Gina Gutzeit is Senior Managing Director, David White is Senior Managing Director, and Alan Numsuwan is Managing Director at the Office of the CFO Solutions practice at FTI Consulting. This post is based on their FTI Consulting memorandum.

FTI Consulting’s annual CFO Survey offers insights from business leaders on the challenges they face and their expectations for 2022. The CFO Survey includes organizations across all major industries. Respondents include chief financial officers, financial planning and analysis leaders, finance vice presidents as well as directors, controllers, treasurers and others with financial decision-making roles.

FTI Consulting’s 2020-21 survey, Leading the Way Through Critical Times, highlighted the tremendous resolve and strategic leadership that CFOs and finance leaders demonstrated as they navigated through the COVID-19 pandemic. The exceptional performance by finance to take on a more enterprise-wide view of their organizations has led to greater responsibilities and expectations. This year, CFOs and finance leaders will find themselves confronting greater challenges, with their soft skills put to the test.

One notable aspect of this new environment is the evolving finance talent landscape. Last year, our survey revealed that most CFOs were experiencing personnel setbacks in their finance functions. At the time, CFOs may have presumed that downsizing and/or avoiding hiring new talent was an appropriate response during a period of uncertainty. However, the impact of hiring freezes or downsizing that occurred in 2020 may have been exacerbated by significant employee turnover this year, often referred to as the “Great Resignation.” In response, CFOs and finance leaders will need to focus more on team culture, employee retention and recognition and training and development. But talent is only one challenge that has evolved for CFOs. In this new world, CFOs will need to prioritize and allocate their time and resources effectively to make the most impact in both their finance organizations and across the enterprise, including in the areas below.

- Employee Retention

- Hybrid Workforce

- Team Culture

- Inflation

- Supply Chain

- Rising Healthcare Costs

- Cybersecurity

- Event Readiness

- Government Regulations

- New Technology

- Capital Raise

- Investors

- Environmental, Social & Governance

- Financial Reporting & Audit

- Strategic Planning

Top Observations

1. Expectations on CFO Tenure Decrease

Among respondents, 48% expect the CFO to have a tenure of less than five years. However, whether the desire is to serve in the long term or short term, CFOs want to be viewed as someone who can deliver high-impact value, from managing quarterly expectations to developing and executing key strategic initiatives. While the long-tenured public company CFO is still prevalent, serial CFOs are increasing to deliver on shorter-term mandates.

2. CFOs are now Optimizing Workforce Models

Although remote work has proven effective in the short term, the partial return to the office is inevitable, and 59% of respondents anticipate a hybrid work model moving forward; only 23% expect to get back in the office full-time. As a result, CFOs are deploying hybrid work models, including redefining office space to accommodate purpose-built interaction and accelerating the use of automation tools.

3. A Finance Talent Shortage is Driving Interest in Outsourcing and Global Business Services Across all Company Sizes

The finance talent shortage is causing CFOs to be more interested in outsourcing models for the back office to better manage business volatility and have readily available talent at lower and more variable costs. Adoption isn’t as daunting as it once was because many, including mid-size organizations, have already worked in a hybrid model for over a year.

4. Cloud-Based System Adoption Increased Significantly

There continues to be increased adoption of cloud-based systems, including in finance, where 67% of companies are currently implementing or using cloud-based general ledgers. Companies’ ERP and EPM systems have also seen a shift to the cloud. These cloud-based tools are proven, and business cases have been realized more rapidly than originally anticipated.

5. Delivery of Real-Time Insights Persists as a Significant FP&A Gap

Last year, 90% of respondents strongly agreed with the statement that the CFO and finance function perform accurate, real-time planning, reporting and data analysis. In 2021, this improved slightly, to 95%; however, despite CFOs ranking themselves higher this year, nearly 30% of CFOs still indicate that delivering real-time information to make business decisions is a critical priority. Moreover, 50% indicated that developing predictive analytics capabilities is a high priority.

6. Cybersecurity has Moved up the CFO Priority List

More than 70% of respondents say they are involved in their organization’s incident response plan, but a majority do not fully understand the risks that cyber attacks pose and have struggled to maintain device security updates, a challenge heightened with increased remote work.

