Ron Kaniel is the Jay S. and Jeanne P. Benet Professor of Finance at the University of Rochester Simon Business School. This post is based on an article forthcoming in Journal of Financial Economics by Professor Kaniel, Zihan Lin, Markus Pelger, and Stijn Van Nieuwerburgh. Related research from the Program on Corporate Governance includes The Agency Problems of Institutional Investors (discussed on the Forum here) by Lucian Bebchuk, Alma Cohen, Scott Hirst; Index Funds and the Future of Corporate Governance: Theory, Evidence and Policy (discussed on the Forum here) and The Specter of the Giant Three (discussed on the Forum here) both by Lucian Bebchuk and Scott Hirst.

A central challenge in mutual fund research has been to discern whether fund managers have skill and, if so, whether it is persistent. Prior research has made limited progress in answering these questions. We revisit the issue using modern machine learning tools to predict mutual fund performance.

Utilizing a neural network model, we estimate relations among a large set of fund attributes to identify the US mutual funds with the best performance. We use the model’s predictions to form the best-performing decile of funds each month and to compute portfolio weights within the top decile. Not only is the model able to identify skilled funds, but it also is able to predict outperformance that lasts for more than three years. Since we are predicting one-month ahead returns, as opposed to longer-horizon returns, this puts a lower bound on the persistence in outperformance.

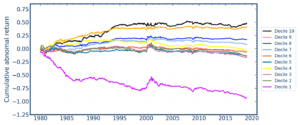

Focusing on the universe of actively-traded US equity funds between 1980 and 2019, and investing according to the model’s predictions, generates a cumulative abnormal return of 72 percent for the top decile of funds over the 40-year period. The decile of mutual funds predicted to exhibit the worst returns each month produces a cumulative abnormal return of −119 percent over the same period. The difference between the returns in the best and the worst deciles, 191 percent cumulatively or about 40 basis points per month, is both economically large and statistically significant.

Apart from using machine learning, which facilitates uncovering complex non-linear relationships, an important departure from prior literature is that our study predicts abnormal returns rather than raw returns. Abnormal returns are those earned in excess of what an investor would expect given a fund’s level of risk. Such returns are estimated by subtracting the monthly Treasury-bill yield from a fund’s monthly performance before fees, as well as the estimated compensation for systematic risk factor exposure. About twenty percent of funds in the sample generate positive abnormal returns after fees. The gains from avoiding the worst-performing funds are very large.

Our analysis considers a large set of both fund characteristics and characteristics of the stocks a fund holds to predict abnormal returns. We find that little can be learned about a fund’s performance from the characteristics of the stocks it holds. Instead, the predictability we identify stems from fund characteristics. From the many fund characteristics that we study, two stand out in having a significant role in the return prediction: fund momentum and fund flow. A fund’s momentum is its mean abnormal return in the preceding 12 months, excluding the most recent month. Importantly, this is distinct from the momentum of the stocks the fund holds. Flow is the change in the fund’s total net assets over the past month.

The neural net also uncovers substantial non-linear interaction effects between investor sentiment and both fund flow and fund momentum. Periods of above-average investor sentiment drive the strong association between fund momentum, flow, and the next month’s abnormal performance. Abnormal returns are nearly identical when the many fund characteristics (and their combinations) in the model were pared down to these three attributes.

When combined with fund characteristics, the state of the macroeconomy, proxied by the Chicago Fed National Activity Index (CFNAI), predicts the best and worst performers as well as sentiment does. Though models that use sentiment and the CFNAI put 78 percent of the same funds in the bottom decile and 74 percent of the same funds in the top decile, the model with sentiment does a better job of predicting funds’ actual abnormal return levels. Investor sentiment is also better at predicting the relative returns within the top and bottom deciles. Prediction-weighted portfolios created from the top decile of funds earn a cumulative abnormal return of 72 percent. Investing in equally-weighted portfolios returned just 48 percent.

Taking a step back, these results are consistent with investors successfully detecting skilled mutual fund managers and reallocating their investment dollars towards them. They are also consistent with funds and fund families successfully using marketing to attract investors. Fund inflows create buying pressure for the stocks these funds hold, raising their prices and lifting fund returns. That demand pressure increases prices further, generating momentum in fund returns. The fact that flows and fund momentum have a much stronger association with fund performance in high-sentiment periods lends further credence to the marketing-driven flows channel. We find that changes in flows are gradual and small enough, allowing for several months out outperformance before the fund runs into zero marginal abnormal returns. Skill, therefore, leaves a trail in the form of fund return momentum, and investors can exploit this to earn higher returns.

This figure shows the cumulative abnormal returns of prediction sorted decile portfolios.

Print

Print