Sarah Keohane Williamson is CEO, Ariel Babcock is Head of Research, and Allen He is Associate Director at FCLTGlobal. This post is based on their FCLTGlobal memorandum. Related research from the Program on Corporate Governance includes The Uneasy Case for Favoring Long-term Shareholders by Jesse M. Fried (discussed on the Forum here).

Executive Summary

Effective long-term capital allocation is fundamental for innovating and creating value; investment in research and development (R&D) fuels this growth. Successful R&D can be transformational for an organization and for broader society. But while worldwide spending on R&D has slowly increased, R&D returns have been declining. What’s driving this decline? Emerging evidence suggests a short-term mindset lies at the heart of this puzzle.

R&D spending, especially long-horizon R&D project spending, faces a unique set of short-term pressures relative to other types of long-term investment. When facing short-term financial pressures, behavioral biases including manager risk aversion and uncertainty around forecasting potential future returns (among other things) lead to a tendency among management teams to cut long-horizon projects first. The declining tenure of managers, the lack of innovation-linked metrics in incentive compensation plans, the typically asymmetric return profile of long-horizon projects, and an investment community that often ignores the potential impact of long-horizon innovation spending in a company’s valuation analysis all contribute to this problem.

Our research suggests the tendency to cut long-horizon projects has left companies and investors with unbalanced innovation portfolios, favoring short-term projects that offer more certain, albeit ultimately lower, incremental returns. Unfortunately, it is often those same long-horizon projects, left on the cutting room floor, that deliver the most long-term value creation potential. The overweighting of short-term projects sacrifices significant return potential offered by long-horizon, transformational innovation, and similarly transformational returns.

Alternative ways to structure, value, and manage long-horizon R&D investments could bring R&D portfolios back into balance, delivering better returns across the investment value chain. Companies can make a variety of changes across their strategy, governance, engagement, and incentive plans to support long-horizon innovation spending—and investors can support this shift by engaging around companies’ R&D investment philosophies and rewarding companies for the optionality offered by long-horizon innovation investment. Getting these activities right is essential.

Funding the Future: Investing in Long-horizon Innovation

Effective long-term capital allocation is fundamental for innovating and creating value, and investment in R&D helps fuel this growth.

Research from FCLTGlobal and others confirms that long-term companies outperform others on financial metrics, including revenues, profitability, and stock price, as well as nonfinancial ones like job creation and sustainability. As demonstrated in our report, Predicting Long-term Success, effective capital allocation is fundamental for creating this long-term value. In fact, this research suggests companies that reinvest a greater portion of their earnings back into the company deliver returns on invested capital that outperform their peers by 9 percent per year on average.

In combination with other uses of capital (fixed investment or capital expenditures, mergers and acquisitions, and return of capital to shareholders), investment in R&D contributes to the foundation for future growth. The returns on successful R&D are often significant and can be transformational for an organization and for the broader society in which it operates. This positive contribution from R&D has been well documented:

- Eberhart, Maxwell, and Siddique (2002) examined U.S. firms that increased R&D expenditures by an economically significant amount between 1974 and 2001, and found significantly positive long-run abnormal operating performance and abnormal stock returns following the increase.

- Lev, Radhakrishnan, and Ciftci (2006) evaluated performance of R&D leaders and followers, and found R&D leaders earned significant excess future returns, higher future sales growth, and higher returns on assets, while R&D followers earned the average return.

- Su, Chen, and Chang (2009) found that Taiwanese firms that made economically significant increases in their R&D expenditures exhibited abnormal excess stock returns.

