Hilary Wiek is a Senior Strategist and Anikka Villegas is an Analyst at PitchBook. This post is based on their Sustainable Investment Survey. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; Does Enlightened Shareholder Value add Value (discussed on the Forum here) by Lucian Bebchuk, Kobi Kastiel, Roberto Tallarita; Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee (discussed on the Forum here) by Max M. Schanzenbach and Robert H. Sitkoff; and Exit vs. Voice (discussed on the Forum here) by Eleonora Broccardo, Oliver Hart and Luigi Zingales.

About the survey

This group of respondents represents the most balanced profile to date for this survey, showing that the interest in sustainable investment issues run far and wide.

Since the release of our last Sustainable Investment Survey report in October 2022, we have been busy with our sustainable investment research efforts. Using our proprietary Impact fund data set utilizing the Global Impact Investing Network’s (GIIN) IRIS+ taxonomy, we updated our reporting on fundraising trends in private Impact fund investing. [1] As a follow-up to 2022’s survey, we took some of the open-ended responses and wrote a report addressing the concerns and criticisms of ESG. In January, we published a piece on sustainable and digital infrastructure in the private markets, noting that infrastructure has not only been expanding as an area of investment, but it is increasingly looking to contribute sustainable solutions to areas like climate change and socioeconomic equality. Finally, we have brought on an emerging technology analyst focused on producing carbon & emissions tech and clean energy work for PitchBook clients.

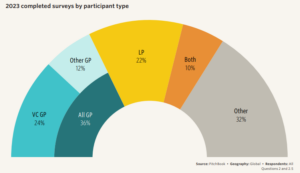

This year’s roughly 30-question survey asked global investors and the service providers who work with them to react to various topics related to sustainable investing, ESG risk factors, and Impact investing. 419 individuals completed the survey, although we recorded at least one answer from 814 individuals, providing us with even more data on a partial basis.

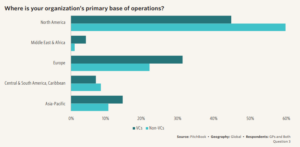

This group of respondents represents the most balanced profile to date for this survey, showing that the interest in sustainable investment issues runs far and wide. We recorded responses from every global region and had significant numbers from each respondent type: LPs, GPs, Both, and Other. This last category self-identified as coming from consultancies, investment advisers, academia, business owners, family offices, investment banks, placement agents, accounting firms, and more not covered by the GP or LP umbrella. Those who answered “Both” were steered to that response if they were LPs and in turn had LPs, so they were largely funds of funds (FoF) in some form.

We updated the questions to better capture the current environment and focus on where sentiments are strongest.

Once again, this year we asked GPs to identify whether they consider themselves to be venture capitalists (VCs), thereby allowing us to contrast how VCs were thinking about sustainable investment topics versus other respondents. 193 of our GPs identified as VCs, 109 of whom made it to the end of the survey, providing us a significant sample from which to report on VC thoughts and trends.

We also reached a broad spectrum of organizations from small to mega: 63% represented assets below $500 million, and 7% were at organizations with $25 billion or more under management or advisement. Only 5% of our GP universe were in the largest bracket, while our Other grouping was most likely to represent assets lower than $500 million, at 69%.

We realize that the sustainable investment field is a confusing collection of terms understood in many different ways. To level set for this survey, we provided the following guidance as each respondent began: “We use sustainable investing as the umbrella overarching both Impact investment approaches (seeking to make both a financial profit and a positive social or environmental impact) and the incorporation of ESG (environmental, social & governance) risk factors into the investment process. We will ask about each aspect of sustainable investing in the survey, using each deliberately as defined here.” This language specification allowed us to identify more nuanced thoughts and practices across the sustainable investment landscape.

We also updated questions to better capture the current environment and focus on where sentiments are strongest. In reaction to the rapid growth we’ve seen in our previous surveys of responses coming in negative on the topic, we added some response options that would allow for those feelings to be better captured. Finally, many questions left space for open-ended comments, some of which we have shared to provide further insights into sentiments around sustainable investing topics.

Trends over time

It can be difficult to track trends over time in surveys, especially when responses are anonymous, as it is unclear whether shifts are due to a different respondent pool or true societal shift in opinion. Thus, while we may interpret results as trends in sentiment around sustainable investing, we are aware that some of the moves from one year to the next may just be that we have attracted more people who want to have their negative views on sustainable investing represented.

