Lindsey Stewart is Director of Investment Stewardship Research at Morningstar, Inc. This post is based on his Morningstar memorandum. Related research from the Program on Corporate Governance includes The Agency Problems of Institutional Investors (discussed on the Forum here) by Lucian Bebchuk, Alma Cohen, and Scott Hirst; Index Funds and the Future of Corporate Governance: Theory, Evidence, and Policy (discussed on the forum here) and The Specter of the Giant Three (discussed on the Forum here), both by Lucian Bebchuk and Scott Hirst; and The Limits of Portfolio Primacy (discussed on the Forum here) by Roberto Tallarita.

Executive Summary

Attention on proxy-voting decisions has never been higher. Voting outcomes on key shareholder resolutions are an important input to the decisions the largest U.S. companies choose to make on environmental and social themes. Voting decisions on these resolutions by the Big Three, primarily passive, asset managers—BlackRock, Vanguard, and State Street—also clearly indicate the issues the firms are prepared to make a stand on regarding environmental and social themes. This is useful to investors in passive funds who may wish to select a manager whose voting record aligns most closely to their own sustainability priorities.

Scrutiny on voting decisions by the Big Three has been especially high, given their outsize position in U.S. equity markets. Although the ongoing rollout of “pass-through voting” [1] will allow fund investors more choice in how their equity investments in funds are voted, millions of fund investors will continue to rely on their fund manager to make proxy-voting decisions on their behalf. And whether those investors place their capital in a high-intention sustainable fund or a broad index tracker, investors’ thirst for knowledge about how well aligned a manager’s voting decisions are with their own environmental and social priorities will only continue to grow. With that in mind, we have compiled this research paper analyzing how the Big Three voted on 100 key environmental and social resolutions in the two years to March 2023, to help investors assess that level of alignment.

Key Takeaways

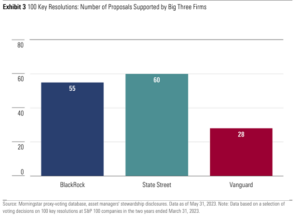

- BlackRock and State Street supported the majority of the key resolutions in this analysis (55% and 60%, respectively), in line with average support levels by independent shareholders and commensurate with the firms’ Morningstar ESG Commitment Level of Basic. Vanguard—consistent with the firm’s record of low backing for social and environmental shareholder resolutions— supported only 28% of the proposals.

- The three firms made different decisions on more than two thirds of the 100 resolutions. When State Street cast a minority vote among the three, it tended to vote “For” a resolution that the other two firms voted “Against.” In Vanguard’s case, the firm tended to vote “Against” a resolution that the other two firms voted “For.” Only 7% of the time did BlackRock make a voting decision that the other two firms disagreed with—in these cases, the firm usually voted “For” the proposal.

- BlackRock showed a high level of support (above 70%) for resolutions on civil rights and racial equity, while State Street showed its highest level of support (above 90%) for resolutions addressing human rights and ethical use of technology. Vanguard voted “Against” all of the key resolutions on civil rights and racial equity and on environment-related issues other than climate.

- All three firms showed a medium level of support (between 40% and 70%) for key resolutions addressing climate change and workplace equity issues.

- BlackRock published voting rationales for 97 of the 100 voting decisions, compared with only 45 and 28 for Vanguard and State Street, respectively. Voting rationales are essential to help investors assess the level of alignment between a manager’s decisions and their own environmental and social objectives.

Key Findings

Review of the Big Three’s Voting Decisions on 100 Key Resolutions

Attention on proxy-voting decisions has never been higher. Voting outcomes on key shareholder resolutions are an important input to the decisions the largest U.S. companies choose to make on environmental and social themes. Voting decisions on these resolutions by the Big Three, primarily passive, asset managers—BlackRock, State Street, and Vanguard—also clearly indicate the issues the firms are prepared to make a stand on regarding environmental and social themes. This is useful to investors in passive funds who may wish to select a manager whose voting record aligns most closely to their own sustainability priorities. Scrutiny on voting decisions by the Big Three has been especially high, given their outsize position in U.S. equity markets. According to Morningstar Direct, the Big Three represented 43% of the U.S. funds market, with USD 10.3 trillion of assets as of April 30, 2023. Most of this investor capital is held in USD 8.9 trillion of passive funds.

