Brigid Rosati is Managing Director of Business Development; Kilian Moote is Managing Director; and Rajeev Kumar is Senior Managing Director at Georgeson. This post is based on their Georgeson memorandum. Related research from the Program on Corporate Governance includes The Agency Problems of Institutional Investors (discussed on the Forum here) by Lucian Bebchuk, Alma Cohen, and Scott Hirst; Index Funds and the Future of Corporate Governance: Theory, Evidence, and Policy (discussed on the Forum here) and The Specter of the Giant Three (discussed on the Forum here) both by Lucian Bebchuk and Scott Hirst; and The Limits of Portfolio Primacy (discussed on the Forum here) by Roberto Tallarita.

EXECUTIVE SUMMARY AND ACKNOWLEDGEMENT

Following the October 2022 release of our report on the 2022 proxy season, our investor voting report offers an expanded analysis of investor voting decisions on key shareholder proposals, as well as management say-on-pay proposals and director elections.

We consider the 2022 proxy season to include company meetings occurring July 1, 2021 through June 30, 2022. Data presented in this report relates to companies in the Russell 3000, unless otherwise noted.

In partnership with Insightia, data was collected from public filings:

- Shareholder Proposals: Investor voting decision data was collected from public filings, including N-PX filings released in August 2022 for companies in the Russell 3000. For certain proposals, we’ve reported on individual investor vote decisions using a color-coded system. In other instances, we detail historical institutional investor vote support by large investors by assets under management (AUM). Each shareholder proposal chart includes a unique mixture of institutional investors researched for that specific topic.

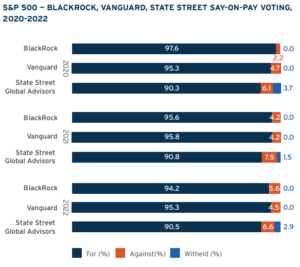

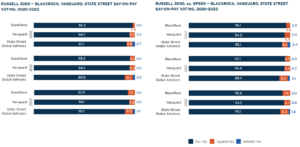

- Say-on-Pay: Investor voting decision data was collected from public filings, including N-PX released in August 2022, for companies in the S&P 500 and Russell 3000 for the big three asset managers (a.k.a “Big 3”), BlackRock, Inc., Vanguard Group, State Street Global Advisors. The “For” (%) is based on the percentage of times an investor voted “For” the say-on-pay proposal.

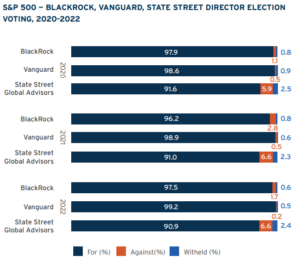

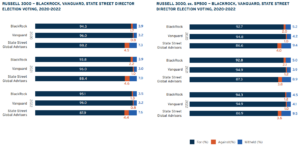

- Director Elections: Investor voting decision data was collected from public filings, including N-PX released in August 2022, for companies in the S&P500 and Russell 3000 for the “Big 3” (described above). The “For” (%) is based on the percentage of times an investor voted “For” a director.

Georgeson partnered with Insightia to coordinate investor voting data. Insightia Ltd., a Dilligent brand, was instrumental in sourcing the annual meeting and proxy voting data contained in this report.

ENVIRONMENTAL SHAREHOLDER PROPOSALS

In 2022, 15 environmentally-focused shareholder proposals received majority support at companies in the Russell 3000.

In 2022, 15 environmentally-focused shareholder proposals received majority support at companies in the Russell 3000. The overall passage rate (15 out of the 60 proposals passed that went to a vote) is, slightly lower when compared to 2021. Rather than fully attributing this decline to weakened support from institutional investors, the passage rate decrease can be more likely attributed to heightened ambitions of some proponents this year, which is indicative of the amount of proposals discussing scope 3 emissions.

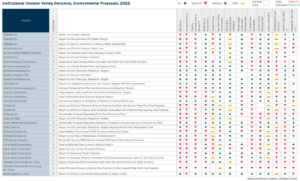

Of the largest institutional holders we examined, Northern Trust and Wellington Asset Management were most likely to support the 60 environmentally-focused shareholder proposals, voting for or splitting their vote on the overwhelming majority of proposals, 93% (56 out of 60) and 88% (51 out of 58) respectively. Norges Bank supported just over half of the proposals voted (33 out of 53) while State Street Global Advisors support was shy of 50% (26 out of 60), abstaining from 1/6 of the remaining proposals. Notably, of the 15 proposals that passed, State Street Global Advisors voted for 12 of them and abstained from 2. BlackRock voted in support of just over 1/3 of the proposals that went to vote (22 out of 60). Of those proposals receiving majority support, BlackRock supported 13 of the 15 that passed. Vanguard (14 out of 60) and Fidelity (17 out of 60) each roughly supported around 25% of the proposals that went to a vote.