At the highest level, we have seen signs of both increased adoption of sustainable investing practices and more people who have no sustainable investment program at all. We’ll go into some detail about why this may be and whether it is likely to change in the Social and political landscape and The future of sustainable investing sections, but here we will provide a few year-by-year trend charts taken from this year’s survey and those of 2021 and 2022.

From 2021 to today, the proportion of respondents that have integrated sustainable investment principles throughout their portfolio has increased, growing from 30% in 2021 to 37% in 2023. On the flip side, we show that more of our respondents have no plans to incorporate sustainability into their investment work, going from 9% in 2021 to 17% in 2023. Fewer people are even considering implementing sustainable investment practices—they have either converted to full integration or have chosen to never do so. Those exploring in 2021 seem to have sorted themselves into either adopters or those who will not be pursuing sustainable investment objectives.

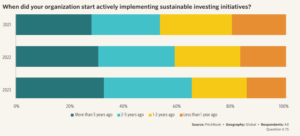

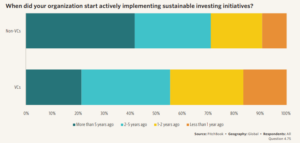

Next, we asked when our respondents began their sustainable investing initiatives, excluding the people who had said they had no plans in the prior question. Fewer are just getting started now than in 2021: In the current survey, only 15% began in the past year, while 20% were just starting out in 2021. The groups that began two to five years ago or more than five years ago have been growing: Added together, those have gone from 53% of the population to 66%. We are nearing the point that if a firm or organization was going to integrate sustainable investment principles, it would have already started the journey and the program is becoming more seasoned.

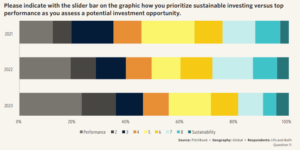

Our question that asks participants to indicate where they lie on the spectrum from “performance is the only important factor” to “sustainability is the only important factor” gives some indication of the polarization of sustainable investing views. While there is still clustering in the middle, with the largest contingent in 2023 being the 19% who selected a six on the scale, the endpoints have both grown in magnitude. It appears that it is not only the anti-ESG individuals who are becoming more entrenched.

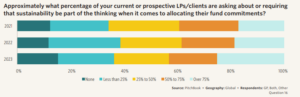

In terms of adoption, more allocators have been asking about sustainability as time has marched on. While in 2021, only 17% of asset managers said that 75% or more of LPs were asking them about sustainability, now, 25% report such questions from so many current or prospective clients. There has been a small increase in the asset managers saying that none of their clients are asking about sustainable investing, but the majority are getting questions—and needing to have answers—at least some of the time. This ties back to the question about whether respondents have implemented a sustainable investment program or not—potential clients are asking for definite answers, even if that answer is no. Fewer every year are in the exploration phase.

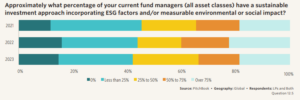

Allocators are gradually increasing the amount of their portfolios that employ sustainable investment approaches—either ESG or Impact funds. While the largest percentage of respondents has continued to say that less than 25% of their portfolio has sustainable investment mandates, the percent who selected this option has gone from 34% to 27%, with the percentage of those saying that 25% to

50% of their portfolio has such mandates has been increasing as LPs place more mandates with managers aligned with their sustainable investment objectives. Only 15% of LP and Both respondents said they have no sustainable investment funds in their portfolio, so asset managers that feel they can skip out on integrating sustainable investing into their investment approach may be finding it more and more difficult to find a target audience for their product offerings.

The allocator perspective

More than 75% of respondents feel that at least some amount of thinking around sustainability is important when considering a potential investment.

For the purposes of this section, allocators are either traditional LPs or fit into our Both category, where they make allocations to funds and also have clients to serve. For some of the questions, we also include the folks who serve in an advisory capacity to LPs in our Other category, such as LP consultants.

Out of our pure LP group, there has been a steady increase in the share of allocators not intending to do any sustainable investment work. In 2021, 11% of the group said this; in 2022, it jumped to 20%; and this year, it was up again to 23%. There were definite indications in the earlier days of this survey that it mainly attracted people positively inclined to sustainable investment practices, but as each year has passed, more individuals who feel strongly that incorporating sustainable investment principles into their investment portfolio is not for them have taken the time to register their sentiments.

