Brigid Rosati is Managing Director of Business Development; Rajeev Kumar is Senior Managing Director; Kilian Moote is Managing Director; and Michael Maiolo is a Senior Institutional Analyst at Georgeson. This post is based on a Georgeson memorandum by Ms. Rosati, Mr. Kumar, Kilian Moote and Michael Maiolo. Related research from the Program on Corporate Governance includes Social Responsibility Resolutions (discussed on the Forum here) by Scott Hirst.

METHODOLOGY

Period Presented & Data Sources

For the 2022 proxy season, this report is based upon annual meeting results proxy year 2022, for companies within the Russell 3000 Index. Prior season data is for companies within the Russell 3000, for the full proxy season, running from July 1 — June 30 for each period presented, unless otherwise noted. For example, 2021 proxy season data is for the period from July 1, 2020 — June 30, 2021. As data for all years is based on Russell 3000 Index constituents as of proxy season 2022, such information may include minor inconsistencies compared to previous reports relating to the 2021 and 2020 proxy seasons, due to changes to index membership over time.

Shareholder proposal submission data and annual meeting results discussed herein have been sourced from ISS Corporate Solutions and supplemented by our own research through additional sources, including various proponents’ shareholder proposal submission data.

Vote Outcomes Reported

For results reported, we use each company’s vote standard applicable to each proposal analyzed to determine proposal passage, failure or level of support. For purposes of considering average support, we have examined votes cast for and against proposals, not considering abstentions.

Shareholder Proposal Categorization

There is inherently some subjectivity in categorizing the focus and subject matter of shareholder proposals. Such categorizations have become increasingly challenging over time as environmental, social and corporate governance topics increasingly overlap and influence one another. Where proposals address multiple topics, we have aimed to categorize them based on what we believe to be the primary focus of the proponent in submitting the proposal. For purposes of this report, governance proposals include proposals addressing topics such as: shareholder special meeting and written consent rights; voting standards; dual class structures; independent board chairs; proxy access; board declassification; director term limits; executive compensation matters, including proposals concerning compensation linked to ESG topics; and shareholder approval of bylaw amendments. Social proposals address a broad set of topics, including board and employee diversity matters; discrimination and sexual harassment; mandatory arbitration policies; pay disparity; public health and welfare; human rights; employee welfare and workplace matters; product safety; animal welfare; disclosure of board qualification matrices, including director nominees’ ideological perspectives; political contributions disclosure; and disclosure of lobbying policies and practices. Environmental proposals address topics including climate change risks and reporting; greenhouse gas (GHG) emissions goals; recycling, single-use plastics and sustainable packaging; renewable energy; environmental impact reports; and sustainability reports.

INTRODUCTION

A comprehensive examination of 2022 proxy season voting statistics yields a number of notable observations:

| Average support for director elections is roughly in line with 2021 support levels, although appears to be trending downwards when results are limited to the 2022 calendar year (which more accurately assesses the impacts of policy changes that went into effect during the 2022 calendar year) |

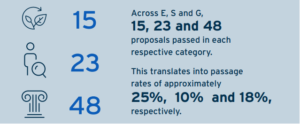

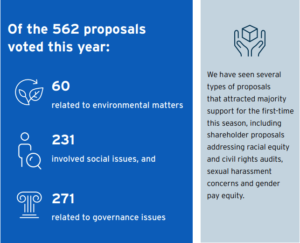

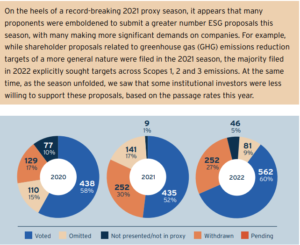

While overall raw numbers of passing shareholder proposals in 2022 were in line with 2021, the percent of proposals voted that passed dipped due to an increase in the number of proposals voted upon. As in 2021, we saw significant withdrawal activity particularly within environmental and social-related proposals, as well as a decrease in the number of proposals omitted through the SEC’s no-action process due to a shift in SEC guidance in late 2021. Accordingly, what may appear on the surface as muted support we see as less as a matter of decreasing shareholder attention on ESG matters and more as a reflection of proponents’ heightened ambitions in the shareholder proposals voted upon in 2022.

Thematically, the US saw several new or evolving trends. On the environmental side, proposals requesting Scope 3 emissions reductions targets, policy alignment with the International Energy Agency’s, or IEA’s, Net Zero scenario, and cessation of financing to fossil fuel projects were notable in 2022. On the social side, racial equity audit proposals gained momentum and expanded into broader requests for civil rights audits. Across both categories, almost 20 new “system stewardship” proposals were submitted in 2022 focusing on companies’ impacts to broader systems, with proposals focused for example on the public health costs of protecting vaccine technology at healthcare companies and external costs of misinformation at technology companies. On the governance side, the number of special meeting-related proposals submitted, as well as the number that passed, more than doubled since 2021; many of these proposals sought to lower the threshold required to call a special (typically to 10%).

