Jason Frankl and Brian G. Kushner are Senior Managing Directors at FTI Consulting. This post is based on their FTI Consulting memorandum. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian A. Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian A. Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Frankl and Kushner Leo E. Strine, Jr. (discussed on the Forum here).

Introduction and Market Update

With 2023 fast approaching, FTI Consulting’s Activism and M&A Solutions team welcomes readers to our quarterly Activism Vulnerability Report, highlighting the findings of our Activism Vulnerability Screener for 3Q22 as well as other notable trends and themes in the world of shareholder activism and engagement.

U.S. stock markets continued to struggle in 3Q22 as investors revalued positions and rebalanced portfolios in response to the U.S. Federal Reserve’s two 0.75% interest rate increases and escalating economic uncertainty during the quarter.[1] Alongside additional rate hikes of 0.75% in both October and November, investors received a welcome smidge of positive economic news in early November – October’s inflation report showed that increases in the Consumer Price Index decelerated from June’s four decade-high reading, perhaps boosting the likelihood of a smaller, 0.50% increase in the federal funds rate at the Federal Reserve’s next meeting in mid-December.[2]

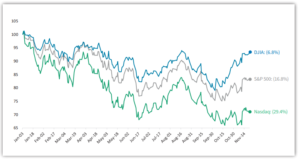

The highly anticipated U.S. midterm elections were also held in early November. Though Democrats managed to keep control of the Senate, Republicans regained control of the House of Representatives.[3] Following Election Day, the S&P 500 experienced a drawdown of 2.1%. However, from November 10 onwards, the index increased by 5.8%, though major U.S. indices are still down year-to-date.[4] As of November 28, 2022, the Dow Jones Industrial Average (“DJIA”) was down 6.8% year-to-date, the S&P 500 was lower by 16.8% and the Nasdaq Composite fell by 29.4%. Over the same period, the CBOE Volatility Index (“VIX”) increased 19.0%.[5]

Year-to-Date Performance (2022)[6]

As equity markets suffered amid economic and monetary policy uncertainty in 3Q22, so too did IPO and SPAC activity. Our team views these markets as proxies of broader market health and investor appetite for investments with larger risk and reward profiles. The first half of the year witnessed a precipitous drop in activity, and that subdued enthusiasm carried over through 3Q22, as the volume of U.S. SPAC IPOs (when a SPAC is listed on a public exchange) fell to just eight listings in 3Q22, relative to 89 SPAC listings in 3Q21.[7] Further, only 25 IPOs occurred in the U.S. in 3Q22, relative to 94 in 3Q21, at a total value of just $2.4 billion compared to an aggregate amount of $27.6 billion in 3Q21.[8]

Activism Update

There was an uptick in activist campaigns in 3Q22 compared to 3Q21. In 3Q22, activists initiated 119 campaigns against U.S. and Canada-based companies, compared to just 87 in 3Q21. There were notable increases in the number of campaigns focused solely on operational changes (13 in 3Q22 v. four in 3Q21) and divestitures (seven in 3Q22 v. five in 3Q21).[9] The latter has become popular of late, as investors seem to be taking advantage of the current market state to unlock shareholder value. In September, Third Point LLC and The Walt Disney Company (“Disney”) settled on adding one director to Disney’s Board. Third Point initially demanded that Disney repurchase shares, spin off ESPN and acquire the remainder of Hulu equity, but dropped the demands following the settlement.[10] Shortly after the settlement, Disney’s Board shockingly announced that it had re-appointed the company’s former CEO, Bob Iger, to the role, after his handpicked successor, Bob Chapek, struggled through his short tenure as CEO.[11] Value creation may be one of many contributing factors as to why activist board seat acquisition was substantially more successful in 3Q22, winning 24 of the 33 (73%) board seats sought, compared to just 15 of 34 (44%) in 3Q21.[12]

