David A. Bell and Dawn Belt are partners and Ron C. Llewellyn is counsel at Fenwick & West LLP. This post is based on their Fenwick memorandum. Related research from the Program on Corporate Governance includes Politics and Gender in the Executive Suite (discussed on the Forum here) by Alma Cohen, Moshe Hazan, and David Weiss; Will Nasdaq’s Diversity Rules Harm Investors? (discussed on the Forum here) by Jesse M. Fried; and Duty and Diversity (discussed on the Forum here) by Chris Brummer and Leo E. Strine, Jr.

The intense focus on board diversity from a variety of stakeholders over the last several years has spurred many companies to examine the composition of their boards and to take action to diversify their boardrooms. While the boards of U.S. companies have slowly diversified over time, the pace of diversification has accelerated since 2018 as a result of legislation and other initiatives, particularly following the calls for racial justice in 2020.

In this post we examine these recent trends in board diversity and other developments in 2022, with a particular focus on efforts to increase racial and ethnic board diversity. In doing so, we examine the board racial/ethnic diversity disclosure practices and resulting demographic data gleaned from the companies in the Standard & Poor’s 100 Index (S&P 100) and the technology and life sciences companies included in the 2022 Fenwick-Bloomberg Law Silicon Valley 150 List (SV 150). For the 2022 proxy season, which generally ran from July 1, 2021 through June 30, 2022, 146 of the SV 150 companies filed proxy statements.

Key Takeaways Include:

- All of the S&P 100 and 83% of the SV 150 companies provided racial/ethnic board diversity

data in their proxy statements for the 2022 proxy season. - The majority of companies in each group disclosed the racial/ethnic composition of their

boards by specific racial/ethnic categories. - Racial and ethnic minorities have experienced recent gains in board representation, but still

face many of the same challenges encountered by women. - One can extrapolate even from the limited number of companies that disclose racial and

ethnic diversity information that both the S&P 100 and the SV 150 are significantly far from

proportional board representation for racial and ethnic minorities compared to the national

workforce at-large. - The demand for greater diversity on U.S. corporate boards and related disclosure of such

information will likely continue until equitable gender, racial and ethnic representation is

achieved.

Board Gender Diversity – Recent Progress

This report builds on, and should be read in conjunction with, our prior reports examining board diversity, see 2022 Corporate Governance Practices and Trends and Gender Diversity Survey 2020 Proxy Season Results. As we discuss in those reports, legislation and various corporate and stakeholder initiatives have resulted in tangible gains in board representation for women in recent years. Companies in both the S&P 100 and SV 150 saw significant increases in the number of women directors. For the 2022 proxy season, women constituted 32.3% and 32.5% of S&P 100 and SV 150 directors, respectively.

The rates of increase in gender diversity have increased at a higher rate for SV 150 companies than for S&P 100 companies, allowing SV 150 companies to surpass their percentage of women directors for the first time in 2022. However, despite these recent gains, women still remain underrepresented in the boardroom when compared to the workforce at-large.

As we will explore further, racial and ethnic minorities have also experienced recent gains, but still face many of the same challenges encountered by women. To put these gains and challenges into context, it is important to recap some of the forces that have created the current environment.

Despite recent gains, women still remain underrepresented in the boardroom.

Legal Requirements

Nasdaq Rules

As we discussed in our earlier alert, in August 2021, the U.S. Securities and Exchange Commission (SEC) approved listing rules that require a Nasdaq-listed company to have at least two diverse directors (including at least one woman and one member of an underrepresented minority or who self-identifies as LGBTQ+) or explain why it failed to meet the requirement in its proxy statement (or Form 10-K) or on its website, subject to certain exceptions. The rules also require annual board diversity disclosure that provides gender, racial/ethnic and LGBTQ+ demographic information in a matrix format.

The rules allow for disclosure of demographic information on an aggregated basis, but companies must report according to the specific categories included in the EEO-1 Reports that companies are required to file with the U.S. Department of Labor. The company must provide these disclosures in its proxy statement (or its Form 10-K if it does not file a proxy statement), or on its website. Companies must have their first diverse director (or explain the lack of diversity) by December 31, 2023, and their second diverse director by December 31, 2025 for Nasdaq Global Select Market and Nasdaq Global Market companies, and by December 31, 2026 for Nasdaq Capital Market companies.

The Nasdaq board diversity rules have been challenged by activists in Alliance for Fair Board Recruitment et al. v. SEC, in which the petitioners have argued that the rules violate the U.S. Constitution by conferring preferential status on racial minorities, women and members of the LGBTQ+ community. Specifically, they claim that the rules violate the equal protection clause under the Fifth Amendment and the First Amendment’s free speech clause. The case was heard by the Fifth U.S. Circuit Court of Appeals in August 2022 and a decision is pending.