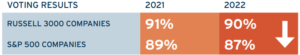

| Average support for Say on Pay proposals is roughly in line with support experienced in the 2021 proxy season. | 90% in 2022 as compared to 91% in 2021. |

We saw the trend continue this season of companies recommending that shareholders vote in support of, or not make a recommendation with respect to, shareholder proposals.

| As a result, we have seen 16 shareholder proposals so far this season receive support above 80%. |

2022 PROPOSALS VOTED AND PASSED

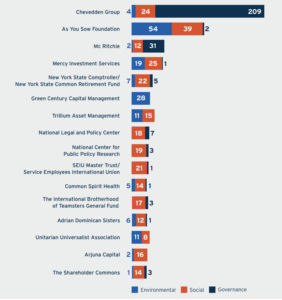

As for proponents, familiar names accounted for most proposals filed in 2022. However, we believe coordination among proponents may have increased, perhaps — at least in part — in response to changes to Rule 14a-8 finalized in 2021 that now prohibit proponents from filing more than one shareholder proposal at a given company. In particular, we observed increasing coordination among Chevedden group members, who historically focused on governance matters, with proponents and advocacy groups across the ESG spectrum, including The Shareholder Commons, As You Sow and various Interfaith Center for Corporate Responsibility members.

TOP SHAREHOLDER PROPONENTS [1]

SAY ON PAY

Say-on-pay vote results for 2022 season witnessed a decline in the average support for Russell 3000 companies, with approximately 90% of votes cast in favor (excluding abstentions), compared to 91% support in 2021. As we have been seeing in recent years, S&P 500 companies have garnered lower support, with 87.3% of votes cast in favor, also down from 2021 when they received 88.7% favorable support.

74 Russell 3000 companies failed to receive majority support for their say-on-pay proposals in the 2022 season, with 67 failed votes occurring since January 1, 2022. Nearly 30% of these companies are in the S&P 500 index, with 23 failed votes in 2022 and 20 since January 1, 2022. Among the S&P 500 companies, Norwegian Cruise Line Holdings Ltd. received the lowest support, with only 15.4% vote. Concerns relating to limited responsiveness to last year’s similarly low 16.6% vote, CEO’s high pay and pay for performance alignment seem to have contributed to significant shareholder opposition. Additionally, 5.5% of Russell 3000 companies in 2022 had say-on-pay “red zone” voting results — i.e. vote support falling between 50% and 70%. By comparison, 6.1% of S&P 500 companies had results falling within the “red zone.”

ISS recommended “Against” a higher percentage of Russell 3000 companies in 2022, with 13.2% of say-on-pay proposals garnering a negative recommendation, compared to 11.2% in 2021. Negative ISS vote recommendations may have reduced shareholder support by as much as 31.3% of votes cast at such companies in 2022, compared to 29.9% in 2021. ISS’s negative recommendations at S&P 500 companies in 2022 were also up at 12.7% compared to 10.3% last year, and reduced shareholder support by almost 39%.

In assessing pay for performance alignment in 2022, a common concern for both shareholders and ISS seemed to relate to goal rigor of incentive programs, as some companies lowered targets following challenging business conditions due to the ongoing pandemic. ISS particularly scrutinized maximum or above target payouts where targets were lowered compared to last year, or where there has been inadequate disclosure of how companies determined award payouts. As ESG metrics are increasingly used in incentive compensation, proxy advisory firms and investors are asking for enhanced disclosure relating to use of such metrics and achievement against the related goals. Among poor pay practices, retention grants without performance conditions or additional compensation without adequate justification are seen as being especially problematic.

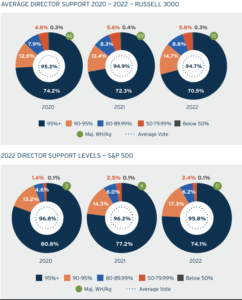

DIRECTOR ELECTIONS

Support for director elections at Russell 3000 companies continued to be strong in 2022, averaging 94.7%, a slight downtick compared with the average support of 94.9% for the 2021 proxy season. This slight average downtick in support has corresponded with the increase in the number of directors receiving less than 90% support for their (re)election. 14.9% of directors of 2022 received less than 90% vote support compared to 14.3% in 2020. Directors at S&P 500 companies, who tend to fare better, averaged 95.8% support for the proxy year 2022 down from 96.2% last year.

62 director nominees failed to receive at least 50% shareholder support, with all but 5 at non-S&P 500 companies. However, only 14 of these 62 directors failed to get elected due to the existence of a majority vote requirement at their respective companies. The remaining 48 directors were nonetheless (re)elected, as they served on boards with plurality vote standards in place. Arrowhead Pharmaceuticals, Inc. accounted for three of these failures. Poor responsiveness to last year’s failed say-on-pay vote seems to have resulted in investors’ opposition to these directors, and the company’s say-on-pay proposal again failed this year, garnering only 20.4% support.

