Kyle Isakower is Senior Vice President of Regulatory and Energy Policy at the American Council for Capital Formation. This post is based on his ACCF report.

Introduction

For nearly a decade, the U.S. Securities and Exchange Commission (SEC) has examined and considered various regulatory reforms around the widespread use and influence of proxy advisors, third-party arbiters whom institutional investors often rely on to determine how to exercise their voting authority amid the thousands of votes they cast each proxy season.

Responding to significant concerns raised by a wide variety of market participants around the accuracy and influence of proxy advisor recommendations over both management and shareholder proposals, the SEC under former Chairman Jay Clayton took a series of actions to provide greater oversight of proxy advisors after soliciting comment on and convening a roundtable on the proxy process.

Effective September 10, 2019, the Commission approved new guidance to investment advisers detailing their proxy voting responsibilities and confirming that it is their fiduciary duty to conduct due diligence with respect to their use of proxy advisors. On the same date, the Commission released additional guidance on the applicability of the proxy rules to proxy advisors, which interpreted proxy advisor recommendations as a “solicitation” and therefore subjected advisor recommendations to anti-fraud provisions in the SEC’s proxy rules.

In 2020, the SEC approved a formal rule on proxy advisors (Proxy Advisor Rule), codifying the SEC’s longstanding position that proxy advice is a “solicitation”, but exempting advisors from complying with those rules if they disclosed conflicts of interest and allowed companies the opportunity to review and respond to recommendations. At the same time, the Commission approved additional supplemental guidance to investment advisers directing them to review the new information that would be made easily available as a result of the rule.

Notwithstanding the SEC’s thorough examination of proxy advisors and bipartisan support in Congress for reform of the industry, new leadership at the SEC has since issued a proposed rule in November 2021 that would effectively gut the reforms included in the 2020 Proxy Advisor Rule. Without citing any specific evidence or data for why the rule should be amended, the SEC is proposing to do away with the requirement that proxy advisors provide public companies with an opportunity to review and comment on vote recommendations—which is the most important reform to improve upon the currently flawed process of relying on supplemental filings. The SEC also proposes to weaken some of the antifraud provisions included in the Proxy Advisor Rule that were intended to protect investors against false or misleading statements made by proxy advisory firms.