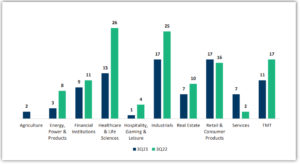

Healthcare & Life Sciences remained a key target for activist investors this quarter, with the total number of campaigns (26) doubling from 13 in the same period last year; this sector represented 22% of all U.S. campaigns in 3Q22, closely followed by the Industrials sector (21%).[13] The dramatic influx in Healthcare & Life Sciences campaigns may be partially driven by the contraction in Biotechnology valuations we have witnessed year-to-date (e.g.; XBI Biotech ETF is down 28.9%).[14] Months after Third Point disclosed a stake in Cano Health, Owl Creek Asset Management, L.P. delivered a letter to the company’s Board of Directors in August, urging Cano Health to consider selling itself to a strategic buyer.[15] Only a month later, Humana and CVS Health both expressed interest in acquiring Cano Health.[16] Additionally, in early September, Elliott Management added four directors to the Board of Cardinal Health and is forming a business review committee to analyze the company’s strategy and capital allocation framework.[17]

Activists also continued to target the Telecom, Media & Technology (“TMT”) sector (17 campaigns) and the Retail & Consumer Products (16 campaigns) sector.[18] With software revenue growth slowing and tech stocks retreating from their pandemic highs, we will be watching closely to see what plays out in the TMT sector in the fourth quarter. Already in 4Q22, we observed Starboard Value disclose positions in three software companies, including Salesforce, all with the theme of improving margins.[19] Similarly, TCI Fund Management recently called for Google’s parent company, Alphabet, to slash costs and reduce headcount.[20]

The Real Estate sector seems to be garnering increasing interest from activists this year. Not only has the number of activist campaigns in the Real Estate sector increased 43% from 3Q21, but the number of campaigns per quarter has also grown steadily in 2022, from just seven in the first quarter, to 10 in 3Q22 and 15 so far in 4Q22.[21]

Activist Targets by Sector – 3Q22 Year-Over-Year Change[22]

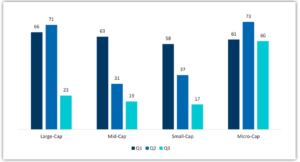

Though activists have continued to target large cap companies at an increasing rate since 2020, the second half of the year has, so far, seen a shift as smaller companies witnessed a jump in activist targets as a percentage of total campaigns in 3Q22 and early 4Q22. Micro-cap companies were by far the most popular activist targets in 3Q22, representing 50% (60 campaigns) of all activist campaigns, compared to 44% in 3Q21. Meanwhile, large-caps experienced a meaningful drop in activist targets in 3Q22, representing 19% (23 campaigns) of all activism campaigns, versus 23% in 3Q21.[23]

Similarly, from the end of 3Q22 to early 4Q22, large cap companies only experienced 19 campaigns, while companies below a $2 billion market cap experienced 40 campaigns.[24] This shift toward smaller-cap targets may be the result of activists taking advantage of the depressed valuations of companies they may have had their eyes on in prior quarters, or because activists can more easily distinguish operational pain-points in smaller companies that could potentially act as levers for value-enhancement opportunities. The increased interest may also stem from first-time activists with limited cash who are targeting smaller companies in order to build a sizeable stake at a reasonable cost.

Campaigns Initiated by Market Capitalization (1Q22 – 3Q22)[25]

Shareholder Activism in Real Estate

As previously mentioned, the Real Estate sector attracted substantial attention from shareholder activists in 3Q22, as shown by the sector’s 43% year-over-year increase in campaigns, a trend that has continued to pick up steam in 4Q22. One reason may be the underperformance of the MSCI U.S. REIT index: it is down ~24% year-to-date, relative to the S&P 500’s ~17% decline over the same period.[26] Activists may now view the industry as fairly valued or may have an easier time identifying struggling firms. Regardless of the reason, it is clear the sector is garnering increased attention.

One campaign has already proved fruitful; in August, Star Equity Fund successfully convinced shareholders to not re-elect two Gyrodyne Board members and to vote against their executive compensation plan. Star Equity Fund did not add new directors to the Board but pledged to keep pressure on Gyrodyne to advocate for the interests of all shareholders.[27] In September, Land & Buildings Capital Growth Fund, LP nominated two directors to the Board of Apartment Investment and Management Company, after it had pushed privately for a sale of the company.[28]

October brought several high-profile campaigns. Kushner Companies made an unsolicited offer to acquire Veris Residential for $16 per share.[29] Separately, Blackwells Capital targeted two REITs managed by AR Global, Global Net Lease Inc. and Necessity Retail REIT Inc., with the ultimate goal of renegotiating or cancelling management contracts with AR Global and exploring a sale.[30]

In these campaigns, activists have made a number of operational, strategy and M&A-related demands. Given the recent sharp rise in interest rates, and the debt-heavy capital structure of real estate, it may seem counterintuitive that activists are targeting real estate companies more often. However, a recent Cohen & Steers report indicates that U.S. REITs typically fall less than overall equities in recessionary periods and continue to outperform equities in the early stage of the business cycle.[31] This may explain why activists are more frequently targeting real estate companies, and why they may be using the current weakness in share prices to force communication with the board and management to improve strategy or operations.

