Alyssa Stankiewicz is an Associate Director of Sustainability Research and Lindsey Stewart is a Director of Investment Stewardship at Morningstar, Inc. This post is based on their Morningstar memorandum. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; Companies Should Maximize Shareholder Welfare Not Market Value (discussed on the Forum here) by Oliver D. Hart and Luigi Zingales; Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee (discussed on the Forum here) by Robert H. Sitkoff and Max M. Schanzenbach; and Exit vs. Voice (discussed on the Forum here) by Eleonora Broccardo, Oliver Hart and Luigi Zingales.

Strive Asset Management and Engine No. 1 are firms on opposite ends of the environmental, social, and governance spectrum that have attracted more attention than assets. Both firms offer index-tracking funds that focus on voting decisions to allow fund investors to express their preferences on governance and sustainability matters. Now that both have voting records sizable enough to bear examination, this is a good opportunity to look at the signals the two firms’ voting decisions are sending.

Both Engine No. 1 and Strive are in the middle of strategic changes. Engine No. 1 sold its ETF business to TCW and announced its renewed focus on private investments; Strive announced it would reduce its “anti-woke rhetoric” in light of its message being misunderstood by investors. All the same, the firms’ proxy voting records shine a light on the importance of manager due diligence, even when selecting an otherwise plain-vanilla index fund.

Two Activists Against Industry Titans

For resolutions filed at S&P 100 companies in the 2023 proxy year (that is, the 12 months to June 30), we analyzed how Strive and Engine No. 1 voted on:

- Shareholder proposals addressing ESG themes,

- Resolutions put forward by anti-ESG proponents, and

- Resolutions to elect (or re-elect) CEOs to the board.

We compared Strive and Engine No. 1′s decisions with those of the Big Three index managers (Vanguard, BlackRock, and State Street) for context.

