Laura D. Richman is counsel and Michael L. Hermsen is partner at Mayer Brown LLP. This post is based on a Mayer Brown memorandum by Ms. Richman, Mr. Hermsen, David S. Bakst, Robert F. Gray, Jr., Elizabeth A. Raymond, and David A. Schuette.

It is already that time of year when public companies should be thinking about the 2019 proxy and annual reporting season. Advance planning greatly contributes to a successful proxy season, culminating with the annual meeting of shareholders. This post highlights issues of importance to the upcoming 2019 proxy season, including:

- Pay Ratio

- Say-on-Pay

- Compensation Litigation and Compensation

Disclosure - Board Diversity

- Investor Stewardship Group

- Voluntary Proxy Statement Disclosure

- Shareholder Proposal Guidance

- ESG Shareholder Proposals

- Notice of Exempt Solicitations

- Proxy C&DIs

- Pay Ratio

- Examination of Proxy Process

- Virtual Meetings

- Disclosure Update and Simplification

- Cybersecurity Disclosure

- Risk Factors

- Accounting Impact of Tax Reform

- Auditor Report Requirements

- Iran Disclosures

- Changes to Form 10-K Cover Page

- Exhibit Hyperlinks

Mandatory pay ratio disclosure debuted during the 2018 proxy season. Briefly, the US Securities and Exchange Commission (SEC) requires public companies to disclose:

- The median of the annual total compensation of all employees other than the chief executive officer;

- The annual total compensation of the chief executive officer; and

- The ratio of these amounts.

The SEC’s pay ratio disclosure rule gives companies flexibility to select a method for identifying the median employee that is appropriate to the size and structure of their businesses and compensation programs. Companies are allowed to identify the median employee based on any consistently applied compensation measure, such as compensation amounts reported in their tax and/or payroll records.

The pay ratio rule does not dictate the location of the ratio disclosure within the proxy statement. A typical place to include pay ratio disclosure is following the other compensation tables. Also, companies have generally preferred to avoid placing pay ratio disclosure in the compensation discussion and analysis (CD&A) section of the proxy statement since compensation committee members must address the CD&A in the compensation committee report that is included in the proxy statement.

The pay ratio disclosure rule requires a brief, nontechnical overview of the methodology used to identify the median employee and any material assumptions, adjustments or estimates used to identify the median employee. Companies are allowed to provide supplemental pay ratio disclosures, but they are not required to do so and most companies have opted to provide just the mandated disclosure in their 2018 proxy statements.

For more information about the pay ratio disclosure rule, see our Legal Updates “Understanding the SEC’s Pay Ratio Disclosure Rule and its Implications,” dated August 20, 2015, “SEC Provides Pay Ratio Disclosure Guidance,” dated October 25, 2016, “Get Ready for Pay Ratio,” dated September 6, 2017, and “Pay Ratio Rule: SEC Provides Additional Interpretive Guidance,” dated September 28, 2017.

Board intelligence service provider Equilar reported that as of September 17, 2018, the median CEO pay ratio was 64.2 to 1. Executive compensation consultant Semler Brossy’s July 12, 2018 report (the Semler Brossy report) observed that the pay ratio “is more heavily influenced by the magnitude and variance in CEO compensation than by median employee compensation.” Semler Brossy also reported that “CEO compensation scales as company size increases, while median employee compensation has little correlation with company size.”

It is not clear how much impact pay ratio disclosure has on investors. With pay for performance as a dominating theme for executive compensation packages, investors may be satisfied with a high pay ratio to the extent it correlates to stock price performance. Also, investors may understand that pay ratio is affected by the type of business and the scope of international operations or other geographic considerations.

Of course, constituencies in addition to investors are interested in pay ratio disclosures, including a company’s employees. Some consumers, governmental authorities, politicians and media outlets are also paying attention to pay ratio disclosures. As a result, companies should focus not only on the pay ratio calculation and proxy disclosure, but also on how they present and discuss this required public information both within their organization and to the public at large.

While there had been some predictions that pay ratio would be eliminated with Republican control of both the White House and Congress, there now appear to be other, higher priorities for legislative actions. Therefore, companies should assume that pay ratio disclosure will continue to be required for the 2019 proxy season.

Say-on-Pay

Say-on-pay has become an important feature of annual shareholder meetings, having a major impact on proxy statement design and planning, shareholder engagement and features of executive compensation programs. While say-on-pay is an advisory vote, there are real consequences to a failed say-on-pay vote. Generally, if a company receives a substantial vote against its say-on-pay proposal (even if less than a majority of shares voting at the meeting), investors will expect the company to either make changes to its compensation program going forward or to provide an understandable rationale for not making such changes. If the company does not, in future years, the company’s investors may cast a binding vote against compensation committee members or other directors in addition to voting against named executive officer compensation when the next say-on-pay vote is conducted. As a result, companies are very focused on receiving not only majority approval of their executive compensation, but achieving high levels of support.

As has been the case in prior years, most companies had successful say-on-pay votes in 2018. According to the Semler Brossy report, through early July 2018, only 2.6 percent of Russell 3000 companies failed their say-on-pay votes during the 2018 proxy season. The average support for say-on-pay during this period was 90.4 percent, with 76 percent receiving support above 90 percent.

