Leah Malone is a Partner and Leader of ESG and Sustainability Practice and Emily Holland is a Counsel at Simpson Thacher & Bartlett LLP. This post is based on a Simpson memorandum by Ms. Malone, Ms. Holland, Matt Feehily, May Mansour, and Alicia Washington. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance (discussed on the Forum here) by Lucian A. Bebchuk and Roberto Tallarita; How Twitter Pushed Stakeholders Under The Bus (discussed on the Forum here) by Lucian A. Bebchuk, Kobi Kastiel, and Anna Toniolo; Restoration: The Role Stakeholder Governance Must Play in Recreating a Fair and Sustainable American Economy – A Reply to Professor Rock (discussed on the Forum here) by Leo E. Strine, Jr.; and Stakeholder Capitalism in the Time of COVID (discussed on the Forum here) by Lucian A. Bebchuk, Kobi Kastiel, and Roberto Tallarita.

After years of buzz in business circles, ESG seemed to have lost some of its shine in 2023. We saw a host of new state laws looking to limit its use. Mentions of ESG on earnings calls dropped to their lowest level since 2020. Governors from 19 states joined an anti-ESG coalition and conservative members of Congress dubbed July “ESG month” as they held hearings and advanced bills aimed at limiting ESG-based investing. A major asset manager and traditional advocate of investment stewardship publicly took a step back from its ESG focus. Investor demand for ESG products cooled, as the third quarter of 2023 saw the fourth consecutive quarter of net outflows from sustainable funds in the United States.

But in our view, the market pullback on ESG is a natural and anticipated course correction, rather than a death knell. ESG is growing up, and challenging the corporate and financial sectors to grow with it. As regulators and lawmakers put investment strategies under the microscope, the economic drivers supporting the use of ESG criteria, and the need to demonstrate tangible evidence connecting ESG and investor returns, came into sharper focus. More companies than ever are offering ESG and sustainability reporting using commonly accepted frameworks. An SEC crackdown on greenwashing and related suits has led many companies to apply greater scrutiny to their nonfinancial disclosures and sustainability-related communications, with a rigor reminiscent of (though not equal to) that applied to financial disclosures.

Record high global temperatures continued to bring attention to businesses that are particularly prone to climate-related risks, and the steps they are taking in response to such risks, amidst conclusions that the carbon offset market may be broken. A landmark climate change lawsuit in the United States against state actors suggested new pathways to hold corporations accountable for perceived shortcomings in their climate mitigation efforts in U.S. courts. In the headline agreement that came out of COP28 in Dubai, nations made a historic pledge to “transition away” from fossil fuel- based energy.

From a regulatory perspective, ESG continues to occupy a divided world. In the United States, the backlash against ESG and a looming 2024 presidential election may pose hurdles, while a new era is dawning in the EU (and globally) with laws that compel increased disclosure, transparency and accountability with respect to ESG issues from companies, investors and lenders.

As 2023 comes to a close, we examine the seven key trends that shaped ESG and sustainability this year, and share what we anticipate for 2024.

