Jason Frankl and Brian G. Kushner are Senior Managing Directors at FTI Consulting. This post is based on their FTI Consulting memorandum. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism (discussed on the Forum here) by Lucian A. Bebchuk, Alon Brav, and Wei Jiang; Dancing with Activists (discussed on the Forum here) by Lucian A. Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch; and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System (discussed on the Forum here) by Leo E. Strine, Jr.

Introduction

As 2023 ends, we note that it has been a mixed year for activism and M&A activity. There has been an uptick in the number of campaigns year-to-date despite a rather challenging backdrop for M&A more broadly, as interest rates climbed to levels not seen since early 2001.[1] Interest rate-sensitive sectors experienced heightened attention from activist investors. Somewhat surprisingly, director turnover from shareholder activism has been less than anticipated.[2] In this edition of FTI Consulting’s Activism Vulnerability Report, we discuss these developments, as well as other notable trends in the world of shareholder activism.

Key Highlights

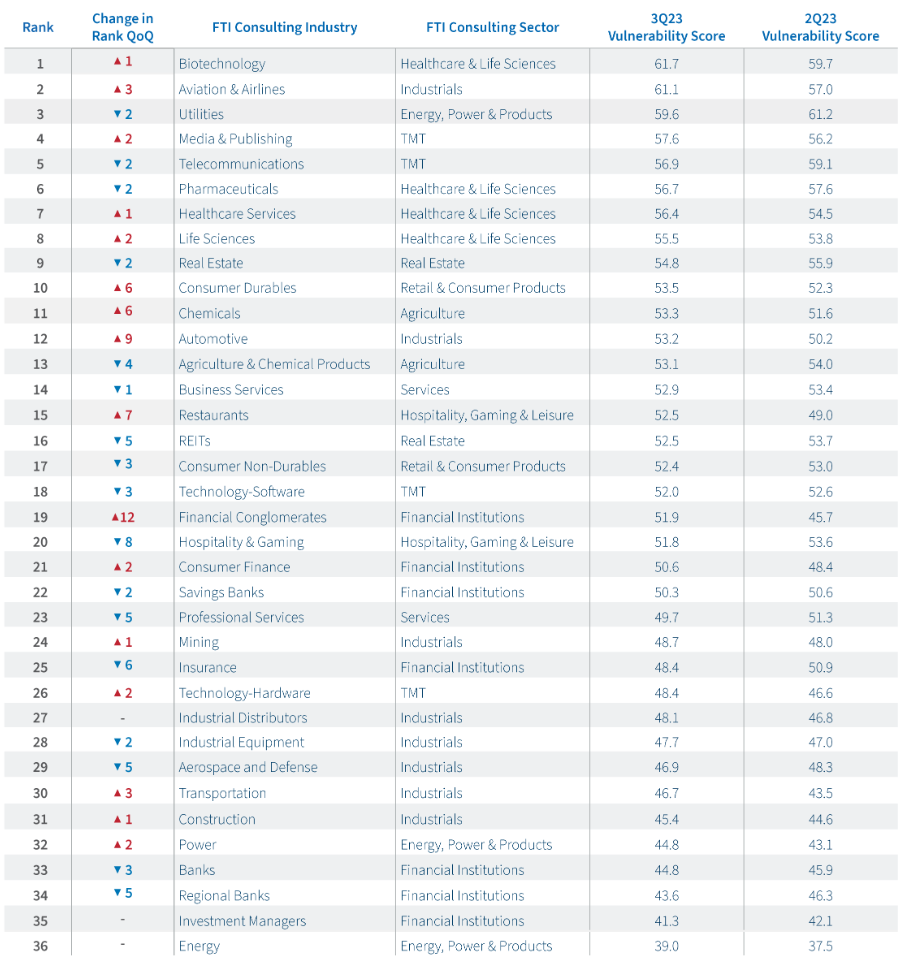

- Biotechnology claimed the top spot for vulnerability to activism, followed by Aviation & Airlines and Utilities, while the Financial Conglomerates, Automotive and Restaurants industries all jumped more than seven spots in the rankings.

- While the Universal Proxy Card (“UPC”) may have lowered the bar to launch a campaign, it did not influence outcomes when measured by changes to board seats.