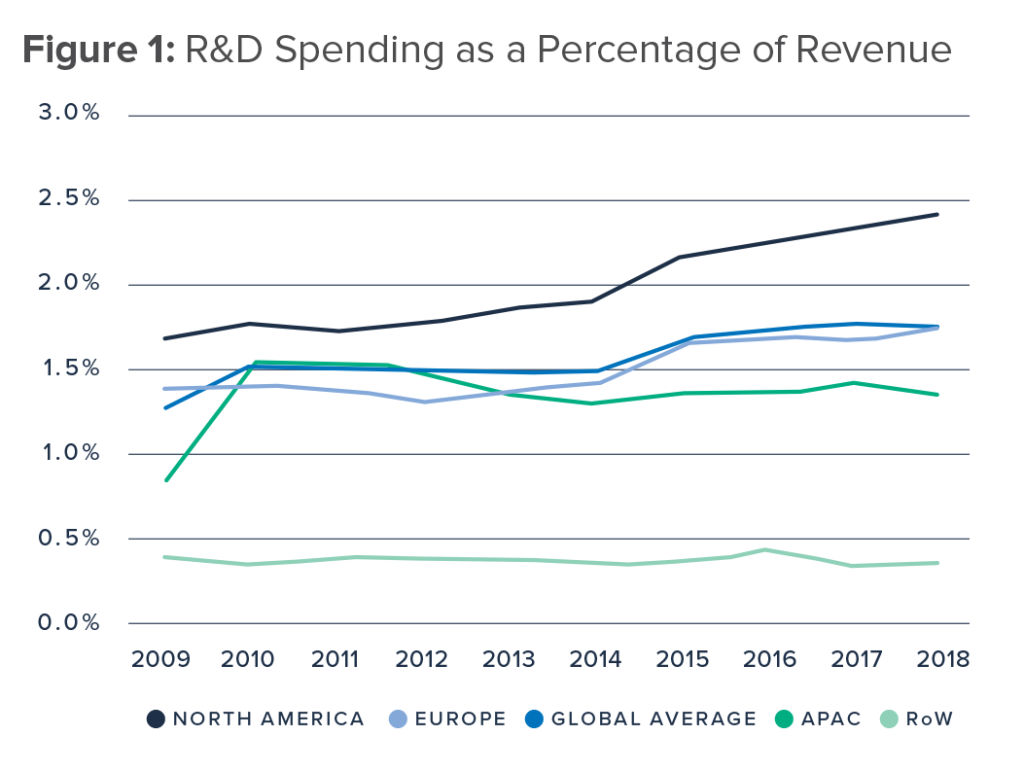

Worldwide spending on R&D has slowly increased, but returns have been declining. Over the past 10 years, total global R&D spending has grown—on both an absolute basis (from $374 billion in 2009 to $778 billion in 2018) and as a proportion of global corporate revenue (accounting for 1.7 percent of revenue in 2018, up from 1.3 percent in 2009).