1. Anti-ESG State Lawmaking Surges

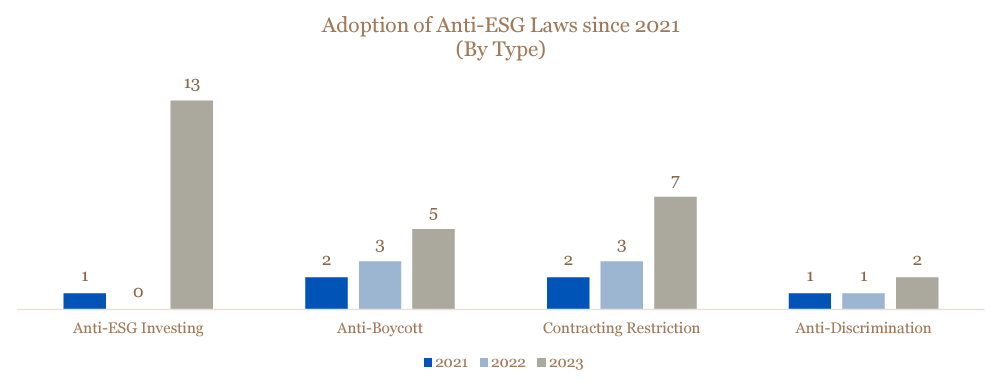

Anti-ESG lawmaking efforts, which first emerged as a trend in 2021, reached new heights this year with over 150 anti-ESG bills and resolutions introduced in 37 states. Most of these bills were rejected or failed to advance, but as of December 2023, at least 40 anti-ESG laws have been enacted in 18 states.[1] In many cases, proposed bills leveraged model legislation issued by organizations dedicated to the principles of limited government, free markets and federalism, such as the American Legislative Exchange Council (ALEC) and the Heritage Foundation. They fall into four main categories:

- Anti-ESG investing laws seeking to limit the ability of public entities (such as state-sponsored pension plans) to consider ESG-related factors in their investment decisions,

- Anti-boycott laws authorizing a blacklist of financial entities that engage in “boycotts” of companies involved in industries such as fossil fuels or firearms,

- Contracting restrictions that prohibit contracts with state entities absent verification that the counterparty does not and will not boycott companies in specified industries, such as fossil fuels, timber, mining, agriculture or firearms, and

- Anti-discrimination laws that prohibit state entities or insurers from using social credit or ESG scores.

In addition to the anti-ESG laws that have been passed, officials from at least 28 states have signed on to one or more multistate initiatives taking aim at ESG-related activity or investment. Most of these initiatives took the form of letters from a group of state attorneys general, targeting certain companies’ ESG-related practices, coordinating investigations, or expressing a view with respect to federal rulemaking.

What we are watching for in 2024: As state legislatures begin to be gaveled into session, we already see at least some continued momentum for anti-ESG laws from state lawmakers.[2] But we also see stalled efforts and significant pushback. Early indications were that ALEC’s focus would turn to a new model state law restricting the investment of funds managed and invested by state universities and other state funds held for charitable purposes, though that model legislation was not ultimately adopted by its board. In Oklahoma, a pensioner has filed a lawsuit to block an anti-boycott law, claiming it is unconstitutional in part because of the vagueness of the terms—terms that are similar to those used in other anti-boycott laws. Successes in this case could create a blueprint for other challenges, bolstered by increasing data about the costs associated with some of these laws. And it’s worth noting that while 14 states did adopt new anti-ESG legislation in 2023, 23 rejected or failed to advance similar laws. As new bills on the topic come up for debate in 2024, we expect discussions to be informed by more extensive data on the financial implications associated with ESG investing, as well as expert opinions as to the implementation challenges posed by some laws’ formulations.

2. California Leads the Charge on New ESG laws, Including Climate Disclosure

Against the backdrop of state anti-ESG activity, California forged ahead with extensive new ESG-related disclosure requirements through the passage of four laws with broad application to public and private companies.[3]

- SB 253 requires annual reporting of greenhouse gas emissions (Scope 1, 2 and 3, in accordance with the Greenhouse Gas Protocol) for public and private companies with over $1 billion in annual revenue that are doing business in California. Phased-in disclosure requirements (and assurance) begin in 2026, covering the prior year.

- SB 261 requires biennial climate risk reporting in accordance with the Task Force for Climate-related Financial Disclosure (TCFD) recommendations by public and private companies with over $500 million in annual revenue that are doing business in California. First reports will need to be published on or before January 1, 2026.

- AB 1305 requires annual website disclosure of details relating to voluntary carbon offsets marketed, sold, purchased or used to support carbon reduction or net zero claims made within California. The implementation timeline remains unclear, but we expect requirements to go into effect as of January 1, 2025.[4]

- SB 54 requires annual reporting of demographic data and diversity statistics of the founders and executive team members leading companies in which venture capital and other investment firms make investments. Disclosure will first be required in 2025, covering investments closed during 2024.

It’s not the first time California has been the first mover with respect to sustainability state regulation: it issued the world’s first modern slavery reporting statute in 2010, and an ambitious plastic regulation law last year that requires packaging to be recyclable or compostable by 2032, among others.