- Small cap companies garnered significantly more interest in the back half of the year, rivaling levels not seen since 4Q20.[3]

- Some activists have been leaning into their high conviction investments.

Market Update: The Capital Markets Rollercoaster

Heading into 3Q23, the optimism that had picked up steam in the second quarter continued to gain momentum. However, as market participants started to digest the indications that the Fed will likely not be cutting rates until 2024, much of that optimism seemed to dissipate.[4] This may appear confusing when GDP grew at a reportedly healthy clip of 5.2%, the highest growth the U.S. economy reported in nearly two years, and consumer spending accelerated and inflation continued to decelerate with an October reading of 3.2%.[5][6] Nevertheless, as the Fed had made it clear that its mission is to “restore price stability,” this would likely mean that rates will stay high for some period longer.[7] Markets began to come to grips with this economic reality, as evidenced by elevated yields.[8] Equity market participants turned pessimistic during 3Q23, as the S&P 500 finished in the red, down 3.8%, the Dow lost 2.7%, and the tech-heavy Nasdaq finished down 4.3%.[9] Notably, the indices are up YTD, with the S&P 500 in the green 18.6%, the Dow gaining 6.8%, and the Nasdaq up 36.5%.[10]

Since the close of the third quarter, there has been a slight reversal in sentiment. October saw a peak in treasury yields as the 10-year broke 5% for the first time since 2007.[11] Following the Fed’s meeting on November 1st, in which they decided to keep the federal funds target rate steady at 5.25%-5.50%, treasury yields continually decreased.[12][13] As of this writing, the 10-year yield currently sits at 4.3%.[14] Yields continue to drop following a better than expected CPI report for October.[15] Additionally, equity markets seem to have reversed course and are catching a second wind.[16]

Year-to-Date Performance (2023)[17]

Global M&A continued to decline in 3Q23 on a year-over-year basis, as the number of transactions decreased to 8,775, compared to 10,612 in 2Q23.[18] Total deal value fell from $582.1 billion in 2Q23 to $498.6 billion in 3Q23, down 14% quarter-over-quarter, and down almost 12% from $565.5 billion in 3Q22. Increased cost of debt, coupled with greater risk aversion, likely influenced reduced M&A activity. Furthermore, a perceived gap in valuation multiples seems to have played a role in lower transaction volumes.[19]

Looking ahead, we believe that M&A activity will remain softer over the next two or three quarters, with potential for an upswing in 2H24. Rates are expected to ease by 100 basis points by December 2024, per the CME FedWatch Tool, which measures implied rate expectations by the debt markets, with the key caveat being underlying economic conditions.

While the U.S. economy has been resilient, there is an ongoing debate in the financial community about the prospects of a soft landing. Should the economy experience a sharper slow-down than expected, it is possible that rates could decline even more, but consumer and business confidence would likely deteriorate, putting further downward pressure on M&A. Suffice it to say that underlying uncertainty in the economy will hamper growth investments, including inorganic opportunities.

Activism: A Mixed Bag of Results

Activists gained 95 board seats at U.S. companies in 1H23, below their median gain of 132 board seats in the first half of each year from 2017 through 2022.[20][[21] This is somewhat surprising, given that stock market weakness in 2022 provided activists with more targets and the introduction of the UPC improved activists’ chances of seizing board seats.

Board Seats Gained in First Half of the Year[22][23]

Aside from more prominent activism industry metrics, some interesting downward movement appeared in sector data as well:

- 3Q23 experienced notable decreases in activity among sectors that were popular targets in the first half of the year and in 3Q22, such as Industrials, Healthcare & Life Sciences and Retail & Consumer Products. This trend has continued so far in 4Q23.

- Activists targeting Industrials and Retail & Consumer Products sectors focused their efforts on large-cap companies in 1H23, launching 13 and 11 large-cap campaigns in each sector, respectively.

- Of the three sectors, Retail & Consumer Products is the only sector to witness an activist campaign against a large-cap company in the back half of the year.

