Victoria Tellez is an Associate Director, and Jessica Pollock is a Research Associate at FCLTGlobal. This post is based on their FCLTGlobal memorandum. Related research from the Program on Corporate Governance includes Politics and Gender in the Executive Suite (discussed on the Forum here) by Alma Cohen, Moshe Hazan, and David Weiss; Duty and Diversity (discussed on the Forum here) by Chris Brummer and Leo E. Strine, Jr.; and Will Nasdaq’s Diversity Rules Harm Investors? (discussed on the Forum here) by Jesse M. Fried.

Asset owners, such as pension plans, sovereign wealth funds, and endowments and foundations, typically allocate their investments to asset managers based on expected performance, risk, and other key characteristics. In building a portfolio, they try to diversify key risks over time horizons that align with their objectives.

While not a guaranteed formula for success, evidence indicates that diverse teams can improve long-term value creation by improving decision-making and incorporating a range of perspectives, skills, and abilities. However, an examination of investment decision-makers handling institutional assets under management (AUM) in the US reveals a significant lack of diversity in demographics. Asset management firms owned by white males oversee 98.6 percent of AUM across different asset classes, while minority-owned firms account for less than 2 percent of the total AUM. The notion that the best managers are overwhelmingly white males, who make up at most 30 percent of the US population, defies logic, highlighting substantial untapped potential.