What we are watching for in 2024: These California laws, while setting broad new standards and requirements for companies, raise significant questions regarding application, implementation and interoperability with existing global standards. In signing messages for both California SB 253 and 261, Governor Gavin Newsom expressed concern over implementation deadlines, and directed his Administration to work with the California Legislature to address these issues in 2024. In addition to this clean-up legislation, which could provide clarity, we will be tracking actions of the California Air Resources Board, which is tasked with significant rulemaking and other responsibilities before the first reporting periods begin. Given the regulatory burden and short timeline for the anticipated implementation (ideally rules would be finalized before January 1, 2025), we will be watching for revisions to the timeline, or to the scope of information required.

On the other side of the country, New York could be the next to follow suit on climate disclosure requirements, as lawmakers in that state have introduced four bills, including two that are nearly identical to California’s SB 253 and SB 261.[5]

3. SEC Advances on ESG, but Continues to Delay Major Climate Rules

During the first two years of President Biden’s administration, the SEC had indicated a strong focus on ESG, creating the Climate and ESG Task Force within the Division of Enforcement and issuing extensive proposed rulemaking relating to greenhouse gas emission disclosure, ESG-related fund disclosure obligations, the naming of “green” investment funds and cybersecurity risk management. As we near the end of President Biden’s third year in office, the agency’s ESG focus is less clear.

Since July, the SEC has finalized two ESG-related pieces of rulemaking, requiring new cyber incident and risk management disclosure[6] and revising the “Names” Rule in part to address greenwashing concerns for retail investors.[7] Yet the SEC’s headline ESG-related rule requiring climate-related disclosures remains in proposed form. The draft rule, which would require public companies to disclose Scope 1 and 2 greenhouse gas emissions (and Scope 3, if material), along with information about climate risk management, made a splash in March 2022 when it was introduced, attracting a record number of comments. Originally targeted for finalization in October 2022, the SEC has repeatedly delayed that timeline, with its latest Reg-Flex Agenda indicating action by April 2024.

On the enforcement front, the Task Force announced in the late spring a $55.9 million settlement against Brazilian mining company Vale S.A.—the largest and most significant settlement obtained by the Task Force since its formation.[8] Notably, the settlement and complaint pointed to statements made by the company in its 20-F and 6-K filings, as well as in its sustainability reports (which were not filed with the SEC) and by the CEO in a magazine profile. With the settlement, and in subsequent comments, the SEC made clear that statements regarding ESG or sustainability efforts made in voluntary contexts and outside of mandatory SEC filings are not immune from agency scrutiny.

What we are watching for in 2024: The biggest question is, of course, whether the climate rule will be finalized in 2024 and, if so, in what form and when it will take effect. Given the scope of SB 253 and 261 in California (discussed above), and the reach of the Corporate Sustainability Reporting Directive in the EU (discussed below), many companies will be required to offer greenhouse gas and climate oversight reporting even without SEC action. But as a critical part of the SEC’s and the Biden administration’s ESG agenda, we do believe the agency will move to finalize the rule (in some form) in 2024. As the election nears, agency rulemaking becomes subject to a risk of nullification under the Congressional Review Act in the event that both Congress and the administration shift political party control—making finalization of the rule by late spring even more of a priority for the agency. Finalization of rules on ESG-related fund disclosure obligations is similarly slated for action by April, as is the proposal of anticipated rules on human capital management disclosure. A proposal on board diversity disclosure is indicated for action by October 2024.

Although the agency did not include ESG in its 2024 Examination Priorities as it had in prior years, we expect enforcement activity relating to greenwashing and other topics surrounding ESG to continue. But the Task Force’s activity in 2022 and 2023 has made clear that ESG-related enforcement actions typically stem from well-trodden principles of disclosure, compliance and governance—principles that will continue to be applied.

