Yair Listokin is the Deputy Dean and Shibley Family Fund Professor of Law at Yale Law School. This post is based on his recent paper, forthcoming in the American Law and Economics Review. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism (discussed on the Forum here) by Lucian Bebchuk, Alon Brav, and Wei Jiang; Dancing with Activists (discussed on the Forum here) by Lucian A. Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch; and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine Jr.

More than 80% of board proxy contests waged by activist investors do not seek corporate control. What is the point of these ubiquitous “short slate” contests? The activist conducts an adversarial campaign against the incumbent board and management, with success meaning the activist serves on a board still controlled by the incumbents. As former Delaware Chancellor Strine put it, such “short-slate” contests are “oddments”.

Observers have put forward several (non-mutually exclusive) interpretations of short slate contests. One theory is that short slate contests are devices for activists and shareholders to credibly signal dissatisfaction with incumbent management. If the incumbent board sees that activists and shareholders are unhappy enough to threaten or even replace a board member (or two), then the board knows that reform is needed to forestall a proxy contest for control over the corporation in the future (Gordon, 2008). A second interpretation is that minority representation allows activists an opportunity to convince other directors to change corporate strategy in a way that ordinary shareholder engagement with the board cannot (Fos, 2017).

In my recently published note in the American Law and Economics Review entitled “The Board-Room Where it Happens”, I offer suggestive event study evidence supporting the instrumental value of an activist’s short slate on a board of directors from the “the largest proxy battle ever”.

Citing chronic under performance at Procter & Gamble Inc. (“P&G”) through 2017, activist hedge fund Trian Management vied with P&G incumbent management for a single seat on P&G’s eleven-member board. The campaign culminated in a remarkably close proxy vote. Both Trian and P&G claimed victory. P&G asserted that the management supported candidate won by .0013% when it announced victory on the day of the annual meeting, while a month later Trian was preliminarily declared the victor by independent vote counter IVS by .0016% of the vote. (The contestants settled—with Trian obtaining a board seat– before they could determine the “true” voting outcome.)

Perhaps even more extraordinary than the razor-thin vote margin was the stock market’s response to news of the likely victor. This news was nearly irrelevant for the signal sent to P&G’s management—regardless of the final tally, it was clear that almost exactly 50% of the voting shareholders favored Trian over P&G’s incumbents. But the outcome mattered greatly for the composition of P&G’s board. If a board seat facilitates Trian’s influence over P&G and Trian’s influence affects firm value, then the market should move in response to news about the outcome of the contest, regardless of signaling value.

On the annual meeting date of October 10, 2017, P&G announced that it had narrowly won. P&G shares promptly dropped by more than 2% in the hour the results were announced, even after Trian refused to concede. (P&G hourly abnormal returns for that date are shown in the figure below. Note that the extremely negative abnormal return, well below the 1st percentile abnormal return, when P&G declares victory.)

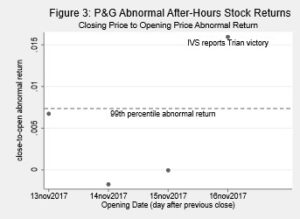

After a month of counting by an independent election inspector, Trian was declared the victor of a preliminary vote count on November 15 after the market closed. P&G shares surged by 1.6%, even though P&G did not concede. (Overnight abnormal returns for the trading days around November 15-16 are shown in the Figure below. Note the extreme positive return, well above the 99th percentile return, when Trian was declared the victor.)

Regardless of the outcome of the contest, the close proxy fight between P&G and Trian indicated that P&G had many dissatisfied shareholders and many shareholders ready to support incumbent management. The extremely negative abnormal P&G returns on news of a likely P&G victory on October 10 and extremely positive abnormal returns on news of a likely Trian victory on November 15-16 offer statistical evidence that the market attributed instrumental value to a single Trian seat on the P&G board. To the price setting investor, P&G with 10 incumbent directors and one Trian-affiliated director was worth billions of dollars more than P&G with 11 incumbent directors (2+ percentage points of an approximately $200 billion company). The results suggest that, while P&G is only one possibly unrepresentative case, even a single director on a large board can make a substantial difference to shareholder value. Short slate proxy contests can be about much more than signaling.

Print

Print