Michael Klausner is the Nancy and Charles Munger Professor of Business and Professor of Law at Stanford Law School; Michael Ohlrogge is Assistant Professor of Law at NYU School of Law; and Harald Halbhuber is partner at Shearman & Sterling LLP and a Research Fellow at New York University School of Law, Institute for Corporate Governance & Finance. Related research from the Program on Corporate Governance includes SPAC Law and Myths by John C. Coates (discussed on the Forum here).

In earlier posts on this blog here and here, we have summarized our research findings regarding the extent to which SPACs have dissipated substantial amounts of cash underlying their publicly held shares by the time they enter into a “deSPAC” merger. We further found that a SPAC’s pre-merger net cash per share is highly correlated with its post-merger share price. The less cash per share delivered to a merger target, the greater the losses tend to be for nonredeeming SPAC shareholders. In the time since we wrote our article, our predictions have largely been borne out. The average share price of SPACs that merged in 2021 is now $6.30, roughly matching the actual net cash per share those SPACs delivered in their mergers. That $6.30 share price represents a steep loss compared to the $10 that SPAC shareholders would have received if they redeemed their shares.

Net cash per share, therefore, is highly material to a shareholder’s redemption decision. SPACs, however, do not disclose their net cash per share, and piecing this figure together based on what SPACs do disclose is a difficult and uncertain task even for a sophisticated shareholder. In a paper we have just posted here, we propose an approach that the SEC could consider in requiring SPACs to disclose their net cash per share as of the time of a merger.

A. Calculation of Net Cash Per Share

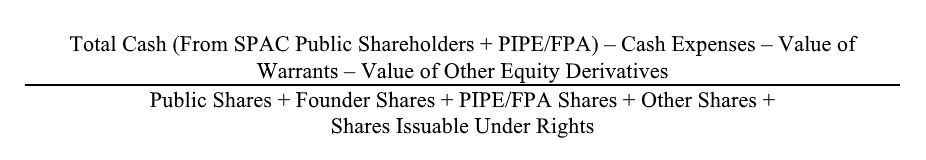

We propose that SPACs disclose net cash per share based on the following calculation:

In the full proposal, we explain each element of the calculation. We further explain how redemptions affect this calculation. In the numerator, redemptions reduce cash and, in the denominator, redemptions reduce public shares. The net result of redemptions is to reduce net cash per share. Therefore, we propose that SPACs disclose the result of this calculation based on hypothetical levels of redemption—for example, 0%, 25%, 50%, 75%, and 90%.

The following example shows how the calculation is performed. Assume a SPAC sold 80 units in its IPO, each consisting of a share and one half of a warrant, resulting in 80 public shares and 40 public warrants. The sponsor would have received 20 founder shares, but assume the sponsor agrees to cancel two shares in negotiating the merger, as sponsors sometimes do. This yields 18 shares for the founder. As is typical, assume further that the sponsor purchased 20 warrants at the time of the IPO, which covered the initial underwriting costs plus SPAC expenses during its search for a target. We assume the Black-Scholes valuation of the warrants is $1. Finally, assume 40 additional shares are sold in a PIPE for $10 each at the time of the merger, and that merger-related advisory fees and deferred underwriting fees amount to $100, a level of fees that seems awfully large but that is in fact consistent with what one sees in SPAC mergers.

For the numerator of net cash per share, this scenario yields, in the case of zero redemptions, net cash of $1,040 ($800 from the IPO plus $400 from the PIPE, minus $100 in fees, minus $60 from the value of the warrants). For the denominator of net cash per share, this scenario yields, in the case of zero redemptions, a total of 138 pre-merger shares (80 public shares from the IPO, 18 founder shares from the promote, and 40 additional shares from the PIPE). Together this results in $1,040 / 138 = $7.54 in net cash per share—approximating the actual mean level of net cash per share in SPACs that merged during 2021 (measured on a zero-redemption basis).

The following table shows net cash per share contingent on alternative redemption levels. In 2021, the average SPAC had 45% of its shares redeemed—an average that was pulled up by the SPAC bubble that extended into 2021. In 2022 so far, average redemptions are 80%.

| Redemptions | 0% | 10% | 25% | 50% | 75% | 90% |

| Net Cash per Share | $7.54 | $7.38 | $7.12 | $6.53 | $5.64 | $4.85 |

The difference between the $10 per share redemption price available to a SPAC shareholder and the amount of cash that a SPAC will deliver to a target in a merger consists of fees of various sorts. Some are explicit fees, such as the fees paid to an underwriter and the fees paid to other advisors in connection with a SPAC’s merger. Others, in effect, are fees. Sponsors take 20% of post-IPO equity as compensation for the services they provide. And investors in SPAC IPOs get free warrants in exchange for buying a SPAC’s shares and propping up the SPAC as a public company until the SPAC finds a merger target, at which point the IPO investors will redeem their shares for the price they paid for a unit—or sell the shares of the trading price is higher than the redemption price—and they will keep the warrants for free.

Requiring SPACs to disclose the extent to which these fees have dissipated shareholders’ cash is consistent with SEC regulations regarding other investment products, such as mutual funds and ETFs, which are required to disclose to investors how much of their investment will be dissipated through expenses. Such disclosure would not only inform SPAC shareholders’ decisions whether to redeem their shares, it might promote improvement in the SPAC structure. Research in other areas of finance shows how improving disclosures of opaque costs can result in improved competition and better outcomes, especially for retail investors.

B. Why Cash Per Pre-Merger Share Rather than Post-Merger Share?

Some SPAC advocates have argued that the dilution of cash in a SPAC is of no great consequence because SPACs tend to merge with targets larger than themselves, and as a result, the cash extracted from a pre-merger SPAC is small in relation to post-merger equity—basically, that it gets lost in the wash. This claim reflects a serious misunderstanding of SPAC dilution and its impact.

What matters to SPAC shareholders is the amount of net cash underlying each SPAC share, after accounting for dilution and dissipated cash. By choosing not to redeem their shares, SPAC shareholders invest that net cash in the target, just as IPO investors invest cash in a company going public through an IPO. The value one would expect the target to exchange for a SPAC share, therefore, is equal to the amount of cash the target will receive in the merger. The logic is the same as that of a sale to the public in an IPO. Consequently, the value of a post-merger share will tend to equal the SPAC’s net cash per share. The size of the target company is irrelevant to what the SPAC shareholder will receive. If there is $5 of net cash per share in a SPAC, that share would be expected to buy about $5 worth of target shares in a merger, regardless of whether the target is worth $100 million or $100 billion.

SPAC advocates also claim that SPACs deliver more than cash to their targets because a representative of the sponsor often sits on the board of the post-merger company and adds value. Empirical results on post-merger SPAC performance do not support this claim on average, but perhaps some sponsors with a board seat do have a Midas touch. This is no reason, however, for a SPAC to decline to disclose the amount of cash it will deliver to a target. Net cash per share should still be disclosed. The SPAC can, however, explain the additional value it believes the sponsor will deliver following the merger.

***

In sum, disclosure of SPACs’ cash per share would provide important information to SPAC shareholders considering whether to redeem their shares. This information would be simple for SPACs to provide. In contrast it is difficult for SPAC shareholders to construct this figure on their own based on the information that SPACs do provide. We therefore propose that the SEC require its disclosure. In our full regulatory proposal, we provide additional details on the rationale behind the net cash per share disclosure, specifics on how it is calculated, and responses to other frequently asked questions about it.

Print

Print