David H. Kistenbroker, Joni S. Jacobsen, and Angela M. Liu are partners at Dechert LLP. This post is based on a Dechert memorandum by Mr. Kistenbroker, Ms. Jacobson, Ms. Liu and Anna Q. Do.

Introduction

Overall, securities class action filings dropped in 2021, down 35% from 2020. [1] This decrease is driven largely by a drop in new merger and acquisition class actions. Similarly, the number of securities class actions against non-U.S. issuers dropped significantly from 88 in 2020 to only 42 in 2021. [2] In contrast, as compared to all securities class actions, the percentage of cases against non-U.S. issuers decreased, but only slightly, from 27% in 2020 to 20% in 2021.

In 2021, plaintiffs filed a total of 42 securities class action lawsuits [3] against non-U.S. issuers.

- As was the case in 2020, the Second Circuit continues to be the jurisdiction of choice for plaintiffs to bring securities claims against non-U.S. issuers. Roughly 75% of these 42 lawsuits (32) were filed in courts in the Second Circuit. A majority (20) of these lawsuits were filed in the Southern District of New York, followed closely by the Eastern District of New York (12). The Third, Ninth and Seventh Circuits followed with 5, 3 and 2 complaints, respectively.

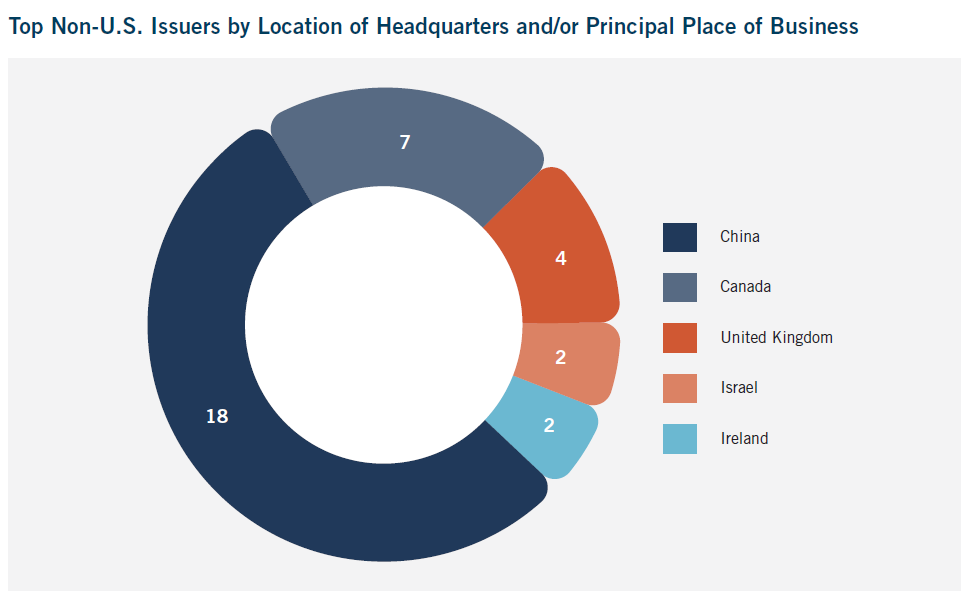

- Continuing the trend in 2020, most non-U.S. issuer lawsuits were against companies with headquarters and/or principal place of business in China and Canada. Of the 42 non-U.S. issuer lawsuits filed in 2021, 18 were filed against non-U.S. issuers with headquarters and/or a principal place of business in China, and 7 were filed against non-U.S. issuers with a headquarters and/ or principal place of business in Canada, followed by 4 non-U.S. issuers with headquarters and/or principal place of business in the United Kingdom.

- g The Rosen Law Firm led with the most first-in-court filings against non-U.S. issuers in 2021 (12), followed by Pomerantz LLP (9). This is consistent with the trend in 2018-2020, when the Rosen Law Firm was the most active plaintiff law firm in this space. Also like the trend of the last several years, the Rosen Law Firm and Pomerantz LLP were appointed lead counsel in the most cases in 2021 (with 6 and 5, respectively), followed closely by Glancy Prongay & Murray LLP and Robbins Geller Rudman & Dowd LLP (with 3 each).

- The majority of securities class actions against non-U.S. issuers (26 of 42) were filed in the third and fourth quarters of 2021.

