Afra Afsharipour is Senior Associate Dean for Academic Affairs & Professor of Law at the UC Davis School of Law. This post is based on her recent paper, forthcoming in the UC Irvine Law Review. Related research from the Program on Corporate Governance includes Politics and Gender in the Executive Suite by Alma Cohen, Moshe Hazan, and David Weiss (discussed on the Forum here); and Will Nasdaq’s Diversity Rules Harm Investors? by Jesse M. Fried (discussed on the Forum here).

Undertaking a large merger and acquisition (M&A) deal involves many different actors—a corporation’s board of directors, its senior management, and legal and financial advisors. Each of these actors plays a significant role in the decision to move forward on an M&A deal and is deeply involved in planning, negotiating, and executing a deal. This paper provides a holistic analysis of the lead actors involved in M&A transactions, revealing gender disparities in leadership among each of these actors. After decades of pronouncements about the commitment to diversity, there remains a significant underrepresentation of women in leadership among all the institutions involved in M&A.

For purposes of corporate law, boards are at the center of corporate governance in M&A. The central role that boards play in corporate governance has made the board as an institution a target for gender diversity efforts. Thus, while women continue to be underrepresented on boards, board diversity has accelerated over the last decade. For instance, in 2008, only sixteen percent of S&P 500 board seats were held by women, by 2021 that number had increased to thirty percent. Nevertheless, women remain underrepresented in board leadership roles, an important element of what some scholars call substantive gender diversity. For M&A transactions, substantive gender diversity is particularly important because the board chair plays a critical role in setting a board’s agenda, and board members often view the chair as influential in board decision-making.

For today’s large public companies, senior executives—especially CEOs—dominate major decisions. The domination of C-level executives in corporate decision-making and in allocating the resources of a company is particularly acute in M&A deals where executives are really the first among equals. For most large M&A deals, board decisions only arise after significant management involvement. Management largely controls the flow of information to the board. C-Suite executives determine whether an M&A transaction is initiated and how it is valued, negotiated, and completed.

The C-Suite’s gender disparities are well-documented. Few women lead companies in corporate America, and even fewer women of color are represented in the C-Suite. By 2021, the number of women chief executive officers (CEOs) of Fortune 500 companies hit an unprecedented high of about eight percent, although women still make up less than a quarter of C-level executives. Not only are women underrepresented as CEOs, but few leaders in the corporate development teams responsible for executing M&A transactions are women.

In M&A deals, senior executives and boards rarely act on their own, and many deal teams are populated by highly compensated financial and legal advisors. Advisors play a key role in the valuation, negotiation, and completion of deals, as well as in the diligence and complex documentation process involved in M&A transactions. Among advisors, there has been little transparency or data on women’s involvement, although anecdotal reports suggest that as among corporate executives, there is a significant lack of women as M&A advisors. This trend is especially prevalent in leadership and management roles in both the legal and investment banking industries.

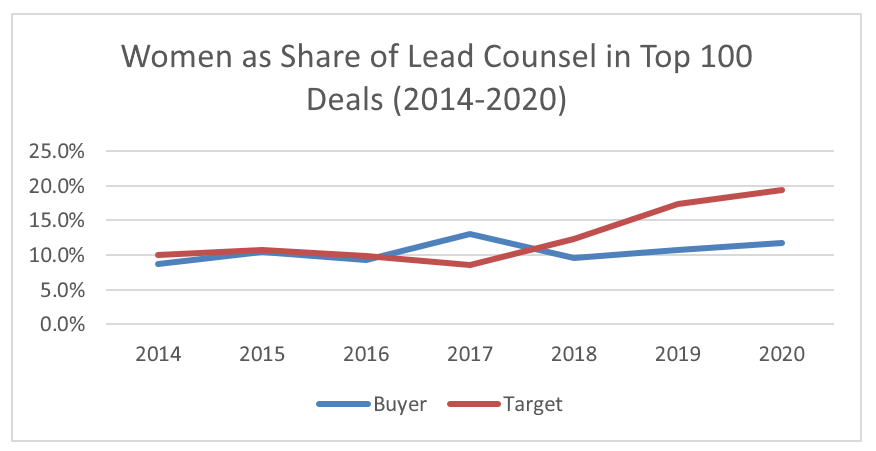

Focusing on one set of advisors—legal advisors—this paper presents hand-collected data from the largest 100 public company transactions in each year from 2014 to 2020. Women have accounted for almost half of all law students for almost thirty years, and one would expect some progress toward gender parity in leadership roles in M&A practice. The study in this paper, however, reveals a persistent gender gap in lead legal advisors in M&A transactions. Analyzing a dataset of 700 transactions between 2014 and 2020, the study finds that gender disparities in leadership on large M&A transactions exceeds disparities in law firm leadership. For instance, while women make up 20% of equity partners at elite law firms, on large M&A deals women account for approximately 10.5% of lead counsel positions for buyers.

For the largest 100 deals over the seven-year period of the study, women held 10.1% of lead counsel roles on the buyer side, and 12.43% of lead counsel roles on the seller side.