4. The EU’s CSRD Sets a Broad New Standard

The European Commission first adopted a legislative proposal for a Corporate Sustainability Reporting Directive (CSRD) in April 2021, but it wasn’t until the Commission’s adoption of detailed European Sustainability Reporting Standards (ESRS) in July of this year that the regime, which starts to apply on Jan. 1, 2024, and its implications for multinational companies, came squarely into focus.[9]

The potential effects of CSRD reporting are far-reaching. Covered topics include information relating to a company’s strategy, governance and policies around matters such as climate (including greenhouse gas emissions figures), pollution, water resources, biodiversity, workforce, workers in the value chain, and affected communities, among others. Disclosure may include sustainability targets and transition plans, due diligence processes implemented in respect of environmental and social risks and impacts connected to corporate operations, business relationships and value chains, and other key data points—in many cases going beyond the areas on which companies may currently report. The intricate scoping rules also mean that companies may be required to provide information at corporate levels that are not aligned with their financial reporting groups, creating additional complexity.

But the most important change CSRD will bring is a new approach to reporting. Under the principle of “double materiality,” a topic will be material (and thus require reporting) if either (i) it could reasonably be expected to affect the company’s cash flows, access to financing, or cost of capital over the short, medium, or long-term (so- called “financial materiality”) or (ii) the impact of the company’s operations and/or value chains on people or the environment (relating to the relevant reporting item such as pollution, water resources, biodiversity, workforce, etc.) is material (“impact materiality”). This framework reflects a significant shift, particularly for U.S. issuers accustomed to reporting under financial materiality standards.

In addition, companies will be required to seek limited assurance over the materiality analysis they conduct and eventual reporting—a practice that is not currently widespread with respect to voluntary sustainability reporting. The assurance process will highlight the need for quality data-gathering and analysis processes, and may lengthen the timeline for reporting.

What we are watching for in 2024: During 2024, the first round of companies—primarily large EU financial institutions and EU-listed issuers—will conduct a materiality analysis on their activities and relationships, applying the double materiality standard, and begin to collect data for reporting due in 2025. Working through the important questions of how to engage meaningfully and credibly with relevant stakeholders in this process, how to carry out the impact materiality assessment, how to address issues uncovered during the analysis, and for companies straddling EU and U.S. markets, how to approach disclosure to ensure compliance with CSRD while limiting legal risk in a charged U.S. political environment, will inevitably begin to shift conversations around sustainability practices and governance structures. For companies that will come into scope of CSRD in future years, the first wave of reporting will offer extensive learnings.

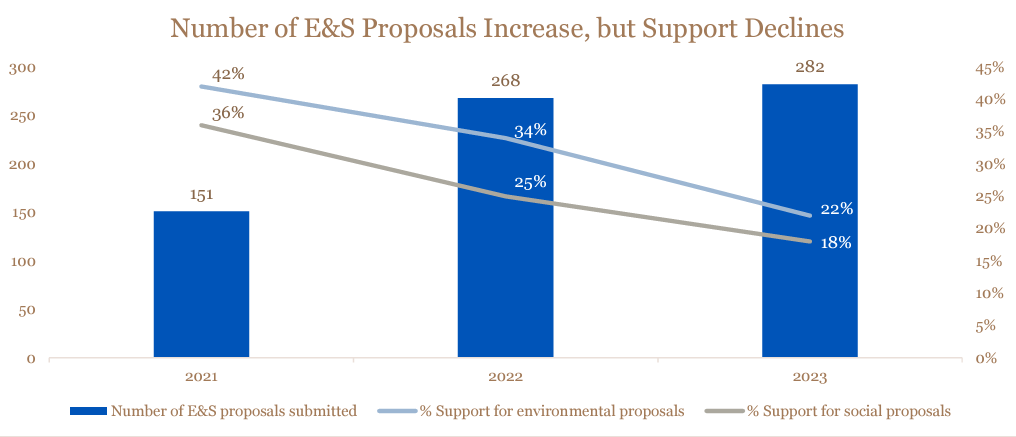

5. Proxy Season Support for E&S Shareholder Proposals Plunges

In recent years, proxy season catalyzed corporate activity on environmental and social (E&S) issues, as shareholder proposals on the topic attracted significant support from institutional investors incorporating ESG oversight and management into their voting policies and engagement priorities. But in 2023, while shareholders submitted more E&S proposals than ever, support for those proposals declined demonstrably.[10]

Source: Diligent, 2023 Proxy Season Review available here.