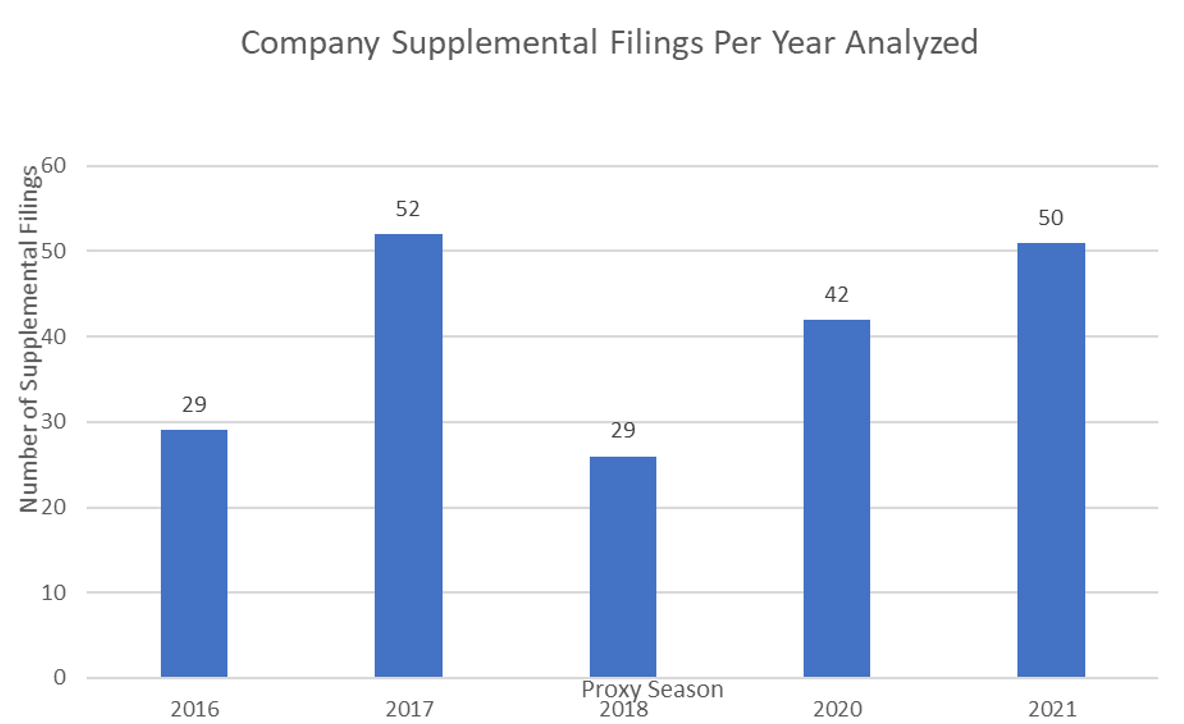

A newly released ACCF paper provides a review of companies’ supplemental filings to the SEC to their proxy materials during most of the 2021 proxy season. As seen in previous reviews, proxy advisory firms remain prone to making significant errors [1] when developing vote recommendations. These errors can impair the quality and objectivity of advice and ultimately harm the interests of investors. ACCF’s review of filings shows at least 50 instances where proxy advisors have formulated recommendations based on data or analysis disputed by the companies themselves, an increase from the 42 filings uncovered in ACCF’s 2020 analysis, suggesting a continued need for the SEC to enforce the 2020 Proxy Advisor Rule.

The paper also examines how, if enforced, the 2020 Proxy Advisor Rule would create a fair process for companies to respond to proxy advisor recommendations and enhance the quality of easily accessible information to investors, contrary to the current system whereby companies may only report any such issues through supplemental filings to their proxy statement.

These results are consistent with the prior analysis of supplemental filings we conducted over previous proxy seasons dating back to 2016—which have uncovered a total of over 200 apparent errors and serious disagreements in the examined time periods.

While compiled prior to the SEC’s recent announcement to roll back protections against proxy firm errors, the findings of this study call into question claims made as part of the SEC’s recent action that proxy advisor errors are rare and fail to have a material impact.

Summary of Findings

A search of the SEC’s EDGAR database through September 8, 2021 found 50 examples of public companies filing supplemental proxy materials this proxy season to correct the record regarding a proxy advisory firm vote recommendation. This represents a 21% increase from the last proxy season. As stated earlier, because supplemental filings are subject to strict antifraud provisions by the SEC, we view them as accurate and not embellished claims on the part of companies.

This year’s data involve the same wide array of companies that include nearly every sector of the economy. Most are small or mid-cap entities that do not have the significant legal and compliance resources of their larger counterparts and are least able to easily engage with proxy advisors or communicate to their shareholders.

These filings are consistent with our previous research into this topic, which showed at least 200 errors dating back to 2016. It is also important to note that the number of supplemental filings highlighted in this and our previous ACCF 2020 and 2018 reports may well represent the “tip of the iceberg” and still undercount the overall instances of errors or other methodological flaws contained in proxy advisory firm recommendations. Specifically, the data includes only those companies that have taken the extraordinary step of filing a supplemental proxy. Doing so not only entails voluntarily increasing the company’s anti-fraud risk, but also requires diverting significant company resources to submit the filing in the limited window available.

Supplemental Filings to Highlight from the 2021 Proxy Season:

Factual Error

- Westinghouse Air Brake Technologies argued that a proxy advisor recommendation against a board member relied on a factually incorrect designation that the board member voluntarily resigned even though the board member was terminated by the company. This impacted the severance pay afforded to the board member, which the company noted is consistent with all executive officers in which termination is initiated by the company and is contrary to the proxy advisor’s justification.

- ASGN Incorporated took issue with a proxy advisor recommendation against the election of a director because that director was a “non-independent member of the audit and compensation committees,” even though she is a member of neither. The company notes that while she serves as an advisor to each committee, she is not a voting member, as depicted in ASGN’s proxy statement.

Analytical Error

- Evofem Biosciences disputed a proxy advisor recommendation to vote against the election of a board of directors due to concerns about the meeting attendance of the nominees in question even though the company released data on near perfect attendance for the board members.