We’ve further analyzed the investor decision outcomes for popular environmental proposal topics from 2022, including GHG, Financing Policy, and Resource Stewardship.

GHG: 22 out of 60 that went to a vote, eight passed

An important subset of environmental-related proposals in the 2022 proxy season addressed the topic of greenhouse gas (GHG) emissions reductions. This year GHGrelated proposals were the most common environmental-related proposal that went to a vote (22 out of 60). They also represented a majority of the passing proposals. One development from previous year’s is that proposals more often included requests for targets or strategies that specifically include or accounted for scope 3 emissions.

Proposals in this category accounted for roughly 63% (74 out of 117) of submitted proposals. The lower percentage of proposals that went to a vote (22 out of 60) indicates that issuers were more willing to negotiate with proponents on these proposals. The high passage rate of these type of proposals that went to a vote (eight out of 22) further strengthens the argument that investors have a high likelihood of siding with proponents on these proposals.

In reviewing voting decisions by the major investors researched for this report, Wellington Management voted in favor or split its vote on every GHG reduction proposal that went to a vote this year. Similarly, Northern Trust voted for 21 of the 22 proposals. Norges voted for 16 of the 18 it voted on.

BlackRock voted in favor of 11 of the 22 proposals and State Street voted for, or abstained from voting, on 17 of the 22 proposals. Collectively these two firms appeared to have the most influence on if a GHG reduction proposal passed. Excluding proposals with dual-class shares or large insider positions, BlackRock voted for all passing proposals but one and State Street either voted for or abstained on all but two.

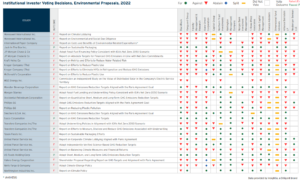

Financing Policy: 11 out of 60 that went to a vote, one passed

In 2022, we saw an increase in the number of environmental proposals submitted at companies in the financial services sector that focused on financing policies and requested these companies cease financing fossil fuel projects. We observed 11 such proposals going to a vote. Outside of Northern Trust and Wellington these proposals had minimal support. Only one of 11 proposals received support from BlackRock, State Street Global Advisors , and Norges, in addition to Northern Trust and Wellington (The Travelers Companies). Notably, Norges voted against 10 out of 11 financing proposals, which accounted for nearly 50% of the environmental proposals (nine of 20) the firm opposed. It stands in stark contrast to its level of support for non-finance GHG proposals for which the firm voted in-favor of 19 out of 21 proposals that went to a vote.

Resource Stewardship: 10 out of 60 that went to a vote, two passed

10 environmental proposals that went to a vote related to companies stewardship of resources. This included water usage, deforestation, and plastics. Two out of the 10 voted on passed. Aside from Vanguard and Neuberger Berman, the two passing proposals had unanimous support (either full or split vote) amongst the largest 10 institutions.

Of the investors we examined for this report, State Street supported seven of the 10 while Blackrock and Fidelity supported about half, six of 10 and four of 10 respectively. Vanguard’s supported just one of these proposals.

DIVERSITY, EQUITY AND INCLUSION SHAREHOLDER PROPOSALS

Consistent with the 2021 proxy season, diversity equity and inclusion (DEI) remained a major theme for shareholder proposals in 2022.

The variety within DEI-related shareholder proposals is illustrative of the evolving ways that investors believe DEI matters continue to be material to a company. This year, shareholder proposals seeking DEI-related data requests included disclosure of recruitment, retention, and promotion information specifically addressing diverse employee populations, or reporting on steps by the company to implement their stated diversity and inclusion initiatives. In addition, in our research we looked at the civil rights audit and racial equity audit proposals, which gained momentum in 2022.

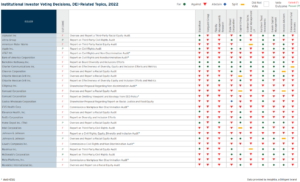

Investor support varied significantly across the 44 DEI-related proposals we examined:

- Highest support: The investors that were most likely to support DEIrelated proposals included Northern Trust (32 of 44, including split votes), Capital Group (26 of 40, including split votes), and Invesco (22 of 43, including spilt votes).

- Medium Support: BlackRock and State Street Global Advisors each voted in support of 17 proposals and State Street Global Advisors abstained from voting on two additional proposals.