Activist Targets by Sector – Year-to-Date Through 3Q23[24]

In 2023, activists have been focused on the Technology, Media & Telecommunications (“TMT”) and Financial Institutions sectors. TMT experienced a quiet first half of 2023 relative to the same period last year, although still busy relative to other sectors and second only to Financial Institutions. TMT has gained steam in the back half of the year as campaign totals jumped 120% in 3Q23 year-over-year, while 11 campaigns have already been initiated through November 19th. Many of these campaigns have seen activists push for a sale of the target, such as Donerail Group with Stratasys, Legion Partners with OneSpan, Stonehouse Capital with D-BOX Technologies and Chain of Lakes Investment Fund with PCTEL. Chain of Lakes succeeded, as PCTEL recently inked a deal with Amphenol, but it will be interesting to monitor how the other campaigns fare considering the tepid state of M&A markets that shows few signs of near-term improvement.

Turning to the Financial Institutions sector, the fallout from the regional banking crisis earlier this year has provided opportunities, or strengthened negotiating positions, in existing investments for activists. The sector was targeted nine times in 3Q23, and 16 campaigns have been launched so far in 4Q23, building upon the 53 campaigns in 1H23. The rapid rise in the federal funds rate exposed weakness at many regional banks and shined a spotlight on the sector, enabling activists to more easily identify targets. One such example was the campaign involving Republic First Bancorp, resulting in the appointment of Philip Norcross as chairman and the appointment of Gregory Braca and two new independent directors, in exchange for a $35 million capital infusion. Republic First has struggled since early 2022 and continued to struggle in the wake of this year’s crisis, ultimately cutting jobs and exiting its mortgage origination business. These circumstances, paired with the firm’s weak balance sheet, opened the door to the activists it had been fending off for over a year and a half. Other institutions, such as AmeriServ Financial and Carver Bancorp, continue to face activist pressure.

Taking a high-level view of the industry, an interesting reversal on a multi-year trend has emerged in 2H23, as some activists have shifted their focus to small-, micro- and nano-cap companies more robustly than they have in years past. The typical trend is a shift from large-cap campaigns to smaller-cap in the back half of the year as proxy season ends. This year, the trend has been amplified, as smaller-cap campaigns comprised a larger percentage of total campaigns in 3Q23 and early 4Q23 relative to years past. For context, smaller-cap campaigns as a percentage of total campaigns in the second half of the year declined from 2019 to 2022, but the downtrend has dramatically reversed in 2023. The percentage of smaller-cap campaigns jumped to 83% in 3Q23 (2019-2022 Q3 average of 68%) and is currently at 65% for 4Q23 (2019-2022 Q4 average of 57%).

Activist Targets by Market Cap – Percentage of Total Campaigns[25]

Note: 4Q23 data as of November 19, 2023

Interestingly, the data also suggests that activists are finding more success by targeting smaller-cap firms relative to mid- and large-cap firms this year, particularly in 1H23. The results are somewhat cloudy for the back half of the year as many campaigns are ongoing. However, in the first half of the year, 81% of large-cap campaigns resulted in the failure of the activist’s objectives. This trend reversal and increasing success in the smaller-cap space could be a result of many different factors, including the ability of activists to buy a larger stake in a smaller company, the costs associated with a lengthy proxy contest for issuers, perceptions of a near-term recession for both sides. But could it be that a large portion of the shift is a result of the UPC? The new rules certainly seem more burdensome for smaller companies as it becomes more costly to defend each and every incumbent director up for election. Perhaps it is not surprising that we are seeing activists win more often in this segment of the market than in the large-cap segment, where companies have much more capital to fend off any advances.

One hypothesis for the shift toward smaller-cap targets is that higher interest rates inhibit the ability of smaller funds to use leverage while executing a campaign. As a result, the ability of such funds to build meaningful positions in larger companies is limited unless they are willing to take on a much higher level of risk. With rates as high as they are, one advantage of larger activist funds is their ability to hold an equity stake for a longer period of time, despite market volatility.[26] Smaller funds may find it difficult to hold a leveraged position in a large company experiencing a downturn. Therefore, investments in smaller firms are more attractive because an influential stake is attainable with less capital.