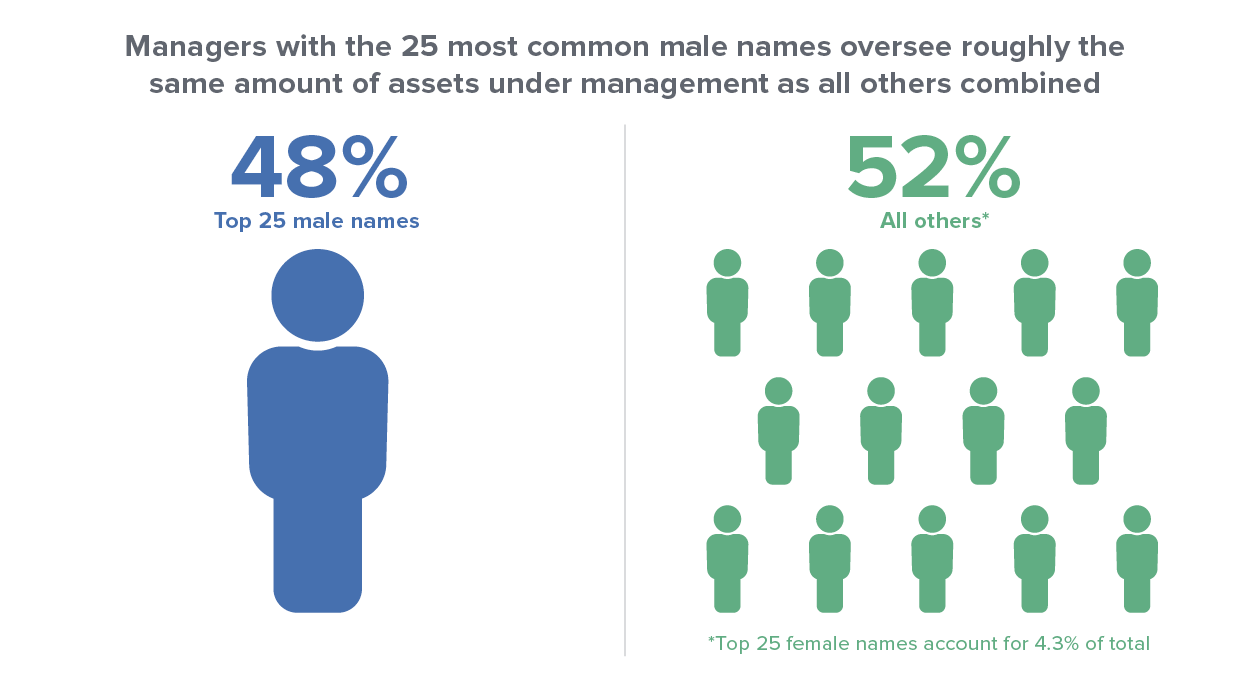

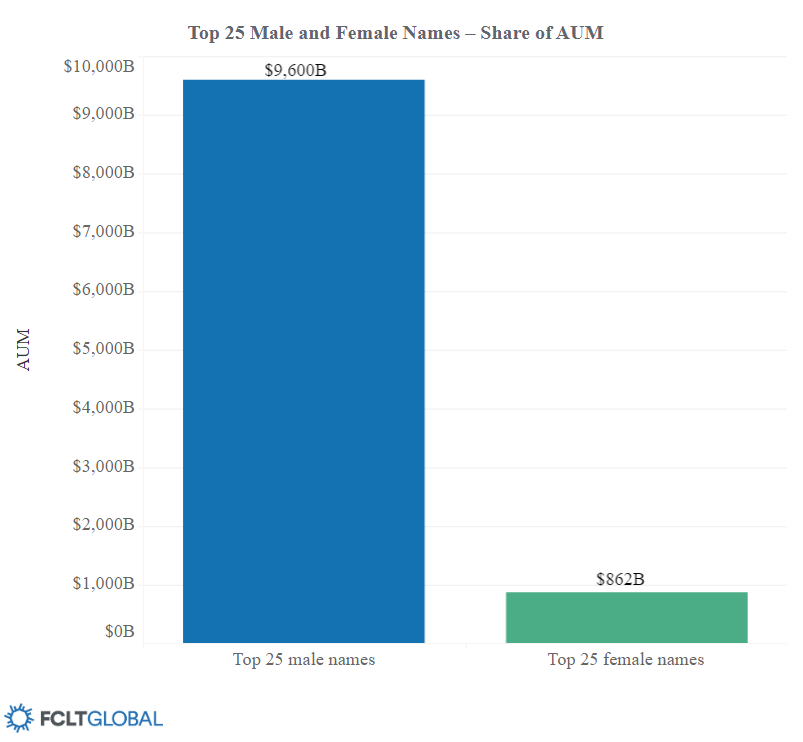

While the underrepresentation of diverse professionals in the global asset management industry is widely acknowledged, the AUM gap is particularly wide. As an illustration, FCLTGlobal’s analysis reveals that the 25 most common male names globally are associated with overseeing more than 11 times the assets under management compared to their female counterparts.

![]() Traditional initiatives addressing diversity, equity, and inclusion (DEI) center around talent pipelines, recruitment, affinity groups, and headcounts. However, they often overlook demographic diversity in AUM.

Traditional initiatives addressing diversity, equity, and inclusion (DEI) center around talent pipelines, recruitment, affinity groups, and headcounts. However, they often overlook demographic diversity in AUM.

Internally measuring the demographic diversification of investment decision-makers by AUM is a crucial first step in understanding portfolio risks and strategic interventions to broaden diversity. Leading organizations are already pioneering initiatives to bridge this gap.

Long-term asset owners play a leadership role in influencing the investment system, and measuring demographic diversity of investment decision-makers is the first step in tackling this issue. Attracting diverse talent across an organization is vital but insufficient, making capital allocation a pivotal driver of change.

Capital allocation to diverse managers emerges as the most impactful strategy for long-term investors, and can be achieved through three key steps:

- MEASURE: Measure the demographic diversity of investment decision-makers by AUM internally to understand the magnitude of the issue.

- ALLOCATE: Reconsider diligence questionnaires and manager selection processes to incorporate the demographic diversity of an investment portfolio in capital allocation decisions.

- PARTNER: Partner with diverse managers and commit to capturing long-term benefits of diversity of thought.

The global asset management industry’s lack of diversity is well-documented and widely reported. For instance, the Knight Foundation found that only 6 percent of US firms are owned by diverse managers in 2021[1]. The CFA reports that people of color constitute just 16 percent of the investment industry workforce in the US[2]. At the global scale, Morningstar and CFA report that women make up a mere 14 percent of fund managers worldwide[3].

While the diversity gap is pronounced when looking at representation, there is an even wider gap when controlling assets under management.

The same Knight Foundation analysis revealed that, when controlling for assets under management, white men dominate 98.6 percent of the US investment industry’s assets under management (AUM) across four asset classes: mutual funds, hedge funds, private equity, and real estate. This implies that minority-owned investment firms make up less than 2 percent of total AUM[4].

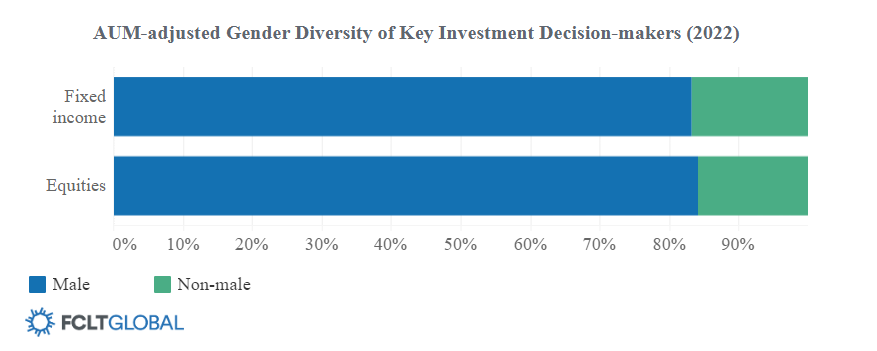

FCLTGlobal conducted a similar analysis across global public equities and fixed income. Results of global self-reported equities data on eVestment indicate that, when adjusting for assets under management, non-male key investment decision makers[5] manage only 16 percent of public equities[6]. Similarly, for fixed income[7], the AUM split between male and non-male managers is 83 percent and 17 percent, respectively. It is important to note that these estimates likely overstate reality, given that self-reported data is often biased, with firms excelling in gender diversity being more inclined to report such data.