NYSE Rules

The New York Stock Exchange does not have diversity disclosure requirements similar to the Nasdaq markets, relying instead on private ordering to drive practice.

SEC Rules

Although the SEC adopted disclosure rules in 2009 requiring companies to disclose the role of diversity in identifying nominees to their boards of directors, companies have the flexibility to define diversity using a wide range of factors beyond gender, race and ethnicity, and need not include those traditional elements. The SEC has indicated that it intends to propose rules this year that would require disclosure of more board diversity information. It would be reasonable to speculate that these rules will be similar in scope to the Nasdaq board diversity disclosure requirements.

Large institutional investors have pushed for companies to diversify their boards.

State Legislation

At the state level, multiple states have adopted legislation regarding corporate board diversity, typically requiring corporations to provide information on board gender or racial/ethnic demographics. However, the State of California has been at the forefront of corporate board diversity legislation by adopting mandates for minimum numbers of women directors (see alert regarding SB 826) and directors from underrepresented communities (see alert regarding AB 979) on corporate boards. AB 979 defines a “director from an underrepresented community” as one who “self-identifies as Black, African American, Hispanic, Latino, Asian, Pacific Islander, Native American, Native Hawaiian, or Alaska Native, or who self-identifies as gay, lesbian, bisexual, or transgender.” In the case of both statutes, not meeting the minimum requirements carries fines in the six figures for each violation.

Both of the California diversity statutes have been successfully challenged in California courts in 2022, which found them to violate the California Constitution’s equal protection clause. While the State of California has appealed these rulings, the timing for the ultimate resolution remains unclear. However, pending the outcome of the appeals process, the lower courts’ orders enjoining enforcement remain in effect.

Other Initiatives

In addition to the legislation discussed above, there have been a variety of shareholder and other initiatives in the

last several years to increase gender and racial/ethnic board diversity.

Shareholder Proposals

In the 2022 proxy season, there was a significant increase in the number of board diversity shareholder proposals submitted compared to recent years. However, shareholders voted on just six proposals, all of which failed, receiving only 11% support, on average. In many cases, the companies targeted had some gender diversity but no racial/ethnic diversity on their boards. These proposals ranged from requesting reports on a company’s efforts to diversify their boards to seeking the adoption of policies requiring companies to include a minimum number of women and minority candidates for consideration for open board seats (i.e., Rooney Rule policies).

Institutional Investor and Proxy Voting Advisor Policies

Large institutional investors have also pushed for companies to diversify their boards. Such investors have adopted policies to vote against nominating/governance committee chairs and other directors at companies lacking gender and/or racial/ethnic diversity.

For example, under its Proxy Voting and Engagement Guidelines State Street Global Advisors may vote against the nominating committee chair at Russell 3000 companies that lack at least 30% gender diversity and against such chairs at S&P 500 companies if they fail to disclose racial and ethnic board composition and do not have a director from an underrepresented community. Similarly, BlackRock’s voting guidelines encourage companies to have at least two women directors and one director from an underrepresented group. Under BlackRock’s guidelines, S&P 500 companies should also aspire to have at least 30% board diversity.

Both of the major proxy voting advisory firms, ISS and Glass Lewis, have also adopted policies in support of gender and racial/ethnic board diversity. For 2023, ISS expanded its policy to recommend voting against the nominating committee chair (and other members as appropriate) at all U.S. listed companies that do not have at least one woman on the board and Glass Lewis will generally recommend against the nominating committee chair of boards of Russell 3000 companies that are not at least 30% gender diverse. ISS and Glass Lewis will also recommend against voting for the nominating committee chairs at Russell 3000 companies and Russell 1000 companies lacking racial/ethnic board diversity, respectively.

ISS and Glass Lewis have adopted policies in support of gender and racial/ ethnic board diversity.

Groups Seeking Additional Disclosure

In addition to these initiatives demanding greater representation and disclosure, there have also been calls to improve the quality of board diversity disclosures in order to hold companies accountable. In November 2022, the Russell 3000 Board Diversity Disclosure Initiative, a consortium of state treasurers, pension funds and other investors, announced that it sent customized letters to Russell 3000 companies encouraging them to provide individual board director diversity information in their proxy statements. The letter noted that many of the initiative’s members maintain or are considering policies that provide for votes against companies lacking board diversity disclosure in their proxy statements and are considering more direct engagement with laggard companies in 2023.

Separately, some shareholders and other stakeholders have argued that companies should provide

individual director racial/ethnic demographic information to promote transparency around diversity in specific circumstances. These proponents of individualized disclosure note that in the absence of company disclosure of which specific directors are racially/ethnically diverse, it would be difficult to determine whether diverse directors are being provided with the opportunity to serve on or chair board committees and assume other leadership roles. They also contend that individual director diversity information may aid shareholders in a proxy fight by allowing them to determine whether they are voting for a diverse slate of nominees.