- Lowest Support: Fidelity supported eight of the 44 and Vanguard supported just five of the 44 voted on. Dimensional sided with management nearly every time, supporting only one of the 44 voted on, and electing to split their vote on two others.

How the largest investors responded to proposals that related to disclosing diversity level data or the effectiveness of diversity programs was consistent. Of the nine proposals voted on four received support from these 10 investors, aside from Dimensional. Notwithstanding the significant support, only one of such proposals passed, largely due to dual-class share structures or large inside positions of the various companies with shareholder proposals.

Northern Trust and Capital Group were most likely to vote in support of these proposals. Similarly, Fidelity supported seven of the nine DEI related proposals, which is in sharp contrast to its lack of support for racial or civil rights audits where it supported just one of 24. Similarly, Vanguard was more likely to support such DEIrelated proposals, whereas State Street Global Advisors and Blackrock did not support any of the nine proposals beyond the core group of four that most top investors supported.

Racial Equity Audit Shareholder Proposals

Following the overall novel in 2021 were racial equity audit proposals, a few of which passed. Consistent with that trend was an expansion to include both civil equity audit proposals. Both such proposals focus on how internal and external procedures at a company may negatively impact minority or protected groups. These proposals represented all but one (eight of nine) of passing diversity related proposals. Following the overall trend Northern Trust supported all 24 proposals and Capital Group and Invesco supported or split its vote on a majority of the proposals (18 out of 24 and 17 out of 24 respectively). Geode Asset Management supported 14 out of 24 while BlackRock and State Street Global Advisors each supported 13 out of 24. While multiple firms supported a majority of audit-related proposals there was a somewhat weak correlation between which proposals they supported, outside of a core group of seven proposals. Of the eight that passed seven were supported by both BlackRock and State Street Global Advisors, which may be an indication of these firms influence over such proposals.

Unlike prior proxy seasons, the 2022 proxy season can be characterized by increased scrutiny towards ESG matters. While this scrutiny has been evident in recent seasons through anti-ESG shareholder proposals it appeared to have expanded in 2022. There were 11 proposals that focused on how DEI efforts by corporations may be discriminatory towards certain populations. None of the top ten institutions voted for these various proposals, which on average received 2% support. As ESG has increasingly become politized it’s likely that more such proposals will be filed; however like other politically motivated proposals it’s unlikely that much support will be garnered for them.

POLITICAL LOBBYING AND CONTRIBUTIONS SHAREHOLDER PROPOSALS

Proposals seeking reporting on political contributions and lobbying payments were prevalent in the 2022 proxy season.

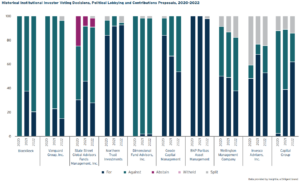

Related proposals accounted for 25% of all submitted proposals within the social category this year, with 55 going to a vote. Fewer political-related shareholder proposals passed this year compared to 2021 (five in 2022 vs. eight in 2021), and as discussed on page 19 of our report, “A Look Back at the 2022 Proxy Season,” there was also a decrease in the average support of these proposals. While investor interest in transparency, at the same time scrutiny of companies’ political contributions and lobbying activities is not new, the 2020 presidential election and subsequent events of January 2021 in Washington, D.C. both likely catalyzed submission of and support for these proposals in the 2021 proxy season; we might not see the same 2021 levels again for a few years.

| FedEx Corporation’s political lobbying proposal received the highest level of support across all related proposals in this category in 2022 — 62.2% of shareholders voted in favor. In reviewing investor voting decisions on this proposal, eight out of the 10 investors surveyed voted in favor, including the Big 3, with one choosing to split their vote (Wellington). Interestingly, the Report on Lobbying Payments proposal at Charter Communications also received support from eight out of the 10 major investors surveyed in this report, however that proposal failed to receive majority support, receiving 38.9% support overall. A closer examination of Charter’s large insider position (est. 36%) likely impacted the overall support. |

Examining the individual voting decisions across the major investors researched, support for political lobbying and contributions proposals ranged from a large investor supporting just one related proposal (Dimensional Funds) to one that supported 50 related proposals (Northern Trust) this year. The expansive range of voting support, warrants a closer look at changing voting behaviors across these major investors over the last three years. When taken as a group, a review of the ten major investors demonstrates a consistent decrease in support for these shareholder proposals on lobbying or political contributions. Collectively the group voted in favor 52% of political

lobbying and contributions proposals in 2021 compared to 46% this year. A further analysis of the ten major investors examined in this section of our report illustrates how the support for these such proposals is shifting, albeit unevenly. For example, the Big 3 major institutional investors supported less proposals in 2022, most notably State Street voted in support of 46% proposals in 2021, while only supporting 28% this year. Other investors’ support has shifted notably in recent years. For example, Capital Group supported less than 3% for these proposals in 2020 and supported over 60% in 2022.