One question asked individuals to show where they are on a spectrum of performance versus sustainability priorities when assessing potential opportunities. The responses showed a marked increase in those who think performance is all that matters, mirroring the rise we have seen in those with no intentions of doing any sustainable investment work. That said, more than 75% of respondents feel that at least some amount of thinking around sustainability is important when considering a potential investment. To presumably no one’s surprise, given the news coming from various states with anti-ESG mandates, of the 46 allocators who said that performance is all that matters, 35 were from North America. This was 28% of the North American respondents to this question. Surprisingly, people working for organizations based primarily in Europe had seven individuals, 18% of European respondents, with this view. We have often been told by European investors that considering sustainability in one’s investment decisions is table stakes, the only way to fulfill one’s fiduciary duty.

Looking across the performance to sustainability spectrum, we note that GPs have the unenviable

task of ensuring that they have a robust ESG  approach for the investors that we heard from in a previous question currently evaluating such characteristics, but they must also avoid saying anything too strongly or publicly about their ESG practices to avoid being blacklisted by the 23% of allocators who believe that performance is all that matters. In fact, in June 2023, BlackRock’s Larry Fink said that the term ESG has become too loaded, but while he will avoid using it, the firm’s stance on E, S, and G issues will not alter. [2]

approach for the investors that we heard from in a previous question currently evaluating such characteristics, but they must also avoid saying anything too strongly or publicly about their ESG practices to avoid being blacklisted by the 23% of allocators who believe that performance is all that matters. In fact, in June 2023, BlackRock’s Larry Fink said that the term ESG has become too loaded, but while he will avoid using it, the firm’s stance on E, S, and G issues will not alter. [2]

Potentially due to the politicization of ESG and sustainable investing in the past couple of years, several questions showed a retraction of support from this area by allocators versus the responses from 2022. More LPs said they had no exposure to sustainable investment products, more LPs said it is not at all important that GPs utilize an ESG risk-factor framework, fewer LPs evaluate a fund manager’s implementation of an ESG risk-factor framework when performing due diligence, and so on. The climate of negative rhetoric has emboldened some to more forcefully register their feelings, but it may also be that some LPs have decided that adding on the complexity of evaluating sustainable investment practices to an investment due diligence practice was more bother than they felt it was worth.

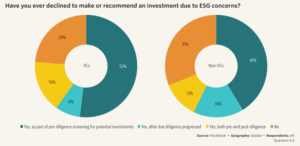

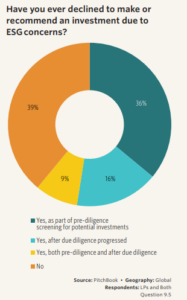

Despite the apparent drops in support outlined above, 45% of our LP and Both respondents indicated that due to ESG concerns, they had declined to make or recommend an investment when screening for potential opportunities, and 25% had declined to make an investment after due diligence had progressed. 17 people selected both options, so 61% of the allocator population chose one or more of these options. Asset managers need to be aware that there is a large population of allocators willing to act on their sustainable investment preferences. In fact, 51% of LPs said that they plan to increase their attention to ESG risk factors in the coming year, and another 18% will not be increasing because they have already fully implemented an ESG program.

Only 34% of allocator respondents (LPs and Both) said this year that more than half of their

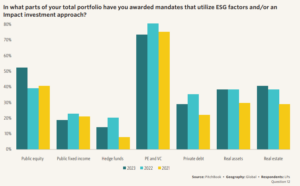

asset managers have some sort of a sustainable investment approach, but 85% said they had at least some exposure to what they consider sustainable investment products. For those who have hired asset managers utilizing ESG factors and/or an Impact investment approach, in what parts of the portfolio are LPs utilizing these products? It is understandable that those who agreed to take a PitchBook survey would skew to private fund investors, so the fact that 73% of the LPs said that they have awarded mandates with an approach to sustainable investing through their PE and/or VC allocations could be expected. Public equity was the second-mostcommon place for exposure, up from 39% in 2022 to 51% in 2023. Hedge funds were least likely to be a focus for sustainable investing mandates. This aligns with industry chatter about how hard it is to find a good sustainable strategy in hedge funds, as so many are too short term in perspective or find it incompatible with their investment approach.