These results are driven by a combination of trends including:

- Increased diversity of proposals and proponents. Proposals in prior years tended to be fairly uniform in their desire for companies to make additional ESG-related disclosure, or to take steps to preserve social safeguards or advance environmental protection. Since 2021, a growing number of “anti-ESG” proponents have submitted proposals asking companies to pull back on these efforts—a trend that intensified in 2023. These proposals received very low levels of support, contributing to lower average figures.

- More specific and prescriptive proposals. Many shareholder proposals have moved from general requests for additional reporting to more prescriptive limitations, such as specific emissions targets or the issuance of detailed climate transition reports. These approaches were less likely to garner broad shareholder support.

- Evolving company practices makes general proposals less impactful. As company disclosure and operational practices evolve, the broader (and typically more successful) shareholder proposals are less relevant. For example, proxy advisor ISS recommended votes in favor of just 29% of proposals for racial and civil equity audits during 2023 (compared to 70% in 2022), noting that its recommendations reflect a company’s existing workforce disclosures and diversity, equity and inclusion practices.

What we are watching for in 2024: If shareholder proponents continue to pursue more specific and prescriptive E&S-related proposals, we may not see a return to the relatively high levels of support for these issues of a few years ago, even as many large institutional shareholders continue to reiterate their focus on creating and supporting long-term sustainable business practices and support for companies’ enhanced ESG- related disclosure.

New or expanded voting choice programs could further shift dynamics and support levels. Several large institutional investors have expanded programs designed to pass voting decisions along to their customers, typically through the selection of a voting policy (such as board-aligned, socially responsible investing, etc.). To the extent investors choose to utilize these programs, it could make institutional support for proposals harder to secure, and more difficult to predict.

6. Supreme Court SFFA Decision Bleeds into Corporate DEI Efforts

At the start of 2023, the conversation around corporate diversity, equity and inclusion focused largely on improving, measuring, and refining strategic clarity around DEI programs. But since the Supreme Court’s June 2023 decision in Students for Fair Admissions, Inc. v. Harvard College (SFFA), striking down race-based affirmative action admissions policies in higher education, that focus has shifted. Despite the narrow holding in the case, SFFA and subsequent developments have led companies to re-examine their DEI programs in light of legal risks.

Following the ruling, state regulators, litigants and activist groups lost little time in attempting to extend the Court’s reasoning to private actors and other contexts (notwithstanding the EEOC Chair’s statement that the decision did not address employer DEI efforts). In July, a group of Attorneys General representing 13 states issued a warning letter to Fortune 100 CEOs on the “serious legal consequences” of using race as a factor in employment and contracting practices, which a second group of 21 state Attorneys General roundly condemned in a separate letter as bearing “a tone of intimidation,” urging companies to stay the course. Since SFFA, a number of lawsuits have been filed targeting companies, government contracting decisions, law firms and other organizations under legal theories including violations of Section 1981 and Title VII of the U.S. Civil Rights Act, the U.S. Constitution and other statutes.

In one such case, Ultima Servs. Corp. v. United States Dep’t. of Agriculture, a federal district court in Tennessee extended the SFFA ruling and held that certain racial preferences in government contracting violated Ultima’s right to equal protection under the Constitution. Another notable suit, Am. Alliance for Equal Rights v. Fearless Fund Mgmt., brought by the group backing the SFFA plaintiffs, challenges a Black-owned venture capital fund focused on funding businesses owned by women of color, and could be a possible forerunner to attacks against corporate DEI programs. The Eleventh Circuit granted the plaintiff’s request for a preliminary injunction in September.

What we are watching for in 2024: A pending case before the Supreme Court, Muldrow v. City of St. Louis, involving questions of what employment conditions can give rise to violations under Title VII, could have further reverberations on corporate DEI programs.