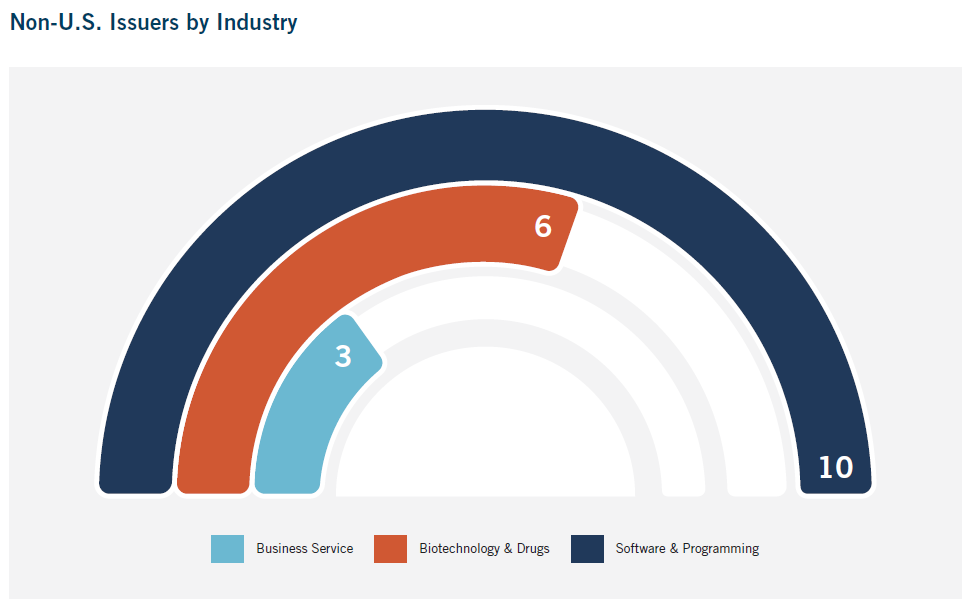

- While the suits cover a diverse range of industries, the largest portion of the suits involved the software and programming industry (10) and the biotechnology and drugs industry (7).

An examination of the types of cases filed in 2021 reveals the following substantive trends:

- About 24% of the cases involved alleged misrepresentations in connection with regulatory requirements and/or approvals (10). This includes seven cases involving alleged misrepresentations in connection with China’s regulatory requirements and/or approvals—with four involving China’s regulations on data protection and cybersecurity.

Compared to the prior two years, 2021 saw relatively no change in the number of dispositive decisions [4] issued in securities fraud cases against non-U.S. issuers. In 2021, courts rendered nine dispositive decisions in cases filed in 2019 and 2020. [5]

Although it is hard to discern trends from nine dispositive decisions, courts’ reasoning for dismissing cases is still instructive for non-U.S. issuers that find themselves the subject to a securities class action. In 2021, courts dismissed complaints for failing to allege an actionable misstatement or omission. One dispositive decision in a non-U.S. issuer case was based on lack of personal jurisdiction and standing.

In addition, 12 cases against non-U.S. issuers were completely resolved by settlements. Of those 12 settlements, 4 were reached before the filing of any motions to dismiss, and 6 of those settlements mooted pending motions to dismiss. Two settlements were preceded by motions to dismiss that were granted with leave to amend or denied in part.

Non-U.S. Companies Remain Popular Targets for Securities Fraud Litigation

In recent years, non-U.S. issuers have become targets of securities fraud lawsuits, a trend that continued in 2021. In 2021, there was a small decrease in securities class actions filed against non-U.S. issuers, but this was against the backdrop of a significant decrease in overall securities class actions filed in 2021. This survey is intended to give an overview of securities lawsuits against non-U.S. issuers in 2021. First, we analyze the number of cases filed, including trends relating to location filed, types of companies that were targeted, and the nature of the underlying claims. Next, we analyze certain dispositive decisions rendered in 2021 and how they impact the legal landscape of these types of claims. Finally, we set forth issues and best practices non-U.S. issuers should consider in order to reduce the risk of being subject to such suits.

A. Filing Trends

In 2021, there was a decrease in the total number of federal securities class actions, with 210 cases filed. Interestingly, as compared to the total number of federal securities class actions filed in 2021, the percentage of cases filed against non-U.S. issuers also decreased significantly from the previous year, with just over 20% of lawsuits (42) filed against non-U.S. issuers, compared to 2020 in which 27% of the class actions were filed against non-U.S. issuers. As in years past, certain filing trends emerged:

- The Second Circuit, and particularly the Southern District of New York (“SDNY”), continued to see the most activity in 2021; with 20 filings, SDNY was the preferred court for about 48% of all lawsuits brought against non-U.S. issuers in 2021. After the Second Circuit, the Third, Ninth and Seventh Circuits followed with 5, 3 and 2 complaints, respectively.