Asset managers: VCs and non-VCs

We can break out the VC perspective on a number of our questions throughout the survey, providing readers a view into where VCs are in relation to non-VC GPs as well as to other groupings. VCs were slightly more skewed to Europe than other GPs—31% of VC respondents versus 22% of other GPs hailing from that continent. Asia-Pacific was also represented more highly in the VC set than the non-VC grouping, with 14% of the VC managers coming from that region versus 10% of the non-VCs.

Fleshing out the VC versus non-VC respondent groups a little further, 73% of VCs had assets under management under $500 million, while only 48% of non-VCs did. A full 10% of nonVCs had AUM above $25 billion, so one can assume a disparity in resources between the two groupings, which could have an impact on whether a firm was willing to layer in the added steps to incorporate ESG or Impact investing into an investment process. Despite perceptions that VC lags other areas of the private markets when it comes to implementing sustainable investment practices—the thought being that these early stage companies need to be focused solely on getting a product to market and the ESG risks are few when operations are so limited—our survey shows that VC respondents and non VC respondents were at similar stages. In fact, 68% of VC respondents had either partially or fully integrated sustainable investment principles into their portfolios, while 69% of the other GP respondents had done so. That said, of those with sustainable investing initiatives, non-VCs have gotten a head start: 71% began their implementation two or more years ago, compared with 55% of VCs. Overall, only 31% of GPs began more than five years ago, so this is a space where many are still fairly early in their journey.

This year, we were curious about when ESG comes into play for investors. It turns out that VCs are more likely to use ESG factors as a screening tool before initiating due diligence than non-VCs are—68% of the former said they had, compared to 53% of the latter. That said, VCs have actually been more likely to have declined an investment opportunity due to ESG risks at either stage of the due diligence process. [3]

While the last question discussed the use of ESG when it comes to pre-investment analysis, post-investment, non-VCs more frequently apply an ESG framework to the management of their portfolio companies. 39% of VCs do not do so, while only 25% of non-VCs have no program utilizing an ESG risk-factor framework in monitoring or managing their portfolio companies. Combined with the last question, this seems to indicate that some GPs believe that ESG is a useful framework for evaluating potential investments, but perhaps it is still too difficult to implement an ongoing program of measuring and reporting ESG factors. In later sections, we discuss the ongoing challenge the industry is having with measuring, reporting, and benchmarking ESG data.

When it came to the decision to develop a sustainable investment program, VCs were more likely than non-VCs (66% versus 58%) to cite a rationale of aligning their organization mission or values with their investment practices. Generally, the selection of other motivations lined up fairly closely, though non-VCs were more likely (37% versus 30%) to utilize sustainable investment practices in order to identify opportunities to improve business risk management. The narrative here seems to be that startups are launching to do some good in the world, while non-VC asset managers have established businesses to run, and there may be more scope to improve these businesses by using the lens of ESG risk factors.

Switching to current priorities, most GPs are planning to increase their attention to ESG risk factors in the coming year, but 67% of VCs have such plans versus only 56% of non-VCs. Interestingly, this is a switch from 2022, when more non-VCs were planning to increase their attention to ESG risk factors. This year, the non VC group was more likely to not be planning to integrate any sort of ESG factor assessments into their work, at 23% versus 18%. This was another reversal from 2022, when VCs were the ones least likely to have an ESG program. This may just be a function of who agreed to take the survey in 2023, but it could also be the result of recent activities of industry groups like VentureESG that have been actively working to make ESG more relevant to VC investors. The timing of this would make sense, as Venture ESG was only founded in December 2020.

Question 20 dealt with ranking, so the chart here shows where the top ranks were placed. In terms

of priorities, more VCs and non-VC GPs put environmental impacts as their top sustainable investing area of focus, though 31% of VCs made this their top rank versus only 24% of non-VCs. Of the choices provided, nearly one-quarter of both groups selected improving investment returns as their top priority for utilizing sustainability in an investment context. Non-VCs were much more likely to be prioritizing governance issues and utilizing sustainable investment principles to mitigate risks in their portfolio.

