Brian D. Feinstein is Assistant Professor of Legal Studies & Business Ethics at The Wharton School of the University of Pennsylvania; Peter Conti-Brown is Class of 1965 Associate Professor of Financial Regulation and Associate Professor of Legal Studies & Business Ethics at The Wharton School of the University of Pennsylvania; and Kaleb Nygaard is a Research Associate at the Yale Project on Financial Stability. This post is based on their recent paper. Related research from the Program on Corporate Governance includes Politics and Gender in the Executive Suite by Alma Cohen, Moshe Hazan, and David Weiss (discussed on the Forum here); and Duty and Diversity by Chris Brummer and Leo E. Strine, Jr. (discussed on the Forum here).

A crucial set of questions in banking law and corporate governance is what effect, if any, does the diversity of decisionmakers have on specific outcomes. The challenge in answering the question, though, is that the more senior these decisionmakers become, the further removed they are from the policy outcomes whose consequences we want to predict. These two areas are important examples of this phenomenon: in corporate governance, the diversity of corporate boards is a perennial question, despite the reality that boards function far removed from corporate decision-making. In banking, it is even more complex: given how much the public and private sectors interact in formulating bank policy, what is the consequence of the diversity of regulators?

In Board Diversity Matters: An Empirical Assessment of Community Lending at the Federal Reserve-Regulated Banks, we exploit some idiosyncratic aspects of US banking to render these questions answerable. We conclude that the increased presence of minority directors on the twelve regional Federal Reserve Banks—the quasi-governmental entities responsible for evaluating many commercial banks’ lending to underserved, and disproportionately majority-minority, communities—is associated with greater lending to these communities. In other words, the more diverse these boards, the better the outcomes for underserved minorities.

Our paper uses bank performance on Community Reinvestment Act (CRA) examination reports as a proxy for bank lending to underserved communities. This is a loose proxy; the CRA, despite its intention for encouraging precisely this lending, has been criticized as ineffective by critics from across the political divide. But it is important measure, nonetheless, in part because it is the only bank examination report that the public can ever see. The rest are bound by doctrines and practices known as “confidential supervisory information.”

We compare these examination grades—which range from Outstanding (1), Satisfactory (2), Needs Improvement (3), and Substantially Noncompliant (4)—to a unique database, available here, which documents the characteristics of the directors of the Federal Reserve Banks throughout its history. Controlling for race, we can then conclude that the diversity of the boards is positively correlated with high performance on the CRA examinations.

To become confident that this not a spurious correlation is no easy task. For example, the main methodological challenge in teasing out meaningful, robust correlations between diverse boards and outcomes in many private sector contexts is companies in the same industry strive to differentiate themselves from each other, thus inhibiting apples-to-apples comparisons.

The structure of the US banking system provides us with an opportunity to overcome this limitation, for a few different reasons. First, the twelve Federal Reserve Banks are organized by geographical district that they do not match state lines. Of the twelve Districts, only the Twelfth District, located in San Francisco, does not bifurcate a state line. In total, fifteen states are split into two different districts.

These splits provide our primary identification strategy. Examining outcomes in two Reserve Districts within a single state—and particularly outcomes near the in-state border between the two Districts—enables us to control for the state-level regulatory and supervisory environment, for state-level economic conditions, and the like. This analysis reports a substantively large and statistically significant connection between the proportion of Black and Hispanic Reserve Bank directors and Fed-regulated banks’ lending to underserved communities, as measured via CRA exam scores.

Second, the Federal Reserve System examines and regulates many—but, importantly, not all—banks in the United States. This permits a comparison between the Fed’s supervisory oversight of the CRA to other regulators, including the FDIC and the Comptroller of the Currency. When we do so, we find that the diversity of the Federal Reserve Bank boards have no outcome on the CRA scores of banks in those districts supervised by these other regulators.

Third, a change in the law in 2010 which precluded the participation of some Fed directors from part of their relevant oversight work allowed us to examine the consequences of that change for lending. And, consistent with our hypothesis that board diversity matters for these outcomes, diversity among these directors prior to the 2010 change are significantly correlated with lending outcomes; after 2010, we see null results.

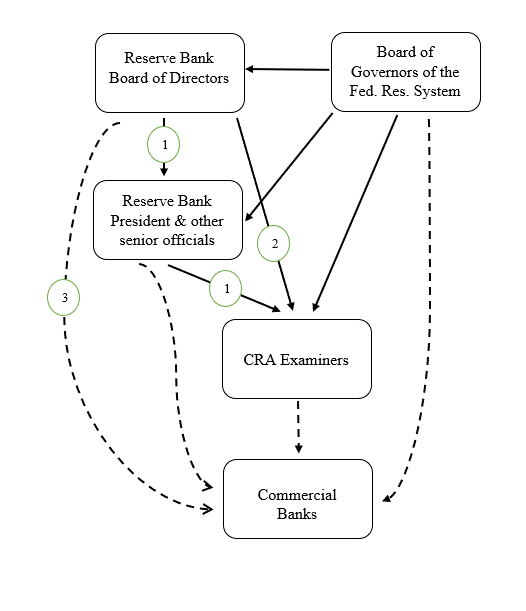

If we are confident that we have a robust correlation between board diversity and lending outcomes, we are less confident on the precise mechanism of that influence. But we hypothesize some of these, summarized in Figure 1 below.

Figure 1: Mechanisms of Board Influence on Lending Outcomes

The potential mechanisms, then, are three:

- Reserve Bank directors exercise indirect influence over CRA examiners because they select and monitor the senior employees at the Reserve Banks who, in turn, have direct supervisory oversight over those examiners.

- Directors may directly influence CRA examiners because the board maintains the legal option to appoint and remove lower-level Reserve Bank employees; and

- Directors may be able to influence member bank executives via “soft power,” given that the relationships between Reserve Bank directors and their communities—including the banking community—is deep.

If these hypothesized mechanisms are correct—and, in the paper itself, we provide evidence supporting each of these—then the conclusion that board diversity is an important policy goal for reasons other than symbolic representation, as important as that may be. Our paper is consistent with the policy conclusion that board diversity matters to lending outcomes.

The complete paper is available for download here.

Print

Print