- The majority of suits were filed against companies headquartered in China (18) and Canada (7).

- The Southern District of New York was a popular venue for suits against companies headquartered in China, with 11 cases filed in the Southern District of New York, followed by 4 cases filed in the Eastern District of New York, and 3 cases filed in the District of New Jersey.

- Of the 7 suits filed against Canada-based companies, 5 were initiated in the Eastern District of New York, 1 was initiated in the Southern District of New York and 1 was initiated in the Central District of California.

- While the suits cover a diverse range of industries, the largest portion of suits involved (i) the software and programming industry (10) [6]—seven of which were against companies headquartered in China; and (ii) the biotechnology and drugs industry (7). [7] All complaints filed against companies headquartered in China (16) were brought against companies incorporated in the Cayman Islands.

B. Substantive Trends

An examination of the 2021 cases reveals two general trends with securities class actions brought against non-U.S. issuers. Specifically, many of the claims alleged that the defendant companies either: (i) misrepresented or omitted material information related to compliance with and/or investigations involving relevant industry regulations; or (ii) falsely overstated revenue as a result of improper accounting methods or false customer and/or user metrics.

Misrepresentations and/or Omissions Relating to Regulatory Compliance

Notably, ten cases filed against non-U.S. issuers in 2021 related to regulatory requirements and investigations, which includes seven related to Chinese regulatory requirements, two involving the U.S. Food and Drug Administration, and one related to gambling regulations in certain European markets. [8]

Class action complaints arising out of China’s data security and privacy regulations were filed against four companies—Didi Global Inc., Full Truck Alliance Co. Ltd., Kanzhun Limited, and 360 DigiTech Inc. Each of these companies provide PaaS (platform as a service) products to consumers or businesses in various industries. Three of the lawsuits allege that defendants failed to disclose or made misrepresentations concerning ongoing or imminent investigations by the Cyberspace Administration of China (“CAC”). For example, in Espinal v. Didi Global Inc., [9] plaintiffs allege that the defendants failed to disclose that the CAC had launched an investigation into DiDi and requested that DiDi stop new user-registration during the investigation. Shortly after the launch of the investigation, DiDi reported that the CAC ordered smart phone app stores to stop offering the DiDi app because it purportedly collected personal information in violation of relevant laws and regulations of the People’s Republic of China (“PRC”). Similarly, in Pratyush v. Full Truck Alliance [10] and Bell v. Kanzhun Limited, [11] plaintiffs allege that defendants failed to disclose that the companies were facing imminent cybersecurity reviews by the CAC and that the CAC would require the companies to suspend new user registration pending their reviews. The fourth lawsuit, Balderas v. 360 DigiTech, [12] concerned alleged violations with respect to the collection or use of personal information in violation of relevant laws and regulations. In 360 DigiTech, plaintiffs allege that defendants failed to disclose that the company was collecting personal information in violation of relevant PRC laws and regulations and was, therefore, exposed to increased regulatory scrutiny and enforcement action. Just as in the other cases, the 360 DigiTech app was removed from major app stores.

In addition, there were three cases filed against non-U.S. issuers arising from Chinese regulatory action in the insurance, education, and e-cigarette industries. In Sandoz v. Waterdrop Inc., [13] the defendants allegedly failed to disclose, among other things, that the company was subject to a regulatory investigation in relation to one of its insurance business segments.

In Garnett v. RLX Technology Inc., [14] the defendants allegedly failed to disclose that Chinese regulators were working on national e-cigarette regulations that would bring them into line with regular cigarette regulations. And, finally, in Banerjee v. Zhangmen Education Inc., [15] defendants allegedly failed to disclose that the Chinese government had adopted stringent new regulations for the online education market just shortly before the company’s IPO.

Misrepresentations Regarding Accounting Fraud and Metrics

Moreover, in 2021, there were five cases filed against non-U.S. issuers alleging violations of the securities laws based on overstated revenues arising from accounting fraud and/or false user metrics. Three cases involve allegations that companies offering PaaS overstated their number of users on their platforms.

