Jamie Allen is Secretary General, Neesha Wolf is Supporting Research Director at Asian Corporate Governance Association. Kei Okamura is Portfolio Manager at Neuberger Berman East Asia and Japan Working Group Chair at ACGA . This post is based on their open letter published in the Asian Corporate Governance Association. Related research from the Program on Corporate Governance includes Politics and Gender in the Executive Suite (discussed on the Forum here) by Alma Cohen, Moshe Hazan, and David Weiss; Will Nasdaq’s Diversity Rules Harm Investors? (discussed on the Forum here) by Jesse M. Fried; Duty and Diversity (discussed on the Forum here) by Chris Brummer, and Leo E. Strine.

This post is based on an open letter by ACGA. Below is the text of the letter with minor adjustments to eliminate the correspondence-related parts. See here for example.

The Asian Corporate Governance Association (ACGA) recently formed a working group of members and other interested investors to discuss the issue of gender diversity on Japanese listed company boards. We are writing to share our thoughts and suggestions on this topic.

There is a growing appreciation that a diverse board is a key driver of strong corporate governance, which is essential to preserve and enhance long-term corporate value. In this context, gender has become a key component of the responsible investment policies of many asset owners and institutional investors around the world, with an increasing number voting against companies with single-gender boards. The issue is gaining traction in new listing regulations as well as corporate governance codes in many jurisdictions. And there is a growing discussion worldwide as to whether enough is being done to promote women to senior management roles in preparation for directorships. As ACGA has found in our engagements with Japanese companies, a diversified boardroom tends to promote more dynamic discussion of a company’s long-term strategy and enhances board effectiveness. There is a growing appreciation that a diverse board is a key driver of strong corporate governance, which is essential to preserve and enhance long-term corporate value. In this context, gender has become a key component of the responsible investment policies of many asset owners and institutional investors around the world, with an increasing number voting against companies with single-gender boards. The issue is gaining traction in new listing regulations as well as corporate governance codes in many jurisdictions. And there is a growing discussion worldwide as to whether enough is being done to promote women to senior management roles in preparation for directorships. As ACGA has found in our engagements with Japanese companies, a diversified boardroom tends to promote more dynamic discussion of a company’s long-term strategy and enhances board effectiveness.

Given these developments, we felt that this was an opportune time to open a discussion on the situation in Japan. The positive news is that the presence of women on the boards of Tokyo Stock Exchange (TSE) Prime companies has been increasing, with 79% of those which held annual general meetings (AGMs) from January to June 2022 having at least one woman director [1]. We also note the attention given to gender issues more broadly by the administration of Prime Minister Fumio Kishida, with plans underway to require disclosure of the gender pay gap, the ratio of women in managerial positions, and the ratio of male workers taking childcare leave [2]. Yet the fact remains that the representation of women on Japanese boards is well below other developed markets in proportional terms.

In this letter we suggest a series of targets for achieving faster and higher levels of board gender diversity via two pathways: the TSE listing rules, with a particular focus on TSE Prime companies, and the Corporate Governance Code (CG Code). We also recommend a number of supporting governance and managerial measures to assist in meeting these targets.

In focussing on gender we do not wish to imply that other elements of diversity, such as age, industrial or professional expertise, nationality, geographic or cultural background, and others are not important. Rather, through our research [3] , we have found that promoting tangible targets for gender diversity has not only produced measurable changes in board composition, it has helped to reinvigorate the broader discussion on board diversity.

Given the global emphasis on the issue, we believe that the current consensus target for women on boards in Japan—that Topix 100 issuers should achieve a 30% ratio (including Kansayaku [4]) by 2030 [5]— is narrow. We suggest that all TSE Prime [6] companies be required to achieve the 30% ratio (excluding Kansayaku) by calendar 2030 through amendments to the TSE listing rules, while the CG Code should encourage all listed companies to reach this level sooner if they can. Doing so would enhance Japan’s status as a major securities market for international investors and help the TSE Prime to achieve its goal of attracting global investors by creating a market with global standards.

How Japan compares

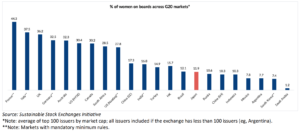

The percentage of women being appointed to directorships of listed companies around the world has increased markedly over the past decade. For example, 37.6% of board positions on the FTSE 350 in the UK were occupied by women as of end-2021 and none of the 350 firms had all-male boards [7] . In the US, women held 30% of directorships on the S&P 500 in 2021 [8] and as of 2020 none of the 500 firms had an all-male board [9]. In Australia and Europe, the percentages for 2021 were similar: 34.2% of board seats in the ASX200 [10] and 35% in the Stoxx 600 [11] were held by women.

While estimates vary, the ratio of women on boards in Japan is considerably lower. For the TSE Prime market, the 2021 figure was reported as 9.3% [12] , and for the Nikkei 225 it was 12.7% as of 30 June 2022 [13] .

