Brianna Castro is Senior Director of U.S. Research; Courteney Keatinge is Senior Director of Environmental, Social & Governance Research; and Aaron Wendt is Director of U.S. Governance Policy at Glass, Lewis & Co. This post is based on their Glass Lewis memorandum.

Key Trends

Last year’s SPACs and IPOs expand this year’s proxy season

- The U.S. research team covered more than 200 additional U.S. meetings in 2022 compared to 2021 (+6.37% increase, following an +8% increase from 2020 to 2021). A frothy IPO and SPAC-merger market in 2021 led to many companies holding first-year AGMs in 2022.

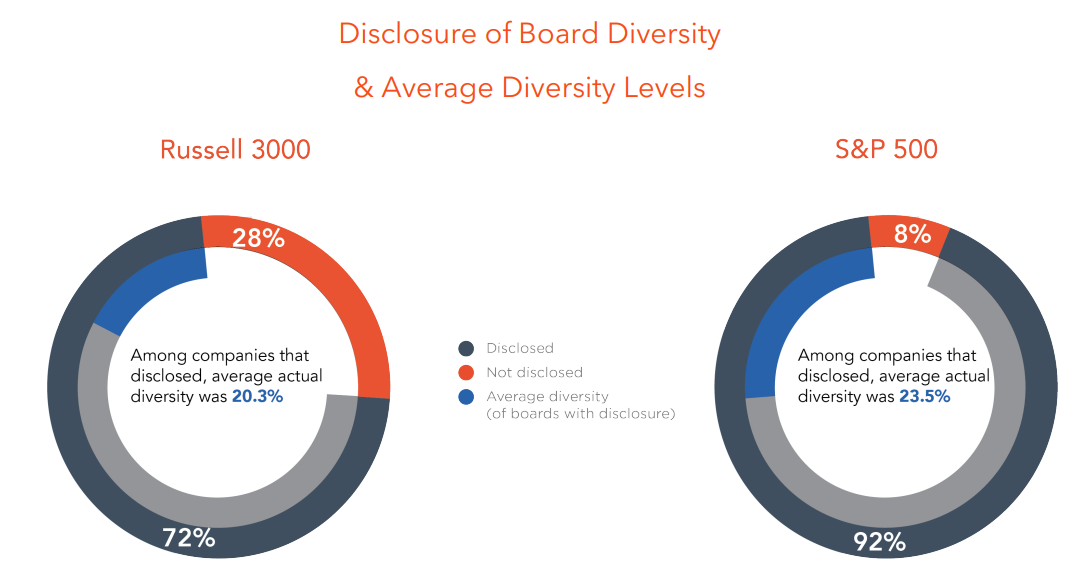

Diversity rulings on hold, but investor interest remains strong

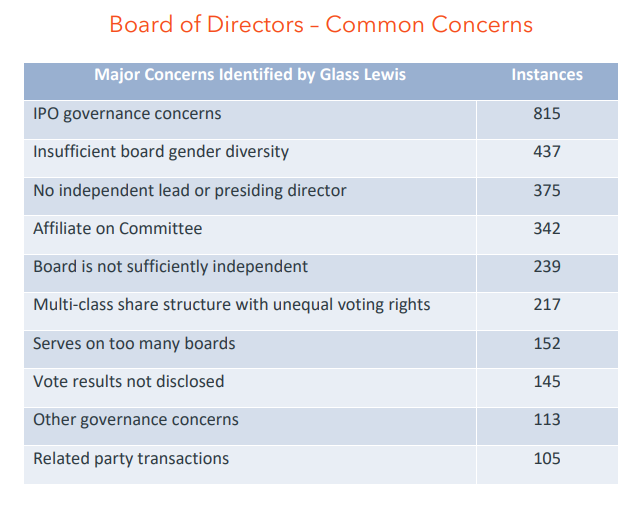

- In judgments that came down at the height of proxy season, California’s landmark board gender and “underrepresented community” diversity laws were both deemed to violate the equal protection clause of the state constitution. The laws remain on hold pending potential appeals; boards should continue to expect pressure from investors and external stakeholders to increase board diversity.