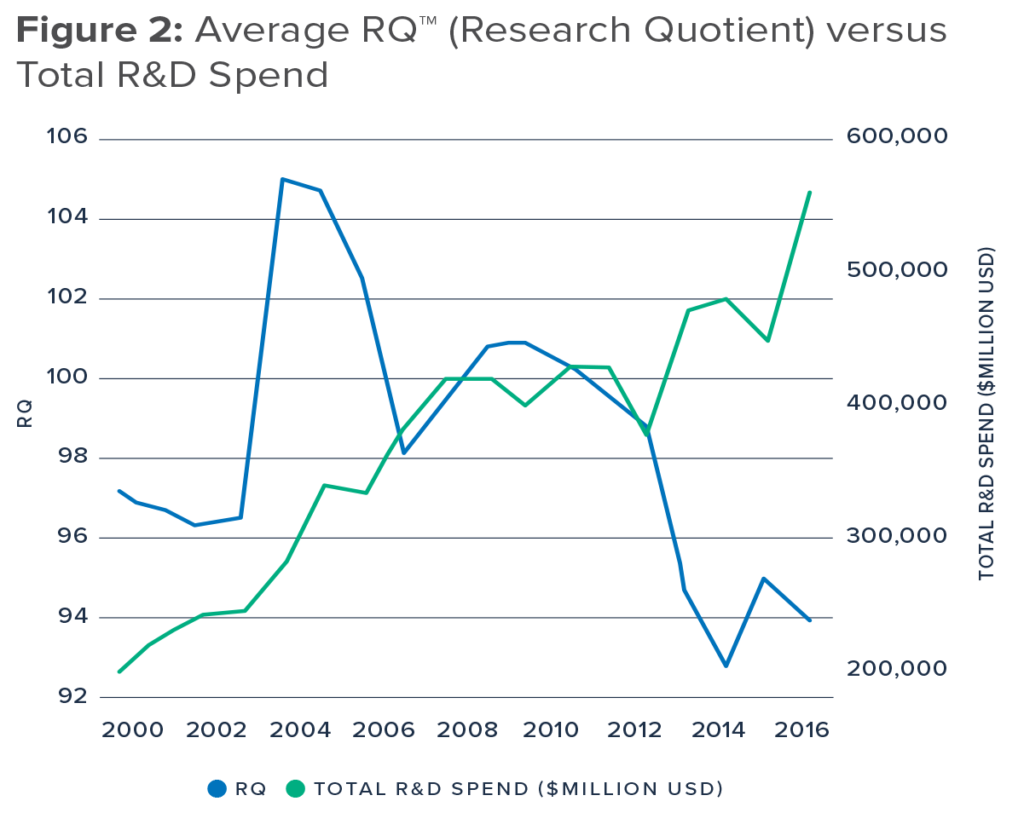

But the productivity of that additional investment has been declining. According to research by Professor Anne Marie Knott of the Olin Business School at Washington University in St. Louis, across industries the marginal returns on additional R&D spending have been falling for over a decade. Curtis, McVay, and Toynbee (2019) evaluated the relationship between R&D spending and cumulative net income over the subsequent five years, and agreed with Knott, noting, “We find evidence of an economically and statistically significant decline in average R&D profitability over time.”

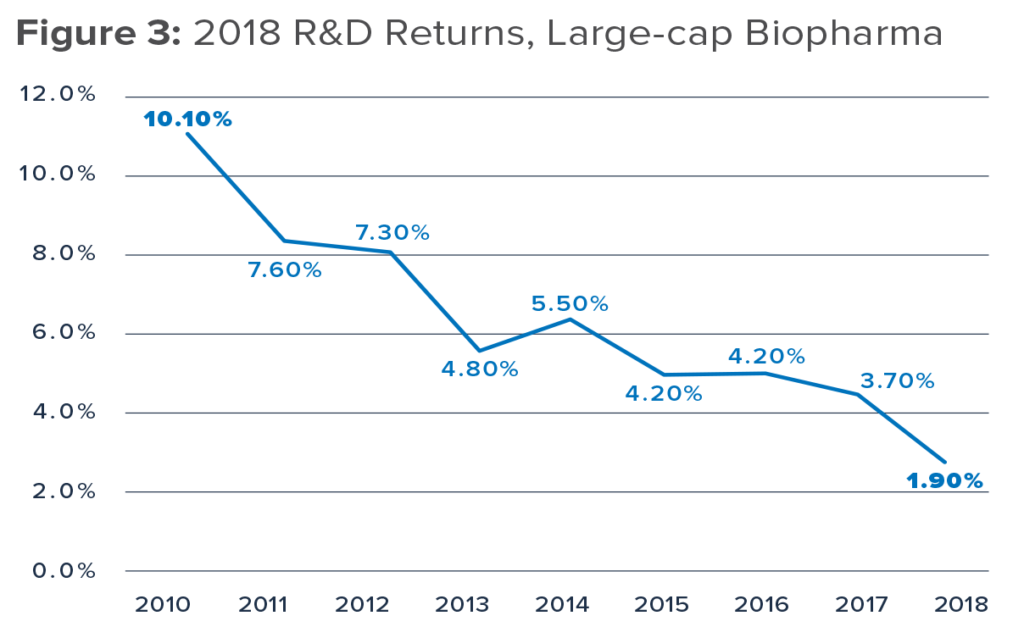

This decline in returns is even more evident in key industries like biopharma. Deloitte’s 2018 examination of the biopharma industry found that the costs to bring an asset to market had increased to record levels ($2.2 billion in 2018 versus $1.2 billion in 2010), while returns on R&D investment had fallen to their lowest level in nine years (1.9 percent return in 2018 versus 10.1 percent in 2010).