7. CFOs Are Considering Environmental, Social & Governance (“ESG”) Initiatives

Increased investor pressure and the prospect of mandatory disclosures have heightened CFOs’ attention to ESG. As CFOs begin to develop their ESG programs, they are contending with the complexity of sustainability reporting, including sourcing, warehousing, analyzing and visualizing underlying ESG data. Building the business case for anticipated ESG requirements is the critical first step.

Expectations on CFO Tenure Decrease

About half of the respondents in this year’s survey expect the CFO tenure to be under five years, suggesting that CFOs may view themselves as having a shorter window to deliver significant impact to the organization. However, this shorter tenure may also mean that CFOs have greater options for career progression. “Now more than ever, finance executives have optionality.” Barry Toren, leader of Korn Ferry’s North American Financial Officer practice states, “there is no longer a ‘standard’ path to become a CFO and the path does not need to end in this role. Given the demand in the market, CFOs are being presented with new opportunities and it’s a great time to be a nimble finance leader with strong ‘soft’ skills.”

Moreover, while CFO tenure is decreasing, promotion from CFO to CEO is at a five-year high, with over 7% of sitting CEOs coming directly from a CFO chair. [1] One reason for this may be the heightened strategic focus that CFOs have taken on recently. For example, our survey results last year indicated that CFOs took a prominent role in leading their organizations through the initial impacts of the coronavirus pandemic. These leading CFOs exemplified strategic thinking and keen management in addition to traditional finance responsibilities, which are contributing to the

CFO-to-CEO transition.

Companies are rethinking what they want in a CFO as well. No longer needing solely a “scorekeeper,” companies are viewing the CFO role in a more comprehensive manner, seeking someone with strong people-management skills who can lead multiple areas and manage the unrelenting demands of internal and external expectations.

CFOs are now Optimizing Workforce Models

For most organizations, the pandemic fast-tracked workforce strategies to adopt a hybrid working model. There has also been a significant shift from 2020 to 2021 in sentiment regarding workforce operating models, with many organizations still uncertain on when they will return to “normal.” Currently, many organizations have their offices open in a limited capacity to meet the needs of employees that must be in a workplace, and most have implemented policies or recommendations around vaccination status and/or negative COVID testing.

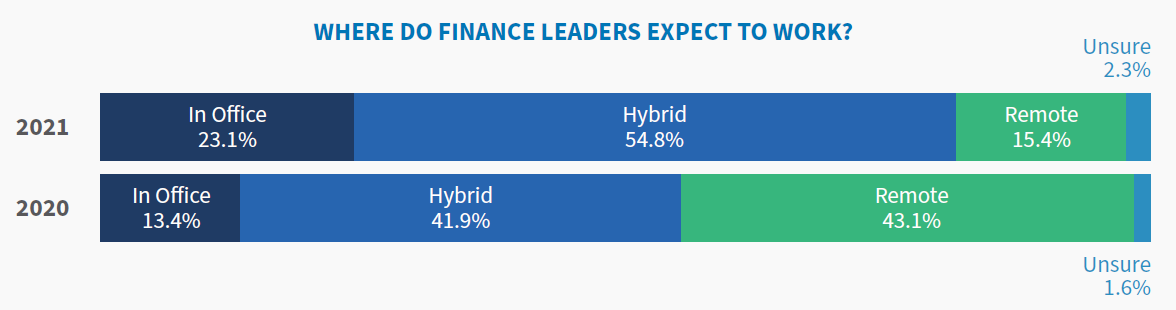

In 2020, 43% of our CFO respondents indicated they were expecting their organization to adjust to a remote workforce operating model. The 2021 outlook for a fully remote workforce model lowered significantly to 15.2%, with 59% respondents anticipating that work will be done in a hybrid fashion, and only 23% expecting to go back into the office full-time. Put differently, the overall sentiment seems to be that while the efficacy of work from home was proven during the height of the pandemic, people are ready to return to a collaborative, in-person environment. One of the key drivers of this shift is the shortage of talent. Turnover has peaked for several reasons, and as companies onboard new talent, the need to meet in person, experience company culture and feel connected is resounding.

CFOs of many organizations, depending on industry, are taking advantage of the opportunity to cut operating costs in the near term by reducing their real estate footprints, and optimizing IT services and HR policies to support a marked increase in a remote or hybrid workforce.