All companies in the S&P 100 and 121 companies in the SV 150 provided racial/ ethnic board diversity data in their proxy statements.

Board Racial/Ethnic Diversity Disclosure Trends in 2022

Generally, companies have directly or indirectly provided disclosure of gender diversity for many years. All companies in the S&P 100 and 121 of the SV 150 companies (83%) provided racial/ethnic board diversity data in their proxy statements for the 2022 proxy season. All companies in the S&P 100 and 121 companies out of the 146 SV 150 companies for which data was available (83%) provided racial/ethnic board diversity data in their proxy statements for the 2022 proxy season (based on disclosures in annual meeting proxy statements for the 2022 proxy season).

This is consistent with other studies showing approximately 93% of S&P 500 companies disclose racial/ethnic board data in addition to gender (see Spencer Stuart’s 2022 S&P 100 Diversity Snapshot). However, there is variation in the level of detail that companies in both groups provide.

More companies in the SV 150 than the S&P 100 disclosed racial/ethnic composition on an aggregated basis.

Majority of Companies Disclosing Racial/Ethnic Board Diversity

The majority of companies in each group (61.6% or 90 of the SV 150 companies and 67.0% or 67 of S&P 100 companies) disclosed the racial/ethnic composition of their boards by specific racial/ethnic categories similar to the categories noted above for the Nasdaq rule and AB 979. Some companies disclosed on an aggregated basis, while other disclosed on an individualized basis. A company using an aggregated method would disclose the total number of directors belonging to a specific racial/ethnic category (e.g., African American) without identifying the individual directors belonging to that category.

More companies in the SV 150 disclosed such information on an aggregated, rather than individualized, basis (50% or 73 of the SV 150 companies, compared to 37% or 37 of the S&P 100 companies). On the other hand, more S&P 100 companies provided the specific racial/ethnic category for directors on an individualized basis (30 or 30%) compared to the number of SV 150 companies disclosing such individualized diversity information for directors (just 17 or 11.6%).

The remaining disclosing companies in each group (21.2% of the SV 150 and 33.0% of the S&P 100) chose not to use specific racial/ethnic categories, but instead provided racial/ethnic diversity information using an umbrella term for racial/ethnic diversity such as “from underrepresented communities” or “racially or ethnically diverse”). Accordingly, in most cases the number of racially/ethnically diverse directors was aggregated, but four companies in the SV 150 and ten companies in the S&P 100 identified individual directors using such an umbrella term (i.e., without specifying the category of diversity).

There were an additional ten companies in the SV 150 and five companies in the S&P 100 that used an umbrella term that encompassed both gender and racial/ethnic diversity. As we could not determine whether the number of diverse directors disclosed was based on race/ethnicity as opposed to gender, those companies and affiliated directors are not included in the demographic information below.

The Impact of the Nasdaq Rules

Because of the Nasdaq rules, many Nasdaq-listed companies provided disclosure to comply with the rules for the 2022 proxy season. Significantly, many non-Nasdaq companies also voluntarily disclosed board diversity information that was similar in scope to the requirements of the Nasdaq rules, including categorized disclosure rather than umbrella disclosure, suggesting that many public companies believe that disclosure of such information is important to shareholders or other stakeholders.

However, SV 150 companies were less likely to voluntarily provide racial/ethnic diversity information than S&P 100 companies. Approximately 25% of the 48 NYSE-listed SV 150 companies voluntarily disclosed the demographic make-up of their boards by specific racial/ethnic categories at an aggregate or individual level compared to approximately 54% of the NYSE-listed S&P 100 companies.

Board Racial/Ethnic Demographics

Due to improvements in the availability of racial/ethnic board diversity data, we have been able to analyze the racial/ethnic demographic information for both the S&P 100 and SV 150 for the first time. While there are limitations to this data because it only reflects those companies that chose to report racial/ethnic demographic information for their board (and even at those companies some directors chose not to identify their race/ethnicity), it supports anecdotal evidence and other research regarding the prevalence of racial/ethnic board diversity at large corporations. The information below is based on the proxy statement disclosures of the 90 SV 150 companies and the 67 S&P 100 companies that provided board demographic information using specific racial/ethnic categories (whether aggregated or by individual director) for the 2022 proxy season. We refer to these companies as “diversity disclosing companies.’’

Of the 111 SV 150 companies providing some form of racial/ethnic demographic data, 96.4% reported some racial/ethnic diversity on their boards.