“The U.S. real estate market over the last several years has looked a lot like a car driven by a student driver, alternatively accelerating and then coming to a screeching halt. After substantial debate in 2019 about where we were in the market lifecycle, transactions dropped off the cliff as the cloud of COVID-19 descended. When the unprecedented distress that was highly anticipated never actually materialized, the real estate market went into overdrive from 2021 through early 2022, with deal making at unprecedented levels. However, it was a story of the ‘haves’ and the ‘have nots.’ Industrial real estate, long the most boring of all real estate asset classes, became the darling property type as eCommerce drove demand for warehouses and distribution facilities. Housing was not far behind, with multi-family and the newly minted single family rental (SFR) and built-to-rent (BTR) assets all the rage. The whole time, retail and office continued their descent, and despite many hopeful gasps, never made a full recovery – and likely will not in the near term. Heading into 2023, real estate investors are asking, “What’s next?” As interest rates continue to rise, office workers do not appear to be racing back to their cubicles, and eCommerce is unlikely to wane; there are likely to be some rough seas as certain segments of the industry experience shifting tides. Adaptive reuse will be a common theme, as overabundant and underutilized office assets are converted to residential or other alternative uses. Distress likely will finally materialize in certain corners of the industry, where there is insufficient cash flow to cover debt service. New and existing home sales each have fallen sharply so far in 2022, and prices for homes have declined since their peak in June 2022. However, we expect housing asset values to remain strong, as demand will continue to significantly exceed supply in the years to come. SFR and BTR will see further expansion, even as legislators seek to put a stop to institutional ownership of single-family homes. Overall, we expect the real estate market in the first half of 2023 to be quiet. However, barring the unforeseen, the latter part of 2023 will see transaction volumes pick back up again as the Fed stops raising interest rates, and rates return to historical norms.”

Josh Herrenkohl, Senior Managing Director,

Real Estate Solutions, FTI Consulting, Inc.

Observations and Insights

“While stock prices have declined for much of 2022, and M&A markets have slowed compared to record 2021 levels, shareholder activism has continued at a torrid pace. As of November 1, the number of activism campaigns in the U.S. is on track to surpass last year’s record levels. Activists also are looking abroad for new targets, in particular to Europe and Japan. No company is too big, and as Engine No. 1 illustrated last year: a stake of just 0.02% can be enough to cause significant disruption even at mega-cap companies. In 2022 yearto-date, a third of all activist campaigns have been against large-cap companies, an increase from 28% last year and 18% in 2020. Activist demands have also shifted. With financing markets largely closed for much of 2022, activist demands for return of capital or for M&A transactions have decreased. As a result of depressed stock prices, many companies are currently trading at a discount to their sum-of-their-parts valuations. This has led to a substantial increase of activist demands to close the valuation gap through breakups, spin-offs and divestitures. These campaigns have targeted some of the world’s most respected companies in the U.S. and Europe, including Disney, Saint-Gobain and Shell. In addition to breakup demands, activists worldwide continue to be focused on governance and board representation. In the U.S., the universal proxy card came into effect in September, and it requires companies to include activist director nominees on the company’s proxy card. Rather than pick a single slate of directors (the company’s or the activist’s), shareholders can now pick a combination of incumbent and dissident directors from a single proxy card. The universal proxy card is widely expected to reduce SEC filing costs for activists and make it easier for them to launch and win proxy fights. It also makes long-tenured directors particularly vulnerable. In our analysis of activist campaigns since January 2021, we found that 72% of all campaigns have targeted companies with three or more directors with 10 or more years of service. Boards that lack relevant experience, investor perspectives or diversity also have been targeted. Looking ahead, the road remains uncertain. The past year has shown that activism activity remains elevated even in downturns, and it is likely that campaigns focused on M&A transactions and return of capital will return as financing markets re-open. We expect that sustained pressure on valuations will likely encourage shareholders to maintain a more hands-on approach – and activists will likely be entering the new year with more ammunition and a more aggressive playbook. To that end, defense preparedness is essential. Proactive preparation for shareholder activism should be a part of every company’s ongoing risk management practices to avoid being targeted and to be better positioned in the face of an activist campaign.”