As for areas of focus that drove investors’ director election decisions, board composition and oversight appear to continue to be at the top of the list in the 2022 proxy season. Racial and ethnic diversity expectations likely contributed to the slight increase in opposition observed. Significantly, ISS’s and many investors’ policies to hold nominating committee chairs/members accountable where their boards lack of racially and ethnically diverse members went into effect this year. Glass Lewis and many investors also increased their board gender diversity expectations, from one to at least two women on the board. Relating to oversight, both proxy advisory firms and some investors have also increased expectations as to how boards should oversee material environmental and social matters and companies’ sustainability disclosures, especially those relating to climate change. Lastly, overboarding continued to result in director opposition, as investors increasingly tighten their policies relating to directors’ time commitments.

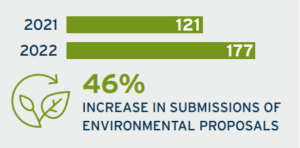

SHAREHOLDER PROPOSALS: ENVIRONMENTAL

Climate remained a key focus in the 2022 proxy season, and the various environmental shareholder proposals showcased heightened proponent ambitions. Year-over-year, submissions of environmental proposals increased 46%, with 177 proposals submitted during the 2022 season compared to 121 during the 2021 season. Despite the increased volume of submissions, voting results and support are similar to 2021.

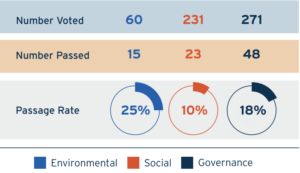

In 2022, we have observed 15 environmentally focused shareholder proposals pass, representing a passage rate of approximately 25%. While the 2022 passage rate suggests somewhat weaker support relative to 2021, we view this less as a matter of decreasing shareholder support and more the result of heightened ambitions in this year’s proposals, as discussed further below.

Emissions Reduction Targets

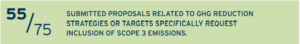

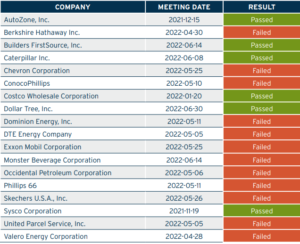

Like 2021, shareholder proposals calling for companies to adopt or enhance greenhouse gas (GHG) emissions reduction targets represented the most common environmental sub-category this season. However, this year’s proposals more often requested for targets or strategies that specifically include or account for Scope 3 emissions. Of the 75 submitted proposals related to GHG reduction strategies or targets, at least 55 specifically request inclusion of Scope 3 emissions. [2]

36 of the 55 Scope 3 proposals were withdrawn, and 18 went to a vote this season. Of the 36 proposals that were withdrawn, 24 specifically reference withdrawal due to an agreement being reached, a commitment being made, or general constructive dialogue. Notably, As You Sow was listed as a filer in 17 of the 36 withdrawn proposals. Turning to proposals that were brought to a vote, of the 18 proposals voted upon, 12 failed and 6 passed. Further, of the six that passed, in two instances management recommended that shareholders vote in favor of the proposal, and in another two instances management did not make a recommendation with respect to how shareholders should vote on the proposal.

TABLE OF SCOPE 3 PROPOSALS

No New Fossil Fuel Financing

Several environmental proposals within financial services have focused on financing policies, requesting companies to cease financing fossil fuel projects. This year we have observed 11 of such proposals filed across 10 companies.

All proposals within this category reference the International Energy Agency’s (IEA) Net Zero by 2050 scenario. In this context, these proposals request that the subject company refrain from financing or underwriting activities that would be inconsistent with said scenario. In practical terms, these proposals effectively call for an end to the financing or underwriting of new fossil fuel projects. Of the nine such IEA-related proposals that went to a vote this year, all nine failed to pass and none receiving support above 19.4%, as shown below.

Audited Report on Impact of IEA’s Net Zero by 2050 Scenario

In addition to the aforementioned proposals regarding financing policies, we saw IEA’s Net Zero by 2050 scenario referenced across companies within the energy and utility sectors. In these proposals, proponents requested companies to issue audited reports on the impacts of the IEA’s Net Zero by 2050 scenario, including how applying the scenario’s assumptions regarding fossil fuel demand would impact each company’s underlying assumptions and financial positions. This year we observed six proposals within this category, four of which have been withdrawn and two that went to vote in May 2022, one of which passed (Exxon Mobil).

