Melissa Burek is a Founding Partner and Michael Bonner is a Principal at Compensation Advisory Partners. This post is based on their CAP memorandum.

CAP analyzed annual incentive plan payouts over the past ten years of 120 large U.S. public companies, with a median revenue of $43B. We selected these companies to span ten major industries and provide a broad representation of market practice. This study is a continuation of studies that we conducted in 2017 and 2020.

Annual incentive plans are an essential tool for companies to incent and reward executives for achieving short-term financial and strategic goals. The goal-setting process has always challenged management teams and committees to achieve a balance between rigor and attainability to motivate executives.

In recent years, economic volatility has placed even more pressure on committees to set appropriate goals. This research is intended to be a guide and a reference point to help evaluate whether goal-setting has led to the right outcomes.

Highlights

1 |

Based on our analysis of actual incentive payouts over the past ten years, the degree of difficulty, or “stretch”, embedded in annual performance goals translates to:

|

2 |

This pattern reinforces the importance of performance metric selection and performance goal setting, given that companies are spending annual incentive monies equal to at least the amount of their overall target pool 70 percent of the time. |

3 |

Annual incentive payout distributions in 2020-2021 are outliers, despite a significant portion of companies making adjustments to their bonus payouts in 2020-2021, given the impact of the pandemic on businesses. |

Summary of Findings

Plan Design

For the purposes of this study, we categorized annual incentive plans as either goal attainment or discretionary. Companies with goal attainment plans set threshold, target, and maximum performance goals and corresponding payout opportunities for the performance period. Companies with discretionary plans determine payouts at year-end based on a retrospective review of performance results with no predefined relationship between goals and payouts.

Our study focuses on the 89 percent of companies in the sample with goal attainment plans.

| Industry | Sample Size | Annual Incentive Plan Type | |

| Goal Attainment | Discretionary | ||

| Automotive | n= 11 | 100% | 0% |

| Consumer Goods | n= 14 | 100% | 0% |

| Financial Services | n= 15 | 40% | 60% |

| Health Care | n= 11 | 100% | 0% |

| Insurance | n= 12 | 83% | 17% |

| Manufacturing | n= 10 | 90% | 10% |

| Oil and Gas | n= 11 | 91% | 9% |

| Pharmaceutical | n= 12 | 100% | 0% |

| Retail | n= 11 | 100% | 0% |

| Technology | n= 12 | 100% | 0% |

| Total | 89% | 11% | |

Performance Metrics

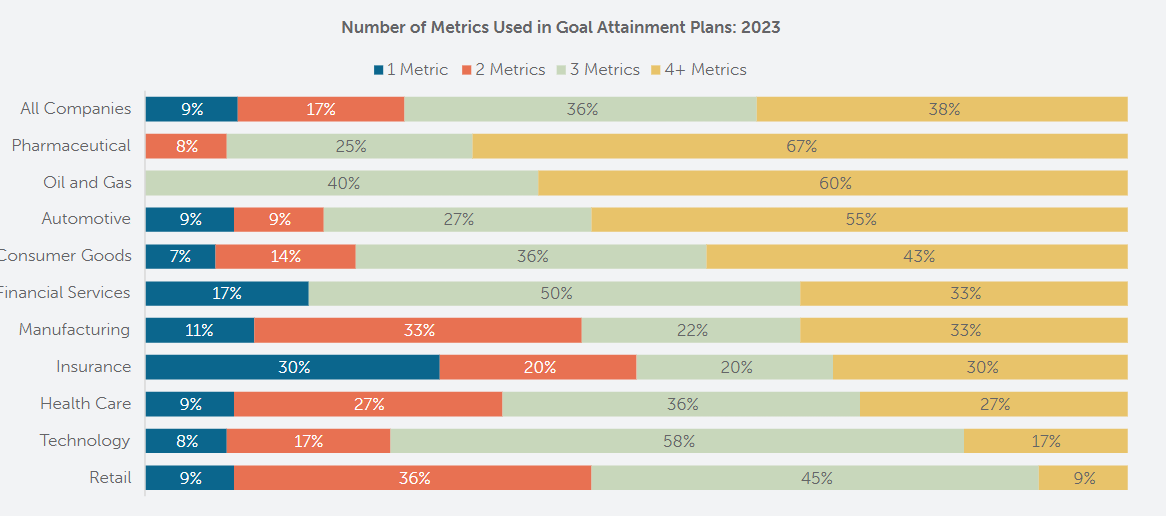

Nearly three-quarters of the companies in our study use three or more metrics to determine bonus funding, an increase compared to the findings of our 2020 report.

