Dan Konigsburg is Global Corporate Governance Leader, Sharon Thorne is Deloitte Global Board Chair, and Stephen Cahill is Vice Chairman, Deloitte LLP. This post is based on their Deloitte memorandum.

Introduction

Today, a climate of dynamic, shifting expectations among investors is changing the corporate landscape. Investors are stepping up their engagement and raising their voices through policy and voting as they seek to influence corporate policies, mindsets and activities.

In doing so, investors risk confusing companies with a wide range of voices: those looked at as part of this research have adopted their own unique fashion, have issued policies and guidelines that diverge significantly from each other. This depends to some degree on the profile of the institutional investor, their geographic location, and the laws and regulations applicable to them.

Inconsistencies in policy and emphasis across the vast landscape of the institutional investor community can make the already difficult work of the board in overseeing strategy, operations, compensation, and much else, including reporting to owners, rather more challenging.

This disparate landscape can become even more challenging when you consider the discrepancies between investors’ voting guidelines—how they say they intend to vote—and the actual voting outcomes.

This first-of-its-kind analysis across a range of current topics identifies trends across annual general meetings (AGMs) and contrasts these with the published voting guidelines of institutional investors, from pension funds to sovereign wealth funds to asset managers.

With the 2021 AGM and proxy season in the rear-view mirror, it is an opportune time to reflect on investor expectations at a global level, and to see how carefully investors have placed their steps.

Key findings from the report

- An analysis of voting guidelines issued by institutional investors across Asia, Europe and the Americas reveals large differences in where and when investors will vote against directors, support shareholder proposals, or support Say-on-Pay resolutions. These differences are difficult to compare across investors, and they are not easy to spot; in some cases, they are even contradictory;

- For certain well-established topic areas, for example those relating to director elections and remuneration, shareholder resolutions may be withdrawn at high rates as there appears to be much engagement and discussion between issuers and investors; and

- Social issues, the ‘S’ in environment, social and governance (ESG) issues, have come to the fore since the advent of the Covid-19 pandemic. Investors have put forward more social-related shareholder proposals this year than in previous years, and the trend is not confined to the US: from Korea to Canada, companies are fielding proposals from shareholders about the diversity of their workforce, hiring and retention practices, and beyond.

Takeaways from the 2020 proxy season: Background

The 2021 AGM season is the second proxy season of the pandemic. This has meant, to some degree, a continuation of some trends that appeared last year during the 2020 proxy season, including hybrid or all- virtual AGMs. [1]

COVID-19 has prompted businesses to engage investors in a much fuller dialogue about social issues [2]—the ‘S’ in ESG – a trend specifically called out in BlackRock’s annual stewardship report for the 2020 proxy season “As Larry Fink communicated in June 2020, ‘To better serve our clients, we will focus on racial equity and social justice in our investment and stewardship activities.’ We are committed to advocating for more robust disclosures to better understand how companies are working deliberately to deliver an inclusive and diverse work environment”. [3]

But the impact of COVID-19 on investor engagement and voting behavior has also been seen elsewhere: For example, there has been a great deal of investor focus on the outcome of Say-on-Pay votes at companies that received and not yet repaid financial assistance from governments.

Furthermore, as many national governments focus on the long-term resilience of their economic systems, [4] investors are asking questions about companies’ long-term positioning in broader society, which of course includes their workforce and employees, and prompting the extension of the acronym to “EESG” (Employee, Environmental, Social and Governance), [5] building on institutional investors’ interest in environmental, social, and governance issues already apparent from the 2020 voting season. [6]

Climate change and people matters, particularly diversity and inclusion, have been, along with COVID-19, at the top of investors’ agendas. A number of regulatory interventions reflect this. In Europe, for example, the EU’s Sustainable Finance Disclosure Regulation, already in force, became applicable in March 2021 as part of the European Green Deal, and this may further sharpen some of the observable trends such as climate related shareholder resolutions and executive pay at future AGMs.

