Benjamin Colton is Global Head of Asset Stewardship, and Michael Younis is Vice President of Asset Stewardship at State Street Global Advisors. This post is based on their SSGA memorandum.

This post reviews State Street Global Advisors’ stewardship activities, including related efforts in the Asia Pacific region with a focus on the Australian proxy voting season, case studies of our social stewardship activities, and an overview of executive remuneration and succession planning. It also outlines thematic stewardship priorities for 2023.

Social Stewardship in Practice

Civil Rights Audits

The 2022 proxy season saw a marked increase in the number of shareholder proposals related to civil rights audits. An overview of our voting record on these topics is available here. Several of the companies where we supported this proposal have committed to undertake civil rights audits, and a few companies (including Altria Group, Inc., Johnson & Johnson and McDonald’s Corporation) have proactively reached out to our Asset Stewardship team to seek our feedback on the plans for their audits. We appreciate this responsiveness and engagement from companies, as well as the commitment to effective oversight of civil rights-related risks and opportunities.

Diversity ESG Reporting

In engagements leading up to Moderna, Inc.’s April 2022 Annual General Meeting, our Asset Stewardship team encouraged the company to enhance its ESG reporting, specifically, to publish its EEO-1 report, as well as SASB-aligned disclosures. We took voting action against relevant directors given the lack of disclosures at the time. At our November 2022 engagement, we learned that Moderna had published an EEO-1 report, and also published its first ESG report in line with SASB. We appreciate the enhanced disclosure and look forward to following the company’s ESG journey.

Human Rights

At the March 2022 Walt Disney Company Annual General Meeting, our Asset Stewardship team abstained on a proposal calling for a human rights risk assessment. While we were not supportive of the proposal’s specific ask, we did identify opportunities for Disney to enhance its human rights-related disclosures. Existing disclosures focused on human rights risks in the supply chain for Disney-branded products, and we encouraged the company to offer insights into risks that exist outside that narrow part of the company’s operations. The company did improve its human rights-related disclosures accordingly, including the publication of an enhanced human rights policy.

Launch of the Just Transition Engagement Campaign: Managing the Social Risks of the Energy Transition

Just transition is an emerging area of focus for our Asset Stewardship team. The journey to a net zero emissions world is complex and we believe will require tremendous efforts from both the private and public sectors to achieve an effective transition that is orderly and just. With this understanding, we included just transition as one of several key factors in our Disclosure Expectations for Effective Climate Transition Plans.

In Q3 and Q4 2022, we conducted a series of engagements with companies in high carbon emitting sectors including Energy, Materials, and Utilities to better understand current trends and disclosure practices on the emerging topic of just transition. Our dialogues centered on how companies are identifying and managing risks and opportunities in the low-carbon transition associated with workforce transformation, customer affordability, stakeholder engagement, and supply chain management, among others. We intend to share the insights and takeaways of this campaign in future publications. Some early takeaways include:

- Strategy Companies leading on just transition have a clear understanding of its importance as a centerpiece within their climate transition strategy. This is demonstrated by an understanding of which stakeholders will be most impacted by their own low-carbon transition and how a just transition relates to their overall business strategy. It is clear, however, that there is no one-size-fits-all approach to a just transition. To address this challenge, companies seek to integrate different perspectives from across the business into just transition planning.

- Board Oversight Successful oversight of a just transition and its associated risks requires thoughtful engagement with the board and management. Multiple leading companies with which we engaged noted that as part of their overall sustainability objectives, they currently report on just transition-related priorities to the relevant board committees that oversee related climate and social-related risks. As just transition continues to gain market clarity and as companies define relevant goals and metrics for their own just transitions, we expect boards to be more engaged on this topic.