While some form of hybrid work is likely to continue in perpetuity, there will be a slow move back toward the pre-pandemic model of office-based work, owing to the need for collaboration, ideation and community that is inherent in working in an office.

A Finance Talent Shortage is Driving Interest in Outsourcing and Global Business Services Across all Company Sizes

The challenges overcome by CFOs to manage a remote workforce in 2020 and 2021 will have a profound effect on the finance service delivery model. Business Process Outsourcing (BPO) and offshoring as a component of a Global Business Services (GBS) strategy are expected to become more compelling to CFOs who are coping with rising wages and talent shortages.

Moreover, CFOs are increasingly recognizing the importance of developing an effective hybrid work model. When respondents were asked about the workforce model they expect for their organizations, more than 97% indicated some proportion of employees working remotely. Over 44% of survey participants indicated the need to develop and transition to a hybrid workforce model, likely in response to competition with other employers who are making this a permanent feature of employment to attract or retain top talent. It is also possible that CFOs, having developed capabilities to effectively manage a remote workforce, are also seeking to lock in efficiencies realized from this arrangement over the past year. Finance systems are increasingly cloud-based, designed with workflow to enable remote working models and cybersecurity. Digital collaboration tools such as Zoom, Microsoft Teams and others are widely used to bolster organizational cohesion, culture and people development.

According to a recent Harvard Business Review study entitled “Who Is Driving the Great Resignation?”, employees between 30 and 45 years old have the greatest increase in resignation rates, averaging 20% with an average increase of more than 20% between 2020 and 2021. Unlike past years, in which turnover was typically highest among younger employees, the study found resignations actually decreased for workers in the 20-to-25 age range. This increase in turnover for older, more experienced employees is one of the key drivers for the wage inflation that many survey respondents expressed concerns over. In fact, cost optimization was ranked as a high priority by 44.1% of CFOs, and the need to pay higher wages for skilled talent and anticipated employee turnover will surely complicate matters.

The business changes that allowed CFOs to weather COVID-19 will also help them cope with the talent shortages and cost challenges they currently face. Greater comfort with the remote workforce model, coupled with new tools built for delivery from virtually anywhere, have increased the adoption of Global Business Services (GBS) and Business Process Outsourcing (BPO) to address organization talent gaps. Simply put, the barriers, both perceived and real, to GBS and BPO are not as onerous as they were just a couple of years ago, which is signaling an interest from companies large and small.

Cloud-Based System Adoption Increased Significantly

CFOs have increased adoption of cloud-based systems with 67% of respondents indicating that they are currently implementing or using cloud-based general ledgers. This is primarily driven by CFOs having increased comfort with cloud security, heightened interest in out-of-the-box features such as controls and automation, and the speed of implementation with a lower total cost of ownership. Moreover, this pivot to the cloud is also causing CFOs to look beyond the general ledger towards cloud-based Enterprise Performance Management (EPM) solutions. In fact, 69% of CFOs surveyed express that they currently use or are implementing an EPM solution, an 18% jump from 2020.

The fast timing of realizing benefits from cloud-based systems is also significant. 92% of CFOs who have adopted a cloud-based general ledger and 94% of CFOs that have adopted an EPM solution indicate they realized the benefit within the first year, with a majority realizing the benefit within the first 6 months for both solutions. Additionally, the top three benefits listed by adopters of a cloud-based general ledger or EPM solutions were found to be the same:

- Accuracy and timeliness of data

- Productivity

- Retained talent in the finance function

CFOs are also benefiting from enhanced accessibility, particularly with the increase in remote and hybrid work models, which has resulted in convenience without compromising productivity. The increase in cloud-based adoption can also be attributed to the new normal, with nearly 60% of CFOs expressing that their organizations will adjust to a remote or hybrid work environment in the next 3-6 months and persistent demand of productivity.

Looking ahead, as cloud-based general ledger and EPM solutions continue to improve, CFOs may speed up initiatives to create end-to-end, integrated processes across essential processes such as order-to-cash and procure-to-pay. This year’s survey showed that more than 50% of respondents were already using cloud-based systems to enhance procure-to-pay, compared to 37% from last year.