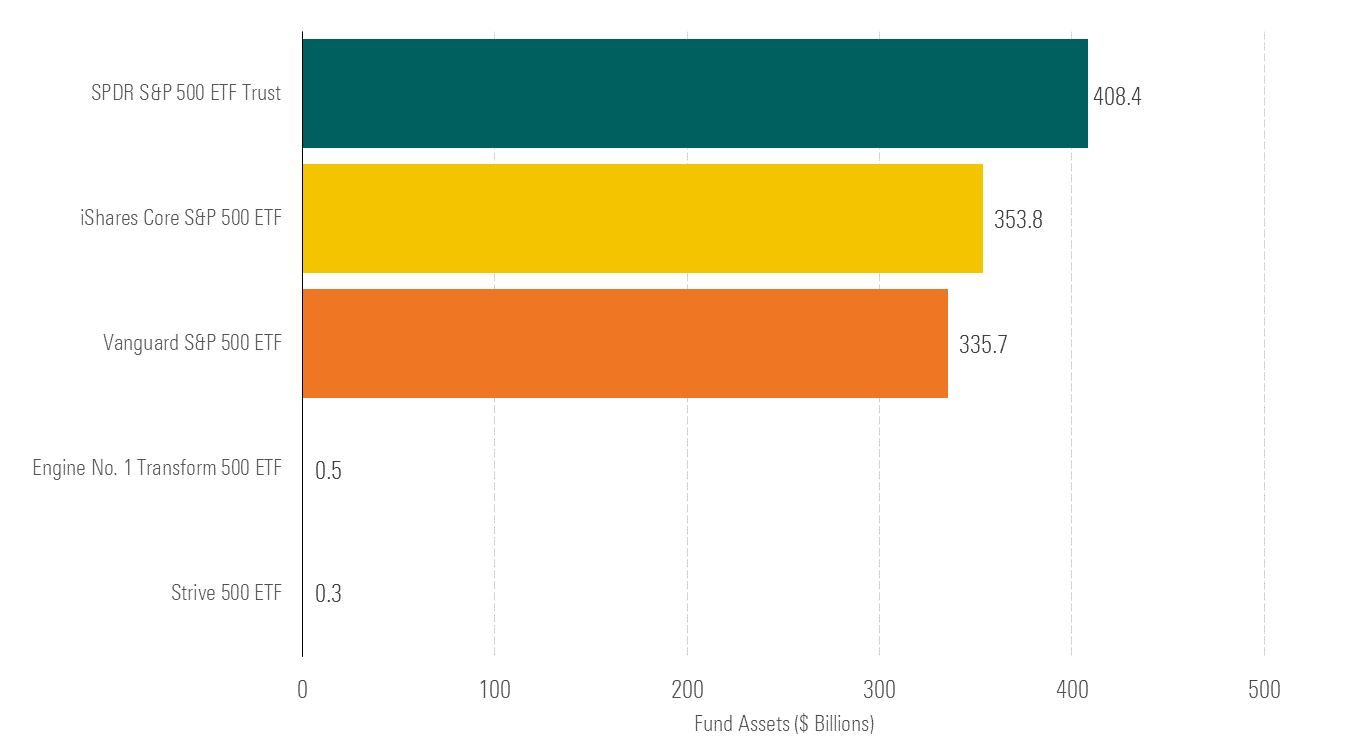

Both Engine No. 1 and Strive offer exchange-traded funds that track broad market indexes. These funds don’t apply any ESG criteria—for or against—in their portfolio construction; rather, they advocate for investor values through proxy voting and engagement. Both firms have also made big names for themselves despite relatively small asset bases: As of August 2023, Engine No. 1′s three funds claimed $681 million, and Strive’s nine equity funds totaled $921 million. The exhibit below shows assets in each firm’s largest U.S. equity index-tracking fund for comparison.

Assets in S&P 500 Tracker ETFs

With just over $500 million in assets, Engine No. 1 Transform 500 ETF VOTE seeks to use voting decisions to “strategically hold companies and leadership teams accountable while focusing on sustainability issues that create value,” while “actively [working] with companies to strengthen the investments they make in stakeholders to drive company performance.”

The Strive 500 ETF STRV, launched only in September 2022, has $268 million in assets and takes the opposite view of Engine No. 1 when it comes to voting. The firm’s ethos is to “always prioritize the shareholder over other stakeholders” by rejecting what they perceive is a tendency for large asset managers to “[incorporate] non-pecuniary factors under the guise of considering environmental, social, and governance risk factors.”

Of course, those large asset managers assert that they have always prioritized shareholder value and continue to do so. And they certainly are large. As shown in the exhibit, the Big Three’s U.S. equity market tracker ETFs—BlackRock’s iShares Core S&P 500 ETF IVV, State Street’s SPDR S&P 500 ETF Trust SPY, and the Vanguard S&P 500 ETF VOO—are around 1000 times the size of those from the two activist firms, with $300 billion-$400 billion in assets each.

So how did each firm vote?

Engine No. 1 Showed Near-Total Support for Pro-ESG Proposals

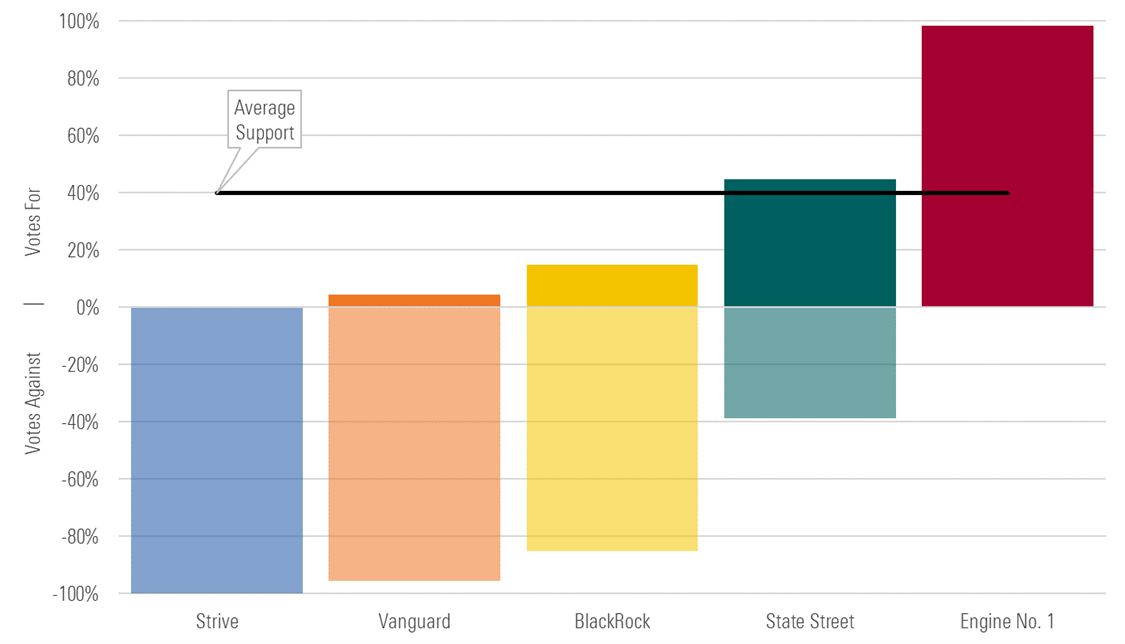

There were 222 pro-environmental and social shareholder proposals that went to a vote at S&P 100 companies during the 2023 proxy year. Just 67 of those resolutions received more than 30% support from independent shareholders. Calculating support from independent shareholders excludes votes cast by company insiders who are unlikely to support shareholder resolutions, such as founders, directors and executives, and strategic investors. We also call this adjusted support.

