Mike Kesner is partner and Linda Pappas and Joshua Bright are principals at Pay Governance LLC. This post is based on a Pay Governance memorandum by Mr. Kesner, Ms. Pappas, Mr. Bright, and Ira Kay. Related research from the Program on Corporate Governance includes The Perils and Questionable Promise of ESG-Based Compensation by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here) and Paying for Long-Term Performance by Lucian Bebchuk and Jesse Fried (discussed on the Forum here).

The 2021 proxy season was dominated by COVID-19. Close to half of Standard & Poor (S&P) 500 companies took some type of COVID-19-related action in 2020, including base salary reductions, modifications to incentive plan targets, and the grant of special awards.

Despite the significant upheaval in compensation, financial results, and stock price performance during 2020, shareholders supported 97.3% of Say on Pay votes among Russell 3000 companies through November 30, 2021, with strong average support of 92.2%. Sixty-two companies—or 2.7%—failed Say on Pay, including some large, “name-brand” companies. The reasons for these high-profile failures can be primarily attributed to several factors including the use of positive discretion in determining annual incentive payouts, modifications to in-flight long-term incentive (LTI) awards, grants of “out-sized” stock awards without a compelling rationale, and a disconnect between pay and performance.

Part of the strong showing in shareholder support can be attributed to Institutional Shareholder Services (ISS) recommending a vote for Say on Pay at 88.5% of Russell 3000 companies, which was only down 0.5% compared to the 2020 proxy season. While ISS approved most companies’ Say on Pay proposals, those companies that received an against recommendation from ISS were more likely to fail Say on Pay (24%) compared to prior years (for example, 18.4% in 2020, 18.8% in 2019, and 17.1% in 2018). Thus, ISS influence increased in 2021 and an against recommendation was far more likely to result in a failed Say on Pay vote compared to prior years.

The 2021 compensation year has also been filled with continued uncertainty due to COVID-19, supply chain issues, workforce shortages, and—most recently—inflation fears and the Russia-Ukraine conflict, so what should we expect to see (or not see) during the 2022 proxy year compared to 2021?

The 2022 Proxy Season

Given strong shareholder support in the 2021 proxy season, it is unlikely companies will have significantly revamped their 2021 compensation programs. In some cases, compensation practices that were adopted in 2020 to address COVID-19-related uncertainty will have carried over to the 2021 compensation year, including:

Wider performance curves. Many companies widened their performance curves to minimize the chance of a zero or maximum payout given the uncertainty in setting performance targets. This uncertainty persisted at the beginning of 2021, and a widening of the performance curve allowed companies to retain the basic structure of existing plans but with far less pay/performance leverage.

Semi-annual short-term incentive performance periods. Companies in industries facing the greatest level of uncertainty continued or adopted a “1st half/2nd half short-term incentive plan whereby 6-month goals are set at the beginning and the middle of the performance year to allow for a “resetting” of targets at mid-year based on more current financial outlook.

Inclusion of qualitative metrics. After unprecedented levels of discretionary adjustments applied in 2020, some companies added or increased the weighting of qualitative metrics to allow the Compensation Committee to exercise discretion within predefined guardrails (e.g., +/- 20%).

Above target annual incentive plan payouts. Given the limited visibility at the beginning of 2021 amid the continued impact of COVID-19 (e.g., supply chain pressures, “The Great Resignation,” etc.) and 2020 annual incentive plan payouts, the majority of which were below target or zero, many companies may have established relatively conservative financial targets for their 2021 annual incentive plans. Early indications are that above target (or maximum) annual incentive payouts are being reported by companies that were more resilient than forecasted and capitalized on better-than-expected market opportunities in 2021.

As of the writing of this post, actual annual incentive payouts for 2021 at Russell 3000 companies are tracking between target and maximum (average of nearly 150% of target). [1] Eighty percent of the companies in the sample are paying annual incentives above target (average of 160% of target). Based on year-over-year comparisons for a subset of companies paying 2021 annual incentives above target, 2020 annual incentives were paid out at an average of about 90% of target.

Preliminary Results of Russell 3000 Fiscal Year 2021 Annual Incentive Payouts [2]

| Total Sample |

At or Below Target Payouts | Above Target Payouts |

|

|---|---|---|---|

| Sample Size | n=319 | n=63 | n=256 |

| % of Sample | 100% | 20% | 80% |

| Average Payout (% of Target) |

148% of target | 67% of target | 160% of target |

Inclusion of relative total shareholder return (TSR) as a metric in performance share(PSU) plans. Many companies struggled to set annual financial targets, let alone multi-year goals for PSUs. To address this uncertainty, more companies may have added relative TSR to their PSU scorecards, thereby eliminating the need to establish absolute goals at the beginning of the performance cycle.