Delivery of Real-Time Insights Persists as a Significant FP&A Gap

Traditional Financial Planning and Analysis (FP&A), encompassing planning, forecasting, budgeting and reporting, earned high marks once again across respondents. This year, CFOs ranked their FP&A capabilities slightly higher than last year, up from 90% to 95% in strongly agreeing that the function was high-performing. Yet more than 50% of respondents indicated that there was still progress to be made in developing predictive analytics capabilities, and another 30% of respondents signified criticality in needing to deliver real-time information to make business decisions.

This disparity reflects that finance leaders confront challenges when moving their FP&A functions up the maturity curve and suggests that most respondents align to the first profile below.

| Foundational FP&A | Data-Empowered | Strategic Thinker |

|---|---|---|

| Provides accurate planning, reporting and analysis

Financial Planning & Analysis

|

Focuses on data insight to support decision-making and build on functional expertise

Performance Reporting & Analytics

|

Acts as the advisor and strategic partner to the CEO and their C-suite Colleagues

Financial Planning & Analysis

|

Based on the survey responses, there is a strong desire among finance leaders to deliver real-time insights that drive operational improvement, maturing FP&A to become broader Enterprise Performance Management (EPM). CFOs want to use FP&A insights to optimize key business drivers such as pricing, channel management, labor and operational efficiency; however, less than 10% of survey respondents are successfully achieving this task. Following a year in which the CFO is increasingly expected to be a strategic business leader across the enterprise—in addition to managing financial records, controls and transactions—it’s imperative to develop finance talent, optimize underlying data, leverage finance systems and deliver on critical business planning, reporting and analytics outputs for key stakeholders. Common challenges to achieving this include inaccurate or ineffective datasets, a lack of consistent and accurate business drivers, and not having the appropriate finance talent to execute.

Cybersecurity has Moved up the CFO Priority List

An encouraging 70% of respondents indicated that they are involved in their organization’s incident response plan despite primarily working in a financial or C-suite role, a statistic that continues to break down the perception that cybersecurity is solely an IT responsibility. However, with many finance processes being conducted remotely, CFOs are spending more time focused on security measures inside and outside the finance function. In third-party supplier risk, one of the highest areas of cybersecurity focus for CFOs, respondents showed that they are proactively implementing cyber risk-mitigation processes, as 76% of respondents assess cybersecurity risks of third-party suppliers during procurement. The outcome is that almost 80% of respondents are confident or very confident in mitigating potential cybersecurity risks after implementing digital technologies.

However, according to U.S. respondents of FTI Consulting’s 2021 Resilience Barometer, 60% of organizations do not fully understand the cybersecurity risks posed by third parties, and 63% have struggled to manage device security updates. This suggests that organizations are proactively considering cybersecurity challenges, but they are unsure how to address risks and threats once they are identified, a task made more difficult with the increase in remote work.

Leading CFOs play a vital role in helping bridge this gap. An initial step involves active engagement with the cybersecurity budget process. Dedicating resources is essential, but instead of applying additional funds at the issue, CFOs should work to better understand the cybersecurity risks they are facing. This will help facilitate strategic and financial decisions based on the unique threat profile of their organization and offer better protection. These risks particularly apply to any connected entities, including those added during mergers or acquisitions, making a CFO’s attention to cybersecurity an important part of the transaction process.

CFOs Are Considering Environmental, Social & Governance (“ESG”) Initiatives

With ESG gaining traction in boardroom discussions, CFOs are increasingly considering their roles in sustainability accounting. However, managing data, including the systems and controls surrounding it, remains a significant concern, as is understanding and prioritizing ESG requirements that cut across operational, legal and human resources functions, despite often being led by the CFO.

With ESG new to our survey, 57.2% of respondents noted that establishing and making progress toward ESG objectives was of “high” importance, with 18.9% noting it as being of “critical” importance. Given the threat of increased regulatory scrutiny, this trend should continue, if not accelerate.

However, the complexity and lack of standardization endemic to sustainability disclosures today—particularly those related to climate change risk—have left many organizations playing catch-up. Appeasing the expectations of investors with useful information while at the same time limiting liability of forward-looking statements can be especially difficult without explicit guidance. Despite efforts to create structure around ESG metrics to make comparisons within industries, the diversity and context of these metrics will require internal education and alignment on material issues to appropriately communicate ESG performance.