BlackRock’s 2022 Climate-related proposal

When we published our Early Season Report in June 2022, we expected many of the early voting trends on climate proposals to persist throughout the remainder of the season, a sentiment that, at the time, was bolstered by BlackRock’s published commentary regarding 2022 climate-related proposals. In its Spring 2022 bulletin, BlackRock characterizes this year’s climate proposals as more prescriptive than 2021’s proposals and noted that “[t]he nature of certain shareholder proposals coming to a vote in 2022 means we are likely to support proportionately fewer this proxy season than in 2021, as we do not consider them to be consistent with our clients’ long-term financial interests.” [3] [4]

At the time, BlackRock flagged specific categories of proposals that they believed warrant special attention. These themes included:

- Ceasing providing finance to traditional energy companies

- Decommissioning the assets of traditional energy companies

- Requiring alignment of bank and energy company business models solely to a specific 1.5°C scenario

- Changing articles of association or corporate charters to mandate climate risk reporting or voting

- Setting absolute scope 3 GHG emissions reduction targets

- Directing climate lobbying activities, policy positions or political spending

Following up on its Spring 2022 bulletin, in July 2022, BlackRock published its “2022 voting spotlight summary” outlining global voting decisions made during the 2022 proxy season (July 1, 2021 — June 30, 2022) across relevant management and shareholder related topics. The July report included commentary on how it voted to reflect climate-change concerns; as expected, its voting was muted compared to 2021. For example, BlackRock did not support the election of 176 directors for climate-related concerns, down from 254 in 2021. Further the report stated that BlackRock had “not supported certain climate shareholder proposals that are overly prescriptive” and provided commentary that these proposals did not receive their support because of a myriad of factors including:

- Attempting to micro-manage how companies should decarbonize.

- Commanding the pace of energy transition plans despite continued consumer demand, with little regard to company financial performance

- Failing to recognize that the related company had largely already met the proposal’s ask

It is important to note that in its Spring 2022 bulletin, BlackRock emphasized its role as an asset manager, noting: “It is not BIS’ position to tell companies what their strategies should entail, as this proposal prescribes. Rather, we assess, based on their disclosures, their climate action plan, board oversight and business model alignment with a transition to net zero by 2050.” As we begin to review and report on definitive voting decisions from major investors, we will further examine BlackRock’s overall dampened support of environmental shareholder proposals this season and focus on against rationales related to climate-related proposals.

Voting DecisionsIn 2022 we saw the continued trend of institutional investors pre-disclosing their voting decisions in advance of the N-PX deadline, which is in August every year. While BlackRock and Neuberger Berman have historically led this effort, we have seen an uptick from investors such as Engine No. 1 and AllianceBernstein. With the August deadline now past, we have access to expanded analysis of institutional investor voting decisions on key shareholder proposals, as well as management say-onpay proposals and director elections. Georgeson will be releasing a comprehensive report analyzing key voting decisions across important topics from the 2022 season, including passing environmental proposals, evolving social-related proposals, director elections in the Russell 3000 and S&P 500, and more. |

SHAREHOLDER PROPOSALS: SOCIAL

PASSING SOCIAL PROPOSALS 2022

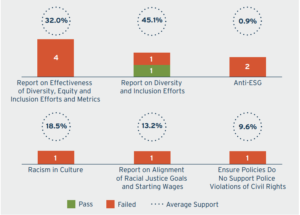

Diversity, Equity & Inclusion

Consistent with the 2021 shareholder season, diversity equity and inclusion remained a major theme for shareholders in 2022, with 44 proposals identified. The variety within proposal resolutions relating to DE&I matters is illustrative of the variety of ways that investors believe DE&I matters can be material to companies. This season, 33 DE&I related proposals were withdrawn or omitted, 11 were voted, and one passed. One notable trend was the growth in shareholder proposals seeking reporting on workforce data beyond disclosure of EEO-1 survey workforce diversity data. Data requests this year included disclosure of recruitment, retention, and promotion information specifically addressing diverse employee populations, or reporting on steps by the company to implement their stated diversity and inclusion initiatives.

As for EEO-1 reporting, proposals seeking such disclosure decreased dramatically in 2022 compared to 2021 (7 vs 47), and all but one such proposals were withdrawn, not in proxy or omitted from ballot. We believe the decline in the number of such proposals does not represent a decreased demand for workforce diversity data, but rather is an indication of the rapid increased prevalence of this disclosure, particularly across S&P 500 companies.

DIVERSITY, EQUITY AND INCLUSION PROPOSALS 2022

2022 AVERAGE SUPPORT FOR DIVERSITY, EQUITY AND INCLUSION PROPOSALS

Board Diversity

An additional 18 proposals filed this year addressed board diversity matters, a slight decline as compared to the 2021 season. As with EEO-1-related proposals, we believe this decline in proposal volume is not indicative of waning importance of this topic, but rather an indication of progress. Many companies have made meaningful strides in diversifying their boards — and providing disclosure thereon, whether as a result to Nasdaq’s recently revised listing standards or otherwise — and institutional investors have increasingly revised proxy voting guidelines to provide for votes against directors where companies fall short of their diversity expectations.