Japan’s level of gender diversity is also lower than most markets in Asia. For example, the Malaysian CG code now encourages all listed companies to aim for 30%, while the actual figure is 29% for the top 100 firms and 20.5% for all listed companies (as of 1 October 2022). [14] Moreover, from 1 September 2022 all Malaysian issuers with a market capitalisation of RM2 billion or more (US$450m approx) were mandated to have at least one women director, while all other publicly listed companies must do so by 1 June 2023. Indeed, in mid-2022 there were only three firms in the top 100 with all-male boards, while just over half had already achieved the 30% threshold. By October 2022, none of the top 100 issuers had all-male boards.[15]

The figures are less impressive for Hong Kong, where gender diversity stands at around 16%[16] for the 100 largest companies. Nevertheless, in late 2021 the Hong Kong stock exchange announced listing rule changes that would prohibit single-gender boards for new listings from July 2022 and for existing issuers from January 2025. As for Singapore, it is doing somewhat better than Hong Kong with a gender diversity ratio of 19.7%[17] in the boards of the top 100 companies as of early 2022.

The following chart, from the Sustainable Stock Exchanges Initiative, shows how board gender diversity across the top 100 listed companies in Japan compares on average with the same group of issuers in other G20 countries and markets. Note that a minority of markets, including France, Italy, Germany, the US (Nasdaq), India and South Korea, mandate a minimum number of women directors.

The two pathways

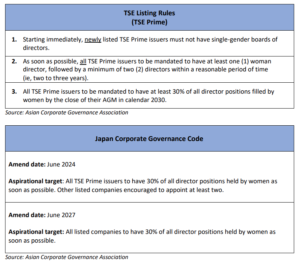

Our recommendation for raising gender diversity in Japan follows two pathways. The first pathway involves proposed changes to the listing rules to phase in a greater proportion of women directors on the boards of TSE Prime companies over the eight years to 2030. This starts with a recommendation that all newly listed Prime firms no longer be permitted to have single-gender boards.

We further recommend that the TSE listing rules be amended to mandate a minimum of one woman director as soon as possible. Given that most TSE Prime companies have already achieved this level, such a rule change would pose little challenge for most of them. This would be followed by two women directors within a reasonable space of time, say two to three years. We do not wish to dictate a more specific timeframe, as that is a decision best left to regulators and the market.

This pathway ends with a proposal for all TSE Prime issuers to have at least 30% of their director positions occupied by women by the close of their annual general meeting in calendar 2030.

Such rule changes would send a firm signal to the market and global investors that Japan is serious about board gender diversity.

The second pathway involves more ambitious aspirational targets to be included in the next two revisions to the CG Code in calendar 2024 and 2027. The first would encourage all TSE Prime issuers to have 30% of board seats filled by women as soon as possible, while other listed companies would be recommended to appoint at least two. In the second revision, the 30% target should be applied to all listed companies.

The following tables summarise our recommendations:

We recognise that achieving enhanced gender diversity requires more than just setting numerical targets and that Japanese companies face genuine challenges in restructuring their boards. The next section focusses on the complex issue of women in senior management, followed by our recommendations for how governance systems could be strengthened within companies to support greater board gender diversity and enhance the long-term value that it can bring.

Women in senior management

The Japanese government has undertaken a number of efforts in recent years to address workplace gender inequality. In 2016 the “Act on the Promotion of Female Participation and Career Advancement in the Workplace in Japan” came into force. This required public- and private-sector companies above a certain size to measure gender diversity data, create action plans to address gaps, and disclose this information. The Act was revised in June 2019 and extended to more companies. Then in December 2020 the government approved “The Fifth Basic Plan for Gender Equality”, which outlined a series of specific targets across a range of areas including raising the proportion of women in leadership roles, supporting the development of female executives and managers, and fostering greater participation of women in science and technology. More recently, there are plans to require the disclosure of the ratio of women in management positions. [18]

Our focus in this letter is on the urgent need to expand female representation at the executive officer level. We would briefly note that the factors underlying this phenomenon are not necessarily the same as for under-representation in the lower ranks of companies, a broader issue that is beyond the scope of this letter.

There are a number of ways Japanese companies could increase the ratio of female executive officers who would be next in line to take up board seats. One place to start is to require disclosure of this ratio and expand support for initiatives such as career development, mentoring, and management training for this group of women. Many of the corporate action plans published in response to the 2019 revision of the “Act on the Promotion of Female Participation” contain mid-term initiatives and KPIs linked to supporting female workers at the employee and manager levels, but lack measures at the executive officer level, leaving a critical gap in the pipeline for new women directors. This is why it is important for such action plans to include concrete initiatives to support women at the executive officer level and for companies to come up with a mid-term KPI to achieve a level of female executive officers that will enable them to meet their upcoming board gender diversity targets. Finally, we would also encourage companies to address the issue of unconscious gender bias while formulating such mid-term strategies and targets, so as to offer a level playing field for women to excel in their management careers.

