Paul Washington is Executive Director of the ESG Center at The Conference Board, Inc. Merel Spierings is Researcher at the ESG Center. This post relates to Shareholder Voting Trends Live Dashboard, an online dashboard published by The Conference Board in partnership with ESG data analytics firm ESGAUGE and in collaboration with Russell Reynolds Associates and Rutgers Center for Corporate Law and Governance.

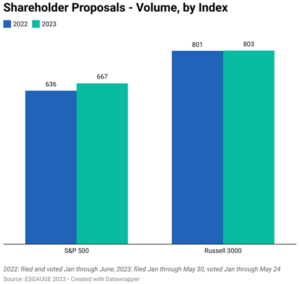

We are continuing to see a flood of shareholder proposals in 2023. Thus far this year, shareholders have filed 803 proposals at Russell 3000 companies, compared to 801 through in the first half of 2022. That’s more than the 798 proposals filed in all of 2021.

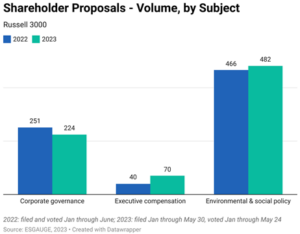

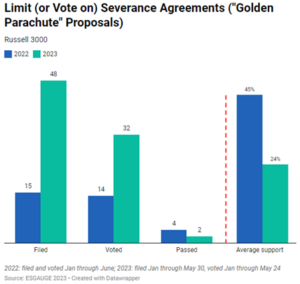

The sharpest increase in shareholder proposals is in the area of executive compensation. That has been driven by a dramatic rise in the number of proposals targeting severance arrangements.

Shareholder proponents are continuing to target marquee firms. Eighty-three percent of the shareholder proposals filed thus this year have been at S&P 500 companies, compared to 79 percent in the first half of 2022. This suggests that shareholders are continuing to focus on companies where they can get the most attention, not necessarily the companies that may merit the most attention, as smaller companies generally have less robust ESG programs. [1] [2]

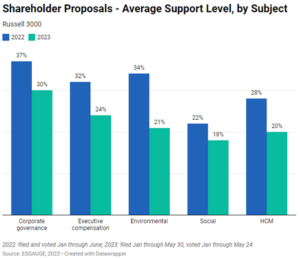

While the number of shareholder proposals is increasing, support is declining across the board. Continuing the trend we saw in 2022, support dropped for shareholder proposals in every category: governance, executive compensation, environmental, social, and human capital management. As in 2022, governance proposals continued to gain higher levels of average support than those in other areas. A number of factors appear to be contributing to the decline in support, including the proscriptive nature of some proposals, the steps companies have already taken to address the topics raised by proposals, and major institutional investors taking a more discerning, case-by-case approach in evaluating shareholder proposals as compared to a few years ago.

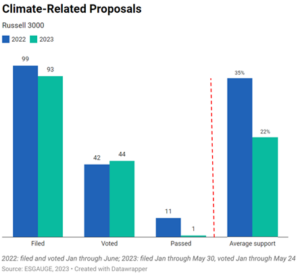

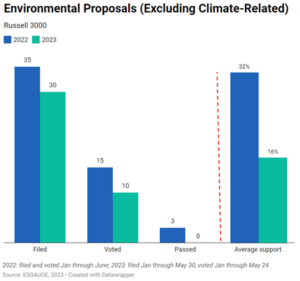

Among the various categories, environmental proposals have seen the sharpest drop in support, from 34 percent to 21 percent in the first half of 2022. Within that context, shareholder proposals on climate continued to dominate environmental proposals and be the most resilient in terms of average support.