Role of proxy advisory firms

The degree of influence of proxy advisory firms over investor voting outcomes is hotly debated, and the topic has led to both significant academic research [7] as well as regulatory initiatives. [8] Yet, given a wide variety of approaches, [9] it is perhaps unsurprising that emerging academic views suggests that – despite their voting recommendations – the main role of proxy advisors is to flag important governance issues to investors, rather than to influence actual voting patterns. [10]

The largest proxy advisors are both based in the US: Institutional Shareholder Services (ISS) and Glass Lewis, [11] but there are many smaller, national or regional proxy advisory firms, with significant influence in their respective geographies. A new industry oversight committee, called the Best Practice Principles Group (BPPG), has proposed areas for improvement, including more disclosure about how the firms safeguard against conflicts of interest, and additional disclosure about the firms’ procedures allowing companies to offer feedback on their own proxy reports.

Takeaway one: More support for environmental proposals

Shareholder proposals focusing on the environment, particularly those addressing climate change, reached a record number this year.

In the US, shareholders submitted 115 proposals related to the environment in 2021, of which 89 (74%) related to climate. This is a significant increase from 2020, when shareholders submitted 89 environment-related proposals of which 48 (54%) related to climate; 28 (31% of the 89 proposed) climate-related proposals went to a vote (in contrast with 14 (16%) in 2020), and 11 were adopted (compared to only 3 in 2020). The average support for climate-related proposals in 2021 jumped to 41% from 33% the previous year. Similarly, the adoption rate climbed to 39% from 21% the previous year. [12]

In Japan, out of 472 companies that received questions from shareholders at their AGMs, 11% (52 of them) were asked questions related to ‘environmental and social issues’, an over two-fold increase from 2020. [13] With respect to shareholder proposals, there were 162 this year (183 in 2020) at 48 companies (51 in 2020).

Japanese shareholder proposals related to climate change also drew attention. Following a single shareholder proposal last year, requesting disclosure plans for aligning management strategies with the goals of the Paris Agreement, [14] 2021 saw three proposals. Two proposals requested amendments to companies’ articles of incorporation so that they align with the goals of the Paris Agreement, and one asked a company to disclose plans for adopting the Task Force on Climate-related Financial Disclosures (TCFD) reporting framework. [15]

While climate-related shareholder resolutions in Japan fell short of the required level of support to be adopted, climate-focused activist investors are expected to remain interested in climate change, particularly in the banking sector due to its role as a finance provider. [16]

In China, where the government has pledged to become carbon neutral by 2060, [17] asset managers are starting to engage directly with public companies on ESG issues. For example, there are now 71 Chinese signatories

to the Principles for Responsible Investment (PRI) as of October 2021, which represents more than a ten-fold increase from the number of signatories in 2017. [18] While this increase has not led to a commensurate number of shareholder proposals, there are signs of individual companies engaging with shareholders on ESG matters and major asset owners as well as asset managers taking an active role in ESG. [19]

All of this is increasingly being translated into investor pressure over shareholder rights as well. The US 2021 proxy season has seen some shareholders request the right to vote annually on a climate related resolution, alongside requesting additional disclosures about companies’ climate impacts. In the US, six of these so-called ‘Say-on-Climate’ proposals were filed and three went to a vote. [20] While none of these proposals received majority support, two financial service companies that pro-actively presented their ‘Say-on-Climate’ proposals for a vote received overwhelming shareholder support. In Europe, this year’s AGM season saw a major airport operator become the first company in the world to give shareholders an annual vote on its effort to tackle climate change, following pressure from an activist hedge fund. [21] Its action plan was duly approved by shareholders. [22]

This year also saw a large increase in the number of proposals withdrawn by shareholders. One study in the US indicated the early withdrawal of 82 environmental proposals, double the number withdrawn in 2020, largely due to companies’ willingness to engage with shareholders [23] prior to the AGM.