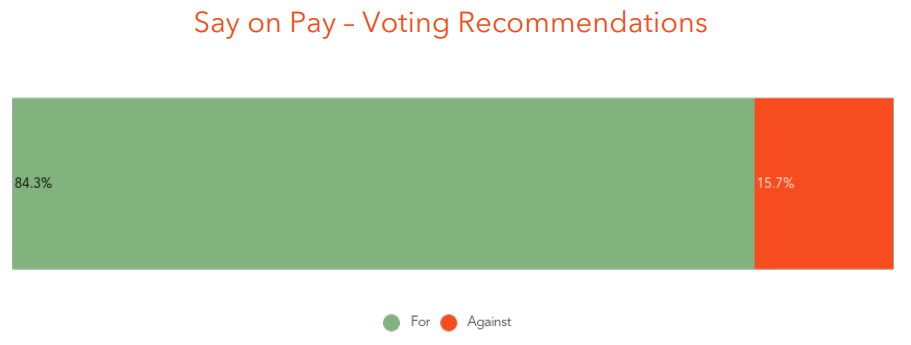

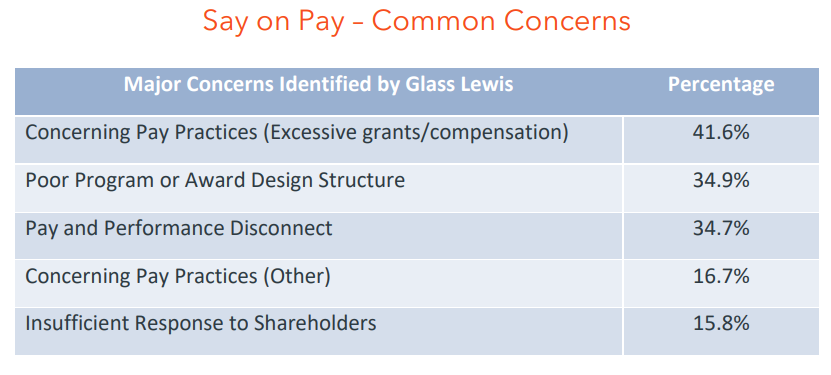

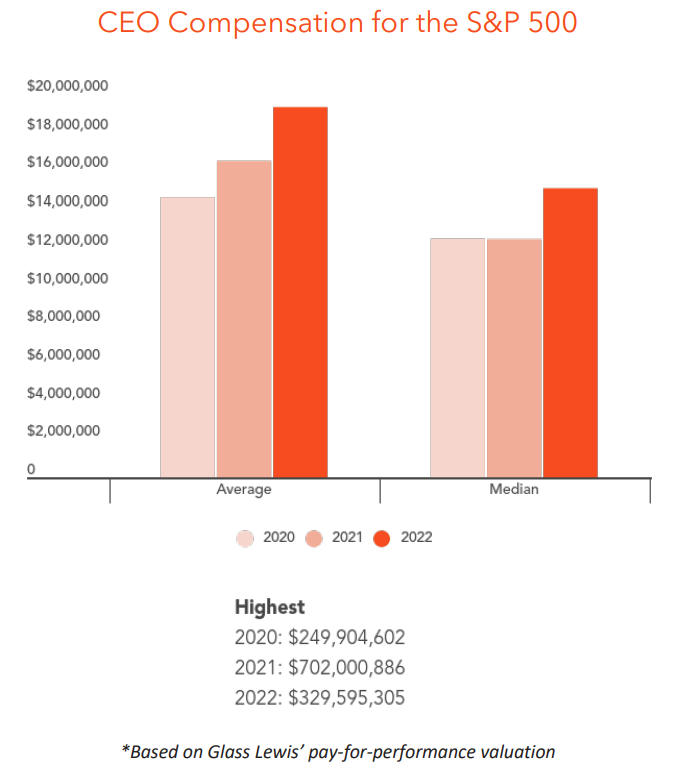

Excessive granting and overall pay continued to drive Say on Pay opposition

- This can partially be attributed to the “mega-grant” trend, as many companies within the wave of new listings gave their executives outsized awards.

- We also saw an uptick in retention one-time awards, with many companies citing the need to keep top talent during a tumultuous economic environment and a few even citing the “Great Resignation.”