Meanwhile legislative and political efforts continue to challenge DEI initiatives directly and indirectly. This includes various state anti-ESG investing and anti-boycott laws addressed above and, at the federal level, Senate Bill 3252, the “Abolish Government DEI Act,” introduced in November, which proposes to terminate the authorities of certain DEI offices and officers of various executive departments and federal agencies. In 2024 we expect more companies to take proactive steps such as conducting a privileged DEI risk assessment, enlisting an external advisory board to consult on DEI programming, and being prepared to clearly articulate the rationale behind specific DEI initiatives and demonstrate their value with evidentiary support.

7. Regulatory and Financial Headwinds Impact Sustainable Finance Strategies

Sustainable finance remains a modest but meaningful part of the overall $300 trillion global market, as companies seek access to additional financing sources (and/or financing on more favorable terms), and financial institutions look to fulfill their own sustainable finance funding objectives. Last year, total issuance of sustainable debt amounted to $1.5 trillion in deal volume, down from a record high of $1.7 trillion in 2021, a drop attributed to political and financial challenges. Based on figures for the first half of 2023, total issuance this year could surpass 2022’s volume as the market absorbs new regulation and policy initiatives, momentum continues around transition finance, and issuers and borrowers seek to respond to concerns relating to credibility and transparency.

In the sustainable bond market, project-based green bonds continue to account for the largest percentage of volume, with issuance of performance-based sustainability-linked bonds waning amid greenwashing and reputational concerns. By contrast, within the sustainable loan market, green loans account for smaller market share than sustainability-linked loans, despite facing some of the same criticism directed at their bond market corollaries. Overall, there is a sense that the green finance hype cycle may be calming as banks and investors demand credibility, compliance with higher standards and evidence of performance.

As part of that move toward credibility, 2023 saw the adoption of the world’s first green bonds standard regulation in the EU (EuGB Regulation), which takes effect on December 20, 2023, with entry into application to occur in December 2024.[11] The EuGB Regulation, originally announced as part of the EU Green Deal policy package to tackle climate change in 2020 and envisioned in the European Commission’s 2018 report offering a sustainable finance strategy for the EU, is poised to have a dramatic effect on transparency, consistency and comparability in the green bond market, setting new standards to address concerns associated with greenwashed debt.

2023 also saw an increase in private lending—a shift that puts the market for private credit in the U.S. at roughly the same size as the market for publicly listed high-yield corporate bonds. Within the private credit market, an increasing number of investment managers are focusing on credit strategies that emphasize sustainability, and even if a private credit strategy is not sustainability-oriented, a majority of private lenders now consider and incorporate ESG factors in some form or another.

What we are watching for in 2024: We anticipate supply and demand for sustainable debt will stay strong but continue to face scrutiny from banks, which will walk a fine line as they seek to sustain demand for sustainable debt instruments while imposing tougher standards on issuers and borrowers. It is likely that efforts will focus on stronger clauses and stiffer penalties in financing documentation, increased reliance on compliance with commitments aligned to voluntary frameworks at a minimum, and the implementation of internal policies and methodologies to formalize the evaluation, selection and monitoring of sustainable debt portfolios. From the green bond issuer perspective, while voluntary standards will remain available, we anticipate that a meaningful subset of issuers in the EU (and potentially outside the EU as well) will take steps to leverage the requirements set forth in the EuGB Regulation, particularly as compliance with EU sustainability disclosure and due diligence regimes enable more companies to demonstrate strategies and business practices aligned to sustainability and resilience principles.

What Else May Be on the Horizon in 2024?

Given the fast pace of developments in this space during 2023, we don’t expect any slowdown in 2024. In addition to the areas already mentioned, we will be keeping an eye on the following: ·

- Continued framework and reporting convergence. After a long proliferation of new reporting frameworks, the “alphabet soup” of various standards is starting to converge, with the International Sustainability Standards Board (ISSB) absorbing both the Sustainable Accounting Standards Board (SASB) standards and responsibility for monitoring progress on the state of climate-related financial disclosures using the TCFD framework. EU-wide regulations also aim to bring greater harmonization to corporate sustainability disclosure and due diligence. Further consolidation or alignment between key frameworks would represent a welcome development as reporting evolves.