Proxy advisory firms such as Institutional Shareholder Services (ISS) have become very influential in the say-on-pay process. As a result, if a company receives a negative proxy voting recommendation from a proxy advisory firm, it often (but not always) prepares additional material in support of its executive compensation program. In order to use such materials, companies must file them with the SEC as definitive additional soliciting material not later than the date first distributed or used to solicit shareholders. According to the Semler Brossy report, when ISS recommends an “Against” vote on a say-o

n-pay proposal, shareholder support for the proposal is 31 percent lower than at companies that receive a “For” recommendation. Although an “Against” recommendation does not always result in a failed say-on-pay vote, the drop in shareholder support may influence the ongoing level and tone of shareholder engagement on compensation matters and director nominees in the coming year, as well as future votes on say-on-pay and director elections.

Compensation Litigation and Compensation Disclosure

Director compensation can potentially raise litigation concerns because of self-dealing issues, requiring the application of a heightened “entire fairness” standard rather than the business judgment rule. For example, in December 2017, the Delaware Supreme Court issued an opinion in In Re Investors Bancorp, Inc. Stockholder Litigation limiting shareholder ratification as a defense when directors make equity awards to themselves on a discretionary basis. Although shareholders approved the plan itself, the court held that because they did not ratify specific awards under the plan, “the directors must demonstrate the fairness of the awards to the Company.” To minimize this risk, companies and boards should carefully review existing director compensation arrangements (perhaps on a separate cycle from executive compensation) and consider adding shareholder approved annual limits or annual formula-based awards to current (or new) plans. Alternatively, companies and boards may choose to develop a factual record of these arrangements with a view to withstanding an “entire fairness” scrutiny, including by reviewing director compensation paid at a carefully selected group of comparable companies, possibly with the assistance of an outside expert.

Executive compensation and directors compensation decisions should be made, and compensation disclosures should be prepared, with care, especially for companies that anticipate resistance to any aspects of their compensation programs. Compensation committee members should be able to demonstrate that they exercised due care in applying their business judgment to determine executive compensation by reviewing adequate information, asking questions and understanding the pros and cons of various alternatives, any or all of which can involve the assistance of company personnel or outside experts, as appropriate. They need to be even more careful with respect to director compensation, taking steps to establish that director compensation, especially discretionary director awards, satisfies entire fairness standards. Companies may find it worthwhile to emphasize in their proxy statements the corporate governance processes followed when setting director and executive compensation, as well as compensation decisions. Companies may want to include additional narrative detail in their proxy statements describing the objectives and resulting design for determining director compensation. When plans are submitted for shareholder approval, the proxy disclosure should be sufficiently clear to establish that the shareholder vote was obtained on a fully informed basis.

Board Diversity

Board diversity, especially with respect to women and minorities serving as directors, is an issue that has garnered a growing amount of attention in the corporate governance arena. New York City Comptroller Scott M. Stringer and the New York City Pension Funds, which previously had been instrumental in getting companies to adopt proxy access, launched another board accountability initiative for the 2018 proxy season, sending letters to 151 companies to request disclosure of the skills, race and gender of board members in a standardized board matrix in the proxy statement, as well as seeking engagement to discuss board “refreshment” opportunities to bring new voices and viewpoints onto the board. In a few cases, the Comptroller’s office submitted shareholder proposals requesting proxy disclosure of gender and race/ethnicity, as well as skills, experience and attributes, of directors and nominees in a matrix form. The Comptroller’s office announced that 49 of the companies that it targeted in this initiative elected a total of 59 new, diverse directors and that 24 targeted companies publicly committed to include women and people of color in the candidate pool for every board search.

Some large investors have indicated that they will vote against or withhold their votes from directors due to a lack of gender diversity. For example, BlackRock has publicly stated that it expects to see at least two women directors on every board, indicating that it may vote against nominating/governance committee members if it believes that a company has not accounted for diversity in its board composition. State Street Global Advisors (SSGA) advised that it will vote against the chair of the nominating and/or governance committee or board leader of companies that fail to take action to increase the number of women on their board of directors and reported that by early March 2018 it had voted against more than 500 companies for failure to demonstrate progress on board diversity. CalPERS engaged more than 500 US companies in the Russell 3000 index regarding lack of board diversity and adopted a Board Diversity & Inclusion voting enhancement to hold directors at these companies accountable for failure to improve diversity on their boards or diversity and inclusion disclosures. CalPERS reported that through May 2018 it withheld votes or voted against 271 directors at 85 companies as a result of board diversity concerns.

Glass Lewis has stated that beginning in 2019, it will generally recommend voting against the nominating committee chair of a board that has no female members and, depending on the circumstances, may extend that negative recommendation to all members of the nominating committee.

The California legislature recently passed a bill that requires publicly traded companies based in California to have at least one woman on their boards by the end of next year, with boards of five directors required to have two or more women directors and boards of six or more directors would have to have at least three directors by the end of 2021. As of time that this Legal Update was written, California Governor Brown has not yet signed this bill into law. It is possible that this legislative initiative could spur board diversity legislation in other jurisdictions.