More shareholder proposals, but lower shareholder support

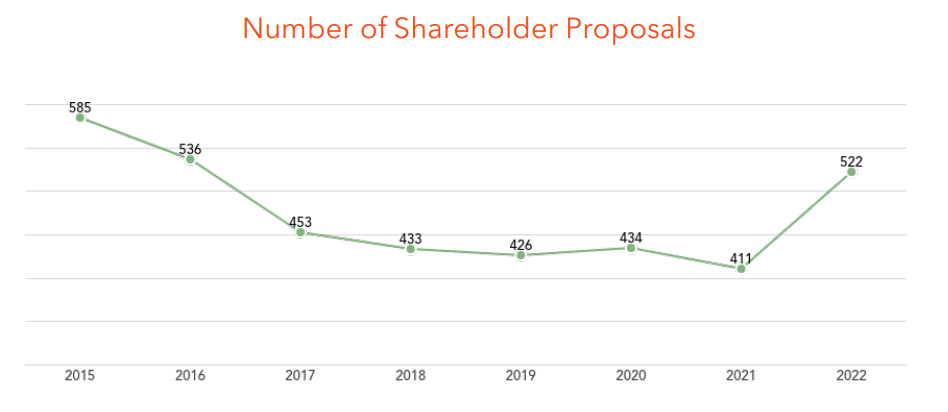

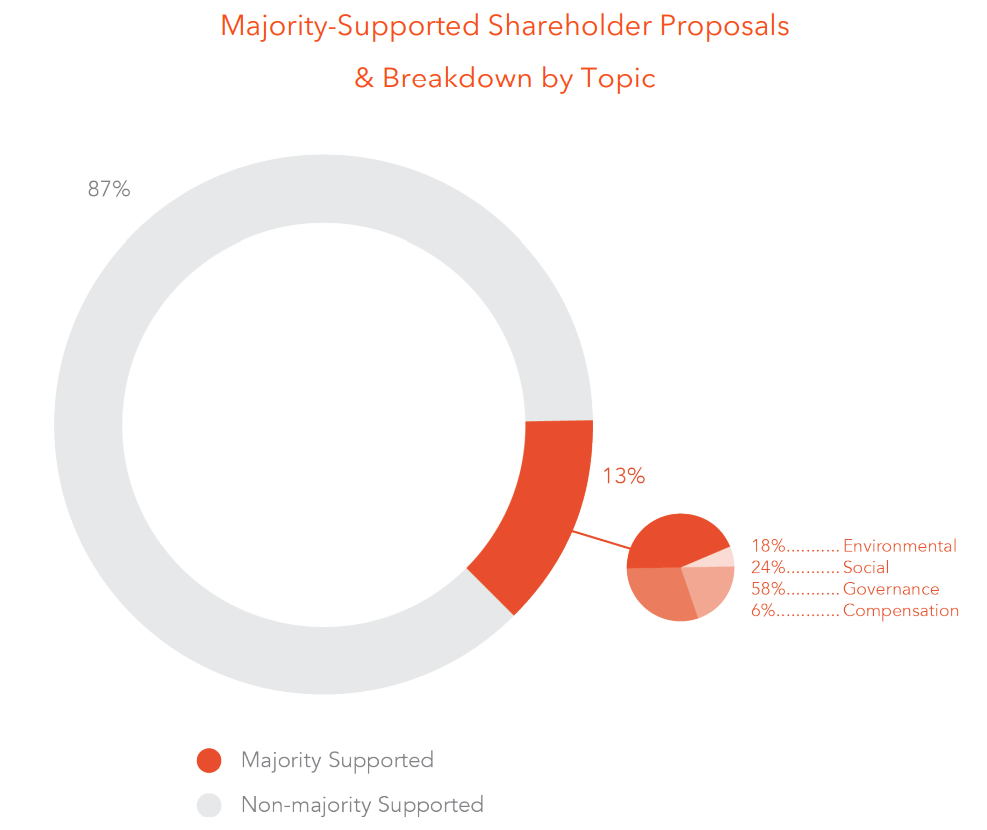

- As a result of a more permissive regulatory environment and the growing focus on ESG-related issues, over 100 more shareholder proposals went to a vote during the 2022 proxy season relative to the previous year. The increase was largely as a result of proposals submitted by advocacy groups, such as NGOs and think tanks.

- However, at the same time, shareholder support for these proposals declined for most types of shareholder proposals, with average shareholder support for these resolutions dropping from 36% in 2020 to 31% in 2022.

Data Highlights

Glass Lewis Voting Recommendations & Most Common Concerns

Proxy Statistics

The complete publication is available here.

Print

Print