The most prevalent financial metrics used in annual incentive plans were Revenue, EPS, and Operating Income (including EBIT, EBITDA, and Pre-tax Income).

57 percent of companies in our current study use strategic or nonfinancial goals, an increase from 38 percent in 2020. These metrics incentivize behaviors that contribute to long-term success but may not be captured by short-term financial performance results. Specific strategic or nonfinancial metrics vary by industry and company – for example, pharmaceutical companies often use pipeline metrics and oil and gas companies often use safety and environmental metrics.

60 percent of the companies include Environmental, Social, and Governance (ESG) goals as part of their annual incentive award determination. ESG metrics are typically evaluated on a qualitative basis, and less commonly on a quantitative basis.

Performance and Pay Scales

Compensation committees annually approve threshold, target, and maximum performance goals and corresponding payout opportunities for each metric in the incentive plan. Target performance goals are most often set in line with the company’s internal business plan. Executives most often earn 50 percent of their target bonus opportunity for achieving threshold performance and 200 percent for achieving maximum performance. Only two companies in the study provide an award opportunity over 200 percent of target for achieving maximum performance goals, a decrease compared to our 2020 report.

Annual Incentive Plan Payouts Relative to Goals

All Companies

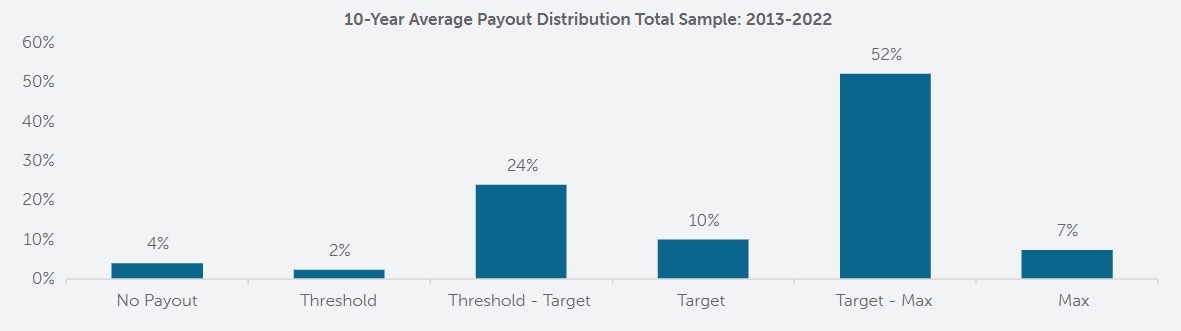

Based on CAP’s analysis over the 10-year period, the degree of “stretch” embedded in annual performance goals translates to approximately:

- A 95 percent chance of achieving at least Threshold performance

- A 70 percent chance of achieving at least Target performance

- A 5 percent chance of achieving Maximum performance

This shows that participants are achieving threshold performance and earning some payout 95 percent of the time and receiving maximum payouts 5 percent of the time by achieving superior results. These findings reinforce the importance of performance goal settings, as companies are spending annual incentive monies equal to at least the amount of their overall target pool about 70% of the time.