Bill Anderson, Head of Global Activism/Raid Defense and

Strategic, Defense & Shareholder Advisory Practices,

Evercore Inc.

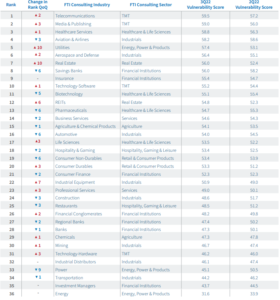

Screener Results

Unlike the volatility we witnessed in 1H22, where many industries experienced substantial changes in their vulnerability rankings, only two industries moved 10 or more spots in 3Q22. The Utilities industry jumped ten spots into the top five industries most vulnerable to activism. Although Utilities provided a safe haven for investors earlier in the year, the sector came under pressure in 3Q22 as utility stock prices fell rapidly toward the end of the quarter. Among the likely catalysts for the sell-off: the 10-year U.S. Treasury yield surpassed the dividend yield for the sector.[32] Gas utilities, which were particularly highly valued, were hit harder than the broader sector, as natural gas prices fell more than 30% from late August through the end of September.[33]

One notable campaign in the Utilities industry began in early August when activist fund Corvex Management disclosed a 5% stake in North Dakotabased conglomerate MDU Resources Group Inc., only days after the company announced that it will spin off its construction materials unit (Knife River Corporation) into a separate publicly-traded entity.[34] Although the activist acknowledged that this was a “positive first step,” Corvex also indicated that it planned to further engage with the company’s Board and management about additional strategic alternatives, as well as areas to enhance the earnings potential of the company’s assets.[35] It seems likely that Corvex is pursuing a similar strategy to the one it enacted against Exelon Corporation in 2020, where the activist successfully encouraged Exelon to spin off one of its divisions because Exelon’s pure-play competitors were outperforming its diversified business structure.[36] It will be interesting to see if Corvex makes a similar demand at MDU Resources as we head into proxy season. Similarly, the Real Estate and REITs industries jumped 10 spots and six spots, respectively, with Real Estate entering the top 10 for the first time since 1Q21. The pandemic-era conditions that once favored the real estate market have since dissipated, with mortgage rates recently crossing the 6% threshold.[37] Notably, Redfin, a residential real estate brokerage, recently witnessed its stock plummet by about 90% from its 52-week high.[38] Redfin has since laid off 13% of its staff.[39]

What This Means

The third quarter and early fourth quarter proved to be another volatile period for markets as the Federal Reserve kept itself busy, issuing four consecutive rate hikes totaling 300 basis points, in an effort to stamp out the inflation fire.[40] Both the equities market and bond market continued to fall in unison, but activists appeared to be making the most of the discounted share prices by initiating a multi-year high of 119 campaigns over the course of the third quarter.[41] Similar to one of the takeaways from our Q2 2022 Activism Vulnerability Report, activists seem ready to deploy their dry powder through the end of the year, especially now that investors are beginning to see some positive results in fighting inflation, despite the less-than-appealing economic forecasts.[42] All investors will be watching and reading closely to determine the path forward in regard to additional monetary policy changes and the future state of the global economy.

FTI Consulting’s Activism Vulnerability Screener Methodology

- The Activism Vulnerability Screener is a proprietary model that measures the vulnerability of public companies in the United States and Canada to shareholder activism by collecting criteria relevant to activist investors and benchmarking to sector peers.

- The criteria are sorted into four categories, scored on a scale of 0-25, (1) Governance, (2) Total Shareholder Return, (3) Balance Sheet and (4) Operating Performance, which are aggregated to a final Composite Vulnerability Score, scored on a scale of 0-100.

- By classifying the relevant attributes and performance metrics into broader categories, experts at FTI Consulting can quickly uncover where vulnerabilities are found, allowing for a more targeted response. FTI Consulting’s Activism and M&A Solutions team determined these criteria through research of historical activist campaigns in order to locate themes and characteristics frequently targeted by activist investors.