Average adjusted support for the 67 resolutions stood at 40%. Engine No. 1 supported all but one of these resolutions, abstaining on one proposal directed at abortion-related privacy measures at Meta Platforms META. Unsurprisingly, Strive voted against 100% of the pro-ESG resolutions on which it voted.

Support for Environmental and Social Shareholder Resolutions

Support from the Big Three ranged from 4.5% from Vanguard at the low end, to 45% from State Street at the high end. In the case of both Vanguard and BlackRock, these levels of support represent notable drops from past years. Both firms insist that the resolutions coming to vote in 2023 were of lower quality compared with previous years. On the other hand, State Street’s support for key ESG resolutions in 2023 is roughly in line with recent years.

In the proxy year ended June 2023, the best-supported ESG resolution (with 66% adjusted support) came from the New York State Common Retirement Fund, which requested a report describing Tesla’s TSLA efforts to prevent harassment and discrimination against protected classes of employees. This proposal followed a federal court’s ruling against Tesla based on a culture of racism. BlackRock, State Street, and Engine No. 1 voted for this proposal; Strive and Vanguard voted against.

Strive Asset Management’s Anti-ESG Stance Shone Through

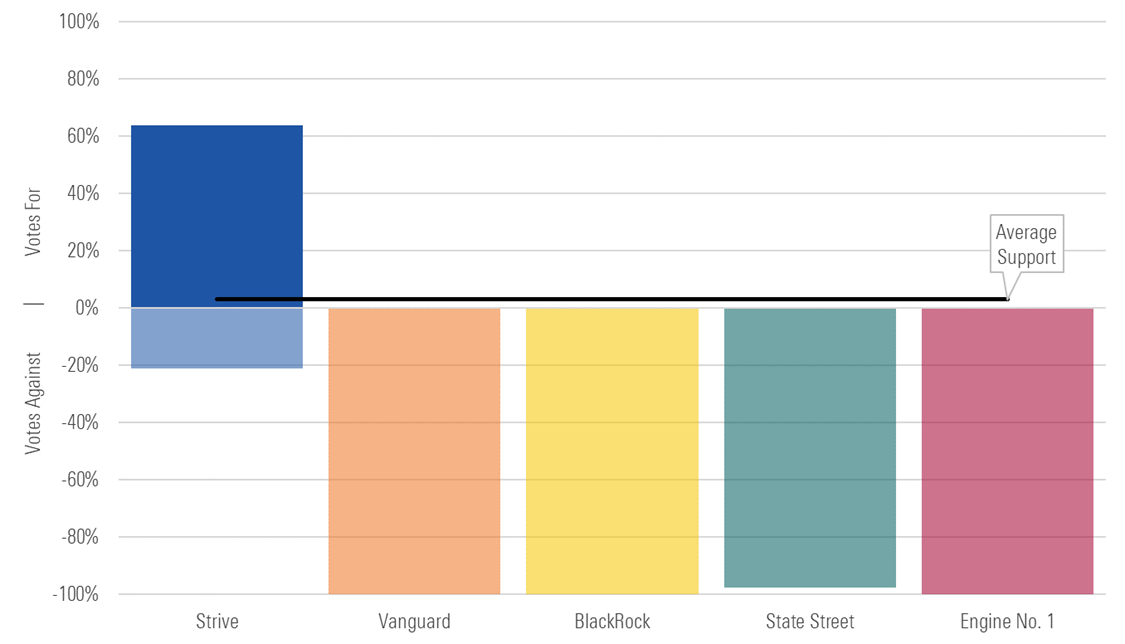

Shareholder resolutions by anti-ESG proponents have ramped up in recent years. Forty-seven such resolutions addressing environmental and social themes went to a vote at S&P 100 companies in 2023. Support for these resolutions remained quite low, averaging just 3% adjusted.

As expected, Engine No. 1, Vanguard, and BlackRock voted against all 47 of these resolutions. Strive, on the other hand, supported 30 of these proposals (64%), voted against 10 (21%), and abstained on seven (15%).