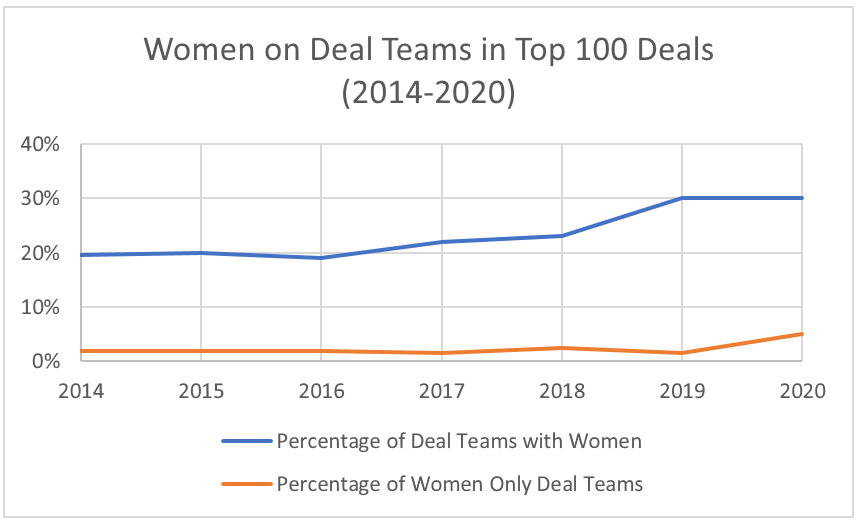

Across the 700 transactions included in the study, less than 5% of deal teams included only women as lead counsel.

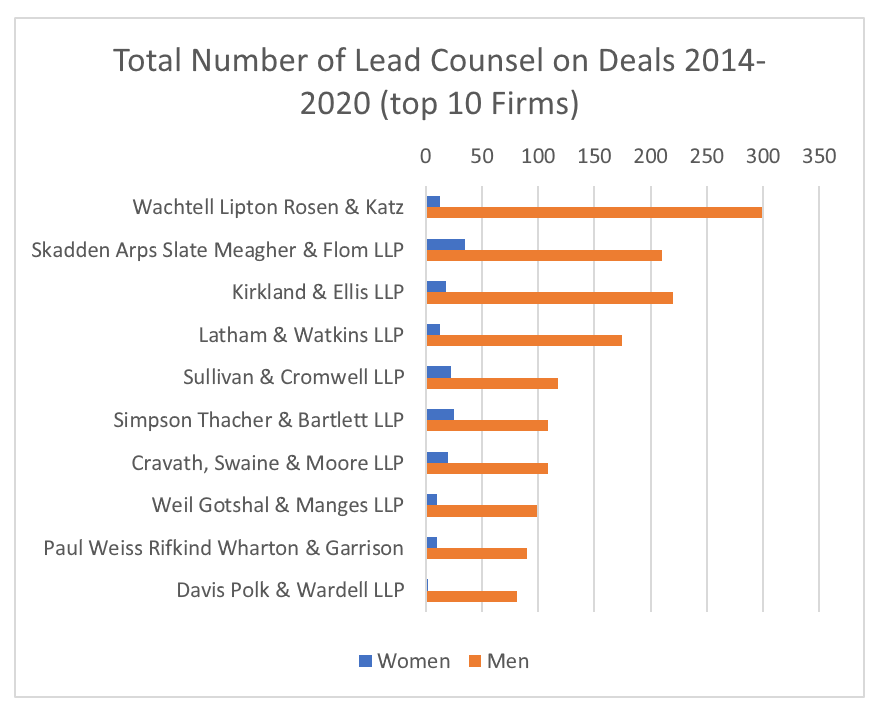

The study also examined gender disparities among the top 20 law firms advising on the deals over the seven-year period. While the predominance of men as lead counsel was not driven by one firm alone, the gender gap was particularly pronounced in the ten firms advising the greatest number of transactions from 2014 to 2020.

The data on financial advisors is more opaque than it is for legal advisors. There is little industry, firm, or deal-specific disclosure on women’s leadership in M&A investment banking. Nevertheless, numerous reporting highlights the male-dominated banking and finance industry.

Diversity matters for M&A—it matters for moral and social reasons, and it matters for instrumental reasons. From an equity standpoint, a significant portion of the population does not hold key decision-making roles in fundamental deals that greatly impact companies and billions of dollars trading hands. Second, research on group decision-making suggests that greater diversity could improve M&A transactions significantly. M&A transactions are often the most impactful decisions that a corporation can undertake. Research suggests, however, that M&A deals are also plagued with shortcomings in decision-making. A new body of finance literature has begun to explore the connection between M&A transactions and lack of diversity in M&A, suggesting that greater diversity may improve M&A outcomes.

The data examined in this paper shows that women’s underrepresentation and slow progress in holding leadership roles in M&A dealmaking is still far from fully understood. Research on women and leadership indicates that solutions that have succeeded in attaining greater gender diversity on boards—including shareholder advocacy, disclosure, and quotas—are only a few of the many tools necessary to transform M&A practice. Organizations aiming to achieve greater diversity in M&A leadership face a difficult task that requires tackling persistent and pervasive inequalities from many angles. This paper argues that disclosure and transparency regarding each institutional actor involved in M&A are critical for increasing accountability and for determining the solutions that may work to reduce gender disparities in M&A.

The complete paper is available for download here.

Print

Print