Campaigns for gender diversity on boards of directors have already had an impact on board composition and recruitment. Equilar reports that for a third consecutive quarter the percentage of women on Russell 3000 boards increased during the second quarter of 2018, with 34.9 percent of new board seats going to women. Gender and minority board diversity is likely to remain an important topic for the 2019 proxy season.

Investor Stewardship Group

The Investor Stewardship Group (ISG), comprised of large institutional investors and asset managers that invest over $22 trillion in US equity markets, developed a set of six corporate governance principles for US listed companies with an effective date of January 1, 2018. It also developed a stewardship framework for institutional investors consisting of six principles.

ISG’s corporate governance principles provide:

- 1. Boards are accountable to shareholder

- 2. Shareholders should be entitled to voting rights in proportion to their economic interest.

- Boards should be responsive to shareholders and be proactive in order to understand their perspectives.

- Boards should have a strong, independent leadership structure.

- Boards should adopt structures and practices that enhance their effectiveness.

- Boards should develop management incentive structures that are aligned with the long-term strategy of the company.

While ISG’s governance principles do not have the force of statute, regulation or listing standards, they may be influential because of the amount invested by ISG members. For example, SSGA has said that if companies do not comply with the ISG governance principles, and “cannot explain the nuances of their governance structure effectively, either publicly or through engagement, SSGA will vote against the independent board leader as a result of non-compliance with the principles.” It would be worthwhile for companies that have ISG members as large shareholders to evaluate the extent of their compliance with the ISG principles in order to be prepared to engage with these shareholders.

Voluntary Proxy Statement Disclosure

While there is no requirement to provide disclosures in the audit committee report contained in an annual meeting proxy statement beyond what is specified by Item 407(d) of Regulation S-K, many audit committees are voluntarily doing so. For example, in its 2018 proxy review, Deloitte found an increase in discussions of the audit committee’s role in the oversight of cybersecurity. Other voluntary topics that were frequently addressed in audit committee reports include the roles and responsibilities of the audit committee, topics of discussion by audit committees, oversight of risk, oversight of financial reporting processes and oversight of internal audit.

There has also been a growth in optional board composition disclosure in proxy statements. For example, in its 2018 proxy season review the EY Center for Board Matters reported that director skills matrix disclosure climbed sharply, although not uniform in nature, and observed that graphics have become common to highlight matters such as board tenure, gender, race, ethnicity and age. In August 2018, the Comptroller’s office published a compendium containing examples of what it considers “best practices” in board matrices included in 2018 proxy statement, which it divided into two categories. Both approaches included individual director disclosure of qualifications, with one category also presenting gender and race/ethnicity for each individual director and the other category presenting gender and race/ethnicity on an aggregate basis for the board.

In another voluntary development, some companies have chosen to discuss sustainability initiatives and environmental, social and governance (ESG) commitments in distinct sections of their proxy statements, which are separate from responses to any ESG shareholder proposals that will be voted upon at the meeting. With growing interest in ESG issues among certain investors, this approach may provide an opportunity for companies to control their message and provide a basis to direct shareholder engagement in this area.

It is worthwhile for companies in the planning stages for their 2019 proxy statements to consider early whether it makes sense for them to voluntarily add or expand any disclosures. Enhanced disclosures may be well-received by institutional investors, proxy advisory firms and organizations that rate public company corporate governance. Making decisions on optional proxy disclosures well in advance will allow time to develop and assess the most effective presentation.

Shareholder Proposal Guidance

The staff (Staff) of the SEC’s Division of Corporation Finance issued Staff Legal Bulletin No. 14I (SLB 14I) on November 1, 2017, to provide guidance on shareholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934 (Exchange Act). Among other topics, SLB 14I addressed the scope and application of:

- the ordinary business grounds for exclusion under Rule 14a-8(i)(7), and

- the economic relevance grounds for exclusion under Rule 14a-8(i)(5).

SLB 14I suggested that an analysis by a company’s board of directors explaining why it is appropriate for the company to exclude a particular shareholder proposal from its proxy statement under either Rule 14a-8(i)(7) or Rule 14a-8(i)(5) could assist the Staff’s review of a no-action request. Such analysis should contain a discussion of the specific processes that the board employed to ensure that its conclusions were well-informed and well-reasoned. Although language in SLB 14I could be read as a Staff expectation that no-action requests for exclusion of shareholder proposals under the Rule 14a-8(i)(7) or Rule 14a-8(i)(5) should include a board analysis, the Staff made clear in subsequent public statements that a board analysis was not required. For a further discussion of SLB 14I, see our Legal Update, “SEC Staff Issues Legal Bulletin on Shareholder Proposals,” dated November 7, 2017.

The Staff did not automatically grant no-action requests for exclusions of shareholder proposals under Rule 14a-8(i)(5) and Rule 14a-8(i)(7) that contained a board analysis. For example, the Staff rejected no-action requests when it determined that the board analysis did not provide a sufficient level of detail to reach a determination that exclusion was appropriate (without articulating the way in which the Staff found the included information to be inadequate). In addition, the Staff denied no-action requests based on such provisions where relatively substantial amounts of votes were cast supporting similar proposals in prior years.