- The following is a selection of themes that are included for each category:

-

- The Activism and M&A Solutions team closely follows the latest trends and developments in the world of shareholder activism. Due to the constantly evolving activism landscape, FTI Consulting’s Activism and M&A Solutions team consistently reviews the criteria and their respective weightings to ensure the utmost accuracy and efficacy of Activism Screener.

Endnotes

1Board of Governors of the Federal Reserve System, Policy Tools: FOMC’s target federal funds rate or range, change (basis points) and level, Federal Reserve (last updated November 2, 2022), https://www.federalreserve.gov/monetarypolicy/openmarket.htm.(go back)

2Gwynn Guilford, October Inflation Report Shows Consumer Prices Rose 7.7% From Year Earlier, The Wall Street Journal (November 10, 2022), https://www.wsj.com/articles/usinflation-october-2022-consumer-price-index-11668050497?mod=article_inline.(go back)

3Election Results 2022: Live Map, Politico (last visited November 21, 2022), https://www.politico.com/2022-election/results/.(go back)

4FTI Consulting analysis. Data provided by FactSet as of November 28, 2022.(go back)

5Ibid.(go back)

6Ibid.(go back)

7Nicole Hallas, Q3 2022 IPO Trends: Market Continues to Cool, Audit Analytics (October 25, 2022), https://blog.auditanalytics.com/q3-2022-ipo-trends-market-continues-to-cool/.(go back)

8Updated: Renaissance Capital’s 3Q 2022 US IPO Market Review: IPO Market Misfires in the Slowest 3Q in Over a Decade, Renaissance Capital: The IPO Expert (October 3, 2022), https://www.renaissancecapital.com/IPO-Center/News/94994/Renaissance-Capitals-3Q-2022-US-IPO-Market-Review(go back)

9FTI Consulting analysis of activist campaigns. Data provided by Insightia as of November 21, 2022.(go back)

10Robbie Whelan, Disney, Activist Investor Agree to a Standstill as Entertainment Giant Adds Tech Executive to Board, The Wall Street Journal (September 30, 2022), https://www.wsj.com/articles/disney-appoints-carolyn-everson-a-veteran-media-executive-to-board-11664573740.(go back)

11Brooks Barnes. Disney Brings Back Bob Iger After Ousting Chapek as C.E.O., The New York Times (November 20, 2022), https://www.nytimes.com/2022/11/20/business/disneyrobert-iger.html.(go back)

12FTI Consulting analysis of activist campaigns. Data provided by Insightia as of November 21, 2022.(go back)

13Ibid.(go back)

14FTI Consulting analysis. Data provided by FactSet as of November 28, 2022.(go back)

15Owl Creek Asset Management Delivers Letter to Cano Health Board of Directors, Cision US Inc.: PR Newswire (August 22, 2022), https://www.prnewswire.com/news-releases/owlcreek-asset-management-delivers-letter-to-cano-health-board-of-directors-301610253.html.(go back)

16Laura Cooper and Dana Cimilluca, Humana, CVS Circle Cano Health as Potential Buyers, The Wall Street Journal (September 22, 2022), https://www.wsj.com/articles/humanaother-potential-buyers-circle-cano-health-sources-say-11663874254.(go back)

17Kenneth Squire, A shake-up on Cardinal Health’s board could pave the way for activist fund Elliott to create value, CNBC (September 10, 2022), https://www.cnbc.com/2022/09/10/ a-shake-up-on-cardinal-healths-board-could-pave-the-way-for-activist-fund-elliott-to-create-value.html.(go back)

18FTI Consulting analysis of activist campaigns. Data provided by Insightia as of November 21, 2022.(go back)

19Ron Miller and Alex Wilhelm, Starboard Value goes after 3 tech companies with cost-cutting axe, TechCrunch (October 19, 2022), https://techcrunch.com/2022/10/19/starboardvalue-goes-after-3-tech-companies-with-cost-cutting-axe/.(go back)

20Rohan Goswami, Alphabet must cut headcount and trim costs, activist investor TCI says, CNBC (November 15, 2022), https://www.cnbc.com/2022/11/15/alphabet-must-cutheadcount-and-trim-costs-activist-investor-tci-says.html.(go back)

21FTI Consulting analysis of activist campaigns. Data provided by Insightia as of November 21, 2022.(go back)

22Ibid.(go back)

23Ibid.(go back)

24Ibid.(go back)

25Ibid.(go back)

26FTI Consulting analysis. Data provided by FactSet as of November 28, 2022.(go back)

