8Ly1tcsKNhhGie/3e2FkF/manda-newsletter-cravath-quarterly-review-2021_q3.pdf(go back)

13https://www.lazard.com/media/451867/lazards-q3-2021-review-of-shareholder-activism.pdf; FTI Analysis(go back)

14https://www.lazard.com/media/451867/lazards-q3-2021-review-of-shareholder-activism.pdf(go back)

15https://www.wsj.com/articles/willis-towers-to-revamp-board-following-activist-pressure-11637240400(go back)

16https://www.activistinsight.com/members/ActivistTimelines.aspx?actid=72(go back)

17https://www.lazard.com/media/451867/lazards-q3-2021-review-of-shareholder-activism.pdf(go back)

18https://www.activistinsight.com/members/CampaignSummary.aspx(go back)

19https://www.activistinsight.com/members/CampaignSummary.aspx(go back)

20https://www.sec.gov/Archives/edgar/data/866787/000121465921011391/p1110214px14a6g.htm(go back)

21Activist Insight, Market Data as of November 11, 2021; FTI Analysis(go back)

22https://corpgov.law.harvard.edu/2021/11/19/sec-dramatically-changes-the-rules-for-proxy-contests/#more-141796(go back)

23https://www.natlawreview.com/article/federal-reserve-relaxation-restrictions-activist-bank-investors(go back)

24FactSet, Market Data as of November 18, 2021; FTI Analysis(go back)

25https://www.moodys.com/sites/products/ProductAttachments/Moodys_ReadyOrNot.pdf(go back)

26https://thirdpointlimited.com/wp-content/uploads/2021/10/Third-Point-Q3-2021-Investor-Letter-TPIL.pdf(go back)

27https://assets.contentstack.io/v3/assets/bltc7c628ccc85453af/bltab8cd50fae615bf1/6131f287504fe365615e557d/Engine-No.-1-Reenergize-ExxonMobil-Investor-Presentation.pdf(go back)

28https://thirdpointlimited.com/wp-content/uploads/2021/10/Third-Point-Q3-2021-Investor-Letter-TPIL.pdf(go back)

29https://www.activistinsight.com/members/ViewNews.aspx?mode=1&neid=41980(go back)

30https://www.activistinsight.com/members/CompanyNews.aspx?cmpid=13327(go back)

Print

Print