On the other hand, the Staff granted no-action requests, even if the no-action request did not contain a board analysis. For instance, the Staff permitted a proposal to be excluded under Rule 14a-8(i)(7) where the Staff concurred that the proposal sought to micromanage the company, notwithstanding the proponent’s complaint that the no-action request did not include any discussion of board analysis of the matter.

Even when the Staff agreed with a no-action request that contained a board analysis under the Rule 14a-8(i)(7) or Rule 14a-8(i)(5), the extent to which such analysis influenced the Staff’s decision was not necessarily evident. For example, in one Rule 14a-8(i)(7) no-action letter, the Staff’s reply specified that micromanagement of the company provided the basis for a proposal’s exclusion, without mentioning the board analysis that was described in the no-action request. Similarly, in response to a no-action request that presented a multifaceted argument under Rule 14a-8(i)(7), one component of which was a board analysis, the Staff permitted the exclusion of the shareholder proposal with just a reference to the rule.

In granting a no-action letter permitting an exclusion under Rule 14a-8(i)(5), the Staff’s reply explained that it based its decision on a review of the company’s submission, including the description of how the board analyzed the matter, but it is not clear from the reply how much weight the Staff gave to the board analysis.

The 2018 proxy season was a learning experience on the application of the Staff’s suggestion that companies consider including a board analysis as part of their no-action requests seeking exclusion of shareholder proposals in reliance on Rule 14a-8(i)(7) or Rule 14a-8(i)(5). A key takeaway is that the Staff will continue to reach its own decision about the appropriateness of excluding shareholder proposals under Rule 14a-8(i)(7) or Rule 14a-8(i)(5), whether or not a board analysis is included as part of the no-action request.

Companies receiving shareholder proposals for the 2019 proxy season that are potentially excludable under Rule 14a-8(i)(7) or Rule 14a-8(i)(5) should evaluate whether to include a board analysis in their no-action requests. If they choose to do so, the board analysis should address, to the extent possible, points that the Staff identified as insufficient in board analyses contained in 2018 no-action requests. In particular, if a board analysis is included, it is not enough just to generally mention several factors contributing to the board’s determination. In order to be the most persuasive, the description of the board analysis must contain a sufficient level of detail to explain the company’s specific situation in relation to the proposal. And, if the proposal is on a topic that has been the subject of a prior shareholder vote, the results of that vote should be addressed by the board, especially if the level of shareholder support was relatively high for the shareholder proposal.

ESG Shareholder Proposals

ESG proposals represent a dominant category of shareholder proposals submitted for the 2018 proxy season. Environmental and social shareholder proposal topics included climate change and sustainability, political activity and human rights, as well as proposals relating to gun violence, the opioid crisis and sexual misconduct. Topics for governance proposals included calling special meetings of shareholders, proxy access, shareholder action by written consent and maintaining an independent board chair. Although most ESG proposals voted upon at 2018 annual meetings did not achieve majority support, some did, including in the areas of climate change, sustainability, special meetings, written consents and proxy access. In addition, other ESG proposals, while failing to achieve majority support, nevertheless received a relatively high percentage of support in the 30 percent to 40 percent ranges of approval.

The number of proposals relating to requirements for shareholders to call a special meeting of shareholders and to act by written consent dramatically increased in 2018, with many of those proposals voted upon. However, some companies were able to exclude special meeting shareholder proposals from their proxy statements on the grounds of conflicting with a company proposal by including a company proposal seeking shareholder ratification of an existing by-law provision that required a higher threshold of share ownership in order for shareholders to call a special meeting than was required in the shareholder proposal.

There continued to be proxy access and proxy access “fix-it” proposals (i.e., proposals seeking revisions of existing proxy access by-law provisions) during the 2018 proxy season. However, with proxy access provisions already in place at two-thirds of S&P 500 companies, the number of shareholder proposals requesting proxy access adoption declined. A few proxy access adoption proposals received majority approval, but through mid-June 2018, no proxy access fix-it proposals received majority support.

There have been a number of developments that may be contributing to growing shareholder support for ESG proposals. Some funds holding large positions in many public companies have increasingly made ESG issues a priority. For example, BlackRock indicated that if it has concerns that a company might not be dealing with environmental or social issues appropriately, it may support a shareholder proposal on the issue. ISG members may be more inclined to vote in favor of governance proposals reflecting their corporate governance principles. In addition, ISS has started to include environmental and social scores, together with its governance scores, in the company reports that it sends to investors that subscribe to its voting advice. While ISS has indicated that those scores will not affect its proxy voting recommendations, it is possible that ISS clients could factor those scores into their own voting decisions, which could also impact support for ESG proposals.

On a related development, in April 2018, the Department of Labor issued a Field Assistance Bulletin No. 2018-01 (FAB 2018-01) to address questions arising under the Employment Retirement Income Security Act of 1974 (ERISA). This bulletin emphasized that although ESG factors may be considered in investment choices, “ERISA fiduciaries must always put first the economic interests of the plan in providing retirement benefits.” FAB 2018-01 noted that while investment policy statements, which may include proxy voting guidelines, “are permitted to include policies concerning the use of ESG factors to evaluate investments, or on integrating ESG-related tools, metrics, or analyses to evaluate an investment’s risk or return,” ERISA fiduciaries do not always have to adhere to such guidelines. According to FAB 2018-01, if it is imprudent to comply with an investment policy statement on ESG voting in a particular instance, the manager must disregard the voting policy.