27Star Equity Fund Issues Statement on Gyrodyne’s 2022 AGM, GlobeNewswire (August 30, 2022), https://www.globenewswire.com/news-release/2022/08/30/2506744/0/en/StarEquity-Fund-Issues-Statement-on-Gyrodyne-s-2022-AGM.html.(go back)

282022 Annual Meeting of Stockholders of Apartment Investment and Management Company; Proxy Statement of Land & Buildings Capital Growth Fund, LP, United States Securities and Exchange Commission Schedule 14A (Rule 14a-101) (October 12, 2022), https://www.sec.gov/Archives/edgar/data/1536520/000092189522002845/ defc14a10432030_10202022.htm.(go back)

29Kushner Sends Letter to Board of Directors of Veris Residential, Cision US Inc.: PR Newswire (October 20, 2022), https://www.prnewswire.com/news-releases/kushner-sends-letterto-board-of-directors-of-veris-residential-301655682.html.(go back)

30Svea Herbst-Bayliss, EXCLUSIVE Blackwells Launches Proxy Fights, Wants Board Seats at GNL, Necessity Retail, Reuters (October 25, 2022), https://www.reuters.com/business/ exclusive-blackwells-launches-proxy-fights-wants-board-seats-gnl-necessity-2022-10-25/.(go back)

31James Corl and Jason A. Yablon, Recession and the Roadmap for Listed and Private Real Estate, Cohen & Steers, Inc. (September 2022), https://www.cohenandsteers.com/ insights/recession-and-the-roadmap-for-listed-and-private-real-estate/.(go back)

32Tom DiChristopher, Gas utility stocks slumped in Q3’22 as pricey sector entered correction, S&P Global Market Intelligence (October 5, 2022), https://www.spglobal.com/ marketintelligence/en/news-insights/latest-news-headlines/gas-utility-stocks-slumped-in-q3-22-as-pricey-sector-entered-correction-72394827.(go back)

33FTI Consulting analysis. Data provided by FactSet as of November 28, 2022(go back)

34David French and Svea Herbst-Bayliss, U.S. utility MDU Resources backs its strategy after Meister’s Corvex takes stake, Reuters (August 9, 2022), https://www.reuters.com/business/ us-utility-mdu-resources-backs-its-strategy-after-meisters-corvex-takes-stake-2022-08-09/.(go back)

35MDU Resources Group Inc., United States Securities and Exchange Commission Schedule 13D (August 8, 2022), https://www.sec.gov/Archives/edgar/ data/67716/000101143822000245/form_sc13d-mdu.htm.(go back)

36Kenneth Squire, Activist Meister eyes up another possible conglomerate break-up to unlock value, CNBC (August 13, 2022), https://www.cnbc.com/2022/08/13/activist-meistereyes-up-another-possible-conglomerate-break-up-to-unlock-value.html.(go back)

37Matt Ott, Mortgage Rates Hit 6%, First Time Since 2008 Housing Crash, U.S. News & World Report (September 15, 2022), https://www.usnews.com/news/business/ articles/2022-09-15/mortgage-rates-hit-6-first-time-since-2008-housing-crash#:~:text=Average%20long%2Dterm%20U.S.%20mortgage,a%20rapidly%20cooling%20housing%20 market.&text=By%20Associated%20Press-,Sept.,2022%2C%20at%205%3A22%20p.m.(go back)

38FTI Consulting analysis. Data provided by FactSet as of November 28, 2022.(go back)

39Khristopher J. Brooks, Redfin lays off 862 employees as housing market cools, CBS News, (November 9, 2022), https://www.cbsnews.com/news/redfin-layoff-hundreds-of-workerszillow/.(go back)

40Board of Governors of the Federal Reserve System, Policy Tools: FOMC’s target federal funds rate or range, change (basis points) and level, Federal Reserve (last updated November 2, 2022), https://www.federalreserve.gov/monetarypolicy/openmarket.htm.(go back)

41FTI Consulting analysis of activist campaigns. Data provided by Insightia as of November 21, 2022.(go back)

42Gwynn Guilford, October Inflation Report Shows Consumer Prices Rose 7.7% From Year Earlier, The Wall Street Journal (November 10, 2022), https://www.wsj.com/articles/usinflation-october-2022-consumer-price-index-11668050497?mod=article_inline.(go back)

Print

Print