The governance ecosystem

Another important building block for enhanced gender diversity is a robust system of good governance practices that support the operation of the board and allow it to become more effective. These include such things as:

- A board “skills matrix”: The success or otherwise of adding new directors to a board will depend a great deal on who is chosen and the business/leadership skills and experience that they bring. The same can be said for executive and non-executive directors generally. Using a “skills matrix” to analyse the current range and level of director expertise can be a useful starting point for director selection and ensuring a balanced board composition. Any new director, male or female, should add value to the board and complement the other directors. Using a skills matrix would also give companies a firmer basis for choosing between alternative candidates and allow them to explain their selection rationale more transparently.

- Nomination committee: Putting in place a well-structured nomination committee, with a clear set of responsibilities and a regular schedule of meetings (at least twice a year), can also assist companies to devote sufficient time to researching and discussing a range of new director candidates. Effective nomination committees develop a pipeline of potential candidates that is regularly refreshed and discussed. The committee should also be independently chaired, which is important to ensure the selection process is unbiased and board evaluations are meaningful. ACGA research has found that appointing women to this committee and having a woman chair it are effective ways of analysing candidates’ performance and identifying and recruiting more female board members, while addressing unconscious bias. [19]

- Director training: A well-designed induction and ongoing training programme for all directors, executive and non-executive, can enhance the long-term effectiveness of boards as unprepared directors add little value to board discussions. For women who are senior executive officers this training should ideally start even before they have been shortlisted for board positions.

- Disclosure: Given the current opacity in some company reporting in Japan, we recommend that there be full disclosure of the sex, age and experience of all board directors. It is sometimes difficult to tell who is male and female on boards, particularly for non-Japanese readers of corporate disclosures. Companies should also explain their rationale for selecting any new director and such statements should be thoughtful and adequately detailed, not brief and generic.

- Policies and targets: We recommend that companies develop meaningful diversity policies that are relevant to their businesses, with targets for achieving higher levels of gender diversity over the short and medium term, and reporting against those targets. Such disclosure could be made in conjunction with existing gender diversity disclosures and upcoming pay gap reporting requirements. Having KPIs linked to the long-term component of executive compensation may be an effective approach to support management commitment on this topic.

We trust this letter and our recommendations will prove constructive in helping to enhance gender diversity on boards in Japan.

Link to the full letter.

Endnotes

1https://insights.issgovernance.com/posts/japanese-companies-improve-on-board-independence-and-diversity/ (go back)

2https://www.fsa.go.jp/singi/singi_kinyu/tosin/20220613/03.pdf (go back)

3 See for example the “Listed Companies” sections in ACGA’s CG Watch 2020 report. (go back)

4“Kansayaku” literally means “auditor”. The traditional system of corporate governance in Japan has a two-tier board structure: the Board of Directors (BOD) and the Kansayaku Board (kansayaku-kai). The former is the lead decision-making entity in the company, while the latter monitors or audits the executive directors to ensure they are in compliance with relevant business laws and financial reporting rules (ie, that they are meeting their fiduciary duties). The Kansayaku Board also oversees the external accounting auditor and should be distinguished from the internal auditor, which has a different function. We advocate not including Kansayaku in our target ratios, since they are not directors and have no voting power in the BOD. (go back)

5The consensus target also includes 執行役 (executive/corporate officers) at companies with three committees. ACGA does not support including such non-director executives in the 30% calculation. (go back)

6The Prime market came into being in April 2022 following a reorganisation of the TSE’s three market segments. The Prime market is the lead segment and comprises more than 1,800 listed companies. Its goal is to create a market that is attractive to international capital and follows international standards. The other two markets are called Standard and Growth. (go back)

7https://ftsewomenleaders.com/wp-content/uploads/2022/05/2021_FTSE-Women-Leaders-Review_FinalReportv1_WA.pdf (go back)

8https://www.spencerstuart.com/-/media/2021/july/boarddiversity2021/2021_sp500_board_diversity.pdf (go back)

9https://www.cnbc.com/2020/12/15/all-sp-500-boards-have-at-least-1-woman-first-time-in-over-20-years.html (go back)

10https://www.aicd.com.au/about-aicd/governance-and-policy-leadership/board-diversity/Board-diversity-statistics.html (go back)

11https://europeanwomenonboards.eu/wp-content/uploads/2022/01/2021-Gender-Diversity-Index.pdf (go back)

12https://asia.nikkei.com/Business/Business-trends/Japan-falls-behind-on-women-in-boardrooms-as-Europe-makesstrides (go back)

13https://www.japantimes.co.jp/news/2022/07/22/business/abe-women-boardrooms/ (go back)

14Securities Commission Malaysia: https://www.sc.com.my/regulation/corporate-governance (go back)

15Securities Commission Malaysia: https://www.sc.com.my/regulation/corporate-governance (go back)

16ACGA, “Board Diversity at the top 100 in Hong Kong”, January 2022. See www.acga-asia.org/thematic-research.php (go back)

17Singapore Council for Board Diversity, News Release, 22 March 2022: https://www.councilforboarddiversity.sg/diversityon-boards-approaching-a-momentous-milestone/ (go back)

18https://www.fsa.go.jp/singi/singi_kinyu/tosin/20220613/03.pdf (go back)

19ACGA, January 2022, ibid, p4 (go back)

Print

Print