Notice of Exempt Solicitations

During the 2018 proxy season, certain individual and non-profit proponents of shareholder proposals, such as John Chevedden and As You Sow, filed voluntary notices of exempt solicitations pursuant to Rule 14a-6(g) and Rule 14a-103 to urge shareholders to vote for their shareholder proposals, to vote against a management proposal or to encourage shareholders to vote in situations where a proposal otherwise may be in danger of failing. The notice of exempt solicitation format allows a proponent of a shareholder proposal to respond to the company’s statement of opposition in the proxy statement and to make additional arguments supporting the proposal. These notices are not subject to the 500-word limitation for shareholder proposals appearing in the proxy statement. In addition to filing notices of exempt solicitations relating to shareholder proposals included in a company’s proxy statement, such notices have been filed in advance of a company releasing a proxy statement and even after an annual meeting was concluded.

Notices of exempt solicitation appear on the EDGAR page of the company, identified by a “PX14A6G” filing type. Investors or other interested parties that have set up general alerts for a company’s SEC filings will be notified when such a filing is made. Notices of exempt filings may also generate media attention.

While relatively few notices of exempt solicitations have been filed by individual retail investors in support of their shareholder proposals, this practice may expand during the 2019 proxy season to the extent proposal proponents find these notices to be a relatively simple and cost-effective way to promote their views. Companies do not need to respond to notices of exempt solicitation, but they likely will want to at least review what is being said about them in a document filed with the SEC. Therefore, companies receiving shareholder proposals for their 2019 annual meetings should make their investor relations and public relations departments aware of this new practice and monitor the SEC website for notice of exempt solicitation filings.

Proxy C&DIs

On May 11, 2018, the Staff issued compliance and disclosure interpretations (C&DIs) on proxy rules and related Schedules 14A and 14C that replaced previously issued interpretations. While these new C&DIs are generally consistent with the interpretations they replaced, there were several substantive changes that may impact the upcoming proxy season. For example, C&DI 124.07 provides that a company must file preliminary proxy materials if it receives adequate advance notice of a non-Rule 14a-8 matter that may be raised at a meeting if Rule 14a-4(c)(2) does not permit the company to exercise discretionary authority on such matter. C&DI 161.03 specifies that if a company is required to include a New Plan Benefits Table in a proxy statement, the table must list all of the individuals and groups for which award and benefit information is required, even if the amount to be reported is “0,” but notes that this disclosure could be provided narratively. C&DI 126.02 states that a change in a company’s name, by itself, does not require a company to file preliminary proxy materials. C&DI 163.01 specifies that a proxy statement seeking securityholder approval for the elimination of preemptive rights from a security must contain the financial and other information to the extent required by Item 13 of Schedule 14A because elimination of preemptive rights is a modification of a security for the purpose of Item 12 of Schedule 14A. For a further discussion of these C&DIs, see our Legal Update “SEC Updates Proxy Interpretations,” dated May 16, 2018.

On July 31, 2018, the Staff issued two additional proxy rule C&DIs relating to notices of exempt solicitations. While explaining that the proxy rules only require that a notice of exempt solicitation be submitted by a soliciting party that beneficially owns more than $5 million of the class of securities that is subject to a solicitation, C&DI 126.06 specifies that the Staff will not object to a voluntary submission of such a notice as long as it is submitted with a cover that clearly states that the notice of exempt solicitation is being provided on a voluntary basis. C&DI 126.07 clarifies that the cover for a notice of exempt solicitation, whether or not a voluntary submission, must present the name and address of the soliciting person before any written soliciting materials (including any logo or other graphics used by the soliciting party) that are included in the filing. C&DI 126.07 warns that failure to provide the required information in this manner “may, depending upon the particular facts and circumstances, be misleading within the meaning of Exchange Act Rule 14a-9.”

Examination of Proxy Process

In 2010, the SEC issued a concept release seeking public comment on the operation of the US proxy system, which is sometimes referred to as “proxy plumbing.” Recently, SEC Chairman Jay Clayton announced that SEC staff will hold a roundtable this fall to get input from investors, issuers and other market participants on whether improvements are needed in proxy regulation. Potential agenda topics include the voting process, retail shareholder participation, shareholder proposals, proxy advisory firms, technology and innovation in all areas of the proxy process and the SEC’s proposed universal proxy rules. Members of the public may submit comments on the proxy process either before or after the roundtable occurs.

There have also been congressional initiatives regarding regulation of proxy advisory firms such as ISS and Glass Lewis. The House of Representatives passed the Corporate Governance Reform and Transparency Act of 2017 at the end of last year and the Senate Banking Committee conducted hearings on it this summer. At the time of this Legal Update, it is not clear whether any legislation will be enacted to provide proxy advisory firm oversight.