INDEPENDENT CHAIR SHAREHOLDER PROPOSALS

The number of proposals submitted relating to the separation of the roles of board chair and CEO increased in 2022 — 52 such proposals were submitted to companies in the Russell 3000, compared to 43 submitted in the 2021 season.

Further, more independent proposals went to a vote this year, compared to 2021 (41 vs. 33). However, average support has decreased from 35% in 2020 to 30% in 2022. One independent chair proposal received majority support this season — NortonLifeLock Inc., now Gen Digital. Interestingly, when examining the investor support in the table, notably this company’s proposal only received support from one of the 10 investors surveyed (State Street Global Advisors), suggesting that support for this proposal was driven by other institutional investors.

| The independent chair proposal that attracted the most support from the investors reviewed in the table was at Oracle Corporation, where six of the investors reviewed voted in favor. This is up from five of the 10 investors voting in support of the same proposal in 2021. Although the roles of chair and CEO at Oracle’s board are currently filled by separate individuals, Mr. Ellison, the Company’s founder and current Chief Technology Officer, serves as the chairman. The ongoing concerns regarding the Company’s compensation practices may have contributed to investors’ growing support for this proposal year over year. |

SAY-ON-PAY

The decline in average support for the say-on-pay proposals seen in 2022 was also reflected in the reduced support by the Big 3 investors (BlackRock, Vanguard Group and State Street), although by a lesser amount.

On average, they supported 92.4% and 93.3% of such proposals in 2022 at Russell 3000 and S&P 500 companies, respectively, approximately 0.8 percentage points lower compared to 2021 for each of the two indices. This decline in Big 3’s average support has been largely due to BlackRock’s increased opposition to say-on-pay proposals. At Russell 3000 companies, the firm voted against 7.1% of the proposals in 2022 compared to 4.7% last year, while at S&P 500 companies, it opposed 5.6% proposals this year compared to 4.2% in 2021.

State Street has been the least supportive, voting in favor of just above 90% of the proposals at both the Russell 3000 and S&P 500 companies. However, State Street did not vote against all the unsupported proposals, issuing an “abstain” vote at 1.9% and 2.9% of the proposals at Russell 3000 and S&P 500 companies, respectively. State Street “abstain” vote reflects situations where it couldn’t provide unqualified support or where companies had responded to some, but not all, of State Street’s concerns on pay.

Vanguard was the most supportive voting in favor of 94% and 95% of the say-onpay proposals at Russell 3000 and S&P 500 companies, respectively.

DIRECTOR ELECTIONS

Although there was a marginal decline in average support for directors of both S&P 500 and Russell 3000 companies in 2022 compared to 2021, there was an uptick in support by the big three investors (BlackRock, Inc., Vanguard Group and State Street Global Advisors).

On average, they supported the (re)election of 93.0% of the Russell 3000 directors in 2022 compared to 92.7% in 2021. Similarly, at the S&P 500 companies, their average support increased to 95.9% in 2022 from 95.4% in 2021. This was largely due to an increased level of support by BlackRock, whose favorable vote was 1.3 percentage points higher compared to last year at both S&P 500 and Russell 3000 companies. After its increased opposition to S&P 500 directors last year holding them accountable for poor risk oversight of environmental and social issues, BlackRock was more supportive of management in 2022 as companies made significant progress on the governance and sustainability matters. As noted in its “2022 voting spotlight” report, BlackRock found companies to have made substantial improvements in board diversity, and their climate action plans and disclosures. [1]

State Street continued to oppose the greatest percentage of directors, voting against or to withhold at 9% and 12% of the directors at S&P 500 and Russell 3000 companies, respectively. In 2022, State Street continued to use its proprietary ESG scoring system, Responsibility Factor (R-Factor), to vote against companies that scored poorly and failed to take any action to improve their score. Additionally, it also voted against companies that showed a downward trend in their R-Factor scoring as well as those that consistently underperformed their peers in the same market sector.

Vanguard, similar to last year, voted against the fewest number of directors opposing less than 1% of the nominees at S&P 500 companies, and 4% at Russell 3000 companies.

Endnotes

1https://www.blackrock.com/corporate/literature/publication/2022-investment-stewardship-votingspotlight.pdf(go back)

Print

Print