Support for Shareholder Resolutions by Anti-ESG Proponents

The best-supported resolution in this category was filed at Ford Motor Company F by the National Center for Public Policy Research. With 16% adjusted support, the proposal requested an audit of child labor risks in Ford’s electric vehicle supply chain. To clarify, many so-called anti-ESG shareholder proposals use various tactics to get on the ballot, many of which resemble pro-ESG proposals. However, they are usually submitted by groups that oppose the work of sustainability-minded investors. You can read more about it here. State Street abstained on this resolution and did not provide a rationale. Both Engine No. 1 and Strive voted against this proposal. According to Strive, “Ford was already addressing the outlined issues.”

Strive Voted to Oust CEOs From More Than Half of the Largest Companies

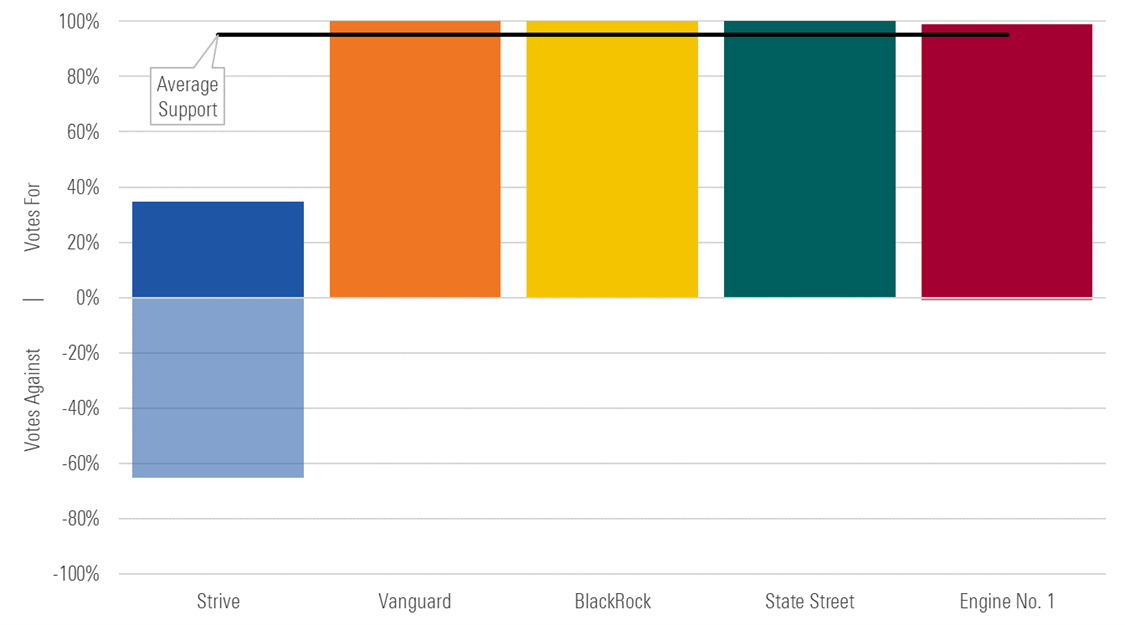

Strive broke away from the crowd when it came to backing the CEOs of S&P 100 companies. Typically, investors support CEOs. In the 2023 proxy season, 94 CEOs were up for election or reelection at the largest companies. These proposals received more than 95% adjusted support on average. As expected, the Big Three voted in support of all S&P 100 CEOs up for reelection.

However, Strive withheld support from 60 of the 92 such proposals it voted on, backing only 32.

Support for CEO Elections at S&P 100 Companies

Voting against the CEOs would likely prompt a board to consider a change in leadership; it would also be an unconventional and somewhat unprecedented approach to address dissatisfaction with company management.

Engine No. 1 only voted against one CEO: Michael Sievert at T-Mobile TMUS. Sievert was the second-worst supported CEO on the list, only trailed by Safra Catz at Oracle ORCL. Here, Engine No. 1 and Strive agreed: Both voted in support of Catz.

By and large, the activists voted as one would expect given their stated objectives. Investors looking to support pro-environmental and social initiatives would likely be satisfied with Engine No. 1′s voting decisions; likewise, investors seeking an anti-ESG voting strategy might find a fit with Strive. On the other hand, the Big Three matched up on anti-ESG proposals and CEO reelections, but broke ranks when it came to pro-ESG resolutions. For investors wishing to take a stance on environmental and social issues, these results underscore the importance of manager due diligence when choosing between otherwise similar index-tracking funds.

Print

Print