Virtual Meetings

The practice of holding virtual annual meetings continued to grow during the 2018 proxy season and is expected to increase further during the 2019 proxy season. Online shareholder meetings can take a variety of forms. Some are hybrids, with in-person meetings supplemented by audio and/or video options. Other companies conduct fully virtual meetings. Broadridge reported that during the first six months of 2018, public companies held 212 virtual meetings, up from 180 compared to the first six months of 2017, and estimated that the number of companies conducting virtual annual meetings during the full year 2018 will be at least 300 (up approximately 30 percent from 2017), with a large percentage being virtual-only meetings.

Some investors have criticized virtual-only meetings. For example, the New York City Pension Funds adopted a policy in its proxy voting guidelines in April 2017 to vote against incumbent directors serving on a nominating committee who are up for re-election at a virtual-only meeting. Glass Lewis has stated that beginning in 2019 it will generally recommend voting against members of the governance committee if a shareholder meeting will be held on a virtual-only basis unless the proxy statement contains robust disclosure assuring shareholders that they will have the same rights and opportunities to participate as they would at an in-person meeting.

In April 2018, a committee of executives representing retail and institutional investors, public companies and proxy and legal service providers issued “Principles and Best Practices For Virtual Shareowner Meetings.” This white paper outlined five guiding principles for virtual shareholder meetings (which were expressly not intended to create a higher standard than for in-person meetings) and articulated 12 best practices. A number of the suggested best practices, such as creating formal rules of conduct and establishing reasonable time guidelines, appear applicable to in-person meetings as well as virtual meetings. Best practices identified in the white paper that specifically relate to virtual meetings include ensuring equal access for shareholders attending on a virtual basis by opening video, websites and telephone lines before the meeting to let shareholders test their access and providing a technical support line for shareholders that may have questions about accessing the webcast. The white paper also suggested that the items voted upon at a meeting should be relevant to the decision of an annual meeting format.

At this point, virtual meetings have become part of the proxy season landscape. Companies hosting virtual meetings often emphasize shareholder engagement as well as cost savings and observe that web participation may exceed physical attendance, allowing shareholders the ability to attend the annual meeting from any location around the world. Thus, using technology provides a platform that encourages meaningful shareholder engagement at the annual meeting.

Companies considering or planning a virtual meeting should begin preparations early. They should confirm that their governing law permits virtual meetings and that their charter and by-laws contemplate the practice. Companies conducting virtual meetings must decide whether they will retain an in-person component of the meeting and whether the virtual component will be audio-only or will include video. Other important aspects of a virtual meeting include how to handle shareholder questions and whether to permit those who are not shareholders to observe the virtual meeting or to limit access to shareholders. Finally, it is critical for companies conducting virtual meetings to be sure the technology is in place and adequately tested before the meeting.

Disclosure Update and Simplification

On August 17, 2018, the SEC amended certain of its disclosure requirements that it determined to be redundant, duplicative, overlapping, outdated, or superseded, in light of other SEC disclosure requirements, US GAAP, or changes in the information environment. These rule changes, which become effective 30 days after publication in the Federal Register, include amendments involving Regulation S-K and Regulation S-X and will impact periodic filings. Therefore, it will be particularly important this year for companies to do an updated form check when preparing their upcoming filings with the SEC, including annual reports on Form 10-K and the financial statements contained therein.

According to the adopting release, the “amendments are intended to facilitate the disclosure of information to investors and simplify compliance without significantly altering the total mix of information provided to investors.” As part of that process some disclosure requirements have been modified, eliminated or consolidated with other disclosure requirements. In addition, companies should be aware that the movement of some disclosure items from outside to inside the financial statements, and from inside to outside the financial statements, impacts audit review, XBRL tagging requirements and the ability to rely on the forward-looking safe harbor language under the Private Securities Litigation Reform Act of 1995. Companies should consider whether they need to update their disclosure controls and procedures and their internal control over financial reporting in light of these amendments. Companies should work closely with their outside auditors to identify the changes they will need to make to their audited financial statements and other financial information included in their filings with the SEC. For more information about these amendments, see our Legal Update “Capital Markets Implications of Amendments to Simplify and Update SEC Disclosure Rules,” dated August 29, 2018.

Cybersecurity Disclosure

On February 21, 2018, the SEC published interpretive guidance to assist public companies in preparing disclosures about cybersecurity risks and incidents, updating and expanding upon CF Disclosure Guidance: Topic No. 2, which was issued by the Staff in 2011. In addition, the guidance addressed the importance of policies and procedures related to cybersecurity disclosures, including insider trading.

Consistent with the 2011 Staff guidance, the 2018 guidance, which was issued by the SEC’s commissioners, reiterated that companies should consider the materiality of cybersecurity risks and incidents when preparing the disclosure for registration statements under the Securities Act of 1933 and the Exchange Act and for periodic and current reports under the Exchange Act.

While the existing disclosure requirements of the federal securities laws do not specifically refer to cybersecurity risks and incidents, the 2018 guidance emphasized that there are a number of reporting items that may require disclosure of cybersecurity risks and incidents. Depending on the particular facts and circumstances, these areas include business and operations, risk factors, legal proceedings, management’s discussion and analysis of financial condition and results of operations, financial statements, disclosure controls and procedures, and corporate governance. For further details, see our Legal Update “SEC Issues Updated Guidance on Cybersecurity Disclosures,” dated February 28, 2018.