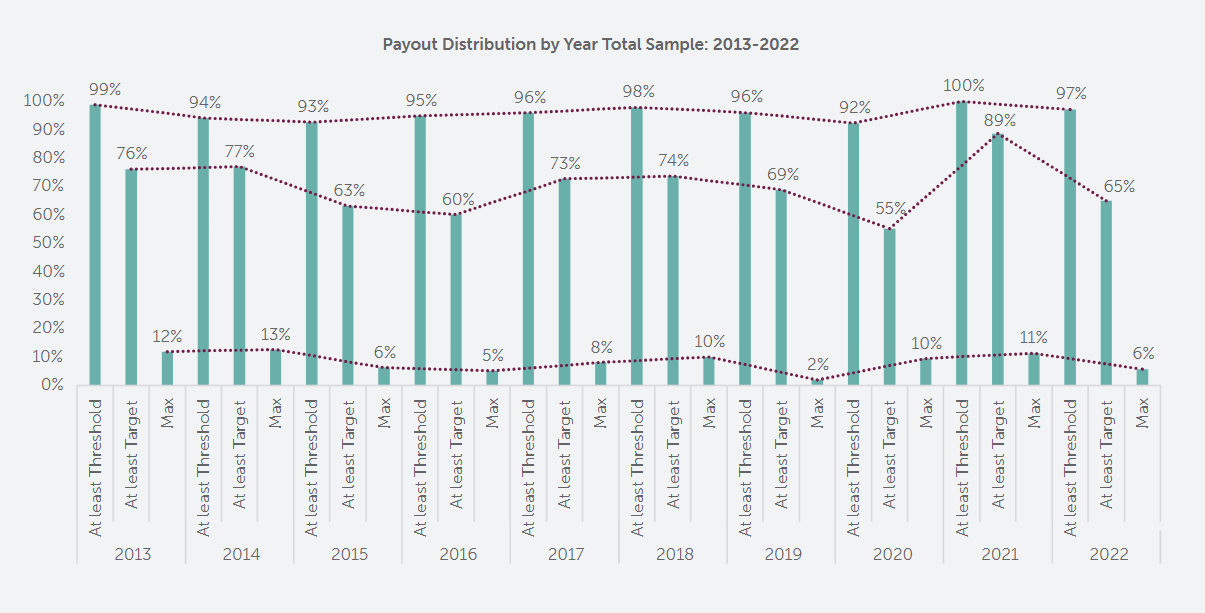

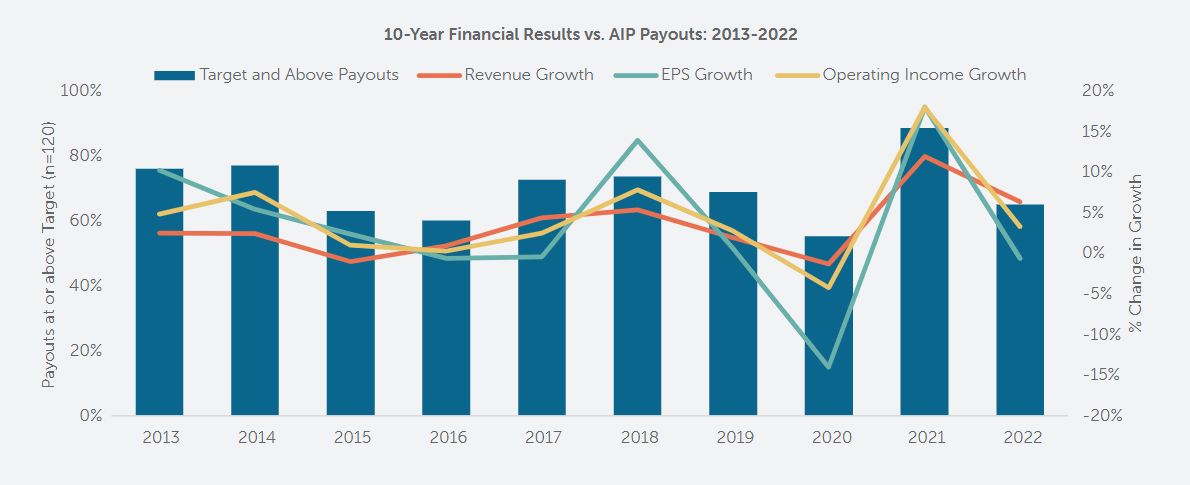

In most of the years reviewed in our study, between 60 percent and 80 percent of companies paid bonuses at target or above. There were two exceptions: 2020, when only 55 percent of companies paid bonuses at target or above, and 2021, when 89 percent of companies paid bonuses at target or above. In 2020, bonuses were generally down due to the unanticipated impact of the COVID-19 pandemic on financial results, while in 2021 bonuses increased due to a faster than expected rebound for most companies. In 2022, we saw a return to more typical payout distributions with 65 percent of companies paying bonuses at target or above.