- Schnitzer Steel cited serious oversight in a proxy advisor recommendation to vote against a say on pay proposal because the proxy advisor failed to consider the COVID-19 pandemic when measuring the company’s total shareholder return against its peer set. While many of the peers use December 31, 2019 for its fiscal year, the company shows that it uses August 31, 2020 for its fiscal year end. The company notes that its total shareholder performance would rise from the 33rd to the 65th percentile if the August 31, 2020 date was used, rather than December 31, 2019 date. The negative recommendation was ultimately correlated with a -15.6 percent change in voting support in the vote to ratify executive compensation from the prior year. It appears that the unfavorable proxy advisor recommendation had impact on the vote. The vote passed with 74.4% in favor, down from 90.1% in 2020 and 96.6% in 2019.

Serious Dispute

- Ares Commercial Real Estate Corp disputed a proxy advisor recommendation against the election of director Michael Arougheti under the premise that no director who is a CEO of a company should also serve on more than two additional public company boards. However, the recommendation failed to consider that Mr. Arougheti served on three boards all affiliated with the parent company, Ares Commercial, effectively exempting him from the rule’s criteria because his duties all lie with the same organization. It appears that the unfavorable recommendation had impact on the vote. Mr. Arougheti received 70.7% of the vote, down from 94.1% and 81.1% when he was up for reelection in 2018 and 2015, respectively.

Titan International’s Chairman vigorously disagreed with the proxy advisor recommendation to vote against three board directors, saying that the proxy advisors “should stick to advising companies that have revenue over $10 billion, because I don’t think they take the time to understand our business.” The proxy advisor justification was that the board members earned some benefit due to a recent company acquisition, which the filing vehemently disputes. The final vote passed nearly 66% in favor of one director, but only narrowly passed with around 55% in favor of the two other directors. It appears that the unfavorable recommendation had impact on the vote. Of the seven directors up for reelection, the three singled out by the proxy advisor received three of the four lowest percentages, at 54.3%, 54.1% and 69.8% in favor of their election.

How the Process for Addressing Errors or Serious Disagreements Would Work with the 2020 Final Rule and Supplemental Guidance

The Proxy Advisor Rule would solve many of the current issues listed above by creating a new process for companies to review and respond to recommendations on an even playing field, as well as making it easier for investors to review all the information they should consider before voting in a contested situation in a way that upholds their fiduciary duty to vote in their clients’ best interests.

The rule stipulates that companies who have filed their definitive proxy statement at least 40 calendar days before the meeting of the votes in question would be entitled to a copy of the recommendation at the time it is disseminated to clients or earlier. This would eliminate the issue of companies not receiving notice or being unable to obtain recommendations.

The SEC’s rule would also require proxy advisors to establish a means to alert their clients if a company responds with a written statement contesting the recommendation. This requirement would better ensure that investors review information that companies are now including in often ignored supplemental filings and make it easier for investors to find such information and conduct the necessary due diligence required to uphold their fiduciary duty.

Finally, the SEC’s supplemental guidance further prompts investors to make use of the information that would become easily available as a result of the rule when conducting their proxy voting activities, which discourages investors to simply robo-vote and outsource their voting responsibilities to proxy advisors as they do now.

Conclusion

The continued prevalence of supplemental filings each proxy season demonstrates that errors and serious disagreements remain an issue, with the potential to harm the integrity of the proxy process. The proliferation and higher success rate of contested shareholder proposals, often where the company disagrees with the proposal sponsor on the great variety of societal issues that encompass ESG investing, renders the integrity of the proxy process all the more important.

After a decade of careful consideration of stakeholder concerns, the SEC took substantive action when they finalized a rule on proxy advisors and updated their guidance to investors on their proxy voting responsibilities. These represent important steps that are significantly less restrictive than other proposals put forward in Congress and the SEC’s original proposal on this subject. The 2020 rule and supplemental guidance were crafted to recognize the important role that proxy advisors play in the proxy process while ensuring that investors retain the ultimate responsibility for voting in the best interests of their clients.

Given this robust process and new data which suggests there are many disputes regarding advisors’ recommendations, the SEC should keep their rule and guidance intact and enforce it before considering further change. To do otherwise would contradict the limited new data that has been released since the SEC finalized their rule and undermine the robust process that went into enacting these important reforms.

Endnotes

1The paper’s use of the term “error” in the context of proxy advisor reports signifies a discrepancy between the data and/or analysis in a proxy advisor’s report and an issuer’s supplemental filing. As only the issuer assumes legal liability associated with these discrepancies, we assume that the proxy advisor is in error. The report author acknowledges that this does not rule out the less likely possibility that the proxy advisor is indeed factually correct.(go back)

Print

Print