Public companies should make consideration of the SEC’s cybersecurity guidance an integral part of the 2019 proxy and annual report season process. Cybersecurity is a topic that the Staff may comment upon in its review of company disclosures. Moreover, deficient disclosures may lead to an SEC enforcement proceeding, which can be costly for a company, as evidenced by a $35 million penalty which the company formerly known as Yahoo! Inc. agreed to pay to settle charges that it misled investors by failing to timely disclose a data breach.

Risk Factors

Annually updating risk factors is a key component of preparing an annual report on Form 10-K or Form 20-F. Risk factors should be tailored for the specific issues affecting the company at the time of filing. While the prior year’s risk factor presentation can be the starting place for analysis, companies should consider whether it is appropriate to disclose new risks, to supplement or revise previously disclosed risks or to delete any risks. A few key developments that may impact risk factor disclosure for the 2019 proxy season are discussed below. However, appropriate disclosures will vary by company—there is no one-size-fits-all approach.

As discussed above, cybersecurity is recognized as a pervasive issue that impacts companies of all types, generating risks from both an economic and security perspective. Companies should assess whether they need to expand or revise their cybersecurity risk disclosures in their annual reports to avoid potentially incomplete or misleading disclosures. Updated cybersecurity disclosure can also be helpful from shareholder and customer perceptions to demonstrate that the company is aware of the significant impact of cybersecurity risk.

Companies should consider privacy-related risk factors, either in conjunction with a cybersecurity risk factor or as a free-standing risk factor. Privacy protection and breach remediation costs may be significant and concern over privacy breaches may impact consumer confidence, potentially resulting in lost business. Among other privacy issues, the European Union’s General Data Protection Regulation (GDPR), which became effective in 2018, could rise to material issues from an investor perspective and may increase the compliance burden for many companies. For example, it could require changes to a company’s business practices, impact a company’s ability to expand internationally or into additional lines of business and subject companies to sizable financial penalties, all of which could materially adversely affect the company’s profitability and outlook. Companies should determine whether they need to update or add a risk factor to address the impact of GDPR.

Changes in laws and regulations also may drive risk factor disclosures. For example, in the trade area, tariffs imposed, or even threatened, on imports could impact certain businesses while retaliatory tariffs on particular exports could affect others. Companies should consider whether they need to update their risk factors to reflect developments relating to potential withdrawal or modification of international trade agreements or sanctions. For some companies the application and uncertain interpretations of the tax reform that was signed into law on December 22, 2017 (Tax Act) may make it advisable to provide a new or updated risk factor. Companies that rely on foreign employees or consultants may need to discuss travel and immigration policies in their risk factors to the extent those policies make it more difficult and more expensive to hire the employees they need to conduct and grow their businesses.

Sustainability and climate change, and related legislation, regulation and treaties, impact the risk profile of many companies. Because concerns regarding these issues have been evolving, the necessity for and scope of a risk factor in this area is something that companies should carefully review.

There are other risks that may impact certain companies. For example, companies in the health or pharmaceutical industry may need to discuss the health crisis involving opioid abuse. Companies impacted by Brexit may need to include or update risk factors for the current status of Brexit negotiations. Some companies include shareholder activism as a risk factor, either as part of a litany of matters that can impact the share price or as a separate risk factor describing how the company’s business could be impacted as a result of actions by activist shareholders or others. It is an important exercise for each company to evaluate and articulate the particular risks that are applicable to it.

Accounting Impact of Tax Reform

SEC Staff Accounting Bulletin No. 118 (SAB 118) provides guidance on the necessary disclosures related to the accounting impact of the Tax Act. Specifically, SAB 118 establishes a three-part procedure for companies to follow when accounting for and reporting the income tax effects of the Tax Act in financial statements that include a reporting period in which the Tax Act was enacted:

- Reflect the income tax effects of the Tax Act in which the accounting under ASC Topic 740 is complete on a non-provisional basis;

- Report provisional amounts for those specific income tax effects of the Tax Act for which the accounting under ASC Topic 740 is incomplete but a reasonable estimate can be determined; and

- Continue to apply ASC Topic 740 based on the provisions of the tax laws that were in effect immediately prior to the enactment of the Tax Act for any specific income tax effects of the Tax Act for which a reasonable estimate cannot be determined.

When preparing financial statements for their annual reports for the 2019 proxy season, companies should continue to take into account the guidance of SAB 118, including the requirements to include narrative explanations necessary to provide information about the material financial reporting impacts of the Tax Act. In particular, companies should consider whether they have more information regarding the effect of the Tax Act than they included previously. For more information on SAB 118, see our Legal Update, “SEC Staff Issues Guidance on Accounting and Reporting Impacts of Tax Cuts and Jobs Act,” dated January 2, 2018.

Auditor Report Requirements

Last year, the standard for unqualified auditor reports of financial statements changed. Among other things, auditor reports now must disclose the year in which the auditor began serving consecutively as the company’s auditor. In addition, the changes were made to the auditor report to clarify the auditor’s role and responsibilities and to make the auditor report easier to read.

