Wes Bricker and Kathryn Kaminsky are US Trust Solutions Co-Leaders, and Kathy Neiland is Partner and Leader at the Trust Leadership Institute, at PricewaterhouseCoopers LLP. This post is based on their PwC memorandum.

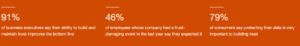

This is the third time we’ve conducted a trust survey and one thing continues to hold true: Consumers, employees and business executives overwhelmingly agree that trust in business is imperative. The trust that businesses build with their stakeholders can boost profitability: 91% of business executives agree (including 50% who strongly agree) that their ability to earn and maintain trust improves the bottom line.

Conversely, a lack of trust can erode brand value, hurt financial performance and limit a company’s ability to attract and retain talent. In the current environment, companies have to work harder than ever to earn trust among their core constituents. And while our latest survey shows that many companies are falling short, it also highlights opportunities for companies to build trust — and create value by doing so.

1. Trust creates value

Nearly all (92% of business leaders, 92% of consumers and 94% of employees) agree that organizations have a responsibility to build trust.

Why? One reason is recommendations and referrals. Fifty-eight percent of consumers say they have recommended a company they trust to friends and family, and 64% of employees say they recommended a company as a place to work because they trusted it. We’ve also found in previous research that levels of consumer trust are linked to performance.

2. But business leaders haven’t captured the opportunity

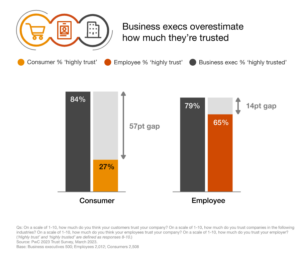

While there’s general agreement that trust is important, there’s far less agreement on how much companies are trusted. Among respondents, 84% of business executives think that customers highly trust the company, yet only 27% of customers say the same. Employees show a less dramatic trust gap: 79% of business executives say their employees trust the company, but only 65% of employees agree. In both cases, this gap in perceived trust remained just as large as our June 2022 survey — 57 percentage points for customers and 14 points for employees.

The average level of consumer and employee trust in business has fallen slightly since June 2022 (by 2% for each group). Similarly, executives’ average perceived level of stakeholder trust has fallen about the same over the same period (down 2% for how much they think consumers trust them and 3% for how much they think employees trust them).

3. Trust is a moving target

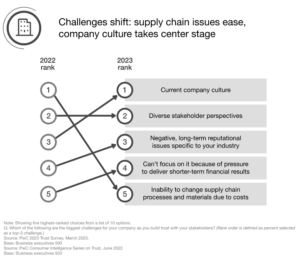

When we asked executives to cite their top challenges when it comes to building trust, we see that the trust landscape has shifted in the past year. For example, executives’ inability to change supply chain processes dropped to No. 5 from the No. 1 spot in 2022 (when executives rank their top 3 challenges).

While executives continue to rank consumers, employees and investors as their most important stakeholders, in that order, this can oversimplify the complexity of building trust in today’s environment. Executives say one of the biggest challenges to building trust continues to be conflicting stakeholder priorities, including within stakeholder groups. In fact, diverse stakeholder perspectives comes in second. With trust in business slipping in the past year, it’s even more important for executives to understand and address stakeholder expectations.

The only challenge that ranks higher is current company culture, which moved up two spots from 2022. For many companies, remote or hybrid work arrangements have become the norm. As a result, corporate culture may be strained as employees no longer meet regularly at the office, see management face-to-face or engage with each other in person. As companies continue to embrace remote and hybrid work, executives should recognize the possible need to make culture adjustments. It’s crucial to set the tone for the organization and make sure that employees understand the company’s values and their role in driving the company’s purpose.

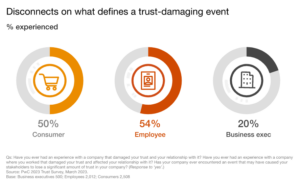

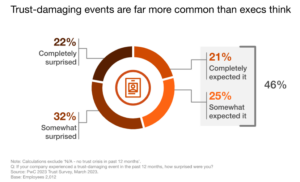

4. Trust breaks down more often than executives think

Trust can take years to build and yet can be damaged in an instant — and such events are far more common than business leaders may think. About half of consumers (50%) and employees (54%) report experiencing a trust-damaging event. But only 20% of business executives say their organization has been involved in this type of incident.

Why such a difference? Consumers and employees both identify more personal experiences that have had a major impact on their trust. These examples highlight the degree to which small issues can — and do — damage trust in big ways. The most common type of event consumers experience relates to customer service (36% experienced), followed by lack of transparency (23%). The majority (63%) ended the relationship with the company by no longer purchasing its products or services. For employees, 33% say bias or mistreatment caused a loss of trust — the most commonly cited event. More than half (53%) report that they left the company after the experience.

To executives, on the other hand, large-scale headline-grabbing events are more likely to define trust-damaging events. They cite security (15%), legal and compliance (11%) and, to a lesser extent, financial issues and system failures. Executives cite the most common response as correcting the problem (32%). They also cite disclosing the reasons for failure, committing to taking steps to rebuild trust and improving transparency.

