Todd Sirras is a Managing Director, Austin Vanbastelaer is a Senior Consultant, and Justin Beck is a Consultantat Semler Brossy LLC. This post is based on a Semler Brossy memorandum by Mr. Sirras, Mr. Vanbastelaer, Mr. Beck, Kyle McCarthy, Nathan Grantz, and Anish Tamhaney.

2023 Say on Pay Results

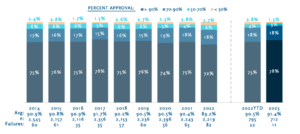

BREAKDOWN OF SAY ON PAY VOTE RESULTS

Russell 3000 companies (1.5%) have failed Say on Pay thus far in 2023. Since our last report, seven companies have failed Say on Pay: BlackLine, CME Group, Equifax, Pitney Bowes, Prologis, Simon Property Group, and Telos

SAY ON PAY OBSERVATIONS

- The current failure rate (1.5%) is 130 basis points lower than the failure rate at this time last year (2.8%)

- The percentage of Russell 3000 companies receiving greater than 90% support (78%) is higher than the percentage at this time last year (75%)

- The current Russell 3000 average vote result of 91.4% is 220 basis points higher than the index’s year-end average vote in 2022, and the current S&P 500 average vote result of 89.3% is 210 basis points higher than the year-end average vote in 2022

- The average Russell 3000 vote result thus far in 2023 is 210 basis points higher than the average S&P 500 vote result