For example, in Crass v. Yalla Group Ltd., [16] plaintiffs allege that Yalla, a social networking site, overstated its user metrics and revenue. In Nath v. Lightspeed Commerce Inc., [17] plaintiffs allege that Lightspeed, which provides a SaaS platform for small and midsize businesses, overstated its customer count, among other things. In Chin v. KE Holdings, Inc., [18] plaintiffs allege that KE Holdings, which offers an integrated platform for housing transactions in China, overstated the number of agents and stores on its platform. The other two accounting fraud cases arise from alleged improper accounting methods that purportedly resulted in, among other things, falsely inflated revenues reported. [19]

Motion to Dismiss Decisions

Despite the trend of decreasing cases filed in recent years, 2021 saw relatively no change in the number of dispositive decisions issued in securities fraud cases against non-U.S. issuers. In 2021, courts rendered nine dispositive decisions in favor of defendants in cases filed in 2019 and 2020. Of the nine decisions rendered in 2021, six of the securities class actions were filed in the Southern District of New York. Moreover, there were two decisions that granted partial dismissal or summary judgment in defendants’ favor, and two decisions ruled completely in plaintiffs’ favor. While it is hard to discern trends from just nine dispositive decisions, the courts’ reasoning for dismissing cases is still instructive for the non-U.S. issuers who find themselves the subject of class actions lawsuits. In 2021, courts dismissed complaints for a variety of reasons, including failing to allege any actionable or material misstatement, lack of standing and lack of personal jurisdiction.

Failure to Allege an Actionable or Material Misstatement

In 2021, courts dismissed claims that failed to allege actionable or material misstatements relating to, among other things, litigation risks and investigations, financial and performance forecasts, and related party transactions.

Some cases that were dismissed in their entirety involved allegations that companies made misleading statements concerning optimistic financial and performance forecasts. In In re Nokia Corp. Sec. Litig., [20] the court found that Nokia’s statements touting the progress of its 5G integration were non- actionable puffery. [21] In Cheng v. Canada Goose Holdings Inc., [22] plaintiffs alleged that “Defendants repeatedly, yet misleadingly, conveyed to investors that the Company was building customer demand ahead of supply,” which “created the misleading impression that Canada Goose’s massive spikes in inventory were justified by increasing demand and accelerated growth consistent with historical trends.” Thus, plaintiffs alleged, the defendants perpetuated a perception that an increase in inventory was because of expected increase in future demand.

The defendants rebutted with three arguments—(i) that the statements were expressions of optimism or puffery, (ii) that the statements were forward-looking statements protected under the PLSRA’s safe harbor, and (iii) that the statements were accompanied by meaningful cautionary language and subject to the bespeaks caution doctrine—all of which were rejected by the court. The court, sua sponte, examined the defendants’ representations and determined that the plaintiffs failed to identify any misstatements or omissions of material fact. The court explained that the plaintiffs did not actually challenge any of the financial information that Canada Goose disclosed, noting that the complaint did not allege that the reported inventory growth, demand growth, projected revenue growth, or any other figures were inaccurate. The court then concluded that plaintiffs had failed to plead facts that plausibly allege that the statements at issue—that defendants were trying to build demand ahead of supply—were false or misleading when made.

In 2021, there were also two dispositive decisions in cases that arose, in part, from purported nondisclosures of related party transactions. In both decisions, the court found that the transactions at issue were not related party transactions. In In re Hebron Technology Co., Ltd. Sec. Litig., [23] the Southern District of New York dismissed a complaint that alleged defendants made false and misleading statements about or failed to disclose the involvement of related parties in several of the defendant’s recent acquisitions and failed to maintain adequate disclosure controls regarding related-party transactions. The court ruled that the facts alleged did not establish that any of the transactions at issue were related party transactions. The court reasoned that the complaint’s implication of control was merely speculative, and there was no relationship of control, significant influence or common control with the other parties. Similarly, in Thomas v. China Techfaith Wireless, [24] the court dismissed a lawsuit alleging that Techfaith and three company insiders failed to disclose related party transactions in violation of federal securities law. The complaint alleged that the defendants engaged in a scheme to steal Techfaith by transferring the company’s operations, employees, and cash (via a loan) to another related company, Mfox, that shared the same founder as Techfaith Wireless. The court ruled that the alleged “scheme” did not involve any transactions or arrangement between Techfaith and Mfox that had to be disclosed. Further, the complaint did not contain sufficient facts to support plaintiffs’ theory that the recipient of a US$53.8 million loan was really Mfox. Plaintiffs complained that the borrowing entity was really Mfox. Plaintiffs pointed to the fact that the borrower entity owned a number of companies alongside Techfaith and Mfox’s founders, that its shareholder was a supervisor for a Techfaith subsidiary, and that the borrower entity and Mfox shared the same business address. The court held that none of these allegations were sufficient to make the borrower entity a related entity.