Insights from the review of voting guidelines

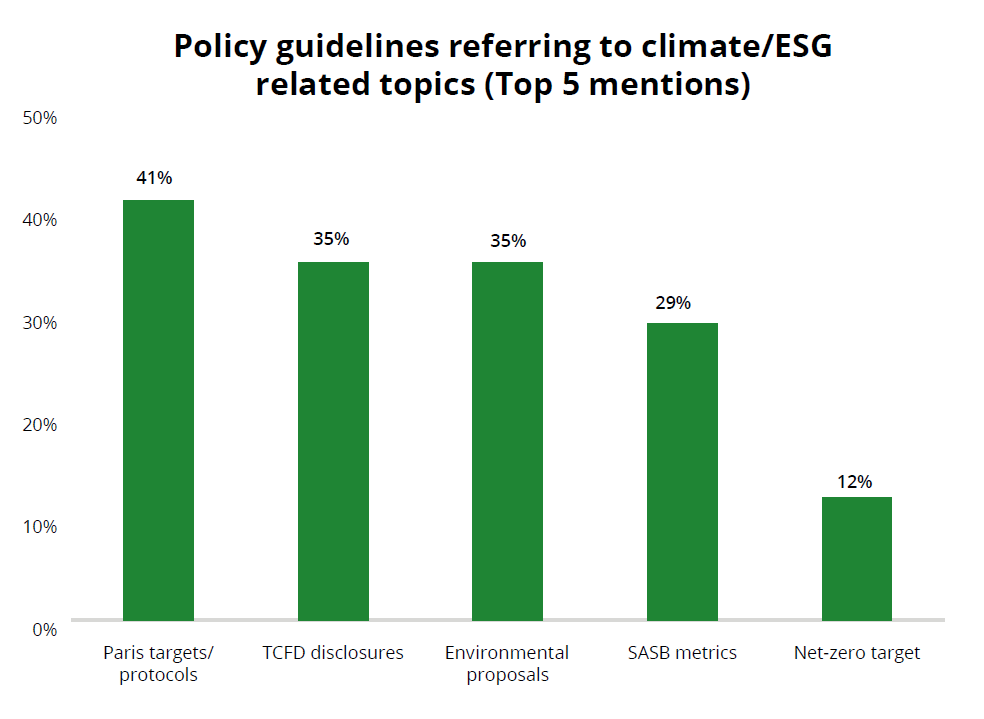

This research shows that all institutional investors we reviewed express a desire to see clear and informative reporting on matters relating to climate and the environment. Although a company meeting the TCFD recommendations will achieve this goal, only about half of asset managers state that they prefer reporting to meet or be in line with the requirements of the TCFD recommendations (and, when it comes to asset owners (as opposed to asset managers) such a preference was voiced by only one asset owner). While all investors reviewed had some form of climate guideline, twenty-nine percent state an expectation for companies to use SASB standards [24] in their reporting, the majority being North American.

Investors from Asia-Pacific appeared to call more often for other forms of environmental reporting. While most investors called for TCFD disclosures or compliance with the targets of the Paris Agreement, one asset owner in Asia encouraged asset managers to sign up to the Principles of Responsible Investing (PRI) and to seek other opportunities to engage on ESG initiatives.

Some US asset managers took the opportunity to explain their own climate activism, indicating reasons they had signed up to Climate Action 100+ and explaining their voting policies, with an expectation that they would look very carefully at supporting climate targets or reporting related proposals.

In EMEA, policies were generally more specific, focused more on achievable climate commitments and reporting on targets in line with the Paris Agreement and protocols.

Eighteen percent of institutional investors (in both APAC and EMEA) voiced an expectation for climate expertise either to be available to the board or to be on the board itself. This explicit call for important and relevant skills to be accessible to the board is expected to become more widespread.