A notable third quarter trend that exemplifies the advantage of larger funds are the double dippers. Large activist funds, instead of cutting losses on underperforming investments and finding new opportunities to allocate capital, double down and renew their previous campaigns. For example:

- Starboard Value nominated four directors at LivePerson, a conversational artificial intelligence company, in February 2022, resulting in a settlement for one board seat in July 2022.[27] Then, in May 2023, Starboard nominated three directors at LivePerson with the goal of replacing the majority of the company’s incumbent directors.[28][29]

- Legion Partners reached a settlement with OneSpan in May 2021, gaining two board seats.[30] At the end of May 2021, when the pair first reached a settlement, the stock was just above $26.00 per share.[31] Fast-forward about two years to August 2023, Legion Partners launched a new campaign calling for the company to implement a plan to boost profits and shareholder returns or pursue a sale.

- In January 2023, Nelson Peltz, CEO of Trian Fund Management, initiated a proxy fight to place himself onto the Board of the Walt Disney Company, citing the declining share price and what he viewed as misaligned executive compensation.[32] A month later, Peltz ended his campaign on CNBC no less, in response to a plan unveiled by Disney to reorganize the Board and implement a $5.5 billion cost-cutting plan.[33] By early October, after Disney shares dropped nearly 30% from February highs, Peltz announced a fresh campaign for board seats. Over the same time period, Trian built its stake from 6.4 million shares approximately 32.9 million shares, valued recently at $3.01 billion.[34][35][36]

Screener Results and Relevant Campaigns

The third quarter results of our Activism Vulnerability Screener returned to the historical trend of relative stability following the exceptionally volatile rankings of the second quarter of this year. In 3Q23, only one industry moved more than 10 spots within the rankings (Financial Conglomerates jumped 12 spots), while in 2Q23 six different industries shifted 10 or more places in rank. The top 10 industries most vulnerable to activism also remained relatively stable with just one industry exiting and one entering – Agriculture & Chemical Products and Consumer Durables, respectively. This suggests that these select industries are continuing to struggle on multiple fronts and have experienced minimal improvements in the areas scored from our screener. Continued weak balance sheets, little-to-no change in investor sentiment and a trend of poor operational results has perpetuated “more of the same” for these industries.

Within the top 10, Biotech has claimed the most vulnerable position this quarter after seeing increases in Operating Performance and Total Shareholder Returns (“TSR”) scores. Notably, the Biotech industry is no stranger to the top three positions, occupying one of these spots every quarter since 4Q22. Poor TSR and lackluster operating results amongst constituents have caused the industry to remain perpetually vulnerable. For context, the S&P Biotech XBI Index has fallen 13.0% year to date while the S&P 500 is up 18.6%, representing a 31.6% delta.[37] Post-pandemic cash flow normalization, higher rates leading to more expensive financing and increased regulatory pressure have taken a toll on the industry.[38] Notably, even one of the industry’s largest constituents, Moderna, has faced a tough 2023, with decreasing revenue and margin compression resulting in the last twelve months (“LTM”) loss per share of $9.34, a far cry from its September 2022 LTM earnings per share of $27.65.[39]

The Automotive industry rose nine spots to 12th in the vulnerability rankings for 3Q23. In the Automotive industry, the United Automobiles Workers Union went on a six-week strike from mid-September to the end of October to renegotiate employee contracts, causing production disruption at Ford, General Motors and Stellantis. On November 16, 2023, the union approved a four-and-a-half-year contract with the three manufacturers, providing much needed relief for the industry’s major players.[40] Looking at a broader trend, electric vehicle inventory is piling up. Ford, General Motors and Volkswagen delayed investments in electric vehicles as Americans’ enthusiasm cools due to a combination of interest rates, high prices and a lack of vehicle charging infrastructure.[41]

Other industries tailored to consumer needs also increased in vulnerability as Restaurants and Consumer Durables moved up seven and six spots, respectively, in the vulnerability rankings. Highlighting one activist campaign in 3Q23, Starboard Value built a 9.6% stake in Bloomin’ Brands, best known for operating Outback Steakhouse. The activist, with prior successful experience at multiple restaurant groups, including Papa Johns and Darden Restaurants, plans to create value by facilitating operational execution.[42][43]

At the other end of the rankings, the Energy industry has once again remained the least vulnerable. Stellar TSR and favorable Operating Performance scores have been the main drivers for the industry’s low vulnerability ranking. A bit further up the list but still in the back half, Financial Conglomerates climbed up 12 positions to become the 19th most vulnerable industry. The move was the largest jump of any industry this quarter and the result of an increase in three of the four score categories, with the major changes stemming from Balance Sheet and TSR score increases.

