Shaun Bisman is a Principal and Jared Sorhaindo is an Associate at Compensation Advisory Partners. This post is based on their CAP memorandum. Related research from the Program on Corporate Governance includes Politics and Gender in the Executive Suite by Alma Cohen, Moshe Hazan, and David Weiss (discussed on the Forum here); and Will Nasdaq’s Diversity Rules Harm Investors? by Jesse M. Fried (discussed on the Forum here).

ISS recently published its 2022 policy updates, which will go into effect for annual meetings held on or after February 1, 2022 (and, in some instances, February 1, 2023). This post discusses key updates made to ISS’ compensation and Environmental, Social and Governance (ESG) voting policies.

Executive Compensation-Related Update

Burn Rate

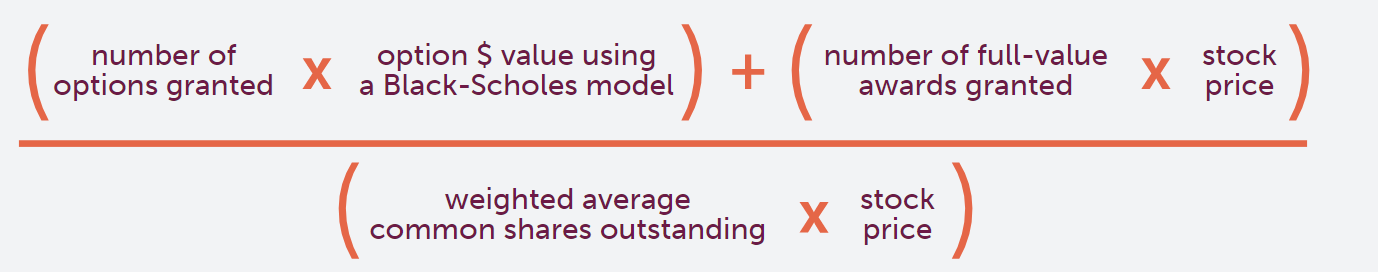

For stock plan valuations, ISS has changed its burn rate calculation, which will be in effect for meetings on or after February 1, 2023. The burn rate will be referred to as the “Value-Adjusted Burn Rate” and will be calculated as follows:

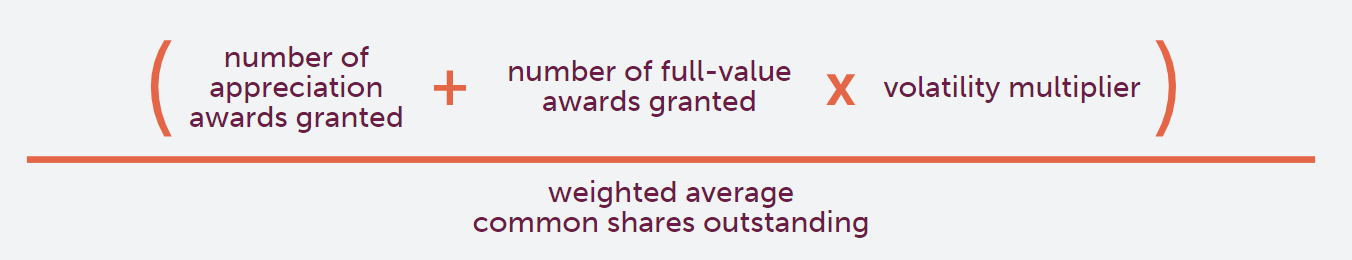

The calculation currently in effect is:

Note: The volatility multiplier is used to provide a more equivalent valuation between stock options and full-value shares and is based on a company’s historical stock price volatility.

Comment Letter on DOL ESG Proposed Rulemaking

More from: Max Schanzenbach, Robert Sitkoff

Robert H. Sitkoff is the John L. Gray Professor of Law at Harvard Law School and Max M. Schanzenbach is the Seigle Family Professor of Law at the Northwestern University Pritzker School of Law. This post is based on their comment letter to the U.S. Department of Labor. Related research from the Program on Corporate Governance includes The Illusory Promise of Stakeholder Governance by Lucian A. Bebchuk and Roberto Tallarita (discussed on the Forum here); Companies Should Maximize Shareholder Welfare Not Market Value by Oliver Hart and Luigi Zingales (discussed on the Forum here); and Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee by Robert H. Sitkoff and Max M. Schanzenbach (discussed on the Forum here).

We are writing in response to the proposed rulemaking [RIN 1210-AC03–Prudence and Loyalty in Selecting Plan Investments and Exercising Shareholder Rights] by the Department of Labor (the “Department”) on prudence and loyalty in selecting plan investments and exercising shareholder rights (the “Proposal”).

This response is based on our expertise in environmental, social, and governance (“ESG”) investing, especially ESG investing by trustees and other fiduciaries. We have undertaken several years of scholarly study of ESG investing by fiduciaries. Our article, “Reconciling Fiduciary Duty and Social Conscience: The Law and Economics of ESG Investing by a Trustee,” 72 Stanford Law Review 381 (2020) (“ESG Investing by a Trustee”), is the leading scholarly study on the topic. We enclose copy of ESG Investing by a Trustee as Exhibit A. In a consulting capacity for Federated Hermes, Inc., we have prepared several white papers and videos and conducted training sessions on ESG investing for trustees and other fiduciary investors. We have also lectured widely in scholarly and industry venues on ESG investing by trustees and other fiduciaries.

We previously commented on the Department’s 2020 rulemaking on financial factors in selecting plan investments (the “2020 Rule”). [1] Our comments were critical of the position taken in the preamble and some substantive aspects of the regulatory text that implied that ESG investing was inherently suspect. We note that the final rule was substantially altered in multiple respects responsive to our criticisms. READ MORE »