Until recently, all those shareholdings were voted in line with the manager’s own proxy-voting policy. However, now all three managers are in the process of implementing “pass-through voting”—new systems and processes that allow fund investors to make choices about whether and how they would prefer fund managers to cast votes on their behalf. BlackRock, Vanguard, and State Street are each taking different approaches to implementing pass-through voting. To be clear, investors are not suddenly being asked to make thousands of individual voting decisions per year. Instead, they will be able to choose a policy that best fits their own stance on environmental, social, and governance themes from a range of options.

Still, even after a full rollout of pass-through voting options to investors, millions of fund investors will continue to rely on their fund manager to make proxy-voting decisions on their behalf. And whether those investors place their capital in a sustainable fund or a broad index tracker, investors’ thirst for knowledge about how well aligned a manager’s voting decisions are with their own environmental and social priorities will only continue to grow. We’ve compiled this research paper analyzing how the Big Three voted on 100 key resolutions in the last two years to help investors assess that level of alignment.

100 Key Resolutions: Topics Addressed and Levels of Support

For this paper, we looked at the Big Three’s voting record on a selection of 100 key ESG shareholder resolutions. [2] The 100 resolutions were all:

- Filed at a U.S. large-cap company (that is, a current S&P 100 constituent),

- Voted on by the company’s shareholders during the two years ended March 31, 2023, [3]

- Supported by between 40% and 85% of the company’s independent shareholders (that is, excluding votes attributable to shares owned by management, company founders, and strategic investors). [4]

The 100 resolutions were filed at 39 companies representing over 60% of the market cap of the S&P 100 index (or over 40% of the S&P 500, the main market index). The list includes tech giants like Google-owner Alphabet GOOGL, Amazon.com AMZN, Apple AAPL, Microsoft MSFT, and Facebook-owner Meta META; energy companies such as Chevron CVX, ConocoPhillips COP, Duke Energy DUK, and Exxon Mobil XOM; financials like Berkshire Hathaway BRK.B, JPMorgan Chase JPM, and Goldman Sachs GS; as well as large consumer companies like Altria Group MO, Home Depot HD, McDonald’s MCD, and Tesla TSLA.

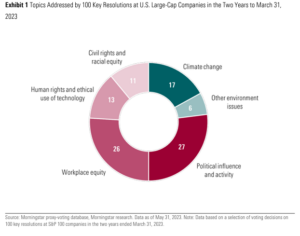

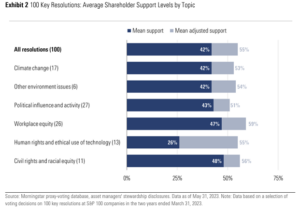

The 100 key resolutions primarily address social issues, as shown in Exhibit 1. There are 77 such resolutions that we have divided into four topics: political influence and activity (27 resolutions), workplace equity (26), human rights and ethical use of technology (13), and civil rights and racial equity (11). The remaining 23 proposals target environmental themes, of which 17 focus on climate change. The other six are on more diverse issues such as deforestation, water risk, and use of plastics. Overall, these 100 resolutions were supported by 42% of company shareholders on average. The figure rises to 54% on an adjusted basis, including only a company’s independent shareholders (see Exhibit 2 below). [5] All the topic groups achieved an average adjusted shareholder support of above 50%. Both environment related topics matched the overall average for shareholder support at 42%, also achieving similar average adjusted support levels (climate change: 53%; other environment issues: 54%).

Among the social topics, political influence and activity resolutions—the largest topic group—also achieved similar support levels. The 27 resolutions gained an average 43% shareholder support, or 51% on an adjusted basis.

Workplace equity resolutions formed the second-largest topic group, with 26 resolutions. The topic covers several matters that asset managers often refer to as “human capital” issues—these include shareholder requests for reporting and policies on workers’ rights; workforce composition; diversity, equity, and inclusion; gender and/or racial pay gaps; and workplace antiharassment and discrimination measures. This group of workplace equity resolutions was well-supported, achieving an average 47% shareholder support, or 59% on an adjusted basis.

The 13 proposals on human rights and ethical use of technology are dominated by three large technology companies: Alphabet, Amazon, and Meta. All except one of the resolutions in this group is from one of those three companies, the exception being a 2021 request for a human rights impact assessment in Nike’s NKE cotton supply chain. The issues raised at the three Big Tech companies range from the human rights impacts of data center siting and facial recognition concerns to measures aimed at preventing both online misinformation and disinformation and abusive content.