- Risk Management Effective risk management for a just transition is well-served by clear stakeholder identification and engagement processes. The energy transition will have varying impacts across a range of stakeholders, from the workforce and consumers, to communities (including Indigenous Peoples) and supply chains. Leading companies have processes to clearly identify which stakeholder groups their transition plans will have the greatest impacts on, and have developed ongoing stakeholder engagement processes to ensure stakeholder perspectives are integrated into transition planning and decision-making. Companies without clear stakeholder engagement plans and ongoing communication within their climate transition planning may face greater exposure to reputational, operational, or financial risk due to resistance from certain groups of stakeholders who view the implementation of the plan does not serve their best interests.

We will continue to integrate just transition considerations into engagements focused on climate transition plans in key sectors throughout 2023.

Observations from Remuneration Consultations in the United Kingdom

In the United Kingdom (‘UK’), executive remuneration policies must be submitted to a shareholder vote every three years. Companies often take this opportunity to make changes to their executive remuneration policies and tend to consult shareholders on proposed amendments. In Q4 2022, State Street Global Advisors’ Asset Stewardship team conducted over 30 such consultations with chairs of Remuneration Committees of UK investee companies whose executive remuneration policies are scheduled for investor vote during the 2023 proxy season.

Key changes proposed by remuneration committees include:

Replacement of performance-based long-term incentive plan (LTIP) awards with restricted share plans

Rationale:

- The business environment in which companies operate has substantially changed, impacted by COVID-19, inflation and supply chain issues, and further exacerbated by the conflict in Ukraine. Looking forward, the geopolitical uncertainties will continue to create substantially greater volatility for businesses.

- With the level of uncertainty impacting companies, they no longer feel confident that the traditional LTIP model, with fixed three-year targets, can consistently reflect performance.

Our Views:

- Performance metrics in LTIPs give investors insight into the key factors that companies are focusing on to drive long-term strategy. In the absence of such performance metrics companies must 1) provide clear disclosure regarding what quantitative and qualitative guide posts they are monitoring to ensure the successful implementation of strategy and 2) ensure there is clear alignment between executive incentives and the long-term shareholder experience, including restricted share units that vest beyond the typical three-year performance period.

- When replacing a performance-based LTIP with a restricted share plan, we expect UK issuers

to apply an appropriate discount to standard award levels, in line with best market practice

and taking into consideration individual company factors. The discount is meant to alleviate

the more certain outcomes under a restricted share plan.

Quantum increases, achieved via either increases in total annual bonus incentive and/or LTIP opportunities or significant increases in base salaries

Rationale:

- The talent environment has become highly competitive and against this backdrop, remuneration committees are working to create competitive remuneration and benefits packages for their workforce. Some companies also cited their growth, along with the exercise of restraint, as key reasons why their executive remuneration offering became uncompetitive.

- Some companies derive a significant portion of their revenues from the US and consider that market within their reward packages, leading to some conclusions that the compensation of certain US-based executives fell short of appropriate levels of incentive pay.

- Increase in complexity and globalization of the business.

Our Views:

- We acknowledge that the market for executive talent is competitive. When benchmarking pay against peers, companies must be reasonable and not include overly ambitious peers. Further, there must continue to be clear alignment between compensation and a company’s current strategy.

Increased focus on ESG in both annual bonuses and LTIPs

Rationale:

- Companies are increasingly adding ESG performance metrics which incentivize executives to follow through on companies’ ESG efforts and ambitions.

Our Views:

- We are agnostic to companies choosing to include ESG performance metrics in executive compensation structure. However, if used, ESG metrics need to be tied to strategy, quantifiable, sufficiently challenging and incentivize behavior that is clearly articulated in companies’ disclosure.

Necessity for Remuneration Committees to apply discretion to allow vesting of awards

Rationale:

- Recognizing that the 2018–21 and 2019–22 LTIP tranches would be impacted, some companies have determined that leveraging the board’s judgement on remuneration was necessary to align business and financial outcomes with the interests of all stakeholders.

- Companies often stated that having LTIPs predestined not to vest neither aligns with the principles of performance-based approach, nor supports the recruitment or motivation and retention of senior leaders who participate in share-based LTIPs in a very competitive talent market.