5. Employees may hold the key to trust blind spots

So how do businesses get smarter at building trust to create value? Constantly listening, starting within their own four walls. Employees are eyewitnesses to customers and operations and can help uncover what businesses should be paying attention to. Among employees who say that their company experienced a trust-damaging event in the past 12 months, almost half (46%) say they expected it. Through their day-to-day work, employees have firsthand information about potential blind spots that companies may face regarding trust. Business leaders can capitalize on those insights to proactively head off future issues — but only if they take steps to actively listen and get that information from employees.

Companies should evaluate whether workers feel safe in surfacing and escalating issues. This goes far beyond written policies and whistleblower hotlines. Managers and leadership have to create a culture where workers feel empowered to speak up — and feel heard and supported when they do. By engaging in this way, companies can get a better sense of where potential trust issues may lurk.

When we asked business executives and employees whether or not company leadership gives appropriate attention to earning trust in the business, less than half (45%) of business executives say they do, and only one third (34%) of employees agree. This highlights another opportunity that executives can take to boost employee trust.

6. What drives trust with consumers and employees now

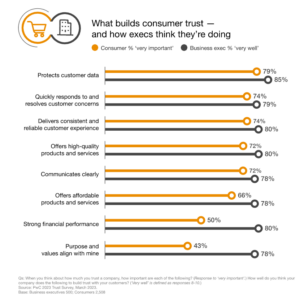

Earning trust comes down to understanding what’s important to your stakeholders at any given moment in time. Our current survey shows a disconnect between the trust drivers that consumers and employees view as very important and those that executives think they are executing well.

For example, when it comes to trusting a company, consumers are most likely to consider data security and high-quality customer service, products and services as most important. Fewer focus on attributes that have less of a direct impact on their experience as a customer.

Purpose and values have increased in importance for employees and companies alike in recent years. As a result, many companies have prioritized communicating what their company stands for, and employees may now view these changes as table stakes. However, our survey shows other things at the top of employees’ list of what’s important now. The most important trust-building issues are paying appropriate wages, protecting employee data and communicating clearly.

When we examine what business executives think they do well for both consumers and employees, over three quarters give a very high rating to their organizations’ performance across all areas. This is yet one more illustration of the disconnect between executives and their stakeholders around what it takes to build trust and how well they’re doing.

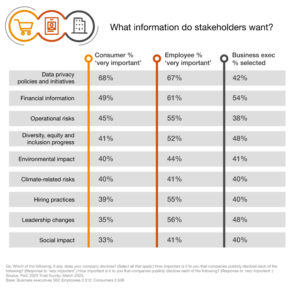

Two thirds of both consumers and employees say it’s very important for companies to disclose data privacy policies, but only 42% of organizations say they do. Over half of employees believe it is very important for companies to be transparent about hiring practices and operational risks, but this is close to the bottom of the list of what companies disclose. Only 40% disclose hiring practices and 38% disclose operational risks. It should be noted that our business executive panel includes respondents from private companies (59%) that aren’t subject to many of the same requirements as public companies.

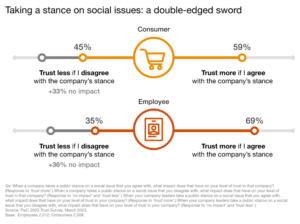

7. Weighing the pros and cons of taking a stance on social issues

With more polarization and competing stakeholder expectations, sticking to what’s relevant to your business may be the ideal path when it comes to speaking out on social issues. In fact, one out of two consumers (49%) and employees (50%) say companies should take a public stance on social issues only if they’re related to the core business.

At the same time, two thirds of business executives tell us that taking a stance on social issues builds trust among customers (64%) and employees (66%). Taking a stance on social issues can be a double-edged sword. When viewpoints align, it can foster company trust with consumers (59% trust more when they agree) and employees (69% trust more when they agree). At the same time, adopting an unpopular stance can diminish trust. However, there appears to be a net benefit in taking a stance as the positive impact when stakeholders agree outweighs the negative impact when they disagree.

Regardless of whether your company decides to take a stance on a social issue or not, the workplace can often be a forum for employees to share their opinions and ideas. One approach to consider: Educate and train managers to provide an environment that fosters psychological safety in which employees feel empowered to speak up, regardless of their views.

8. The newest trust risk: AI

Artificial intelligence (AI) is changing the way businesses operate, and those that don’t evolve to incorporate the technology into their business may fall behind. Yet generative AI brings up new risks and considerations, so it’s vital that AI implementation occurs in a responsible, trustworthy, fair, bias-reduced and stable manner.

Many companies plan to take a variety of steps to confirm that the security, quality and performance of these systems are monitored and optimized. Nearly all business leaders say their company is prioritizing at least one initiative related to AI systems in the near term. Compliance (41%), especially as it relates to privacy, is the top focus for business executives over the next 12 months. Fewer executives (35%) say their company will take the following steps:

- Improve the governance of AI systems and processes.

- Confirm AI-driven decisions are interpretable and easily explainable.

- Monitor and report on AI model performance.

- Protect AI systems from cyber threats and manipulations.