Contrasting views: ESG

Only 23% of allocators, when evaluating a potential GP to partner with or recommend, believe that it is not at all important that GPs utilize an ESG risk-factor framework in their acquisition and management of portfolio companies. That indicates that the rest feel that it is at least somewhat important to their investment due diligence process. When asked if they actually evaluate a fund manager’s implementation of an ESG risk-factor framework, however, only 42% of LPs say they do so, while another 16% said they are working on implementing an approach. Perhaps this is an indication of LPs not putting their money where their mouths are, simply ticking the box in their diligence instead of diving in deep to evaluate the policies and practices of a fund manager and its portfolio companies. It may also be that LPs feel ill-equipped to evaluate something that so many in the industry are struggling to standardize, define, and measure. Different audiences had differing levels of implementation on this point, however. 58% of the Other respondents, some of whom are performing diligence in an outsourced capacity for LPs, said that they evaluate a GP’s ESG approach before making a recommendation

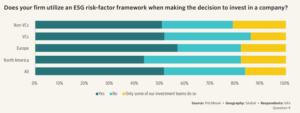

So, what are GPs doing? When asked if they utilize an ESG risk-factor framework when making the decision to invest in a company, 51% said yes, while another 16% said only some of their

investment teams do so. VCs were more likely to say no (34% versus 28% for non-VCs), an

expected result considering that early-stage VCs, in particular, may not have as much to evaluate given the fledgling nature of their investment targets. European GPs were most likely to say yes—57% of GPs from that region include ESG factors in their due diligence of potential portfolio companies. Another 18% of European GPs said that only some of their investment teams do so.

targets. European GPs were most likely to say yes—57% of GPs from that region include ESG factors in their due diligence of potential portfolio companies. Another 18% of European GPs said that only some of their investment teams do so.

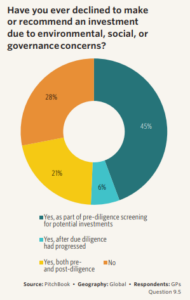

To put a finer point on the usage of ESG in the investment process, we asked how many GPs had declined to make an investment due to findings from the ESG diligence. We were also curious if GPs had just used ESG as more of a screening tool or if deeper diligence had uncovered an E, S, or G concern that led them to abandon the prospective investment. 66% of GP respondents said that they had declined to make an investment in pre-diligence screening, while 28% said they had done so after diligence had progressed. As GPs could select one or both “yes” options, we can do the math for our readers: 72% of GPs selected one or both options, with only 28% saying they’d never declined an investment based on ESG concerns. One of the key tenets of investing is that one way to improve investment returns is to avoid big losses. 72% of our GP respondents seem to recognize this

doctrine, having utilized an ESG framework to dodge potentially risky investments that could detract from overall fund performance.

What about after a company has entered a GP’s portfolio? There, the utilization of ESG principles has seen less adoption. Only 48% of GPs use an ESG risk-factor framework when managing and monitoring portfolio companies, with another 18% saying only some of their investment teams take this more proactive approach to addressing issues around governance and employee treatment rather than simply excluding bad actors. Non-VCs were most likely to do so, with only 25% saying that they do not at all. European GPs are more likely than North Americans to use ESG post-investment, with 70% doing so in at least some of their portfolios.

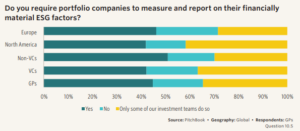

Perhaps surprisingly, this year, more of our GP respondents put requirements on their portfolio

companies when it came to measuring and reporting on financially material ESG factors than said that they, the GPs, were using ESG to manage and monitor portfolio companies. Others may not see this as backward, as sometimes the first step is to measure, after which can come the monitoring and managing of risks. Overall, only 20% of GPs said they do not require portfolio companies to measure and report, with 44% saying that they do, and another 34% indicating that just some of their investment teams do so. In another odd inversion, 25% of European GPs said they do not require this of their portfolio companies, while 16% of North American GPs do not. With so many places where sustainability-oriented thinking can enter the investment process, there are plenty of areas of a GP’s practices for allocators and their advisors to ask about in their diligence process, as an affirmative answer to one practice may not indicate that another has also been adopted.

The fact that there is so much nuance to the application of ESG is typically lacking in the popular press, which tends to portray ESG as one monolithic thing. Our respondents clearly show this is not the case.

In 2022, we added a question to attempt to tease out how our respondents place themselves among the different philosophies of ESG, framing the question in alignment to a piece we published in early 2022, ESG, Impact, and Greenwashing in PE and VC. We asked respondents to share how they prioritize investment opportunities already performing well across ESG issue areas (for example, creating a “clean” portfolio) versus opportunities that are performing more poorly, but where making ESG-related improvements will be a priority of the investment strategy. In our report, we made it clear that both approaches can be perfectly valid applications of an ESG framework, despite some industry participants hurling greenwashing accusations at proponents at the opposite end of the continuum.