Regulatory Changes

On October 10, 2023, the SEC adopted regulatory changes regarding beneficial ownership reporting in Form 13D and Form 13G filings. Starting on February 5, 2024, investors must disclose a 5% stake in a company within five business days, a reduction from the 10-day period.[44] SEC Chairman Gary Gensler rationalized this change based on a view of the accelerated pace of today’s financial markets, which warrants truncating the ten-day period. The ten-day reporting period was last amended in 1977.[45] Among the amendment guidelines, the SEC clarified disclosure requirements of interests in all derivative securities, including cash-settled derivative securities, that use a covered class as a reference security.[46]

On October 4, 2023, the U.S. Department of Justice (“DOJ”) announced a Mergers & Acquisitions Safe Harbor Policy that encourages effective compliance programs and voluntary self-disclosure.[47] The DOJ’s policy allows an acquiring company six months on either side of a deal’s closing date to disclose criminal conduct at the target. If the acquiror cooperates with the DOJ and corrects the underlying issues within a year of closing, it can presume that it will not be prosecuted.[48] This policy allows more ability for acquirors to address issues discovered during an M&A deal. The time frame allowed by the DOJ intentionally pressures the acquiror to practice thorough due diligence on an expedited timeline.[49] Deputy Attorney General Monaco emphasized the importance of compliance in M&A when considering national security concerns.[50]

Shareholders Looking to Unlock Value in Japan

FTI Consulting’s September 2023 Activism Vulnerability Report noted an increase in shareholder activism in Japan. In November, Institutional Shareholder Services (“ISS”) disclosed that it would reinstate its return on equity (“ROE”) policy for Japanese companies, which was suspended in 2020 due to COVID.[51] Under this policy, ISS will recommend withholding votes on directors if the company has posted an average ROE of less than 5% over the last five fiscal years and had an ROE less than 5% in the most recent fiscal year. In a recent survey, 77% of investors who responded were in favor of reinstating this policy.

This means that:

- ISS clients who own shares in Japan apparently believe that Japanese companies have value to unlock and have asked ISS to add this point back to their rating system. This seems to reflect the broader market sentiment that Japanese companies can, and should, perform better.

- Reinstating this policy makes the opportunity for activists seeking a foothold in Japanese companies more attractive, since shareholders are clearly indicating they want to see improved capital allocation. This puts directors under increased pressure to deliver those results to shareholders or risk their seat on the board.

Activists should be able to use this policy change to their advantage. Many institutional investors defer to ISS recommendations or use its analysis as a starting point for their own voting considerations. This change in policy coincides with an uptick in foreign investment interest in Japan; international investors may have different governance and performance expectations and communicate those expectations to management and directors. Boards in Japan should take note of this policy change and actively prepare for increased international investor engagement, especially as activism continues become more mainstream in Japan.

— Val Mack, Senior Director, M&A and Activism, FTI Strategic Communications

The Hidden Effects of the UPC

The introduction of the UPC for U.S. companies in September 2022 led some advisors and experts to predict an increase in activist investor campaigns, as well as a higher likelihood that activists would win contests and gain more board seats.[52][53][54] Data for the 2023 proxy season in the U.S. indicate that neither of those occurred – at least yet. Looking at the top line numbers, this year’s proxy season initially appears similar to the last few seasons. For instance, 403 U.S.-based companies were publicly subjected to activist demands in the first half of 2023, according to Insightia.[55] That is similar to the number of U.S. companies targeted during the first half of any year between 2017 and 2022, which ranged from 362 to 448.[56]

U.S. Companies Publicly Subjected to Activist Demands – First Half of the Year[57]

However, a deeper look reveals several notable differences. In the past, activists winning board seats without support from both major proxy advisors, ISS and Glass Lewis, was extremely rare. This year was a different story.