Further, FCLTGlobal conducted a separate analysis of common male and female names also using global public equities eVestment data as a workaround for the legal barriers to collecting gender identity globally[8]. The analysis yielded a striking disparity: individuals with the most popular 25 male names manage 48.4 percent of total AUM[9], while those with the most popular 25 female names manage only 4.3 percent. This highlights that male-named individuals oversee more than 11 times the assets under management than their female-named counterparts. Put in dollars, people with the top 25 male names manage around $8.8 trillion more in AUM than people with the top 25 female names.

This disparity is concerning because failure to proactively assign funds to a diverse range of managers may lead to untapped potential for investors. For example, in the global pursuit of the “best” investment managers, there is a risk that exceptional managers, such as women, could be disregarded during the selection process.

Evidence suggests that the AUM gap won’t be resolved over time alone, and proactive measures are needed.

Traditional efforts in diversity, equity, and inclusion (DEI) in asset management are focused on talent pipelines, recruitment, affinity groups, and headcounts, and typically overlook the issue of demographic diversity of assets under management.

The Pipeline is Leaky: Merely waiting for junior-level employees to progress in their careers will not close the AUM gap. For instance, consider the 2020 McKinsey study on race equity in US financial services, which found that at the entry level of US financial services firms, the proportion of people of color is in line with their representation in US society—around 40 percent[10]. This number declines in the financial services industry over time, with roughly 9 out of 10 C-level executives identifying as white. Factors contributing to the diminishing representation at the decision-making level include the departure rate of employees of color from US financial services companies and the rate at which employees are promoted.

Time alone is insufficient: An analysis from CFA and Morningstar in 2021 found that women make up only 14 percent of fund managers globally — a figure that has remained stagnant for over 20 years[11].

The lack of progress over time is further accentuated by a deficiency in AUM-weighted measurement. Annual reports on DEI in financial services primarily concentrate on recruiting efforts, affinity groups, mentorship opportunities, and headcounts. While these elements are crucial for enhancing DEI, there is a notable absence of tracking and reporting concerning AUM diversity.

It’s time to begin internally measuring the AUM gap in addition to the representation or headcount metrics. Internally measuring the demographic diversification of investment decision-makers by AUM is crucial for a comprehensive understanding of portfolio risks and strategic interventions to broaden diversity. Leaders can gain a proper understanding of the AUM gap’s magnitude within their organizations and act by measuring the diversity of their own assets under management.

MEASURE

Measure the demographic diversity of investment decision-makers by AUM internally to understand the magnitude of the issue.

Channeling substantial capital into diverse managers is the most impactful approach for long-term investors to tackle the existing disparity in AUM.

Initiatives aimed at attracting and retaining diverse talent are necessary, yet they prove insufficient considering the slow progress observed in diversifying assets under management. When it comes to effecting change, capital plays a pivotal role.

Leading investors are already acting to improve AUM diversity at their organizations, some examples include:

-

CalSTRS offers an emerging diverse managers program. Through this initiative, they establish relationships across a network of investment managers, companies, and industry associations to foster diversity. They report on their progress, and disclose diversity in AUM, annually.

- Carlyle, in collaboration with the Milken Institute, launched the Initiative to Increase Diverse Talent in the Asset Management Industry in 2021. Through this initiative, they committed to taking concrete steps to address the impediments to investing in asset management firms with diverse founders.

- TPG NEXT was created in 2019 with the aim of investing in the next generation of underrepresented alternative asset managers. In partnership with CalPERS as an anchor investor, TPG NEXT launched its inaugural fund in 2023 to raise third-party capital to seed new managers, strengthen their access to capital, offer business building expertise, and provide strategic advisory support to chronically underrepresented talent.

There are also well-established organizations dedicated to improving AUM diversity. We detail four below but include a broader list of resources at the end of this article.

- Institutional Allocators for Diverse, Equity and Inclusion (IADEI) focuses on DEI within institutional investment teams. The organization offers toolkits, a database of diverse managers, a fellows & forum program for on-track CIOs and senior investment professionals, and publications on DEI best practices.