In addition, two decisions found that the nondisclosure of lawsuits and investigations were not required or, to the extent disclosed, were not materially misleading. In In re XP Inc. Sec. Litig., [25] a Brazilian financial services corporation’s allegedly inadequate disclosures concerning its “surging” legal exposures were not material. The court reasoned that there was no indication that the company’s total exposure exceeded the five percent threshold required for materiality, or that any statement concerned a significant segment of the corporation’s operations. In addition, the nondisclosure of particular Brazilian regulatory investigations concerning the company’s anticompetitive conduct were not materially misleading because the registration statement indicated that the company and its related entities “are, and may be in the future, party to legal, arbitration and administrative investigations and inspections and proceedings arising in the ordinary course of [their] business or from extraordinary corporate, tax or regulatory events, involving our clients, suppliers, customers, as well as competition, government agencies, tax and environmental authorities . . .” The court observed that this disclosure mirrored those that other courts have held to be unactionable. At most, the plaintiffs alleged that defendants disclosed an investigation was ongoing, but refused to provide details.

In Jun v. 500.com Limited, [26] plaintiffs asserted securities violations arising from defendants’ nondisclosure of a subsidiary’s bribery scheme to obtain licenses to run integrated resorts and a related internal investigation (namely, by a Special Investigation Committee formed by the Board of Directors). Plaintiffs theorized that the bribery scheme rendered the defendants’ statements in the company’s Code of Business Conduct and Ethics, Sarbaines-Oxley (“SOX”) certifications, and principal activity statements in the subsidiary’s Form 20-F filings misleading. The court dismissed all claims against defendants. The court found that the bribery scheme and internal investigation did not render statements in the company’s Code of Business Conduct and Ethics misleading or false because the Code is “aspirational.” As to the SOX certifications, plaintiff did not allege that the certifier had actual knowledge of the alleged bribery, and therefore the court could not infer or conclude that he knew his SOX certifications were false. Finally, as to statements concerning the company’s principal activity in Form 20-Fs, which did not include the illegal bribery scheme, the court held this was not actionable because “[g]enerally, companies do not have a duty to disclose uncharged, unadjudicated wrongdoing.” The court further explained that a duty to disclose the uncharged wrongdoing did not arise because there “must be a connection between the illegal conduct and the misleading statements ‘beyond the simple fact that a criminal conviction would have an adverse impact upon the corporation’s operations in general or the bottom line.” In this instance, the plaintiffs did not allege that the sources of 500.com’s success were attributable to the bribery scheme which was implemented by 500.com’s subsidiary.

Lack of Standing and Lack of Personal Jurisdiction

In Perez v. HEXO Corp., [27] the plaintiffs’ Section 12(a)(2) claim against HEXO Corp., a Canada-based cannabis supplier, failed for lack of standing as to both lead plaintiffs. [28] As to the first lead plaintiff, the court noted that the complaint did not allege he purchased any shares during the company’s IPO. The court noted that defendants’ status as statutory sellers, alone, is insufficient to establish his standing, and stated that a “nexus to a plaintiff purchaser is necessary.” [29] As to the second lead plaintiff, the complaint alleged that he “bought some of his HEXO shares pursuant or traceable to the Offering.” [30] The court reasoned that while such general allegations could suffice to establish standing at the motion to dismiss stage, plaintiff’s certification precluded standing in this instance. The lead plaintiff’s certification provided that his first purchase of HEXO was at a price that was not the cost of HEXO stock on the NYSE during the IPO, which was evidence that he did not purchase shares of HEXO stock on the date of the offering. [31]

In Holsworth v. BProtocol Foundation, [32] the plaintiffs alleged that the defendant Bancor, a Swiss entity headquartered in Israel, misled investors to believe that tokens sold in connection with the company’s initial coin offering (ICO) were not securities, but rather de-centralized and already functional crypto assets. Plaintiffs also alleged control person liability of Bancor’s principals who were all citizens of Israel. The court granted the defendants’ motion to dismiss on the basis that plaintiff had not plausibly alleged any injury-in-fact, and thus had no standing. The complaint was silent on the point of injury, and there was an attached undated certificate showing that the plaintiff purchased digital coins on September 4, 2019, but as of some unspecified date, had not sold the coins. The court noted that there were no plausible allegations of injury or causal connection of the injury to Bancor’s ICO two years earlier, and, on these grounds, found that there was no standing. In addition, the court found that there was no specific personal jurisdiction based merely on Bancor’s promotional activities at crypto-currency conferences across the United States and its use of social media. The court held that such promotional activities touting the company’s digital activities are insufficient to support personal jurisdiction over citizens of another country.