Takeaway two: More social proposals linked to leadership and workforce diversity

Following the deaths of Breonna Taylor and George Floyd in the Spring and Summer of 2020 and the ‘#metoo’ movement which went viral in 2017, [25] investors began to express far greater concern about diversity, equity and inclusion (DEI) beyond the boardroom, especially in the US.

With respect to diversity disclosure, US companies already file ‘Equal Employment Opportunity (EEO-1) [26] data with the US federal government. This year, nine shareholder resolutions were filed at US companies, three requesting public disclosure of EEO-1 data, of which two received over 80% support. Six proposals requesting enhanced reporting

on DEI with respect to equality of opportunity, promotion and retention were voted on, and three received majority support. In terms of racial equity audits, in total, eight shareholder proposals were voted on in the 2021 proxy season, with an average 31.1% support. None reached majority approval. [27]

Social proposals like these are not purely an American phenomenon. While most resolutions were filed at US companies, shareholders filed five resolutions in Canada [28] and one in Korea, according to Proxy Insights. [29]

An analysis suggests that the small number of proposals is down to active engagement prior to the AGM season and, in the US, additional disclosures, in SEC filings and the increasing prevalence of sustainability reports in the US.

Many companies are themselves actively embracing this area – as their workforces demand action, and as investors write to companies before filing a resolution, providing companies with the opportunity to engage with these requests and avoid a shareholder proposal. [30]

With respect to investor engagement about diversity and inclusion in the UK, the Investment Association this year introduced ethnic diversity, among other topics, to its analysis of FTSE 350 companies, encouraging companies to use the analysis to gain an understanding of investor expectations. This analysis signals greater investor scrutiny for those companies failing to disclose the level of ethnic diversity on their boards, or those that fail to meet the target of the Parker Review [31] in its Shareholder Priorities 2021. [32]

Insights from the review of voting guidelines

This research shows that almost all institutional investors express a view about the importance of a diverse board, and certainly those based in EMEA and the Americas. Seventy-three percent of those that express a view discuss gender diversity, and around half also discuss ethnic diversity. Some investors describe the desirability of having a board (and in some cases, a workforce) that reflects the geographic footprint and customer or operational base of the business.

Eighty percent of those institutional investors advocating for gender diversity also suggest that the board set reasonable targets, with many of those targets aligned to jurisdictional and regional expectations.

Of those that mention ethnic diversity at board level (mainly asset managers concentrated in EMEA and the Americas), three in the sampled voting guidelines set a date of 2022 by which companies are expected to comply or face voting sanctions. This is an area to watch as both investor and regulatory pressures build to achieve genuine diversity on boards.

Takeaway three: More shareholder votes against incumbent directors

If there is one over-arching trend seen this proxy season, it is that shareholders seem marginally more willing to register a vote against incumbent directors.

In the US, statistics show that average investor support for directors remains statistically unchanged – and very high: 2021 saw over 95% support for re-election among those companies in the Russell 3000 and an average of 97% support for S&P500 companies. However, these numbers fail to show that directors in the Russell 3000 Index are receiving less than 80 percent support in higher numbers than in previous years. It seems that the less than unanimous support reflects some frustration over the lack of board oversight on climate change and progress on diversity. [33]

Outside the US, there is a somewhat different trend. For example, voting results tracked by Georgeson in India show that, among the largest 50 companies holding AGMs in 2020, the most commonly contested resolutions (meaning, those resolutions that received more than ten percent against votes) were director elections, where 79% or 24 of the total number of contested resolutions were those for directors. Of these 50, the number of companies where at least one director proposal was contested was 15. Considering that in 2017, when the previous Georgeson report on Indian voting results was published, the number of contested resolutions was 25 at 17 companies, one may conclude that this is a relatively stable trend. According to Georgeson‘s Indian AGM Season Review 2020, the most common reasons for voting against director re-election were lack of independence, poor meeting attendance, serving on too many boards at one time (‘overboarding’) and long tenure. [34]