- Growing demand for energy transition investments. With an estimated $1.7 trillion going to investments in clean energy this year, we’ve seen a notable uptick in interest from private equity funds in 2023. For many sponsors looking to capitalize on growing investor appetite for future-focused energy investments, distinct but overlapping strategies relating to energy transition, decarbonization, renewable energy, clean energy and energy impact have been top of mind for new fund formation projects. We expect more of these funds to go to market in 2024, as well as an increase in climate credit funds to fill the demand for capital to fund large scale projects.

- Increased recognition of nature-related risks. Attention to disclosure around companies’ impact on natural resources continues to build. In 2023 we saw the release of disclosure recommendations from the Taskforce on Nature-related Financial Disclosures (TNFD), modeled on the TCFD, and will be watching for companies disclosing the nature-related dependencies, risks, impacts and opportunities relating to their businesses under that new framework. Companies will also be starting to prepare for implementation of the EU Deforestation Regulation at the end of 2024, which will require companies trading in cattle, cocoa, coffee, oil palm, rubber, soya and wood (and products derived from these commodities), to conduct extensive diligence on their value chains to ensure the goods do not result from recent deforestation.

- Focus on AI as part of ESG. The ability of AI to ingest large amounts of information and analyze data for correlations and patterns can have major impacts on corporate ESG strategy and practices. We predict current uses—to satisfy corporate sustainability reporting and due diligence obligations, to identify or predict companies’ ESG-related controversies, to detect potential regulatory breaches before they escalate, to clarify how a business model aligns with sustainability and sustainable development trends, and to improve and enhance stakeholder engagement—will grow and evolve. We also expect greater scrutiny of how AI tools define, approach and understand ESG, around the clarity and appropriateness of the ESG inputs and explanatory factors that they employ, and in regards to their alignment with ESG principles, frameworks and standards.

Endnotes

1For more information, see our client memo “ESG Battlegrounds: How the States Are Shaping the Regulatory Landscape in the U.S.” (updated as of December 2023) available here, and recent podcast on The Funds Channel, available here.(go back)

2Of the 11 states where legislative sessions have begun as of December 15, lawmakers in three states (Michigan, New Hampshire and Wisconsin) have already introduced anti-ESG bills. Additionally, lawmakers in Missouri, which is not yet in session, have pre-filed at least eight separate anti-ESG bills.(go back)

3For more information, see our client memos, “California’s Flurry of ESG Lawmaking” (October 31, 2023) available here, and “Far-Reaching California Climate Disclosure Bills Signed into Law” (October 10, 2023) available here.(go back)

4The bill’s author, Assemblyman Gabriel, filed a letter to the Chief Clerk indicating his intent that reporting would be required beginning on January 1, 2025.(go back)

5See NY SB 7704, SB 7705, SB 897 and SB 5437.(go back)

6For more information, see our Regulatory and Enforcement Alert, “SEC Adopts Final Rules For Public Companies Relating to Cyber Incident Disclosure and Cybersecurity Risk Management, Strategy and Governance Matters” (July 27, 2023) available here.(go back)

7For more information, see our Registered Funds Alert, “SEC Adopts Amendments to Fund ‘Names’ Rule” (October 26, 2023) available here.(go back)

8For more information, see our memo, “Tracking the SEC’s Climate and ESG Task Force” (April 26, 2023) available here.(go back)

9For more information, see our client memo, “EU Corporate Sustainability Reporting Directive (CSRD): 5 Key Considerations for U.S. Companies,” (Oct. 4, 2023) available here, and our webinar “How GCs Should Prepare for CSRD” (November 8, 2023) available here.(go back)

10For more information, see our client memo “ESG in Mid-2023: Making Sense of the Moment” (August 2023), available here, and our article “Proxy Season Takeaways Indicate ESG Initiative Shifts,” Law360 (Sept. 22, 2023) available here (subscription required).(go back)

11For more information, see our client memo, “EU Lawmakers Approve European Green Bond Regulation” (October 24, 2023), available here.(go back)

Print

Print