The 26% average shareholder support for the 13 resolutions on human rights and ethical use of technology stands out for being the lowest of all the groups by some margin. However, this is primarily because company founders own sizable stakes in all four companies covered in this topic group, which pushes down the average. Furthermore, two of the three Big Tech companies use multiple-class share schemes that give their founders considerably more voting power than other shareholders, which exacerbates the effect.

At Alphabet, Larry Page and Sergey Brin control 51% of the voting rights with their 6% shareholding in the company. Mark Zuckerberg controls 61% of the voting rights at Meta with his 14% shareholding. We calculate that the average (unadjusted) shareholder support for this topic group would be 44% on a oneshare-one-vote basis—18 percentage points higher and well in line with the other topic groups. On an adjusted basis, excluding these founders’ stakes, average shareholder support for these 13 resolutions stands at 55%.

The final topic group of social shareholder resolutions is the smallest but also has the highest average shareholder support (unadjusted). An average 48% of shareholders—or 56% on an adjusted basis— supported the 11 resolutions on civil rights and racial equity that we have analyzed in this study.

How the Big Three Firms Voted on the 100 Key Resolutions

Low Support From Vanguard—Only Half That of BlackRock and State Street

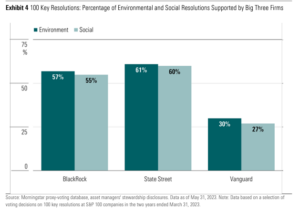

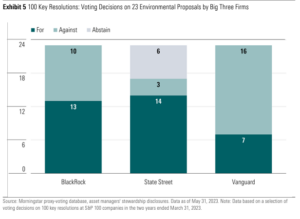

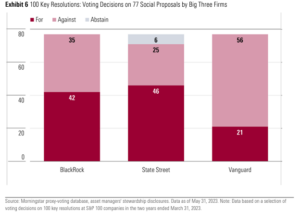

The headline finding from this analysis of the Big Three’s voting records is that Vanguard’s level of support for key resolutions is only half that of BlackRock and State Street, as Exhibits 3 and 4 show. BlackRock supported 55 of the 100 key resolutions, while State Street—the most frequent backer of key resolutions among the three— supported 60 of them. Vanguard supported 28 of these resolutions. This overall trend still holds if we split the resolutions by environmental or social theme (as shown on Exhibits 4–6). Vanguard supported seven out of 23 key environmental proposals (30%); BlackRock and State Street supported 13 and 14, respectively (57% and 61%). On social topics, both BlackRock and State Street supported 42 and 46 of the 77 proposals (55% and 60%, respectively); Vanguard supported 21 such proposals (27%).

Big Three Make Unanimous Decisions on 31 of the 100 Resolutions

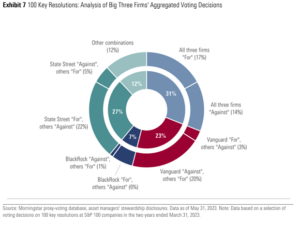

Exhibit 7 shows how often the Big Three made unanimous voting decisions on the 100 resolutions and how often there was a 2-to-1 split (where one of the three firms voted “For” a resolution and the other two voted “Against,” or vice versa).

The Big Three firms made unanimous decisions on 31 of the 100 key resolutions we analyzed for this paper. All three firms voted “For” 17 resolutions. On 14 resolutions, all three firms voted “Against.” There was a 2-to-1 split in the Big Three’s voting on 57 of the 100 resolutions—State Street was most often in the minority, on 27 resolutions; followed by Vanguard on 23 resolutions.

On this analysis, BlackRock is the least likely of the three firms to have made a voting decision that the other two firms disagreed with. This happened on seven resolutions. Only once did BlackRock vote “Against” a resolution that State Street and Vanguard both supported—a proposal requesting a report on lobbying activities at Meta in 2022. The other six times, BlackRock supported resolutions that the other two voted against.