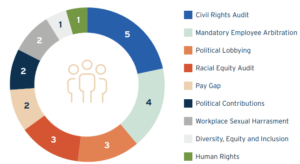

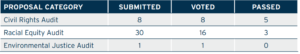

Civil Rights and Racial Equity Audits

Another subject of shareholder proposals under the broader DE&I umbrella that was new in 2021 were those relating to racial equity audits, which were largely (although not exclusively) focused within the financial services sector. In 2022, these proposals were expanded upon to include civil rights audits and proponents have submitted them across several industries. Such proposals typically focus on both internal and external procedures at the company that may negatively impact minority or protected groups. While no proposals on this topic passed in 2021, in 2022 three racial equity and five civil rights audit proposals have passed. Average support across both types of proposals is 43%.

Workforce Harassment/Mandatory Employee Arbitration

Concern around risks posed by workplace harassment also seems to have increased among shareholder proponents. This year two proposals on sexual harassment passed and four proposals on the use of binding arbitration provisions within employment contracts have passed. Critics contend that binding arbitration within employee contracts may pose a barrier to an employee’s ability to make known harassment or discriminatory practices occurring within a company’s workplace. In the case of both proposal types, we believe these represent the first such proposals to have passed. Further, average support for workplace harassment-related proposals voted date this year was 48%, an increase compared to average support of 45% for such proposals in the 2021 season.

Pay-Related

While pay gap proposals have appeared on proxy ballots for several seasons, 2022 marks the first time that two such proposals passed to our knowledge. Typically, these proposals seek reporting on any pay discrepancy that exists between minority groups or women and the average pay within a company. In 2021 no pay gap reporting proposals passed, and average support was below 30%. This season, two such proposals passed and average support across the 8 voted upon has increased slightly to 38%. All paid leave-related proposals were either omitted or were withdrawn in 2021 and only two such proposals went to a vote this year.

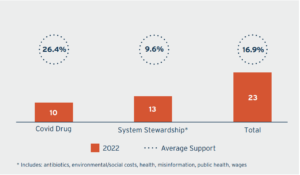

Covid-19/Drug-Related

With the pandemic now entering its third-year, vaccine access remained a focus for shareholder proponents in 2022. 12 proposals were filed with healthcare companies relating to intellectual property and vaccine access. Across the 10 proposals voted on in 2022, none passed, consistent with 2021 results. Average support for these proposals has decreased year-over-year, from the low 30s% in 2021 to 26% in 2022.

NUMBER OF VOTED PROPOSALS AND LEVEL OF SUPPORT RELATED TO COVID-19/DRUG RELATED

Human & Labor Rights-Related

33 human rights related proposals were voted on in 2022. These proposals relate to how companies manage or address human rights or labor rights issues within their direct operations or value chains. Average support across the 33 proposals has been 22%. Shareholder proponents have stayed fairly consistent in their requests yearover-year, with the majority of proposals focusing on human rights due diligence or risk assessment processes of companies.

HUMAN RIGHTS — YEAR OVER YEAR CHANGE IN SUPPORT LEVELS FOR HUMAN RIGHTS PROPOSALS

However, some proposals this year identified company-specific risks. At least 2 that were voted on related in some way to human rights matters within conflict-affected areas. The topic has received renewed media attention following Russia’s invasion of Ukraine. State Street Global Asset Management (SSGA) took the unique step of issuing mid-season guidance on this topic, providing more context on what they expect of companies operating in areas where geopolitical risks may create material risk for a company. In their note SSGA stated they expect detail on:

- Management and mitigation of risks related to operating in impacted markets, which may include financial, sanctions, regulatory, and/or reputational risks, among others

- Strengthened board oversight of these efforts; and

- Detail on these efforts in public disclosures [5]

While not explicitly mentioning Russia, it is fair to assume that this statement was in response to the geopolitical risk created by Russia’s invasion in Ukraine. The guidance follows other actions in response to the conflict — by SSGA and other asset managers — which have included withdrawal of business operations from Russia. Despite the media attention and actions taken by investors to unwind their own exposure to Russia the conflict did not appear to influence how investors responded to shareholder proposals. However, it is clear that the Russian invasion has increased investors’ collective awareness and focus on how geopolitical conflicts may pose myriad risks to companies. Despite this awareness the two proposals discussing risks from conflicts received average of 11.4% support, which is fairly consistent with similar proposals from previous years.

Further, at least 5 human rights-related proposals cited the Uyghur minority population in China as a human rights issue relevant to the companies in question. Of the four that went to a vote average support was 27%, slightly above that of more general human rights related proposals. There was also a series of new proposals this year filed within the technology sector that relate to how technologies, such as Meta’s (formerly Facebook’s) virtual reality platform (“the Metaverse”) or Google’s algorithms may inadvertently cause or enable human rights impacts.

Worker Classification

Another new shareholder proposal type within human rights this year addresses the risk posed to retailers by third-party logistics providers who may have misclassified their truck drivers as independent contractors rather than employees. The proposals hinge on a new California law that extends liability to logistic providers for the treatment of drivers they employ. 3 of the 4 of such proposals went to a vote. Of those voted on average support was 28%.