- Given the anticipated ongoing uncertainty and volatility in the external market, some Remuneration Committees intend to review and set performance ranges based on conditions at the time of award.

Our Views:

- Where boards elect to use discretion in making award determinations, we will need detailed disclosure and narrative describing the board’s decision-making process in order to gain comfort in pay outcomes.

Increases in executive directors’ shareholding guidelines

Rationale:

- In the event of quantum increases, companies are often proposing material increases in executive directors’ shareholding guidelines, in order to further increase alignment with shareholders’ interests.

Our Views:

- We view thoughtful shareholding guidelines as a best practice, though it does not entitle executives to excessive quantum — pay and performance must continue be linked.

Views on Succession Planning

The average CEO tenure at US companies fell once again in 2022, continuing a trend we have observed over the past several years. CEO tenure averaged 9.9 years in 2022, down from 12.7 years in 2017. [1] We expect company boards to explain their general approach to CEO succession planning. With the backdrop of increased executive turnover, boards should provide effective oversight of the succession planning process as companies navigate a competitive executive leadership market.

As a long-term investor, we view well-formed and proactive succession planning as essential to the execution of a company’s long-term strategy. As such, engagements on succession planning continue to be a core topic of the Asset Stewardship team. We believe periods without a permanent CEO or incomplete management team present companies with challenges in setting clear strategy, making capital allocation decisions aligned with a long-term vision, and communicating effectively to stakeholders. We also view the transition process as an essential element of CEO succession planning. For example, through engagement with companies we seek to understand the role of outgoing management in the transition plan. Other questions we may ask during engagements with companies may include:

- What areas of expertise and qualities has the board prioritized in its succession plan?

- How has the board considered internal vs. external candidates for the position?

- If the former executives occupy board positions, how will the board ensure the incoming

management team has the space and confidence to execute their own strategy? - How does the board demonstrate their support and confidence in new leadership?

- What milestones has the board set for the transition process?

While we understand the need to retain individuals responsible for past success, we have observed situations where those where the exit of long-tenured executives has eroded investor confidence in the company’s ability to execute long-term strategy. While so called ‘Boomerang CEOs’ may present the best leadership opportunities in certain circumstances, such reappointments do not always provide the best outcomes for shareholders over the long term. Particularly, we view the reappointment of former management as an indication of a failed succession plan. A clear and transparent succession plan process signals to investors that the board has confidence in the continued execution of long-term strategy and sustainable value creation the hands of different individuals.

2023 Thematic Stewardship Priorities

Every year, State Street Global Advisors identifies strategic priorities that inform the focus of our stewardship activities and guide resource allocation. The four themes for 2023 include: Effective Board Oversight; Climate Risk Management; Human Capital Management; and Diversity, Equity, and Inclusion. We believe each of these four topics presents short- and long-term risks and opportunities to companies across our portfolio. Over the next year we aim to promote alignment with our expectations for effective disclosure and governance practices in each of these thematic areas.

Return of In-Person Engagements

As the global COVID-19 pandemic recedes, State Street Global Advisors’ Asset Stewardship team has returned to conducting some engagements in person. We have had productive conversations with The Clorox Company, Moderna, Inc., Volkswagen AG and Wynn Resorts Limited at our Boston, London and New York offices. We have found that virtual engagements can create opportunities to connect with more directors and other Subject Matter Experts whose schedules and locations might otherwise make it difficult to connect in person. As such, we will continue to pursue a blend of virtual and in-person engagements.

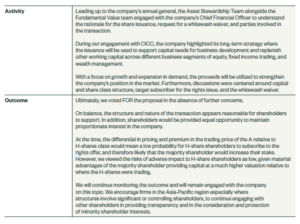

Engagement Highlights

Download the full report here.

Endnotes

1https://omscgcinc.wpenginepowered.com/wp-content/uploads/2022/10/September22-Challenger-CEOReport.pdf.(go back)

Print

Print