- The CFA Institute’s Diversity and Inclusion Experimental Partners Program engaged with 42 organizations to collectively generate ideas and time-bound action plans to make the investment industry more inclusive.

- The Due Diligence Commitment assists long-term investors in allocating more capital to diverse managers by taking an inclusive lens during the due diligence process.

- Similar to the Due Diligence Commitment, the Institutional Limited Partners Association (ILPA) provides a diversity metrics template/due diligence questionnaire (DDQ) to help LPs inquire about DEI in their manager diligence processes.

Notably, a 2019 article in the Psychological and Cognitive Sciences (PNAS) Journal found that in general, asset allocators have trouble gauging the competence of racially diverse teams, and suggests that beyond racial disparities in the pipeline, there are additional systemic racial disparities in how investors evaluate funds and allocate money. ILPA and the Due Diligence Commitment, among others, have resources available that may help improve this systemic issue.

ALLOCATE

Reconsider diligence questionnaires and manager selection processes to incorporate the demographic diversity of an investment portfolio in capital allocation decisions.

Diversity of thought is a quality of future-oriented organizations.

Asset owners, including pension plans, sovereign wealth funds, and endowments and foundations, usually distribute their investments among asset managers considering anticipated performance, risk, and other significant characteristics. When constructing a portfolio, their aim is to diversify key risks and achieve their objectives within time horizons that align with their overall goals.

While not a guaranteed formula for long-term success, evidence indicates that diverse teams have the potential to improve value creation by improving decision-making and incorporating a range of perspectives, skills, and abilities[12]. For example, according to McKinsey’s analysis, an increase in the racial or ethnic diversity of a company’s senior team is associated with higher earnings. Additional research indicates that teams with diversity contribute to improved innovation. Specifically, companies emphasizing innovation tend to experience greater financial benefits when women hold key leadership positions[13].

Failing to allocate funds proactively to diverse managers may lead to untapped potential for investors. Partnering with emerging diverse managers creates connections between experienced professionals and newcomers to the industry, with a particular focus on underrepresented groups. Additionally, the implementation of sponsorship programs, where senior leaders actively champion the career growth of diverse talent, may enhance retention[14]. Finally, fully leveraging the advantages of diversity starts at the top, with strong commitments from senior leadership to fully leverage the benefits of diversity of thought at their organizations[15].

Long-term leaders can fully leverage the advantages of diverse perspectives at their organizations by partnering with diverse managers.

Investors who publicly disclose their investment commitments or showcase partnerships with diverse managers to raise funds can play a significant role in aiding diverse managers, particularly those in the emerging stage, in expanding their networks and accessing additional capital. Leading investors can enhance AUM diversity by openly sharing their initiatives and commitments[16].

PARTNER

Partner with diverse managers over time to enable them to thrive in a changing environment.

Conclusion

Investors recognize that initiating a fund is substantially more difficult without entry to the circles, networks, and pathways traditionally accessible to only a select few. However, it is possible to take steps today to enhance AUM diversity, and long-term investors are already tackling this challenge by taking three key steps:

- MEASURE: Measure the demographic diversity of investment decision-makers by AUM internally to understand magnitude of the issue.

- ALLOCATE: Reconsider diligence questionnaires and manager selection processes to incorporate the demographic diversity of an investment portfolio in capital allocation decisions.

- PARTNER: Partner with diverse managers and commit to capturing long-term benefits of diversity of thought.

Leading through substantial investments with diverse managers shows a dedication to enhancing long-term value creation.

Endnotes

1Knight Foundation defines minority owned as firm to be one that is 50%+ owned by women or minorities..(go back)

3CFA and Morningstar, 2021.(go back)

4Knight Foundation defines minority owned as firm to be one that is 50%+ owned by women or minorities.(go back)

5eVestment defines “key professionals” as portfolio managers and the analysts that support them.(go back)

6Equity: 8.2% of products available on eVestment passed all the diversity reporting filters.(go back)

7Fixed income: 2.7% of products available on eVestment passed all the diversity reporting filters.(go back)

8Analysis assumes male names are assigned to men, and vice-versa. There is no way to confirm gender identity matches first name assumption.(go back)

9Top 25 male and female names from the last 100 years per the Social Security Administration.(go back)

11CFA and Morningstar, 2021.(go back)

12Richard et al 2003; Thomas & Ely 1996; Gosh 2023; IFC & Oliver Wyman 2022; Prequin 2021.(go back)

13McKinsey and W.K. Kellogg Foundation 2020; Dezo and Ross 2011.(go back)

14McKinsey & Co., 2020.(go back)

Print

Print