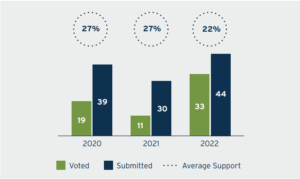

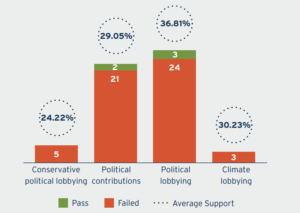

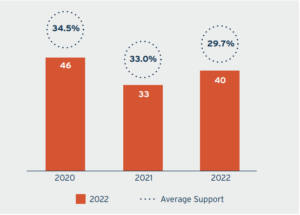

Political Lobbying and Contributions

As in previous years, political spending continues to be a major theme of shareholder proposals. In 2022 political spending accounted for 25% of all the estimated 407 social shareholder proposals filed. This represents an increase compared to 2021, where political spending proposals accounted for roughly 22% of social proposals filed. This season, average support for political lobbying has stayed roughly consistent with 2021 results, with support averaging around 37%, compared to 2021 average support of 38%. Three political lobbying proposals passed this year, compared to five in 2021.

On the other hand, average support for political contribution proposals has dropped from 41% average support in 2021 to 29% average support in 2022. Two political contribution proposals passed this year, down from 6 passing in 2021.

Political spending has also proven to be another area where proponents are exploring additional climate-related themes in 2022, namely environmental justice. 3 shareholder proposals were filed questioning how companies’ political contributions align or conflict with stated racial justice commitments, however none went to a vote this season.

Climate-focused lobbying proposals also continues as an area of focus in 2022. Submission volumes for climate lobbying proposals were up year-over-year, with 17 proposals filed in 2022, compared to 12 in 2021. Note that we have categorized these proposals as environmental, and therefore included them within the number of environmental proposal submissions discussed above.

2022 LOBBYING & POLITICAL CONTRIBUTIONS PROPOSALS THAT WENT TO A VOTE

AVERAGE SUPPORT FOR LOBBYING AND POLITICAL CONTRIBUTIONS PROPOSALS 2020 — 2022

System Stewardship

Another new proposal type this year relates to system stewardship, spearheaded by The Shareholder Commons. There are 14 such proposals across a wide range of environmental and social topics (and bucketed across both categories), such as environmental racism and wage inequality. These measures share a common theme in requesting that subject companies address what the proponents contend are externalities of a company’s practices pose systemic risks to broadly diversified shareholders. These proposals place the emphasis on the risk that the companies’ practices pose to the broader market, rather than a company specific risk, such risks are more relevant to these investors because of their diversified portfolio. Support for those voted upon to date has been relatively low, although 7 have crossed the 10% threshold necessary to be eligible for resubmission in the 2023 proxy season.

SHAREHOLDER PROPOSALS: GOVERNANCE

The volume of governance-focused proposals appears to have decreased in 2022 (357), as compared to the 2021 season (392). Of the 271 proposals voted upon to date,this year, 48 have passed. Many of the topics addressed by these proposals are perennial and not particularly remarkable.

While submission volume is down across the governance category, the number of special meeting-related proposals submitted more than doubled year over year, with 112 such proposals filed in 2022, compared to 41 in 2021. Accordingly, the number of special-meeting related proposals that passed in 2022 (10) has greatly exceeded the number passing in the 2021 proxy season (4).

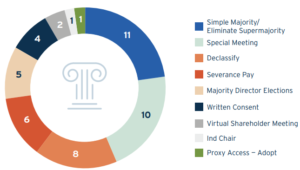

2022 PASSING GOVERNANCE PROPOSALS BY CATEGORY

Within the sub-category of ESG-linked compensation proposals, one notable development this season is a number of new proposals leveraging companies’ CEO pay ratio information. These proposals request that companies take broader workforce compensation into consideration when setting target CEO compensation. This strikes us as an interesting development — while CEO pay ratio disclosure has been a requirement since 2017, it has received relatively little attention from proponents (or otherwise) since enactment. 12 such proposals were filed in 2022; of the four voted upon this season, support ranged from just under 8% to 12%. Considering this relatively low support, it remains to be seen if this will be a continued area of focus in subsequent seasons. Anecdotally, we note that Carl Ichan emphasized CEO pay ratio as an area of concern in his campaign against Kroeger, which focuses on animal welfare and fair wage practices.

During the 2021 season, we saw 18 proposals seeking amendments to companies’ articles of incorporation to become public benefit corporations, which in all but one case — where support approached 12% — failed to receive support in excess of 4%. Given the extremely low rate of support, we see these proposals have dramatically tapered off in the 2022 season, with only 3 such proposals filed, 3 of which appear to be “conservative” proposals filed at companies that signed the Business Roundtable Statement of the Purpose of a Corporation, where the proponent argues that such companies’ incorporation as conventional Delaware corporations contradicts the commitments of the Business Roundtable statement. Of the two voted upon to date, support continues to be extremely low, ranging from 1.1% to just over 3% respectively. We note that the main proponent of these proposals in the 2021 season was The Shareholder Commons, which is focusing its efforts this season on the system stewardship proposals discussed within the Social section of this report.