In contrast, State Street is the most likely of the three firms to cast a vote that the other two firms disagreed with, which it did on 27 of the 100 resolutions we analyzed. When State Street is in the minority among the three, it is more likely to vote “For” the resolution, which it did on 22 out of the 27 such proposals. Furthermore, the 12 “other combinations” of voting decisions shown in Exhibit 7 above, are all resolutions on which State Street decided to “Abstain.” BlackRock voted “For” seven of these resolutions; Vanguard voted “For” only two of them.

State Street uses the “Abstain” option much more often than the other two firms (and most firms generally) because of a significant difference in its voting policy. It is rare that BlackRock or Vanguard would make an “Abstain” decision on a resolution that they were eligible to vote on—the two firms did not “Abstain” on any of the 100 resolutions covered in this paper. However, State Street does decide to “Abstain” in cases “when [the firm] support[s] some elements of a proposal’s request, or recognize[s] a company’s commitment to implement related disclosure and/or oversight practices” on environmental or social topics. [6] By contrast, in these circumstances, the other two firms would normally make a decision to vote “For” or “Against” the proposal based on its overall merits. [7]

Of the three firms, Vanguard is the most likely to vote “Against” a resolution that the other two firms supported, which it did on 20 of the 100 resolutions. However, Vanguard supported three resolutions that BlackRock and State Street opposed, all on workplace equity topics. These were a proposal for a report on diversity and inclusion efforts at Nike in 2021 and proposals for reports on the use of concealment clauses at IBM IBM and Meta in 2022.

Analysis of Each Firm’s Voting Record

Medium Support for Key Resolutions at BlackRock and State Street

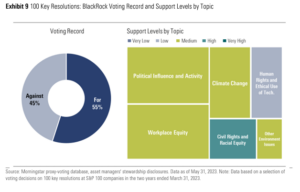

When evaluating asset managers’ support for key resolutions, we assess support levels of 70% or above as high, with 90% representing a very high level (see Exhibit 8). Anything from 40% up to 70% is considered a medium level of support, with anything below 40% considered low (or very low, below 20%). The banding we have used skews slightly high, reflecting the fact that key resolutions are, by definition, well supported by asset managers. Our January 2023 research paper revealed that the three year median support for key resolutions by the top 20 U.S. asset managers was 59%.

By this assessment, Vanguard’s support for the 100 key resolutions is objectively low, with support by BlackRock and State Street close to the three-year median. There follows an analysis of each manager’s voting record on the 100 key resolutions in greater detail. We examine voting decisions on key resolutions, and the managers’ rationales behind those decisions, in more detail on Pages 15–48.

BlackRock

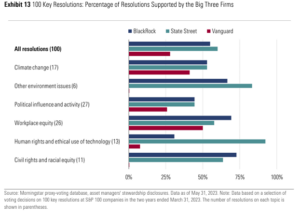

BlackRock’s voting record shows a medium level of support for the 100 key resolutions overall, which is commensurate with the firm’s Morningstar ESG Commitment Level of Basic. The firm also supported a medium proportion of key resolutions across four of the six topics we cover in this paper: climate change, other environment issues, political influence and activity, and workplace equity.

BlackRock’s support for the 13 key proposals in our selection addressing human rights and the ethical use of technology was low. The firm supported only four (31%) of these resolutions. In contrast, BlackRock showed a high level of support for the 11 key resolutions on civil rights and racial equity, and it was the only firm among the Big Three to do so. The firm supported eight (73%) out of the 11 key resolutions in our selection that addressed this topic.

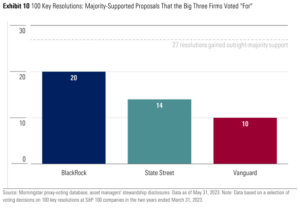

Given that BlackRock is the largest manager to support a majority of the 100 key resolutions, the firm’s voting decision has some predictive value in determining whether a resolution will achieve outright majority support. Of the 27 resolutions supported by an outright majority of shareholders, BlackRock voted “For” 20 of them (74%).

State Street

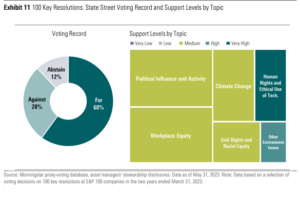

State Street voted “For” 60 of the 100 resolutions in this study, making it the strongest supporter of these resolutions. The firm’s support for key resolutions was at a medium level across four topics: climate change, political influence and activity, workplace equity, and civil rights and racial equity.

