Subodh Mishra is Executive Director at Institutional Shareholder Services, Inc. This post is based on an Institutional Shareholder Services publication by Georgina Marshall, Global Head of Research & Policy at Institutional Shareholder Services.

UNITED STATES

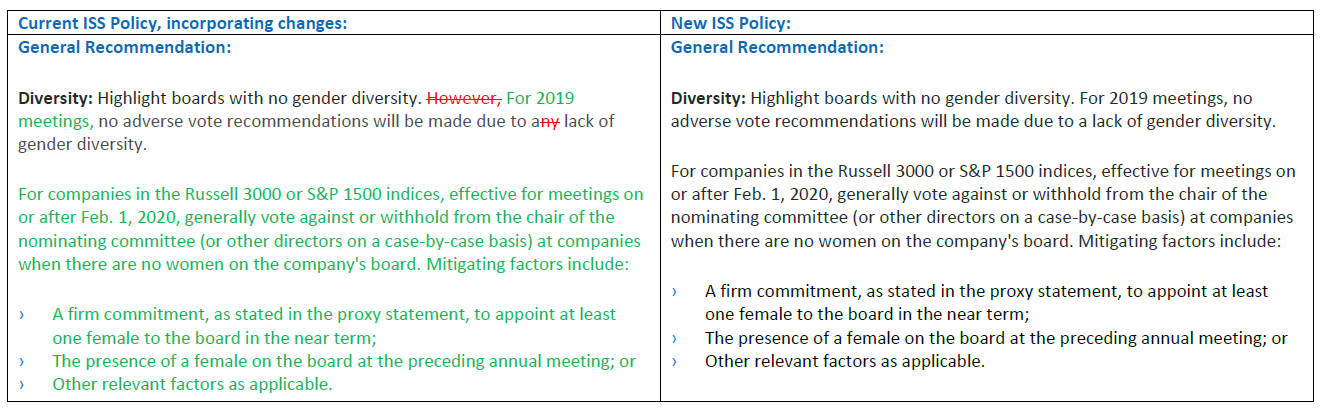

Board of Directors—Voting on Director Nominees in Uncontested Elections

Board Composition—Diversity

Rationale for Change:

1) Investors favor gender diverse boards.

During the 2017 and 2018 proxy seasons, investors increasingly targeted companies with little or no female representation on their boards, citing reasons of equality, good corporate governance, and enhanced long-term company performance. [1] Increased investor engagement on the topic appears to have prompted many boards to add one or more women directors to their ranks over the past two years. When boards fail to respond to such engagement, a number of large investors have cast votes against directors.

Comment Letter: Fiduciary Duty Guidance for Proxy Voting Reform

More from: Cynthia Williams, Keith Johnson, Susan Gary

Keith Johnson heads the Institutional Investor Services Group at Reinhart Boerner Van Deuren s.c.; Susan N. Gary is an Orlando J. and Marian H. Hollis Professor of Law at the University of Oregon; and Cynthia Williams holds the Osler Chair in Business Law at Osgoode Hall Law School, York University. This post is based on their Comment Letter in advance of the SEC’s Proxy Process Roundtable.

Investor proxy voting practices have entered the public spotlight in 2018 as Congress and the Securities and Exchange Commission (“SEC”) consider changes to the rules which govern proxy voting. However, an accurate recognition of the investor fiduciary duties which provide the legal context for exercise of proxy voting rights has been largely missing from the debate.

We believe that any reform discussions should be anchored on an up-to-date understanding of how fiduciary principles fit the 21st century. This includes a balanced application of the fiduciary duties of (a) prudence (including the obligation to investigate and verify material facts), (b) loyalty to beneficiaries (with its obligation to treat different beneficiary groups impartially), and (c) reasonable management of costs. These are legal duties which establish expectations for proxy voting processes at asset owners, investment managers and proxy advisors.

READ MORE »