The topic of separation of the roles of board chair and CEO also continued to be a focus in 2022, with 52 such proposals submitted, an increase from the 43 submitted in the 2021 season. This season, one such proposal has passed, compared to none in the prior season. Interestingly, this topic appears to be one area where mainstream and ESG critics align, as the National Legal and Policy Center is the proponent of 7 of these proposals this season, which appear to advance the same arguments in favor of separation of the two roles as do other proponents.

AVERAGE SUPPORT FOR INDEPENDENT CHAIR PROPOSALS

CONCLUSION

Unlike prior proxy seasons, the 2022 proxy season can be characterized by increased scrutiny towards ESG matters. While this scrutiny has been evident in recent seasons through anti-ESG shareholder proposals it appeared to have expanded in 2022. Much of this newfound attention — from state pension funds and politicians alike — focuses on ESG’s impact on voting and investing decisions. States like Texas, Utah, and West Virginia have made public statements suggesting that ESG’s influence on fossil fuel companies is inappropriate. Further, on May 18th, 2022 legislation was introduced in the Senate calling for asset managers to make client voting choice available to individual investors in passive funds when the asset manager owns more than 1% of a company’s voting securities. [6]

This increased attention has created tension between asset managers and asset owners, some of whom believe that managers are not doing enough to advance ESG goals, while others believe that ESG expectations for public companies are becoming overly prescriptive. This tension may be a driver behind some of the recent pullback in support of proposals from asset managers like BlackRock, who characterized many of this year’s climate-related proposals as overly prescriptive and questioned whether certain proposals would promote long-term shareholder value.

KEY FIGURES FROM GEORGESON’S 2022 EUROPEAN SEASON AGM REVIEW

- Resolutions relating to the remuneration of executives continue to be the most contested resolution type in Europe. Across the seven main European markets, there was a calibrated 4.2% decrease in contested remuneration votes from 2021.

- Director elections were a continued area of focus and negative votes. Although there was a 20.1% decline from 2021 in the proportion of contested director elections across the seven main European markets, the average proportion of contested director elections in 2022 (11.2%) reflects the 2020 level (11.2%) following a peak in 2021 (14.1%).

- Across the 7 markets, the UK saw the lowest proportion of contested remuneration report resolutions (albeit recording the third yearon-year increase), while Germany saw the highest. In line with legal changes, German companies in the DAX put forward their first remuneration reports at AGMs in 2022 and 54% of these resolutions received at least 10% opposition.

- The market that had the highest share of contested remuneration policy votes in 2022 was France, where 48.6% were contested by shareholders.

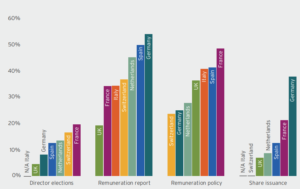

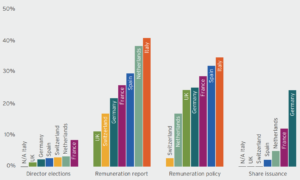

The graph below shows the level of dissent — expressed as a percentage of resolutions that were contested — across four major categories of resolutions common across major European markets, namely director elections, remuneration report, remuneration policy and share issuances.

On average 11.2% of director elections, 39.4% of remuneration report resolutions, 34.8% of remuneration policy resolutions and 14.5% of share issuances resolutions were contested.

Graph 1: Contested resolutions per category (%)

Executive remuneration

Executive remuneration continues to be an important area of focus for many investors.

- In the UK (FTSE 100) dissent over remuneration policy votes has increased by 45.6%, with 36.4% of remuneration policy resolutions receiving more than 10% opposition, compared to approximately 25.0% in 2021. Dissent on remuneration report votes also increased markedly by 18.5% year on year (with 19 out of 99 resolutions receiving more than 10% opposition in 2022 compared to 16 out of 99 resolutions in 2021)

- In Germany (DAX), 25.0% of remuneration policy/system votes were contested during the 2022 AGM season. This is a 6.8 percentage point drop from the share in 2021 (31.8%). It is worth noting that only 8 companies put forward remuneration policy votes in 2022, compared to 22 in 2021. This is the first year that remuneration report votes were require in Germany, 20 of these remuneration report votes received 10% or more opposition.

- The most contented resolution in France (CAC40) were remuneration policy proposals, where 48.6% of resolutions received at least 10% shareholder opposition.

- In Switzerland (SMI), the voluntary advisory vote on the remuneration report was contested in 38.9% of cases (7 out of 18). This is lower than the share of contested remuneration reports in 2021 when ten out of the seventeen advisory votes were contested by shareholders.