What is behind this global decline in returns on R&D, and on investment in innovation more broadly?

Emerging evidence suggests that a short-term mindset lies at the heart of this puzzle.

R&D spending, especially long-horizon R&D project spending, faces a unique set of short-term pressures relative to other types of long-term investment. The issue stems from greater uncertainty around forecasting future potential returns on often riskier and longer-horizon projects. This inherent uncertainty may contribute to the tendency for long-horizon projects to be among the first items management teams cut when faced with short-term financial pressures. Professor Gerben Bakker of the London School of Economics succinctly described the problem of allocating capital to R&D: “The financing of R&D is made difficult by five challenges: the presence of sunk costs, real uncertainty, long and open-ended time lags between outlays and pay-offs, adverse selection, and moral hazard.”

Unfortunately, it is often those same long-horizon projects that could deliver the most long-term value creation potential. As one member of our working group observed, “There is an asymmetry inherent in R&D returns. That fat tail means long-term, transformational R&D doesn’t have to be successful more than 50 percent of the time in order to be worthwhile.”

Nagji and Tuff illustrated this same point in a 2012 Harvard Business Review article, demonstrating that long-horizon, transformational R&D delivers the vast majority (approximately 70 percent) of returns on R&D expense.

Informed by this 2012 research, a new explanation has emerged for the persistent decline in returns on R&D over the past decade-plus. Our analysis suggests the tendency to cut long-horizon projects has left companies and investors with unbalanced innovation portfolios that favor short-term projects delivering more certain, albeit ultimately lower, incremental returns. The overweighting of short-term projects, generally a reliable near-term strategy, sacrifices significant return potential offered by long- horizon, transformational innovation and similarly transformational returns. Our research suggests this behavior is responsible for the decline in R&D productivity—and in returns on R&D more broadly.