Replace multi-year goals with multiple annual goals in PSU plans. Another approach companies carried over or adopted is the use of annual goals within PSU programs, with performance measured each year and earned shares distributed on, for a 3-year plan, the third anniversary of the grant. This approach allows companies to maintain a performance-oriented plan while minimizing the risk with 20-20 hindsight of setting overly aggressive or conservative performance targets.

We do not expect to see, in the 2021 compensation year, some of the compensation practices that were originally adopted during the pandemic. These include:

Base salary reductions. All but the most severely-harmed companies by COVID-19 restored 2020 base salary reductions prior to the end of 2020. Thus, only a handful of companies have maintained reduced base salaries in the 2021 compensation year.

Exercise of upward discretion. Given the more conservative approach in setting performance goals as noted above and the most recent trend on 2021 annual incentive payouts, there will be far less need for compensation committees to exercise discretion to increase annual incentive payouts. It is possible some compensation committees will exercise negative discretion if the formulaic result does not fit with the overall health/performance of the company.

Modifications to in-flight LTI awards. Given the 2021 proxy season investor and proxy advisor backlash delivered to companies that modified in-flight LTI awards in the 2021 proxy season, it is unlikely many companies made similar changes during the 2021 compensation year.

The payout outcomes of LTI award cycles ending in 2021 are likely to be across the full spectrum—zero to maximum. Among companies that set multi-year goals pre-pandemic, payouts are likely to be at or below target. Performance plans tied to relative TSR or based on 1-year performance metrics are generally above target or at maximum.

Stock Price Performance

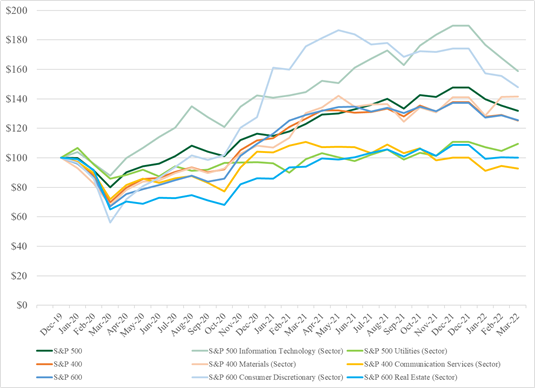

Stock price performance will continue to play a role in compensation decisions, with higher performing companies having significantly more flexibility when making compensation decisions than lower performing companies. After the “COVID dip” in stock prices in March of 2020, which impacted all major market indices and sectors, the rebound was almost as swift. However, the rate of recovery has varied by sector, which led to a broad spectrum of compensation actions. In summary, while the playbook for managing incentive plan actions due to the COVID dip was relatively consistent, the playbook for managing the recovery was more nuanced during 2021depending on the strength of the company’s performance—a trend that we expect to continue during 2022.

The chart below shows the performance of a hypothetical $100 investment from December 31, 2019 through March 15, 2022 for the S&P 500, S&P 400, and S&P 600 as well as the highest and lowest performance sectors (during this measurement period) within each of these indices:

Looking Ahead to 2022 Proxy Season Outcomes

Two areas of potential concern could arise if shareholders and the proxy advisory firms consider the 2021 annual incentive goals lacked rigor or if companies significantly increased 2021 equity awards (either delivered through annual awards or through special, one-time arrangements) without a detailed explanation. Companies are likely to have addressed these concerns by providing fulsome disclosure of the degree of goal rigor, rationale for increased LTI awards, and the linkage to shareholder value creation in their 2022 proxies.

Given the compensation changes made in 2021 to adapt to an uncertain economic environment and likely avoidance of the “foot-faults” that occurred in the 2020 compensation year, it is highly likely shareholder support for Say on Pay in 2022 will be as good as, if not better than, 2021. While this could make for a far less exciting proxy season, it should be a welcome relief and allow companies more time to focus on what could be a challenging business environment.

Endnotes

1Source: ESGAUGE Reflects Russell 3000 companies that filed proxy statements between 11/1/21-3/15/22 and reported target non-equity incentive values.(go back)

2Id.(go back)

Print

Print