Another change was a bit counterintuitive. The UPC lists all director candidates on both proxy cards, making it easier to compare activist and company board nominees head-to-head. As a result, it seems more likely than in the past that an activist could nominate someone perceived as a far better candidate than an incumbent director, and then persuade shareholders to elect its nominee on that basis alone, without making the strong case for change at the company which is typically required to win a contest. That could lead just one vulnerable director on a company’s board to incentivize an activist to run a campaign. One might have expected that this change would lead companies to be more proactive in refreshing their boards. However, the opposite has occurred in 2023, with fewer Russell 3000 companies adding fewer directors than in prior years.[58]

FTI Consulting Managing Director Kurt Moeller recently examined these trends in more detail in his article, “The Hidden Effects of Universal Proxy Cards.”[59]

Crafting the Playbook for the 2024 Proxy Season

The year may be winding down to a close, but stockholder activists are winding up for a new proxy season — building stakes and reaching out to companies now in anticipation of advance notice windows opening in January for most calendar fiscal year companies. Beginning in early 2024, the SEC’s revised, shortened deadlines for Schedule 13D and 13G beneficial ownership filings take effect (e.g., reporting must take place within five business days, instead of ten calendar days). As a result, activists must be even quicker off the mark. Prepared companies are staying informed about changes in their stockholder bases, identifying their activism defense teams and updating their “break glass” memos, so they are ready to respond at the first indication of activist activity.

While this may be the second proxy season with UPCs, we cannot assume that the first season provides a roadmap for the months to come. The 2023 proxy season did not see a tsunami of single-issue activists as some feared. However, it did bring earlier and more frequent settlements, as both shareholder activists and targeted issuers navigated the risks, tactics and logistics of a proxy fight with a universal card. Each fight brought new procedural issues to light, the result of which could be outcome determinative. For example, in a departure from practice in earlier UPC contests, we advocated for our client MindMed to retain broker discretionary authority for the routine auditor proposal for shareholders who did not receive proxy materials from the contesting shareholder. This permitted MindMed to establish quorum for its meeting and elect all six of its director nominees.

The SEC recently weighed in on the evolving landscape, issuing three new Compliance and Disclosure Interpretations in November addressing the treatment of overvoted, undervoted and unmarked but signed ballots, an issue which was the focus of Trian’s ultimately settled campaign at The Walt Disney Company in early 2023. We anticipate UPC logistics continuing to develop this season as procedures are further refined, emphasizing the importance of engaging seasoned advocates deeply familiar with the new UPC rules and associated technicalities.

— Christopher Drewry, Global Co-Chair Shareholder Activism & Takeover Defense Practice, Latham & Watkins

What This Means

Activist activity in 3Q23 and early 4Q23 was a bit of a mixed bag depending on which metrics and trends one follows. With regard to metrics, total campaigns are on track to set the post-pandemic record this year, but activist success as measured by board seats gained has been lackluster, despite the suspected advantage of UPC. With regard to trends, some activists are shifting aggressively to a smaller-cap focus in the back half of the year, but large activist funds have held fast and even double-dipped in certain campaigns against large corporations. These interesting and seemingly contradictory results within the activism arena have produced a relatively mundane start to the second half of the year in terms of campaign outcomes and overall change produced by activists, which aligns with the stability of our Activism Vulnerability Screener results. However, as those results suggest, there are opportunities for activists that are willing and able to brave the shaky markets and economic uncertainty facing all investors at this time. We are excited to witness what the remainder of the year has in store, as well as how the industry continues to adapt to new and proposed regulatory changes through 2024.

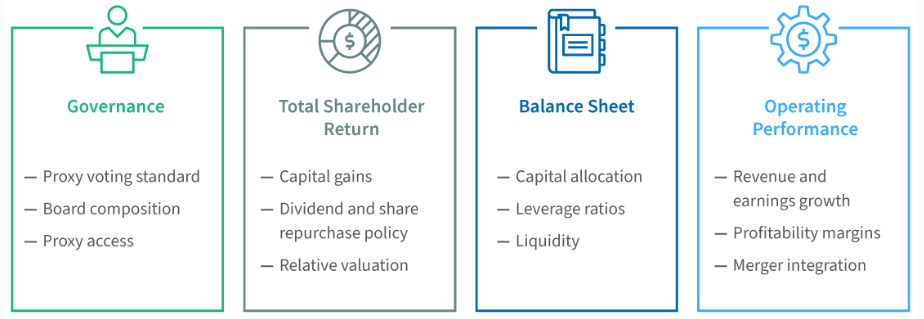

FTI Consulting’s Activism Vulnerability Screener Methodology

- The Activism Vulnerability Screener is a proprietary model that measures the vulnerability of public companies in the United States and Canada to shareholder activism by collecting criteria relevant to activist investors and benchmarking to sector peers.