A similar dynamic is seen in Europe, where France and Switzerland experienced an unusually high level of votes against incumbent directors, with an average increase of “against” votes across both countries of 37%. In France, 25 percent of all director elections were contested at a high rate—again, meaning over a 10% opposition threshold—and in Switzerland, the statistic is 25 percent (the number of contested votes in the CAC 40 and SMI were, respectively, 14% and 10% in 2020). [35]

Why we are seeing these increases in votes against incumbent directors is a matter of debate. There could be a number of reasons. Among them, investors may wish to send a signal of concern about board composition, relating to diversity, lack of expertise or time constraints due to overboarding; shareholders may wish to register similar concern that the board or the company is not responsive to shareholders; or there may be concerns about climate-related action or inaction, or there may be perceived weaknesses in executive compensation decisions.

Insights from the review of voting guidelines

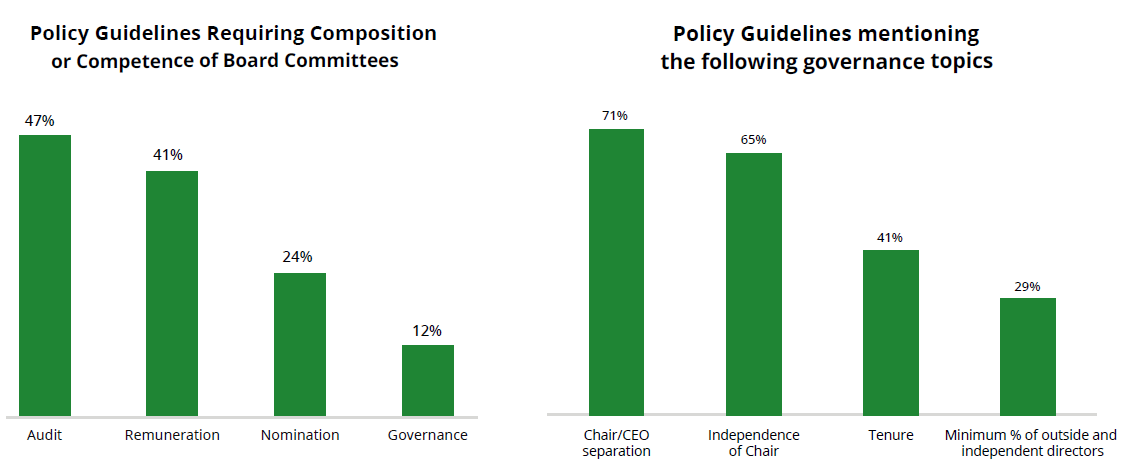

Here, the investor voting guidelines research bears this out. Institutional investors, both asset managers and asset owners, seek confidence in the composition of the board and board committees, and speak directly to this in their guidelines. Over 75% indicate that they expect appropriate skills and experience on the board, with some of those also calling for independence—particularly for audit committee members—and for directors to have enough time to spend on the affairs of the audit committee.

A majority of both asset managers and asset owners in each of EMEA and APAC expect the chair of the board to be independent and for there to be a separation between chair and CEO (or a good explanation if there is not). Notably, this turned into a minority when looking at US based asset managers where the role of independent, lead director is common.

Only a minority of both asset managers and asset owners indicated a maximum tenure for independent directors, suggesting that investors expect these to be set according to local corporate governance norms and guidelines. Both independence and the regular refreshment of the board were considered influencing factors, along with the desire for shareholders to have a regular vote on directors’ re-election. Where a time limit was given, a range of between 10-12 years was considered the maximum reasonable tenure.

When it comes to investor preference for separating the roles of Chair and CEO, 71 percent of investors prefer it, even though there remain wide differences across regions in practice. In the US and in parts of Europe, including France and Spain, combined Chair/CEOs remain a strong feature in the corporate landscape.