The court denied the request to conduct jurisdiction discovery because it contradicted the purpose of personal jurisdiction, i.e., “not to subject foreigners to the burden of court proceedings in a jurisdiction where there is neither general or specific jurisdiction.”

Reaching a different result in Mark Owen v. Elastos Foundation, [33] the Southern District of New York denied the defendants’ motion to dismiss, which sought dismissal arguing lack of personal jurisdiction, among other things. In Elastos Foundation, the plaintiffs alleged the court has personal jurisdiction over Defendants pursuant to 15 U.S.C. § 77v(a), which authorizes nationwide service in cases arising under the Securities Act. The defendants urged the court to find that minimum contacts should be assessed based on the state in which the court sits rather than the United States as a whole. While acknowledging that “the Second Circuit ‘has not yet decided’ what contacts are relevant to determining whether defendants possess sufficient minimum contacts under a statute permitting nationwide service of process,” the court followed the approach of other circuits and assessed the defendants’ relevant contacts with the United States as a whole, and in doing so, found it had personal jurisdiction over each foreign defendant. [34]

Conclusion

Though the overall number of securities class actions have gone down in 2021, the proportion of cases against non-U.S. issuers has not changed significantly. A company does not need to be based in the United States to face potential securities class action liability in U.S. federal courts. As such, it is imperative that non-U.S. issuers take steps to mitigate their risks in not only their home jurisdictions, but also in the United States.

Non-U.S. issuers should be particularly cognizant when making disclosures or statements to:

- speak truthfully and to disclose both positive and negative results;

- ensure that a disclosure regimen and processes are well-documented and consistently followed;

- work with counsel to ensure that a disclosure plan is adopted that covers disclosures made in press releases, SEC filings and by executives; and

- understand that companies are not immune to issues that may cut across all industries.

Non-U.S. issuers should work with the company’s insurers and hire experienced counsel who specialize in and defend securities class action litigation on a full-time basis. Lastly, to the extent that a non-U.S. issuer finds itself the subject of a securities class action lawsuit, the bases upon which courts have dismissed similar complaints in the past can be instructive.

Endnotes

1There were 210 filings in 2021, compared to 324 cases filed in 2020. D&O Diary, Securities Filings Declined in 2021 Relative to Recent Elevated years, Closer to Long-Term Levels (Jan. 2, 2022), available at https://www.dandodiary.com/2022/01/articles/securities-litigation/securities-filings-declined-in-2021-relative-to-recent-elevated-years-closer-to-long-term-levels/#more-22509; see also David Kistenbroker, Joni Jacobsen, Angela Liu, Dechert Survey: Developments in Securities Fraud Class Actions Against U.S. Life Sciences Companies, 2020 ed., Dechert LLP at n.1.(go back)

2Unless otherwise noted, the figures in this white paper are based on information reported by the Securities Class Action Clearinghouse in collaboration with Cornerstone Research, Stanford Univ., Securities Class Action Clearinghouse: Filings Database, Securities Class Action Clearinghouse (last visited Jan. 6, 2022), http://securities.stanford.edu/filings.html. A company is considered a “non-U.S. issuer” if the company is headquartered and/or has a principal place of business outside of the United States. To the extent a company is listed as having both a non-U.S. headquarters/principal place of business and a U.S. headquarters/principal place of business, that filing was also included as a non-U.S. issuer.(go back)

3In its 2021 report of non-U.S. issuer filings, Cornerstone excludes M&A filings and consolidates “multiple filings related to the same allegations against the same defendant(s).” Securities Class Action Filings: 2021 Year in Review, Cornerstone Research, Stanford University. The number of “securities class action lawsuits,” on the other hand, includes M&A filings and counts every unique securities complaint brought in federal court against a non-U.S. issuer in 2021 that Dechert LLP (“Dechert”) could locate. However, complaints that were subsequently consolidated into a single action and complaints that were transferred from one jurisdiction to another were only counted once.(go back)