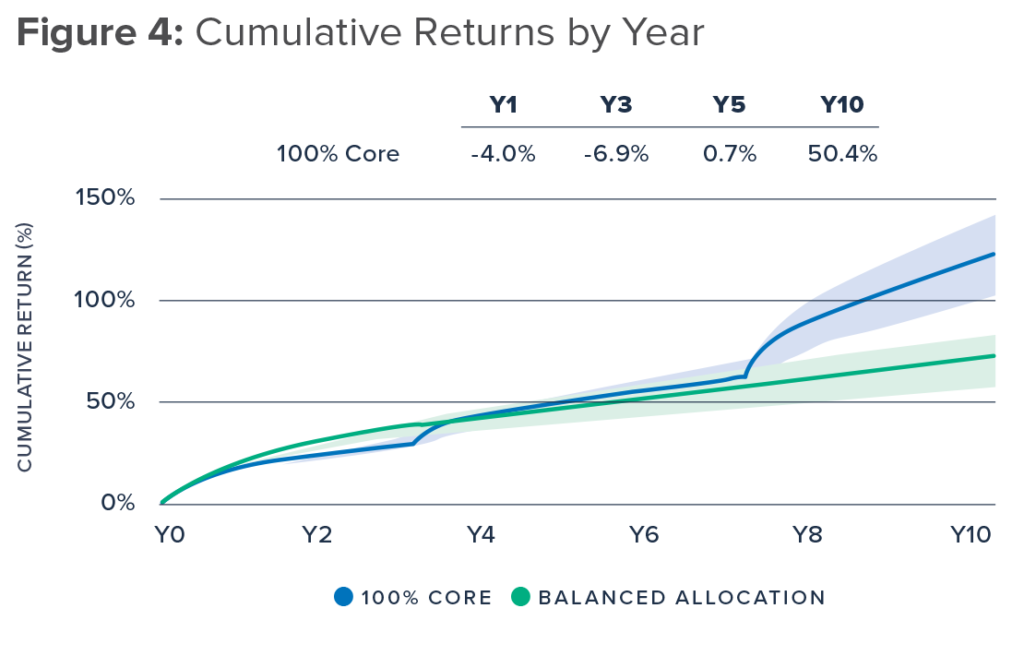

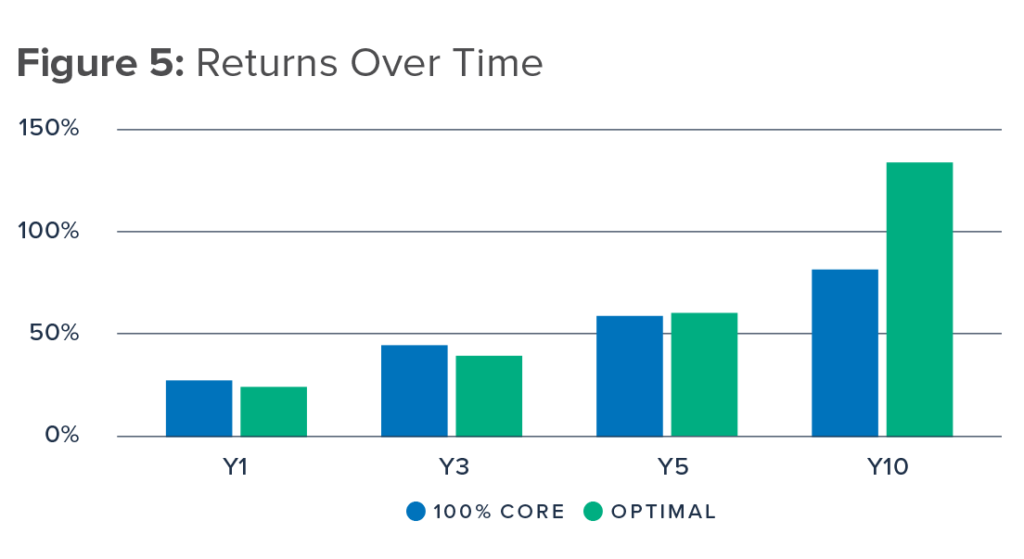

As demonstrated in Figure 4, a management team opting to allocate 100 percent of its innovation capital to short-term core product innovation would deliver better performance in the first five years as compared with a peer team allocating a balanced 70 percent/20 percent/10 percent mix of capital to short/medium/long projects. But that 100 percent allocation to short-term projects looks like a mistake for companies and investors with longer time horizons as the returns from the more balanced allocation to longer-term, potentially transformational innovation starts to materialize.

In Figure 5, we assume the average return on a firm’s core investment is 10 percent per year, over 10 years, while the return of its longer-term investments is several times that but takes until anywhere from three to seven years to meaningfully materialize. Here, an industrials company with a 70/20/10 mix would give up a little over 2 percent per year in returns over the first three years (against a peer with a 100 percent core allocation) for the potential to significantly increase its expected returns by more than 50 percent over 10 years.

To help companies and investors visualize and evaluate the impact their R&D investment allocation decisions have on long-term return opportunities, FCLTGlobal has developed a dynamic R&D Scenario Engine based on this research.

The tool is available at https://www.fcltglobal.org/ rd-scenario-engine/.

Why Would Companies Cluster Their R&D Spending Around Short-Horizon or “Quick-Win” Projects?

- C-suite tenure has been declining, on both a mean and a median basis, and an executive team with a short window of opportunity might naturally prefer to invest in projects likely to bear fruit during its own tenure.

- Incentive compensation plans prioritize near-term results, likely magnifying the preference for “quick-win” projects.

- Longer-horizon projects are inherently riskier, and although they also often carry high reward to compensate for this additional risk, risk-averse decision makers are less likely to fund breakthrough projects.