Looking at the mean values of each of the respondent types, none went above 5, so there was a slight skew to “clean” portfolios, but none of the means went below 4, either, so the tilt was not strong. Non-VC GPs were weighted the most to clean portfolios, with a mean of 4.00, while the Both respondent type was closest to unskewed, at 4.92. North America tilted more to “needs improvement” portfolios, while Europeans were more likely to seek out clean investments. GPs tended to skew clean, while LPs were more open to a “needs improvement” application of ESG.

Interestingly, a decent number of respondents were found all along the spectrum, indicating that many different approaches are coexisting. In fact, very few think that only clean portfolios matter or that portfolios seeking to make improvements through ESG are the only proper application of ESG principles. The fact that there is so much nuance to the application of ESG is typically lacking in the popular press, which tends to portray ESG as one monolithic thing. Our respondents clearly show this is not the case.

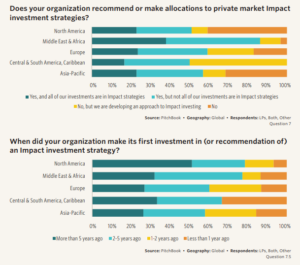

Contrasting views: Impact

Impact investing, which we explicitly defined at the beginning of the survey as investing with the dual goals of achieving financial returns and positive social or environmental results, seems to be remarkably popular across both allocators and fund managers. Of respondents managing investment products, 63% said they offered Impact strategies to external parties, with another 13% indicating that they are developing an Impact strategy. Among allocators, 56% have recommended or made allocations to Impact investment strategies, with another 13% developing an approach to doing so. Many may believe that Impact investing is a niche approach, but the numbers in this survey indicate that many are hoping to both make money and do some good with their investment assets.

Many investors are doing Impact investing, but how mature is the space? Asking only those who said they offer Impact investment strategies, 33% of fund managers have been doing so for more than five years, with another 31% that are two to five years into their Impact investment journey. This has implications for LPs looking for products with some sort of track record: Our data shows that emerging managers capture a larger proportion of Impact fundraising than in the broader private market ecosystem, largely because so few Impact managers launched their first fund more than five years ago. The allocator respondents have been at it for longer overall than the asset managers, with 41% of allocators having made their first allocation to or recommendation of an Impact strategy more than five years ago. 31% of allocators and their

advisors got into Impact investing two to five years ago. It appears that there are few new entrants to the space, meaning that those that are likely to do Impact have already started their journey. Only 13% of asset managers and allocators have plans to launch a strategy or allocate to one in the future.

When it comes to offering Impact strategies, North America has the lead on Europe. 62% of North American asset manager respondents offered Impact strategies either exclusively or as one type of offering among others from the fund manager. In fact, 45% offered Impact strategies exclusively. Of those running Impact funds, 43% got their start more than five years ago. In Europe, 33% of GP and Both respondents offered Impact strategies exclusively, with another 26% offering an Impact strategy as well as other non-impact offerings. Only 20% of these fund managers began more than five years ago, with the larger share, 35%, launching two to five years ago. In terms of pipeline, 20% of European respondents are developing an Impact strategy compared with only 7% from North America, so more Impact fund offerings will likely come online in the future, particularly from Europe.

In contrast to the fund managers offering Impact strategies, a smaller percentage of LPs have put all or some of their portfolio into Impact strategies. 51% of North American allocators or their advisors recommend or allocate to Impact strategies versus the 62% of North American fund managers offering such strategies. As Impact funds are on average much smaller than the overall fund universe offerings, more offerings may make sense in order to serve the demand of LPs for these strategies.5 North American allocators have also been at it longer: Of the respondents that said they have invested in or recommended Impact strategies, 51% said they first did so more than five years ago—a much higher percentage than the other regions. In Europe, the percentages of those respondents offering Impact strategies and those allocating

to or recommending them were the same, at 59%. European allocators have been at it for less time than those in North America, with only 27% of Europeans having allocated to their first Impact strategy more than five years ago.