4A decision is considered “dispositive” if it is a decision that closed the case (i.e., voluntary dismissals are not included), and there are no pending motions for reconsideration or pending appeals. Additionally, decisions on motions to approve settlements are not considered “dispositive” as that term is used herein.(go back)

5Courts rendered five decisions in 2021 for cases filed in 2020 and four decisions for cases filed in 2019.(go back)

6Cases filed against non-U.S. issuers in the software and programming industry arose from a variety of issues, but, notably, two cases are based on allegations relating to investigations by the Cyberspace Administration of China. See infra.(go back)

7Out of the seven cases filed against non-U.S. issuers in the biotechnology and drugs industry, two relate to false or misleading statements submitted to the U.S. Food and Drug Administration and two relate to false or misleading statements in connection with mergers and acquisitions.(go back)

8Securities class action lawsuits are frequently followed by shareholder derivative lawsuits arising from the same underlying facts. There has been a trend of shareholder derivative actions filed on behalf of non-U.S. companies alleging violations of the companies’ home country laws. However, two recent decisions from the New York Supreme Court for the County of New York indicate that such actions have solid grounds for dismissal based on lack of jurisdiction. In Haussmann v. Baumann, the New York Supreme Court dismissed claims against the board of German Bayer AG related to the acquisition of Monsanto due to lack of jurisdiction reasoning that the “case has only a tenuous connection to New York and has a much greater connection to Germany where th[e] case should have been brought.” Index No. 651500/2020 (Dec. 27, 2021). The court concluded that plaintiffs had not established New York’s jurisdiction over claims against the German board members whose deliberations on the Monsanto deal took place exclusively in Germany and are alleged to have violated German law. A similar result came about in a case against the board of Switzerland-based UBS AG Group. Cattan v. Ermotti, Index No. 652270/2020 (Dec. 30, 2021). At the time of publication, both decisions were subject to appeal.(go back)

9 21-cv-05807 (S.D.N.Y.).(go back)

1021-cv-03903 (E.D.N.Y.).(go back)

1121-cv-13543 (D.N.J.).(go back)

1221-cv-06013 (S.D.N.Y.).(go back)

1321-cv-07683 (S.D.N.Y.).(go back)

1421-cv-05125 (S.D.N.Y.).(go back)

1521-cv-09634 (S.D.N.Y.).(go back)

1621-cv-06854 (S.D.N.Y.).(go back)

1721-cv-06365 (E.D.N.Y.).(go back)

1821-cv-11196 (S.D.N.Y.).(go back)

19Qiu v. Tarena Int’l Inc., (alleging defendants engaged in multi-year accounting fraud, made overstatements of net revenue, and did not comply with GAAP); In re Oatly Group AB Sec. Litig., Case No. 1:21-cv-03502 (S.D.N.Y.) (alleging, among other things, that defendants made misleading statements about the company’s financial metrics as a result of unspecified “improper accounting practices,” as indicated by periods of large divergence in revenue and accounts receivable growth rates).(go back)

2019-cv-03509 (S.D.N.Y. Mar. 29, 2021).(go back)

21In addition, plaintiffs’ Section 10(b) and Rule 10(b)(5) claims failed because the use of large block quotes followed by generalized explanations of how the statements were false or misleading were not sufficient to satisfy the heightened pleading requirements and plaintiff failed to identify any statements that were false or misleading when made.(go back)

2219-cv-08204 (S.D.N.Y. Jul. 19, 2021).(go back)

2320-cv-04420 (S.D.N.Y. Sep. 22, 2021).(go back)

2419-cv-00134 (S.D.N.Y. Jul. 7, 2021).(go back)

25524 F. Supp. 3d 23 (S.D.N.Y. 2021).(go back)

2620-CV-00806 (E.D.N.Y. Aug. 13, 2021) (report and recommendation adopted Sep. 20, 2021).(go back)

27524 F. Supp. 3d 283 (S.D.N.Y. 2021).(go back)

28Plaintiffs asserted other claims for securities violations, which were dismissed on other grounds.(go back)

29Id. at 304.(go back)

30Id. at 304.(go back)

31Id. at 304.(go back)

3220-cv-02810 (S.D.N.Y. Feb. 22, 2021).(go back)

3319-CV-05462 (S.D.N.Y.).(go back)

34Id.(go back)

Print

Print