Takeaway four: Increased engagement on executive pay

An annual vote on remuneration policies (the “Say-on-Pay” vote) is now in place—either as a regulatory requirement or as a common practice – across the EU and in more than 10 other countries, including the US, UK, Canada, Australia and Switzerland. [36]

These votes give voice to shareholders on executive pay and related policies and have resulted in more remuneration reports and policies being contested in Europe in 2021 than in 2020. However, this does not necessarily mean that remuneration reports were rejected outright.

During the last US proxy season, there was no notable change in failed Say-on-Pay votes among both S&P 500 and Russell 3000 companies (2% and 3% respectively, compared to 3% and 3% in 2020). Neither was there a significant change in 2021 in the percentage of companies that received over 70% support. In fact, actual levels of support remain high – at 92% and 93% for S&P 500 and Russell 3000 companies, respectively, compared to the previous year’s levels of 93% for both. [37] Moreover, it seems that almost all those 16 companies that did not achieve majority support for SOP votes among the S&P 500 were companies where this happened for the first time. [38]

For the US, there is extensive year-round engagement between companies and their investors in which executive compensation is part of the agenda. A Harvard Business Review analysis of Say-on-Pay proposals bears this out. [39] Perhaps most surprisingly, COVID-related restrictions do not appear to have affected the engagement process significantly, as engagement has moved online and as more companies link ESG metrics to their reward policies. [40]

In Europe, the percentage of pay-related resolutions that were contested (that is, with over 10% of opposition votes), increased measurably in 2021. Relating to both the remuneration policy and the remuneration report, Georgeson’s report on the 2021 proxy season in Europe noted, for example, that in Spain, 61% of remuneration report votes were contested (in contrast with 46% in 2020) and 58% of remuneration policy votes were contested (29% in 2020). In Switzerland, the voting outcomes followed the elevated pattern of the previous year: voluntary advisory votes cast on the remuneration report were at 59% contested and this was comparable to 2020. Meanwhile 28% of the binding votes cast on the remuneration policy were contested, down from 31% in 2020. [41]

In Japan, where the latest Corporate Governance Code requires the introduction of performance-based equity compensation, four companies received proposals from shareholders during the 2021 AGM season. This shareholder focus was mainly performance related: to encourage better performance and improve the link between executive rewards and company performance. [42]

Insights from the review of voting guidelines

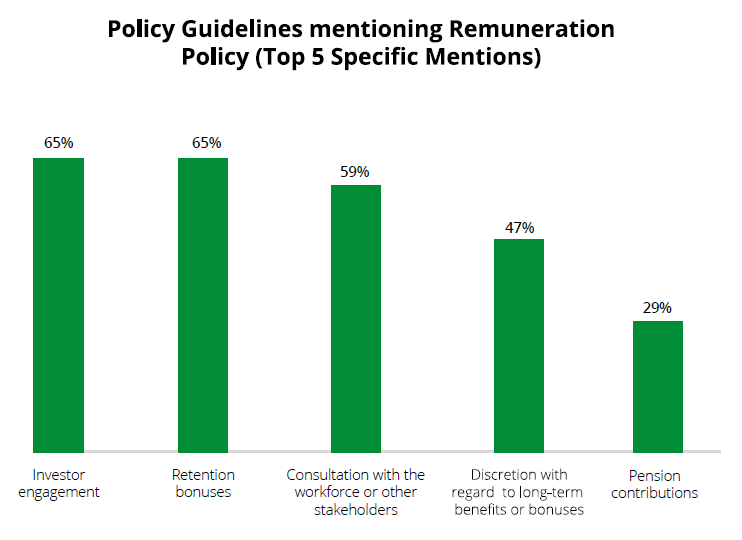

This research shows that almost all institutional investors speak about executive remuneration in their policies and a majority of both asset managers and asset owners call for a discussion of executive remuneration with shareholders.