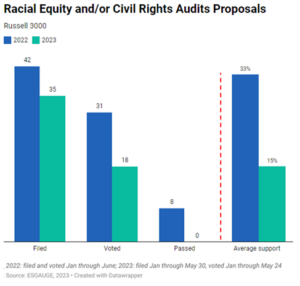

After a small increase from 2021 to 2022, support for shareholder proposals on racial equity and civil rights audits has declined markedly. Such proposals received 32 percent average support in 2021 and 33 percent in the first half of 2022. Average support has fallen by almost half thus far in 2023. Even excluding proposals from anti-ESG groups, average support for racial equity audit proposals has fallen to 23 percent.

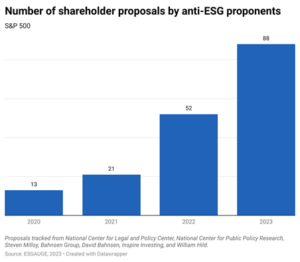

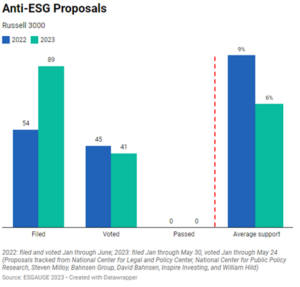

Anti-ESG proposals are on the rise, but support – already low – is falling. As we predicted in our 2023 Proxy Season Preview report, we are seeing a significant increase in shareholder proposals from anti-ESG groups. Eighty-eight proposals have been submitted this year in the S&P 500, compared to 52 in 2022 – a 69 percent increase. As in the past, many of these proposals offer resolutions that are similar to “pro-ESG” proposals but contain supporting statements with vastly different rationales.

Digging deeper, here are four preliminary observations about anti-ESG proposals in 2023:

- Evolving topics. Anti-ESG proponents continue to challenge S&P 500 companies on their diversity, equity, and inclusion (DEI) policies (they filed 13 racial equity audit proposals, compared to 8 last year) and governance practices (including 9 proposals on CEO/chairman separation, compared to 7 proposals last year). But they have expanded their focus: in 2023, they submitted 19 proposals addressing human rights, compared to only 3 last year. They also filed 6 climate-related proposals (taking a skeptical view on the issue), compared to none last year. Conversely, they submitted fewer proposals on topics such as charitable giving (12 in 2022 versus 1 this year) and political spending (4 last year versus 1 this year).

- Continued underperformance. Anti-ESG proposals continue to underperform their pro-ESG counterparts: thus far, support for such proposals is averaging 7 percent in the S&P 500 (6 percent in the Russell 3000), down from 8 percent in 2022 (9 percent in the Russell 3000). The only topic where anti-ESG proponents seem to be getting traction this year is on CEO/chairman separation, a traditional governance topic.

- Quality of – and rationale behind – proposals. Like last year, anti-ESG proposals are seeing high omission rates: 21 percent, compared to 19 percent in 2022, and versus 8 percent for all other shareholder proposals thus far in 2023. This suggests that the quality of such proposals is still lower than traditional proposals and often fails the SEC’s specified requirements (despite the SEC narrowing grounds for excluding proposals from the company’s proxy statement).

- Impact on shareholder proposals in general. Proposals from anti-ESG groups have lowered the average support for all shareholder proposals by approximately two percentage points. Thus far in 2023, average support for all shareholder proposals in the Russell 3000 is 23.9 percent, as compared to 25.0 percent if one excludes proposals submitted by anti-ESG groups.

Even when their shareholder proposals do not go to a vote or receive significant support, anti-ESG groups continue to look for opportunities during the submission process to get their ideas in front of boards and make headlines. In so doing, they force companies to take a public stand that can serve as fodder for further anti-ESG activism. So, as noted in our Proxy Season Preview report, companies’ strategy for dealing with anti-ESG shareholder proposals needs to go beyond narrowly responding to the proposal itself, but to explain how the company’s position is “good for business.”

Endnotes

12022 Proxy Season Preview and Shareholder Voting Trends: Corporate Governance Proposals, The Conference Board/ESGAUGE, February 2022.(go back)

2Sustainability Disclosure Practices: 2022 Edition, The Conference Board/ESGAUGE, January 2022.(go back)

Print

Print