- In the Netherlands (AEX and AMX), proposals relating to the approval of the remuneration report had the highest share of contested votes, with 45.2% of the remuneration report proposals put forward within the AEX and AMX receiving more than 10% opposition.

- In Italy (FTSE MIB), there was a 14.3% decrease in the number of contested remuneration policy votes across the FTSE MIB in 2022 (12 resolutions), compared to 2021 (14 resolutions). There was also a 15.4% drop in the number of contested remuneration report votes from 13 in 2021 to 11 in 2022.

- In Spain (IBEX 35), the highest number of contested resolutions this year were related to remuneration, where 32 resolutions received more than 10% opposition, representing 38.6% of the total resolutions in this category (compared to 46 resolutions in 2021, which represented 48.9%).

Director elections

Director elections continue to grow as an area of focus and negative votes.

- In the UK (FTSE 100), there has been an 8.0% decrease in the number of contested director elections (10%+ opposition) since 2021. The share of director election votes that were contested fell from 4.9% in 2021, to 4.5% in 2022.

- In Germany (DAX), there were only 7 contested director elections votes (i.e. the election of supervisory board members), compared to 13 votes in both 2020 and 2021. This is despite the DAX increasing from 30 to 40 since the end of last year’s AGM season.

- In France (CAC40), resolutions relating to director elections remain highly contested proposals where, across the analysed period, 28 resolutions were contested (10%+ opposition) representing 19.6% of total board election votes.

- In Switzerland (SMI), there was a decreased in opposition to director elections in 2022. 40 resolutions were contested compared to 55 in 2021. This corresponds to an 8.4 percentage point drop from 2021 in the share of contested board election votes.

- In the Netherlands (AEX+AMX), there was a surge in the number of contested director election votes. Whereas only 6 of these votes were contested in both 2020 and 2021, there were 17 contested director election votes in 2022.

- In Italy (FTSE MIB), there was only one director election vote that received over 10% opposition in 2022, the same as in 2021. This contested resolution accounted for 8% of the total director elections in the FTSE MIB during the proxy season.

- Among director elections in Spain (IBEX 35), 24 resolutions received more than 10% voting opposition, representing 12.5% of the total (compared to 18 resolutions in 2021 and 28 in 2020, with ratios of 14.6% and 17.0%, respectively).

Proxy Advisors

ISS

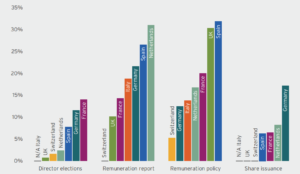

The graph below shows the proportion of ISS negative recommendations across four major categories of resolutions common across major European markets, namely director elections, remuneration report, remuneration policy and share issuances.

On average 6.4% of director elections, 19.7% of remuneration report resolutions, 19.1% of remuneration policy resolutions and 6.4% of share issuances resolutions received negative recommendation by ISS.

Graph 2: ISS negative recommendations per category (%)

Glass Lewis

The graph below shows the proportion of Glass Lewis negative recommendations across four major categories of resolutions common across major European markets, namely director elections, remuneration report, remuneration policy and share issuances.

On average 3.5% of director elections, 26.2% of remuneration report resolutions, 23.3% of remuneration policy resolutions and 7.2% of share issuances resolutions received negative recommendations by Glass Lewis.

Graph 3: Glass Lewis negative recommendations per category (%)

Endnotes

1Amounts represent number of proposals where the proponent is listed as the lead filer or co-filer. Proposals may be double counted given coordination among these proponents (go back)

2This includes the Net Zero Indicator proposal filed at Boeing, which provides: “Shareholders request the Board issue a report, at reasonable expense and excluding confidential information, evaluating and disclosing if and how the company has met the criteria of the Net Zero Indicator, including scope 3 use of product emissions, or whether it intends to revise its policies to be fully responsive to such Indicator.”(go back)

3https://www.blackrock.com/corporate/literature/publication/commentary-bis-approach-shareholder-proposals.pdf(go back)

4This includes the Boeing Net Zero Indicator proposal, which reads: “Shareholders request the Board issue a report, at reasonable expense and excluding confidential information, evaluating and disclosing if and how the company has met the criteria of the Net Zero Indicator, including scope 3 use of product emissions, or whether it intends to revise its policies to be fully responsive to such Indicator.”(go back)

5State Street’s Framework for Stewardship in the Context of Geopolitical Risk Arising from Unexpected Conflict Between or Among Nations is available at https://www.ssga.com/library-content/ pdfs/global/framework-for-stewardship-in-context-of-geopolitical-risk.pdf (go back)

6In October 2021, BlackRock announced client choice voting for certain institutional accounts as the first in a planned series of steps to expand its clients’ abilities to make proxy voting decisions.

Based on our experience so far, we have not observed a significant change in BlackRock’s voting activity as a result of this change. (go back)

Print

Print