SV 150

Company Data

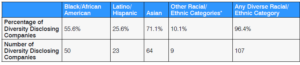

Of the 111 SV 150 companies providing some form of racial/ethnic demographic data (whether using specific racial/ethnic categories or using an umbrella term), 107 or 96.4% reported some racial/ethnic diversity on their boards with only four companies having no racial/ethnic diversity. Below are the number and percentage of diversity disclosing companies with at least one director for each of the following racially/ethnically diverse categories:

*Includes directors identifying as two or more races/ethnicities, Alaskan Native or Native American, Native Hawaiian or Pacific Islander, Middle Eastern, North African and South Asian. Directors who self-identified as two or more races or multiracial were only counted once if it was clear that they were also counted under other racial categories in a board diversity matrix. Where it was unclear, such directors were counted for each racial/ethnic category indicated in the proxy statement matrix, so in a few cases a diverse director may have been counted multiple times.

Director Data

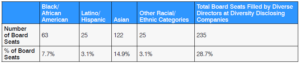

There were approximately 288 board seats held by racially/ethnically diverse directors in total, including those for whom no specific racial/ethnic category was provided, out of a total of approximately 1,040 total board seats at SV 150 companies providing diversity disclosure (approximately 27.7%).

Below is the demographic information for diverse directors at the diversity disclosing companies broken down by specific racial/ethnic categories. The number and percentage of board seats in the table below is based on the 817 SV 150 companies that provided categorized racial/ethnic disclosure in their proxy statements.

S&P 100

Company Data

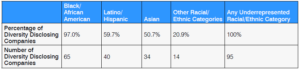

All of the 95 S&P 100 companies providing some form of racial/ethnic demographic data (whether using specific racial/ethnic categories or using an umbrella term) reported having at least some racial/ethnic diversity on their boards.

Below are the number and percentage of diversity disclosing companies with at least one director for each of the following racially/ethnically diverse categories:

Director Data

There were approximately 304 board seats held by racially/ethnically diverse directors in total, including those for whom no specific racial/ethnic category was provided, out of a total of approximately 1,130 board seats at S&P 100 companies, or 26.8%, showing a similar level of racial/ethnic diversity as the SV 150 companies.

Below is the demographic information for diverse directors at the diversity disclosing companies broken down by specific racial/ethnic categories. The number and percentage of board seats in the table below is based on the 786 S&P 100 companies that provided categorized racial/ethnic disclosure in their proxy statements.

Analysis of Racial/Ethnic Board Composition

One can extrapolate even from the limited number of companies that disclose racial and ethnic diversity information that both the S&P 100 and the SV 150 are significantly far from proportional board representation for racial and ethnic minorities compared to the national workforce at-large. However, the data reveals nuances and signs of progress in some areas. For example, Asian directors hold approximately 14.9% of board seats at diversity disclosing SV 150 companies, significantly exceeding their percentage composition on S&P 100 boards.

In contrast, while African Americans hold approximately 13.5% of board seats at diversity disclosing companies in the S&P 100 (slightly exceeding the percentage of African Americans in the U.S. workforce (12.0%) based on 2020 data from the U.S. Bureau of Labor Statistics), they account for just 7.7% of directors at diversity disclosing companies in the SV 150. Significantly, Latinos, despite representing the largest ethnic minority workers in the U.S. at 18.5%, hold just 3.1% and 6.1% of board seats at diversity disclosing SV 150 and S&P 100 companies, respectively.

LGBTQ+ Diversity

The Nasdaq board diversity rules and other initiatives have also encouraged companies to provide more information regarding LGBTQ+ directors on their boards. As a result, we were also able to capture data regarding the number of directors in both groups that self-identified as belonging to the LGBTQ+ community. There were 12 and nine directors disclosed as belonging to the LGBTQ+ community for the SV 150 and S&P 100, respectively. While the numbers are small compared to the number of women and racial/ethnic minority directors, it is possible that we will see increases in the number of companies disclosing LGBTQ+ diversity over time.

Takeaways

The demand for greater diversity on U.S. corporate boards and related disclosure of such information will likely continue until equitable gender, racial and ethnic representation is achieved. While only limited board disclosure is currently mandated, the amount of information regarding board diversity that companies must disclose is likely to significantly expand, especially if the SEC adopts additional rules. Even if not individualized, such disclosure will likely allow for a more detailed and comprehensive understanding of board diversity and trends over time.

Although existing rules requiring board diversification or disclosure of board diversity have been challenged, they appear to have accomplished their intended goals as a majority of both SV 150 companies and S&P 100 companies now disclose such information. Companies that are not currently disclosing their board diversity should consider the trends discussed in this report as well as the preferences and demands of their key shareholders and other stakeholders in deciding whether to initiate or expand their board diversity disclosure.

Print

Print