Establishing internal controls and systems to manage ESG data and reporting was cited by 52.1% of survey participants as their greatest concern. Additionally, 47% of respondents were also concerned with their ability to source, warehouse, analyze and visualize underlying ESG data, and less than one-quarter of respondents (24.2%) noted they are fully confident in their ability to capture the potential costs associated with greenhouse gas emissions-reduction strategies.

Importantly, these challenges are arising at a time when most companies are still determining who should manage sustainability accounting. In fact, nearly two-thirds of respondents have not come to the realization (yet) that their finance function will need to lead and/or be heavily involved in sustainability accounting. Overall, defining the ESG goals, metrics and business case has proven to be challenging for the CFO, but gaining much more attention.

Our Experts’ View

It’s an opportune time to be a CFO. Gone are the days when the CFO’s role was restricted to closing the books and managing cash flow. Today’s CFO is a strategist, business partner, operator and steward – all at the same time.

With competing demands for CFOs’ time, a dynamic marketplace and evolving workforce model, the key is to lead in a strategic direction to address the most important needs and prevent constantly reacting to the urgency of the day. It’s imperative to have a clear strategic direction, a workforce that embraces growth and change mindset and a well-defined roadmap to adjust to the new realities.

- Establish Clear Vision. No matter what perceived tenure CFOs may have, those who successfully lead finance transformation initiatives possess a clear vision of where they want to take their organizations. This vision strengthens the CFO’s case for change, bolsters support amongst stakeholders and aligns finance talent to achieve the vision.

- Define Roadmap. The key for realizing the vision and redefining the operating model is to have a transformation roadmap that clearly outlines the business case, key initiatives, expected outcomes and roles. The roadmap needs to align and support the vision and provide specifics on “what it looks like” and “how to implement”, including the required changes to workforce model, service delivery, technologies, business insights, cybersecurity and ESG.

- Adjust Finance Operating Model. To succeed, CFOs need to absorb additional demands and attract and retain the right talent to execute the vision. This will require deploying the optimal finance operating model to align and support the business strategy. Enhancing service delivery, process design, talent, technology and automation are all key dimensions that must be factored into operating models, which will also have to adapt to the way employees prefer to work.

Other Priorities

CFOs were once again able to provide open-ended responses to our survey. Most challenges were related to the workforce and the impact of remote/hybrid working, as well as technology, supply chain and regulatory issues.

Technology

Adopting new finance technologies has taken significant time and resources; but fortunately, it has also proven to help us maintain our ledgers and balance sheet in an accurate and compliant manner.

Adopting new finance technologies has taken significant time and resources; but fortunately, it has also proven to help us maintain our ledgers and balance sheet in an accurate and compliant manner

I believe in new technology, but it can sure be tricky to use sometimes!

Our volume of work has increased exponentially in the last 2+ years, but our systems have not kept up.

Workforce

I continue to spend more and more time trying to make employees feel welcome and valued.

Keeping people in the workforce is our biggest challenge right now.

Talent retention has been a major challenge for us; coupled with a shortage in skilled finance professionals to fill open roles. There do not seem to be enough talented workers willing and able to meet our needs.

Supply Chain, Cybersecurity, and other Challenges

Rising healthcare costs, cyber security concerns, unpredictable government regulations, fewer full-time employees and more contractors, annual audit delays, general uncertainty…. the list keeps growing.

Supply chain issues and slowdown are obliterating our projections and severely draining our cash reserves.

Ever-increasing regulatory changes and requirements have created an unstable environment that is difficult to operate in.

We are having tremendous difficulties raising capital.

Remote Work

My workforce does not seem to want to return to the office and it is difficult, to say the least, to figure out how to make this new remote model effective.

Our greatest challenge is navigating the return-to-work environment, while adamantly prioritizing keeping employees healthy.

In this pandemic situation we are facing different kinds of problems than ever before, such as restrictions to do physical work.

Endnotes

1Crist | Kolder Associates Volatility Report 2021 https://www.cristkolder.com/media/2819/volatility-report-2021-americas-leading-companies.pdf(go back)

Print

Print