- Financing for projects that may take years to come to fruition is more expensive when using external sources, a fact that could mean only firms mature enough to self-finance have the luxury of investing in long-horizon innovation opportunities.

- Investors and the stock market often fail to value meaningful R&D investment by public companies, potentially leading managers to cut R&D spending.

Short-term Behavior Contributes to the Clustering of R&D Spending

It’s not surprising that CEOs, with a median tenure of five years, would tend to overweight short-term projects with more certain return profiles in their R&D portfolios. Nor would it be surprising for CFOs, with median tenures near 3.3 years, to support this preference. Indeed, such overweighting could be a valid choice for many managers concerned primarily with near-term results. Why might they prefer near-term results?

As Nesta demonstrated in a 2019 paper, even when innovation metrics are included in an executive compensation plan, “they are frequently outweighed by short-term financial measures which can be enhanced by cutting innovation.” There is also a behavioral element to this puzzle related to the risk preferences of managers that was highlighted by an experiment summarized in a recent National Bureau of Economic Research (NBER) paper. The authors found that even when financial rewards disproportionately encouraged the choice of higher-risk breakthrough projects, decision makers consistently selected lower-risk projects for funding, a behavior that likely has an outsized impact on the availability of capital for transformational innovation.

Another NBER paper took a different look at R&D, finding that external financing for innovation work is more expensive than internal financing and that the nature of R&D often does not lend itself to debt financing. These findings suggest that only mature firms with stable cash flows may have the luxury of investing in long-horizon projects, leaving less mature or cash-constrained firms to cluster their spending around projects with quicker potential payoffs. Finally, there is evidence that shareholders themselves often fail to appropriately value investment in R&D, and some might even discourage it in favor of surer bets (such as dividends).

In a series of in-depth interviews with experienced R&D managers conducted in 2019, we found anecdotal evidence that confirmed our suspicions about the shrinking time horizon of R&D investment portfolios. These experts similarly confirmed that short-horizon R&D projects (with expected payoffs less than five years into the future, and often as short as one to three years) tend to be stickier. Our interviews suggested that these quick-win projects account for the vast majority of R&D spending at publicly listed companies today:

“For years we cut long-horizon projects and instead invested a lot of resources into acquisition of late-stage drugs, opting for ‘buy’ versus ‘build.’ None of those deals worked and now we have a hole in our drug pipeline and a question mark hanging over future revenue projections.”

—SVP, Multinational Pharmaceutical Company“We don’t invest in anything with a payback period longer than three years out into the future.”

—Head of Investor Relations, Global Telecomm“Long-term potentially transformational projects are always underfunded, and no one questions you about cutting projects like that. Managers that propose cutting projects in that category almost always get cheered.”

—President, Mid-Cap Manufacturer

Practical Solutions to Bring R&D Portfolios Back into Balance are Within Reach

Alternative ways to structure, value, and manage long-horizon R&D investments could bring R&D portfolios back into balance, delivering better returns for investors, companies, and society.

Investors have a significant role to play in encouraging a more balanced approach to R&D investment. Taking into consideration the optionality offered by the innovation investments of portfolio companies when evaluating their valuation and investment potential is one place to start. And keeping in mind that those long-horizon investments likely have an asymmetric return profile is also helpful.

Next, engaging with companies to better understand their philosophy on managing R&D and their goals for innovation investment can lead to distinctive insights. Encouraging portfolio companies to share the breakdown of R&D budget by expected time to market, and the historical average or expected return for each time horizon, allows for a more detailed conversation about the prospects for the R&D portfolio and the rationale for the current allocation. And advocating for the disclosure of alternative metrics for measuring R&D success may be helpful.

Finally, evaluating how the R&D team is incentivized, whether those incentives are linked to executive compensation metrics, and how those metrics may inform the investor-corporate dialogue can help drive alignment.

Companies can make a variety of changes across their strategy, governance, engagement, and incentive plans to optimize their R&D portfolio.