- The criteria are sorted into four categories, scored on a scale of 0-25, (1) Governance, (2) Total Shareholder Return, (3) Balance Sheet and (4) Operating Performance, which are aggregated to a final Composite Vulnerability Score, scored on a scale of 0-100.By classifying the relevant attributes and performance metrics into broader categories, experts at FTI Consulting can quickly uncover where vulnerabilities are found, allowing for a more targeted response. FTI Consulting’s Activism and M&A Solutions team determined these criteria through research of historical activist campaigns in order to locate themes and characteristics frequently targeted by activist investors.

- The Activism and M&A Solutions team closely follows the latest trends and developments in the world of shareholder activism. Due to the constantly evolving activism landscape, the practice consistently reviews the criteria and their respective weightings to ensure the utmost accuracy and efficacy of the Activism Screener.

Endnotes

1Taylor Tepper, “Federal Funds Rate History 1990 to 2023,” Forbes Advisor, (Oct 17, 2023)(go back)

2“Shareholder Activism in H1 2023,” Diligent (July 2023)(go back)

3Market data provided by Diligent as of November 19, 2023(go back)

4Sarah Foster, “Survey: Fed Won’t Begin Cutting Interest Rates Until 2024 as Officials Keep Tackling Inflation,” Bankrate (Oct. 10, 2023)(go back)

5Lucia Mutikani, “US economy delivers blockbuster performance in third quarter,” Reuters (Oct. 26, 2023)(go back)

6Jeff Cox, “U.S. GDP grew at a 5.2% rate in the third quarter, even stronger than first indicated,” CNBC, (November 29, 2023)(go back)

7Sarah Foster, “Fed leaves interest rates unchanged, sees borrowing costs staying higher for longer,” Bankrate (Sept. 20, 2023)(go back)

8Tom Lauricella, Ivanna Hampton, “What Rising Bond Yields Mean for Investors,” Morningstar (Sept. 28, 2023)(go back)

9Market data provided by FactSet as of November 29, 2023.(go back)

10Market data provided by FactSet as of November 29, 2023.(go back)

11Garfield Reynolds, Ruth Carson, and James Hirai, “Treasury Bonds Market: 10-Year Yield Tops 5% for First Time Since 2007,” Bloomberg (Oct. 23, 2023)(go back)

12Darla Mercado, CFP, “Full recap: Fed leaves rates unchanged, Powell discusses December decision”, CNBC, (November 1, 2023)(go back)

13Karen Brettell, “10-year Treasury yields fall to 2-week lows after Fed stands pat on rates”, Reuters, (November 1, 2023)(go back)

14Data provided by CNBC(go back)

15Sam Goldfarb, “Treasury Yields Fall After CPI Report”, The Wall Street Journal, (November 14, 2023)(go back)

16Market data provided by FactSet as of November 29, 2023(go back)

17FTI Consulting analysis. Market data provided by FactSet as of November 29, 2023.(go back)

18Joe Mantone et al., “Q3’23 M&A and Equity Offerings Market Report,” S&P Global (Q3 2023)(go back)

19Dylan Thomas, Annie Sabater, “Private equity dry powder swells to record high amid sluggish dealmaking,” S&P Global (July 20, 2023)(go back)

20“Shareholder Activism in H1 2020,” Insightia (July 2020)(go back)

21“Shareholder Activism in H1 2023,” Diligent (July 2023)(go back)

22“Shareholder Activism in H1 2020,” Insightia (July 2020)(go back)

23“Shareholder Activism in H1 2023,” Diligent (July 2023)(go back)

24Market data provided by Diligent as of November 19, 2023.(go back)

25Market data provided by Diligent as of November 19, 2023.(go back)

26Michael Ulmer et al., “Shareholder activism and engagement,” Financier Worldwide (Sept. 2023)(go back)

27Starboard Value LP, “Schedule 13D,” Securities and Exchange Commission (Feb. 28, 2022)(go back)

28Peter Feld, “A Letter to the Stockholders of LivePerson, Inc.,” Starboard Value (May 5, 2023)(go back)

29LivePerson, Inc., “Exhibit 99.1 Results of Operations and Financial Condition Press Release,“ Securities and Exchange Commission (Aug. 8, 2023)(go back)