Impact of COVID-19 and Adjustments Made in 2020-2021

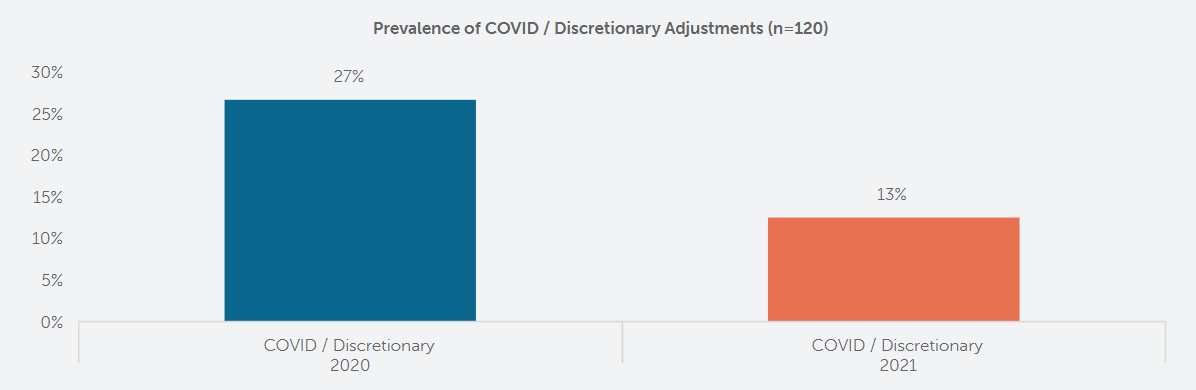

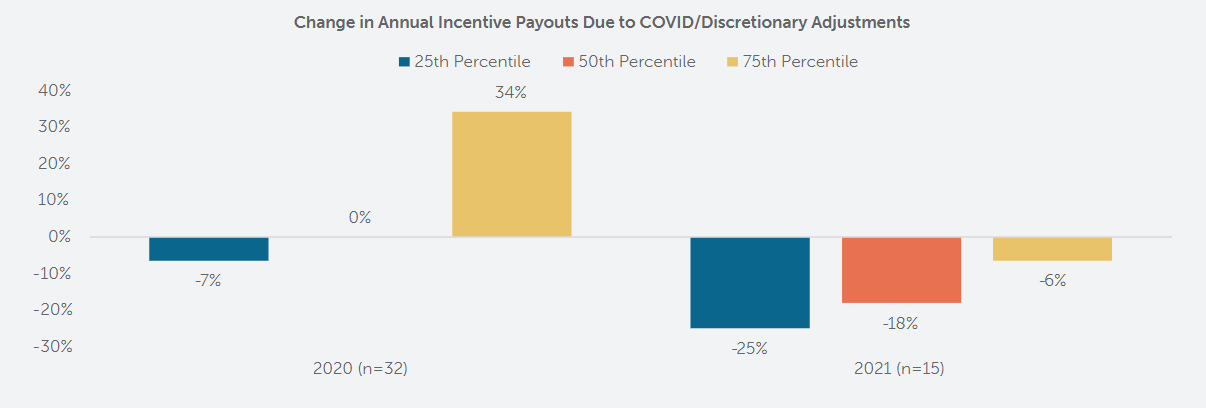

Given the unique economic environment, companies made more adjustments to annual incentive payouts in 2020 and 2021 than in prior years.

In 2020, 27 percent of companies made adjustments to annual incentive payouts. Approximately half of the companies adjusted bonus payouts upward to acknowledge that executives had limited control over the pandemic’s impact on financial results and to recognize efforts in navigating through the challenging environment. The other half of companies adjusted annual incentive payouts downward to realize the unplanned benefit that some companies realized as a result of the pandemic.

In 2021, 13 percent of companies made downward adjustments to annual incentive payouts to recognize that the results exceeded goals because of a quicker-than-expected financial rebound.

The trends seen in the 2020-2021 period reflect a dynamic response to the rapidly changing economic landscape and emphasize the importance of adaptability for companies when navigating unprecedented times.