R&D Optionality: A Technical Aside

In evaluating an R&D portfolio, investors can treat individual projects like a series of call options, each with short (core), medium (adjacent), and long (transformational) times to maturity. We know from the Black-Scholes option pricing model that the higher the volatility and the longer the time to maturity, the greater the value of the option. This structure can be applied to an R&D portfolio if we assume that volatility represents the volatility of future returns (or the uncertainty in predicting those potential returns) from a project, and time to maturity is equivalent to the time it takes to bring a product or innovation to market. All else equal, a Black-Scholes model would tell us that firms allocating more to long-horizon, transformational projects have greater potential and higher option value. But as seen in the R&D Scenario Engine, probability of success must also be considered: it is important to have a balanced mix between safe, low-risk projects and high-risk, high-reward “moonshots.” Investing in a company with an entire portfolio of transformational projects is like owning a series of far-out-of-the-money calls: high potential payoff, low chances of success, and on average a money-losing bet. But a company with an innovation portfolio that contains no risky bets whatsoever curtails any potential significant upside, a similarly poor result for both companies and their long-term shareholders.

Strategy

When it comes to R&D strategy, taking a portfolio approach to R&D investment has added value. By allowing members of the R&D team to work on multiple projects simultaneously, companies encourage the members of their innovation teams to take a more objective approach to evaluating a project’s potential prospects. Being staffed on multiple projects at any given time reduces behavioral biases related to project favoritism or career risk- related fears, while giving employees a fuller picture of the range of opportunities a company is pursuing. Similarly, allowing R&D teams to draw talent and expertise from across the organization to bring new perspectives and inspire cross-pollination of ideas has worked well for companies like Google.

In addition to internal perspectives, bringing in the viewpoints of potential customers early in the design process can be incredibly valuable. As one robotics expert described, “We have to be careful in robotics to make sure we are creating products customers actually want, not simply products a robotics engineer would want. The earlier we can bring the customer perspective into the design process the better.”

Finally, partnering with external organizations or experts can tap new skills and thinking, share the risk, defray costs, and anchor a project—evidence from our interviews suggests long-horizon projects with external partners get cut less frequently, especially when those partners are potential customers.

Customers as Partners

Partnering directly with customers to develop products to meet a specific market need was a famous strategy of Thermo Electron’s (now Thermo Fisher Scientific) Thermo Power division, which partnered with the natural gas industry to develop products specifically to run on that fuel.

According to one former manager of product development at Thermo Power, “These external partners kept our research and development on deadline while sharing the development risk and giving us certainty that there would be an end market customer for the ultimate product. All of those factors allowed the company to remain committed to long-horizon projects.”

Governance

There is a significant role for the corporate board in encouraging a more balanced approach to innovation. This role starts with educating the board about the innovation strategy and sharing periodic updates. Using performance metrics for short-, medium-, and long-horizon projects that acknowledge and account for the differences in project profile (in terms of risk-return) can also offer a more relevant frame of reference when evaluating a project’s performance and prospects.

Accelerating Toward a Minimum Viable Product

The idea of a minimum viable product for early testing and customer feedback is not new but was perhaps made most famous by Jeff Hawkins, the designer of the Palm Pilot. Hawkins carried around pieces of plywood carved into various shapes and button configurations. By using them to pretend to make notes and check his calendar, he tested early designs for the personal computing device that ultimately launched a new category of mobile computing.

Using scenario planning early in the development process can also prove valuable. As one R&D strategy consultant for Fortune 500 information technology companies explained, companies can use scenario planning to evaluate and document how a project might pivot if early milestones are not being met. And it is now more common for investors to ask about scenario planning. As one significant investor in innovation observed, “Companies are often not optimistic enough in their scenario analysis, worrying about downside or worst-case scenarios and not spending enough time on the blue-sky view—long- horizon R&D requires big thinking.” This big-picture thinking may be best described by one large-cap communications services company’s approach to breakthrough innovation, considering long-horizon projects in light of the question, “What could we learn?”, rather than, “How much could we make?”