On environment-related issues other than climate, State Street showed a high level of support, voting “For” five out of the six resolutions on this topic. On human rights and ethical use of technology, the firm exhibited a very high support level, voting “For” all but one of the 13 resolutions (92%). Also notable is State Street’s willingness to use the “Abstain” decision when voting, which most other firms, including BlackRock and Vanguard, avoid (see Page 9). The firm abstained on 12 of the 100 proposals.

Vanguard

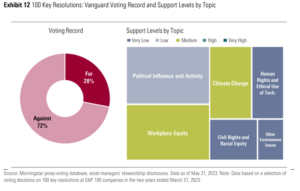

Vanguard’s level of support for the 100 key resolutions we analyzed is markedly different from the other two firms in the Big Three. The firm supported 28% of these resolutions—a low level overall.

Vanguard’s support for key resolutions in three of the six topics we assessed is very low—that is, less than 20%. Notably, Vanguard voted “Against” all of the six resolutions on environment issues other than climate and also voted “Against” all 13 resolutions on civil rights and racial equity. The firm supported only one (8%) of the 13 resolutions addressing human rights and ethical use of technology.

Vanguard’s support for resolutions on political influence and activity was slightly higher than for those three topics but still low overall. The firm supported seven (26%) of the 27 resolutions addressing this topic.

Vanguard’s support for resolutions on climate change and workplace equity issues was at a medium level but still lower than BlackRock and State Street (see Exhibit 13). Vanguard voted “For” seven (41%) of the 17 climate change resolutions we analyzed and voted “For” 13 (50%) of the 26 workplace equity resolutions. This means that climate change and workplace equity were the only two topics in which all three firms supported at least 40% of the key resolutions we evaluated.

We found publicly disclosed voting rationales for 170 (57%) of the 300 voting decisions the three managers made, [8] which we evaluate in the following sections of this paper. For BlackRock, we found published voting rationales for 97 of the 100 voting decisions. We found 45 published voting rationales for Vanguard and 28 for State Street.

We consider these rationales increasingly important as they help investors understand the context and contributing factors that underlie a voting decision, which can often be nuanced. Knowing the rationale helps an investor assess the level of alignment between a manager’s voting policy and decision-making and the investor’s own environmental and social objectives and priorities.

Download the complete report here.

Endnotes

1Pass-through voting refers to the ways in which asset managers employ new systems and processes that allow investors greater influence over proxy-voting decisions that would previously have been made solely at the manager’s discretion. See Page 3 for further information.(go back)

2Morningstar defines “key” resolutions as shareholder resolutions that are supported by at least 40% of a company’s independent shareholders (which we also refer to as “adjusted support”). Adjusted support calculations exclude votes attributable to shareholdings of management, founders, and strategic investors who are unlikely to defy board recommendations by supporting shareholder resolutions. For more information, see Page 5 of our January 2023 research paper Proxy-Voting Insights: 2022 in Review.(go back)

3We note that this time period excludes the ongoing April to June proxy season, which we will analyze in a future paper once all of the voting data becomes available.(go back)

4We applied the 85% cap for this study because shareholder resolutions that are this well-supported are not especially useful for analyzing differences between major firms’ voting decisions. In several cases, these resolutions are also supported (or at least unopposed) by company boards. This makes them similar to management resolutions and is part of the reason why they achieve such high percentage support.(go back)

5In the two-year period, there were 173 key shareholder resolutions in total (including the 100 resolutions for U.S. large-cap companies in this study), according to Morningstar’s proxy-voting database. The average shareholder support for all 173 resolutions was higher than for the large caps only at 47%, or 58% on an adjusted basis.(go back)

6State Street Global Advisors’ Global Proxy Voting and Engagement Guidelines for Environmental and Social Factors, June 2023 https://www.ssga.com/uk/en_gb/institutional/ic/library-content/pdfs/asr-library/proxy-voting-and-engagement-guideline-environmental.pdf(go back)

7We identified at least two clear examples of this: 1) a resolution requesting a report on climate-related lobbying at Alphabet in 2022; 2) a resolution requesting a report on climate scenario analysis at Exxon Mobil in 2022.(go back)

8A full list of sources for the firms’ vote rationales can be found in Appendix 2.(go back)

Print

Print