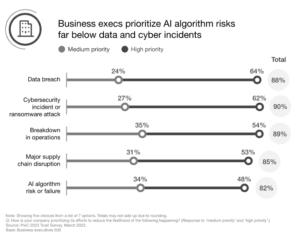

Just under half (46%) of executives say they’re very prepared for an AI algorithm risk or failure, and 48% say they’re making efforts to reduce the likelihood of such an event a high priority. Those responses are a positive first step, but there’s much more to be done. Given the attributes of AI — the lack of human oversight and its reliance on potentially insufficient historical data — leadership teams should prioritize understanding potential risks and how to address them. In our view, executives should prioritize this as highly as they do potential data breaches and cybersecurity incidents.

Executives are optimistic about their response plans should a trust-damaging event occur. The vast majority (89%) agree that their company is prepared to respond within days to a situation that could damage trust. But does the company’s crisis response plan include an AI failure? Given the situation, do you need to respond within hours rather than days? Executives need to regularly update their plans to keep up with the quickly changing technology and risk landscape.

9. Executives miss opportunities to retain trust while doing layoffs

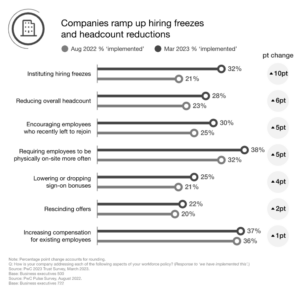

In our August 2022 Pulse Survey, 50% of executives said they had either implemented or had plans in place to reduce overall headcount. In our current survey, that number remains unchanged.

However, when we dig deeper, the percent saying that they have already implemented headcount reductions increased to 28% from 23% in August 2022. Of course, this can’t be equated one-to-one with layoffs, as headcount reductions could be the result of other measures such as offering early retirement or not replacing employees who leave. Perhaps more importantly, we see signs that executives are taking steps to avoid layoffs wherever possible, with hiring freezes jumping to 32% from 21% in August 2022.

Most employees (80%) agree that layoffs in general negatively impact trust in companies. However, their perspective changes when it comes to their own companies. Only 55% of employees say the way their company has implemented layoffs has damaged trust. Meanwhile, executives seem to be harder on themselves, with 72% saying the way their company has done layoffs has damaged trust. This may indicate that executives have a broader view of what is happening across the organization, and employees may not know how layoffs are being handled unless they’re personally affected.

Even in difficult situations such as layoffs, there are opportunities for companies to build trust. Employees identify some specific actions that companies can take to help build trust. For example, 58% say encouraging managers to increase communications with remaining team members can build trust and 57% point to generous severance packages. Yet only 38% of executives have increased communications, highlighting a very tangible and effective step that is currently being overlooked. Performing layoffs virtually is an unpopular option as 32% of employees indicate doing so would erode employer trust (versus only 19% who say it would build trust).

The trust playbook for leaders

Take ownership of trust.

Trust matters. Building trust can create value for your organization and improve the bottom line. Embed trust into your corporate strategy and all of your business processes. Consider a variety of potential future situations to prepare for whatever may come your way. When a crisis hits, you’ll have a roadmap in place that aligns your response actions with your organization’s strategic goals.

Treat trust as a team sport.

Get executive team alignment on trust — what it means to your company and stakeholders. Embed trust in all areas of the business and confirm that leaders of those areas are committed to earning and maintaining trust. Understand who your stakeholders are, and recognize that their needs and expectations will shift — and may compete with one another. Keep this in mind as you prioritize your trust focus areas. It’s important to focus on issues that are material to your business, customize your message accordingly and not be all things to all people.

Build your stakeholder engagement plan.

Assign relationship owners to your stakeholders. Encourage those owners to listen closely so they can anticipate shifts in views and perspectives. Map your stakeholders by issue and be strategic about tradeoffs that may be necessary, especially given that trust isn’t static. This mapping can help connect dots across the company and drive better alignment, understanding and coordination. Seeing the full picture can help mitigate a trust-busting event and help you earn and maintain trust that lasts.

Focus on outcomes.

Building trust can be an opportunity to differentiate your company. Embed it in how you measure success of the business, and evaluate whether the metrics you’re using are based on the appropriate qualitative and quantitative data. Think about how you can drive better business outcomes on things like social issues. Align trust to your core capabilities and stakeholder expectations. Use trust to help build your brand.

Activate trust.

To earn trust, every person in the organization has a role to play. Underscore the importance of management living your company’s purpose and values and showing up as trusted leaders in every interaction. Find ways to make trust personal. Determine your nonnegotiable behaviors that earn or erode trust. Don’t overlook the small things. As we’ve seen, consumer and employee trust can be lost in small day-to-day moments. For example, empower your front-office employees and customer call center representatives to act when appropriate to help solve customer issues.

Prepare your crisis plans with trust in mind.

Put processes in place to prepare for a crisis and understand the possible implications that an event may have on trust in your company. Review your crisis response plans to see if they include new potential threats, such as an AI algorithm failure. The evolving risks you face may outpace the plan you have. When you do experience an issue, take the time to do an objective review of how your company responded. Identifying challenges and gaps is the first step to overcoming them.