Markus Brunnermeier is Professor of Economics at Princeton University, and Marco Pagano is Professor of Economics at University of Naples Federico II. This post is based on an article authored by Professors Brunnermeier and Pagano, in collaboration with Luis Garicano, Professor of Economics and Strategy at London School of Economics; Philip R. Lane, Professor of Political Economy at Trinity College London; Ricardo Reis, Professor of Economics at London School of Economics; Tano Santos, Professor of Finance at Columbia Business School; David Thesmar, Professor of Finance at HEC Paris; Stijn Van Nieuwerburgh, Professor of Finance at NYU; and Dimitri Vayanos, Professor of Finance at London School of Economics.

From 2009 to 2012, the euro area was roiled by financial crisis. In Greece, Ireland, Italy, Portugal, and Spain, perceptions of euro area sovereigns’ default risk shot up; banks approached insolvency and struggled to obtain funding. The “diabolic loop” between the credit risk of sovereigns and that of banks was a hallmark of the crisis. In our paper, forthcoming in the American Economic Review: Papers and Proceedings, we propose a simple model of this sovereign-bank diabolic loop, and show that it can be avoided by restricting banks’ domestic sovereign exposures relative to their equity. Furthermore, we show that equity requirements can be reduced if banks only hold the senior tranche of an internationally diversified sovereign portfolio—known as ESBies (European Safe Bonds) in the euro-area context.

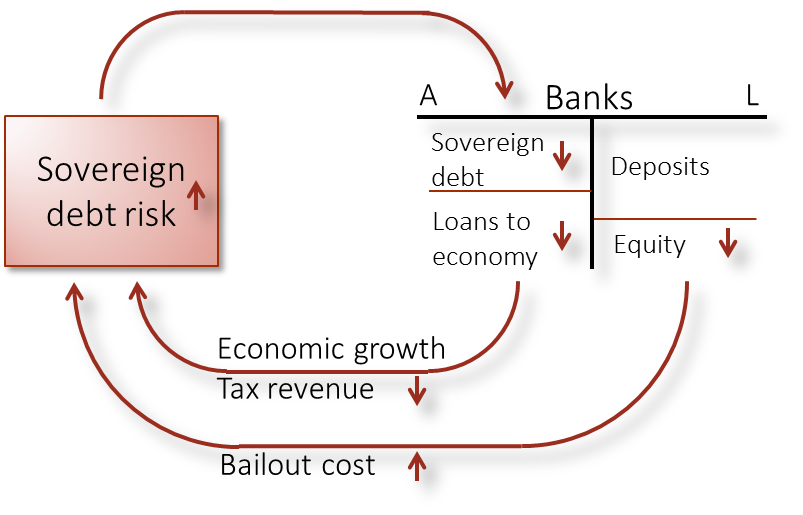

The euro-area crisis illustrates that the sovereign-bank diabolic loop really consists of two distinct but mutually reinforcing feedback loops: a “bailout loop” and a “real economy loop.” First, the deterioration of sovereign creditworthiness reduced the market value of banks’ holdings of domestic sovereign debt. This reduced the perceived solvency of domestic banks, which in turn increased the chances that banks would have to be bailed out by their (domestic) government, and thus increased sovereign distress even further, engendering a bailout loop. Second, as distressed banks cut back on lending, they triggered a reduction in economic activity and tax revenue, which also contributed to weakening government solvency in these countries, triggering a real-economy loop.

There are three ingredients to these feedback loops. First, the home bias of banks’ sovereign debt portfolios, which makes their equity value and solvency dependent on swings in the perceived solvency and market value of their own government’s debt (Carlo Altavilla, Saverio Simonelli and Marco Pagano, 2015). Second, the inability of governments to commit ex-ante not to bailout domestic banks, since bailout is optimal once banks are distressed. Third, free capital mobility, which ensures that international investors’ perceptions of future government solvency—whether warranted by fiscal fundamentals or not—are incorporated in the market value of domestic government debt. To break these loops, policy must remove at least one of these three ingredients. So far, capital controls are the only policy remedy adopted in response to the diabolic loop, in Cyprus and Greece.

In our paper, we analyze the proposal by Brunnermeier et al. (2011), which aims to eliminate the diabolic loop by reducing the sensitivity of banks’ sovereign debt portfolios to domestic sovereign risk. The proposal envisions that banks’ sovereign bond holdings would consist mainly of the senior tranche of a well-diversified portfolio. This seniority structure could be achieved via a simple securitization, whereby financial intermediaries use a well-diversified portfolio of euro-area sovereign bonds to back the issuance of a senior tranche, labeled European Safe Bonds (ESBies), and a junior tranche, named European Junior Bonds (EJBies).

ESBies would have very little exposure to sovereign risk, owing to the “double protection” of diversification and seniority: relative to a simple diversified portfolio of sovereign debt, ESBies would enjoy the additional protection provided by seniority, as the impact of a sovereign default would be absorbed in the first instance by the junior tranche, which would not be held by banks.

Our model shows that restricting euro-area banks to hold ESBies would effectively isolate banks from domestic sovereign risk, and thereby defuse the diabolic loop between sovereign and bank credit risk. Interestingly, both features of ESBies—diversification and seniority—are needed. On the one hand, the price of a diversified but not tranched sovereign debt portfolio would still depend on swings in the perceived creditworthiness of euro area governments, especially if they are correlated across countries due to a generalized “flight to quality.” On the other hand, tranching the sovereign debt of an individual country does not produce enough safe domestic securities in countries with weaker fiscal positions or limited sovereign debt issuance. In contrast, performing the tranching on a large pool of imperfectly correlated sovereign bonds would generate a large stock of an essentially risk-free euro-area sovereign asset, the liquidity and safety of which would be attractive for both banks and non-banks.

Last but not least, the issuance of such a security would not require any form of fiscal solidarity among euro area governments: each government would remain entirely responsible for its own solvency, and the market price of its debt would remain a signal of its perceived solvency. This absence of joint liability stands in contrast to euro-bond proposals, such as the blue-red bond proposal by Jakob Von Weizsacker and Jacques Delpla (2011).

The full article is available for download here.

Print

Print