30“Activists double down on underperforming investments,” Diligent (Oct. 23, 2023)(go back)

31Market data provided by FactSet as of November 28, 2023(go back)

32Robbie Whelan, Theo Francis, “Activist Investor Nelson Peltz Steps Up Pressure on Disney Board,” The Wall Street Journal (Feb. 2, 2023)(go back)

33Robbie Whelan, “Disney Plans to Cut 7,000 Jobs, $5.5 Billion in Costs,” The Wall Street Journal (Feb. 8, 2023)(go back)

34Lauren Thomas, Robbie Whelan, “Nelson Peltz Boosts Disney Stake, Seeks Board Seats,” The Wall Street Journal (Oct. 8, 2023)(go back)

35Trian Fund Management, L.P., “Form 13F-HR,” Securities and Exchange Commission (November 14, 2023)(go back)

36Market data provided by FactSet as of November 29, 2023.(go back)

37Market data provided by FactSet as of November 29, 2023.(go back)

38Matt Chessum, “Biotech sector remains under pressure despite previous COVID gains,” S&P Global (Nov. 16, 2023)(go back)

39Data provided by FactSet(go back)

40Marley Jay, “UAW members approve 4½-year contract with Detroit’s Big Three,” NBC News (Nov. 16, 2023)(go back)

41Stephen Wilmot, “Are Americans Falling Out of Love With EVs?,” The Wall Street Journal (Nov. 17, 2023)(go back)

42Kenneth Squire, “Activist Starboard has a variety of strategies to build value at Bloomin’ Brands,” CNBC (Sept. 9, 2023)(go back)

43“Bloomin Brands, Inc.: Capitalize for Kids,” Starboard Value (Oct. 2023)(go back)

44“Modernization of Beneficial Ownership Reporting,” Federal Register (November 11, 2023)(go back)

45Stefania Palma, “SEC disclosure changes press activists to reveal big stakes faster,” Financial Times (Oct. 10, 2023)(go back)

46“Shorter Schedule 13D and Schedule 13G Filing Deadlines and New Guidance: SEC Adopts Final Rules Amending Beneficial Ownership Reporting,” Vinson & Elkins (Oct. 16, 2023)(go back)

47“Deputy Attorney General Lisa O. Monaco Announces New Safe Harbor Policy for Voluntary Self-Disclosures Made in Connection with Mergers and Acquisitions,” U.S. Department of Justice (Oct. 4, 2023)(go back)

48David Smagalla, “DOJ Policy on M&A to Encourage Extra Scrutiny of Target Companies’ Compliance,” The Wall Street Journal (Nov. 1, 2023)(go back)

49“DOJ Announces Safe Harbor Policy for Voluntary Self-Disclosure of Criminal Misconduct uncovered in M&A,” Latham & Watkins (Oct. 9, 2023)(go back)

50David Smagalla, “DOJ Policy on M&A to Encourage Extra Scrutiny of Target Companies’ Compliance,” The Wall Street Journal (Nov. 1, 2023)(go back)

51“Proposed ISS Benchmark Policy Changes for 2024 – Request for Comments,” ISS (Nov. 2023)(go back)

52Kai Liekefett, Derek Zaba, and Leonard Wood, “Welcoming the Universal Proxy,” Harvard Law School Forum on Corporate Governance (Aug. 8, 2022)(go back)

53Lauren Thomas, “Companies Brace for Onslaught of New Activists After Change in Proxy-Voting Rules,” The Wall Street Journal (Nov. 20, 2022)(go back)

54Louis L. Goldberg, William H. Aaronson, and Ning Chiu, “Practical takeaways of universal proxy card,” Harvard Law School Forum on Corporate Governance (Nov. 9, 2022)(go back)

55“Shareholder Activism in H1 2023,” Diligent (July 2023)(go back)

56“Shareholder Activism in H1 2023,” Diligent (July 2023)(go back)

57“Shareholder Activism in H1 2023,” Diligent (July 2023)(go back)

58Insightia database of Russell 3000 director appointments and exits.(go back)

59Kurt Moeller, “The Hidden Effects of Universal Proxy Cards,” FTI Consulting (Nov. 14, 2023)(go back)

Print

Print