Finally, the structure of the R&D team matters. For long-horizon projects, many companies use siloed teams removed from the business units to allow team members space outside of the usual pressures that come with being part of a business unit’s profit and loss statement. Royal DSM has transformed from its early roots as a coal company more than 100 years ago to a sustainability- and science-based company today. That transformational mindset has been taken up by DSM’s Innovation Center, a unit specifically tasked with driving long-term innovation outside the scope of the mainstream business.

One multinational household and personal products company takes a similar approach to siloing its longer-term R&D, explaining the rationale for this separation simply, “When innovation is everyone’s job it ends up becoming no one’s job. You can’t expect transformational innovation from people who have other day jobs, and you certainly can’t expect them to develop products that would cannibalize their current best sellers.”

Engagement with Investors

Gaining investor support for long-horizon innovation investment requires enhanced communication. Many aspects of engagement and disclosure related to R&D and innovation spending will necessarily be industry and company specific, but a few common themes came through in our discussions with investors. Sharing the breakdown of the R&D budget, segmented by expected time to market, is one way to give additional detail, and including the historical average return or expected return for each time horizon segment can also be helpful. This level of detail is becoming common for companies in the biotech or pharmaceutical industries but could be useful for other sectors as well.

Discussing potentially transformational or “moonshot” projects in terms of the long-dated option value they offer can frame the opportunity that long-horizon R&D spending might bring. Investors are used to thinking about their own investment portfolios in light of the optionality certain investments might present, so giving them the tools to evaluate a company’s innovation investment portfolio in a similar light can be helpful. Reminding them that long-term “risky bets” tend to have asymmetric return profiles can also be helpful. Finally, sharing a summary of the scenario analysis to detail the range of potential outcomes contemplated by the company’s innovation investment strategy (not just the base case) allows investors to make their own assessment of the probability and likely magnitude of success.

Incentives

As the old saying goes, “What gets measured gets managed.” Incentivizing progress toward long- horizon R&D goals by setting interim milestones and deliverables can keep a project on track. As one R&D manager noted, though, “Ultimately an incentive plan should ask, ‘Did the innovation portfolio achieve the promised results?’ Rewards should follow that answer.” The other side of that coin is that organizations have come to allow for and incentivize “fast failure,” in order to alleviate behavioral biases that might keep loss- making projects alive for longer than necessary. Incentivizing fast failure borrows a venture capital approach to funding innovation. With an awareness that most projects will fail, identifying failures quickly helps prevent throwing good money after bad. Finally, some companies have begun to reward their innovation teams for cutting losses early on failing projects, by ensuring those project-related savings stay within the group and are available to redeploy toward more promising ideas.

A Deep Dive into Remuneration

Executive compensation today is often maligned as excessive and blamed for motivating behaviors that focus primarily on short-term financial performance. Still, inertia, market competition for C-suite talent, a “one-size-fits-all” peer comparison rationale, and plan design complexity create obstacles to remuneration design changes that could motivate longer-term behaviors. FCLTGlobal sees incentives as a key lever of long-term value creation and pursues work on this topic.

Conclusion

It is clear that effective long-term capital allocation is fundamental for innovating and creating value. Getting the balance right in R&D portfolios is essential for contributing to this growth. But for too long, that essential innovation spending has been clustered around short-horizon, lower-return projects, starving long-horizon and potentially breakthrough opportunities of capital. Alternative ways to structure, value, and manage long-horizon R&D investments could bring R&D portfolios back into balance, delivering better returns across the investment value chain. Companies can make a variety of changes across their strategy, governance, engagement, and incentive plans to bring R&D portfolios back into balance—and investors can support this shift by engaging around a company’s R&D investment philosophy and rewarding companies for the optionality (in terms of long-term value creation potential) that long-horizon innovation investment offers.

The complete publication, including footnotes, is available here.

Print

Print