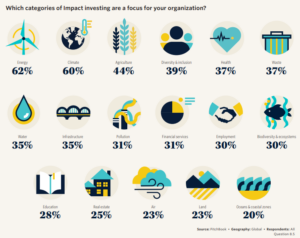

Tying the survey questions in with work PitchBook has been doing to tag Impact funds with the GIIN’s IRIS+ categories of Impact that they are seeking to affect, we asked respondents to indicate which of the 17 categories of Impact were important to them and allowed respondents to select more than one area of focus, if applicable. The top picks across all types of respondents were energy (62%) and climate (60%), both areas with a fair number of funds available for investment as well as significant investment opportunities that can absorb large sums of capital. All other areas were selected by at least 15% fewer respondents, with the third-place area of Impact being agriculture, chosen by 44% of respondents. Some of the more esoteric areas of Impact investing, such as air, land, and oceans & coastal zones, were selected least frequently by respondents. Real estate was another category selected by few respondents, only 25%, which seems surprising, given that green buildings and affordable quality housing are both themes within that category requiring significant capital. It is possible that respondents are not intimately familiar with the IRIS+ framework and didn’t realize that certain activities counted within various categories of the framework, or that we did not attract many real estate investors to this survey.

By respondent type, the top three selections were identical—agriculture, climate, and energy—though with different weightings and orders. In addition, the respondents in the Both type called out financial services as much as they did agriculture, and the Other respondents had diversity & inclusion tied for third. Looking more closely at the GPs, VCs selected waste as their third-highest area of interest in contrast with non-VCs, who chose agriculture. Asia Pacific may have heavily influenced the VC responses, as they, too, had waste as their third-most-selected Impact area.

Understandably, some regions have different concerns than the highly developed regions of North America and Europe. CSAC had a list least like the other respondents: They had agriculture in first place, followed by financial services and education. The Middle East & Africa respondents did call out agriculture and energy, but their top choice was health. While we cannot ascribe motivations to these responses, there is probably a mix of rationale ranging from the perceived social and environmental problems that need to be addressed and the categories that may provide the potential for profits based on their financial merits.

Slightly more than half of LPs would prefer that their managers measure Impact.

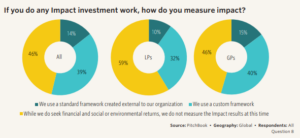

One of our research pieces in 2022 identified two philosophies of Impact that practitioners espouse: One feels that measuring outcomes is the only valid approach, while the other feels that being in the areas where Impact is happening is good enough. We asked one question this year to try to tease out where our respondents were on this continuum. Reflecting the difficulty of measuring outcomes, particularly given our strong response rate from VCs, 46% of all respondents who indicated that they do Impact investing said that while they do seek financial and social or environmental returns, they do not measure the Impact results at this time. 59% of LP respondents were in this camp, with 46% of GPs not measuring their Impact efforts. Being one step removed from portfolio companies, LPs are often at the mercy of what the GPs will report to them. While they can try to mandate that their GPs align in their reporting, every GP is getting similar requests from its other LPs to align with other frameworks. Thus, it is unsurprising that less than half of LPs investing in Impact are measuring that impact, as it can be a daunting task for them.

of what the GPs will report to them. While they can try to mandate that their GPs align in their reporting, every GP is getting similar requests from its other LPs to align with other frameworks. Thus, it is unsurprising that less than half of LPs investing in Impact are measuring that impact, as it can be a daunting task for them.

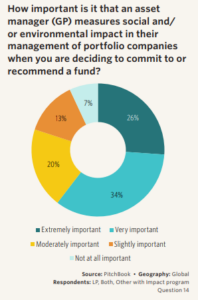

We were able to examine the extent to which GPs are aligned with what Impact investors wish of them by asking allocators and their advisors: When it comes to deciding whether to commit to or recommend a fund, how important is it that asset managers measure social and/or environmental impact when managing portfolio companies? 20% of LPs who have an Impact investing program said this was only slightly or not at all important, so if 46% of GPs with Impact strategies are not measuring the impact of their investments, there appears to be a camp of LPs who will find that approach acceptable. That said, slightly more than half of LPs would prefer that their managers measure impact. 26% said that this was extremely important, while the most common answer, at 34%, was that this was very important.

Download the complete report here.

Endnotes

1For explanations and resources for the abbreviations and organizations mentioned in this report, we provided brown-tinted links to a glossary for reference.(go back)

2https://www.reuters.com/business/environment/blackrocks-fink-says-hes-stopped-using-weaponised-term-esg-2023-06-26/(go back)

3Respondents were allowed to select either of the yes options or both, so the percentages will exceed 100 for question 9.5.(go back)

Print

Print