An upcoming change specified by the new standard requires that the auditor report disclose any critical audit matters (CAM) or state that the auditor determined that there were no CAMs. Any matter arising from the audit of the financial statements that was communicated or required to be communicated to the audit committee will be a CAM if it:

- relates to accounts or disclosures that are material to the financial statements, and

- involves an especially challenging, subjective, or complex auditor judgment.

The CAM provisions will become effective for audits of fiscal years ending on or after June 30, 2019, for large accelerated filers and for fiscal years ending on or after December 15, 2020, for all other companies to which the requirements apply. Although CAM disclosure is not required for the 2019 proxy season, companies should be planning for the CAM disclosure at this time by discussing it with their independent auditors and making sure the audit committee understands the ramifications of this new requirement. It may be useful for companies and their auditors to conduct “dry runs” regarding CAM disclosure in the coming year to get themselves ready for this important upcoming requirement.

Iran Disclosures

The Iran Threat Reduction and Syria Human Rights Act of 2012 (ITRA) continues to require any company that is required to file annual or quarterly reports under Section 13(a) of the Exchange Act (which includes companies listed on a US securities exchange) to disclose in those reports whether, during the period covered by the subject report, it or any affiliate has knowingly engaged in certain sanctionable activities, regardless of whether those actions violate US law. There is no materiality threshold. The ITRA disclosure requirement is statutory. There is no corresponding SEC regulation and the ITRA disclosure requirement is not referenced in the instructions for SEC annual or quarterly report forms. Companies should be sure that they are evaluating ITRA compliance as part of their annual (and quarterly) reporting process.

Changes to Form 10-K Cover Page

There are two technical changes to the cover page of annual reports on Form 10-K this year. (Similar changes will need to be made in quarterly reports on Form 10-Q, and registration statements filed under the Securities Act, as applicable.)

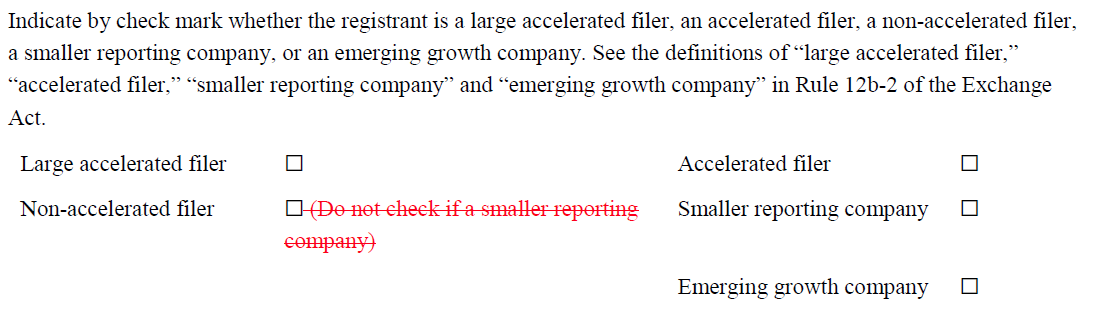

One change eliminates the instruction informing filers to not check the “Non-accelerated filer” box if the issuer is a smaller reporting company, as shown below:

The second change relates to the SEC’s adoption of the inline XBRL format for the submission of operating company financial statement information. The new inline XBRL format does not apply to upcoming annual reports on Form 10-K for calendar year 2018 because the transition schedule does not require compliance for any fiscal period ending before June 15, 2019. However, the SEC has already implemented changes to the Form 10-K cover page to reflect the fact that the Inline XBRL amendments eliminate the need for operating companies to file separate XBRL exhibits or post an interactive data file on their websites, as shown below:

Comparable changes relating to XBRL need to be made to the cover page of annual reports on Form 20-F and Form 40-F, with corresponding changes to the instructions. For more information on the Inline XBRL requirements, see our Legal Update “SEC Adopts Inline XBRL Rule,” dated July 10, 2018.

Exhibit Hyperlinks

The SEC now generally requires the exhibits listed in the exhibit index of specified filings, including annual reports on Form 10-K or Form 20-F, to be hyperlinked. The hyperlink requirement covers both exhibits that are filed as part of a report and exhibits that are incorporated by reference to prior filings. The technical instructions for providing the required hyperlinks are contained in Chapter 5 of Volume II of the EDGAR Filer Manual. Note that Item 601(a)(2) of Regulation S-K and Item 102(d) of Regulation S-T require the exhibit index to appear before the required signatures in the registration statement or report.

Because annual reports on Form 10-K or Form 20-F often contain a long list of exhibits that are incorporated by reference to prior filings, it is worthwhile to double check the hyperlinks for exhibits that are being carried forward from the exhibit index contained in last year’s annual report to confirm that each properly links to the identified document. SEC rules require that incorrect hyperlinks be fixed.

For more information on the exhibit hyperlink requirement, see our Legal Update “SEC Requires Hyperlinks for Exhibits in Company Filings,” dated March 9, 2017, and our Legal Update “Get Ready to Hyperlink SEC Exhibit Filings Beginning September 1,” dated July 20, 2017.

The complete publication, including footnotes, is available here.

Print

Print