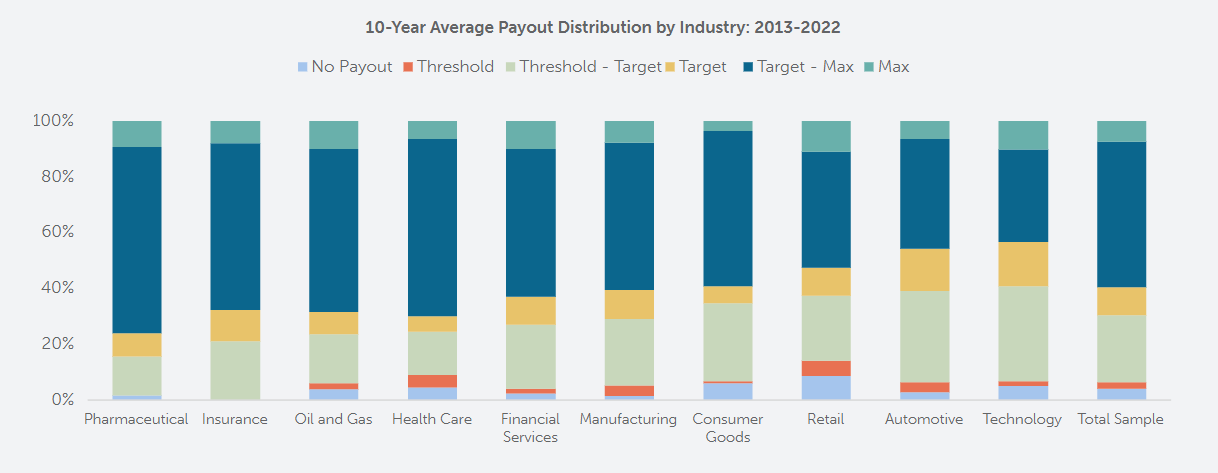

By Industry

Payout distributions differ by industry based on a variety of factors, including metric selection, goal setting, and economic influences. Average payouts for each industry are distributed as indicated in the following chart:

Pay Relative to Performance

CAP reviewed the relationship between annual incentive payouts and annual company performance over the ten-year period with respect to growth in the three most common annual incentive plan metrics: Revenue, EPS, and Operating Income. Payouts were fairly aligned with all three metrics over the 2013-2022 period, indicating that companies are rewarding for both growth and operating efficiency. Aligning bonus payouts with profitability also helps ensure that outcomes consider a company’s ability to pay bonuses.

The chart below depicts the relationship between median Revenue, EPS, and Operating Income Growth and the prevalence of above-target annual bonus payouts among the sample.

Conclusion

Our research indicates that over the last ten years companies set performance goals that translated to:

- A 95 percent chance of achieving at least Threshold performance

- A 70 percent chance of achieving at least Target performance

- A 5 percent chance of achieving Maximum performance

While payouts in select years may diverge slightly from others, given economic, industry, or company factors, this overall 10-year lookback provides a pattern and guidelines that companies can use to assess their actual payouts and established goals over the longer-term.

Looking Ahead

The macroeconomic environment remains uncertain, given factors such as the rising interest rate environment, continuing high inflation, a tight labor market, stock price volatility in certain sectors, and supply chain uncertainty.

Companies can use design strategies to help reduce volatility in their plan payouts, including setting wider ranges around target to recognize the challenges of setting performance goals in an uncertain environment, using non-financial goals to tie annual incentive payouts to other markers of company progress, and adding relative measures, which will allow for relevant comparisons even if the overall market is affected by macroeconomic challenges.

Methodology

The 120 companies in our study had a revenue size ranging from $20 billion at the 25th percentile to $88 billion at the 75th percentile. Median revenue was $43 billion.

CAP reviewed actual annual incentive payouts earned for performance over the ten-year period from 2013-2022 to determine the distribution of incentive payments and the frequency with which executives typically achieve target payouts. In this analysis, CAP categorized actual bonus payments (as a percentage of target) into one of six categories based on the following payout ranges:

| Payout Category | Payout Range |

| Max | 5% below Max to Max |

| Target – Max | 5% above Target to 5% below Max |

| Target | +/- 5% of Target |

| Threshold – Target | 5% above Threshold to 5% below Target |

| Threshold | Up to 5% above Threshold |

| No Payout | 0% |

Print

Print