A majority of asset managers and half of asset owners express clear views that one-off or retention bonuses should either not be paid or should be carefully justified. Some asset managers say explicitly that one-off awards will be opposed if they are not in line with awards to staff as a whole or if linked to a transaction, to the extent that this will result in voting against the reappointment of members of the remuneration committee.

A few asset managers, notably in EMEA, call out pension and post-employment shareholding requirements as important elements of remuneration arrangements, although these are only described as “good practice” (if mentioned at all) when it comes to other jurisdictions—this area is one to watch.

A handful of asset managers in EMEA call out the pandemic as a key element of pay policy this year. In particular, there is a call for executive remuneration arrangements not to be excessive where there have been “controversial practices” during the pandemic—for instance, where state aid has been obtained and not repaid, or where there have been substantial staff lay-offs. As we look to the future—and to the rapidly-approaching 2022 AGM season – the sensitivity of the linkage between executive reward and government support seems likely to continue for some time.

Methodology

The commentary in this post results from a review of publications from influential academics, think-tanks, and global and regional proxy advisors. The report’s conclusions have also been informed by a detailed review of published voting policies, investment stewardship reports, and investment stewardship policies from a sample of 17 leading global institutional investors across multiple regions of the globe. The list of investors reviewed was determined by balancing the following features and criteria:

- Total global assets under management;

- A desired geographic balance;

- Public availability of voting policies;

- A desired balance between asset managers and asset owners; and

- Proprietary research.

Investors whose policy guidelines reviewed are summarised as below:

| Investors by category | Number | AUM (USD billion) |

|---|---|---|

| Asset owners | 7 | 4,993 |

| Asset managers | 10 | 23,225 |

| Investors by regions | Number | AUM (USD billion) |

|---|---|---|

| EMEA | 9 | 14,050 |

| Americas | 6 | 11,975 |

| Asia-Pacific | 2 | 2,193 |

Endnotes

1https://www2.deloitte.com/content/dam/Deloitte/global/Documents/About-Deloitte/gx-virtual-shareholder-meetings-in-the-age-of-COVID-19.pdf(go back)

2https://www.blackrock.com/corporate/literature/publication/blk-annual-stewardship-report-2020.pdf(go back)

3https://www.oecd.org/coronavirus/policy-responses/building-back-better-a-sustainable-resilient-recovery-after-covid-19-52b869f5/(go back)

4See for example, a wide range of policy initiatives by the OECD https://www.oecd.org/coronavirus/policy-responses/building-back-better-a-sustainable-resilient-recovery-after-covid-19-52b869f5/. For specific examples, https://www.oecd.org/coronavirus/en/policy-responses. Also see governmental and international organizational co-ordinations focus on long-term resilience in the World Economic Forum (WEF)’s platform: https://spark.adobe.com/page/6zVj5y5g9bmfb/. For specific projects, see https://www.weforum.org/platforms/covid-action-platform(go back)

5https://www2.deloitte.com/global/en/pages/about-deloitte/articles/covid-19/board-voting-patterns-point-to-sustainability.html(go back)

6https://www2.deloitte.com/global/en/pages/about-deloitte/articles/covid-19/board-voting-patterns-point-to-sustainability.html(go back)

7Recent areas of research focus have centered on so-called “robovoting” mechanisms applied by some large institutional investors, reflecting recommendations from major proxy advisors without systematic internal review. See for example: Proxy Advisors And Market Power: A Review of Institutional Investor Robovoting (harvard.edu).(go back)

8SRD II EU Directive enacting transparency requirements for proxy advisors.(go back)

9For a comparison of ISS and Glass Lewis 2021 voting policies in the US and the frequency of negative voting recommendations, see: 2021 Proxy Season Trends: Proxy Advisory Firms (harvard.edu).(go back)

10See for example: Proxy Advisors as Issue Spotters | Oxford Law Faculty.(go back)

11The combined market share of ISS and Glass Lewis was estimated around 97% in 2013 CHRG-113hhrg81762.pdf (govinfo.gov).(go back)

122021 Proxy Season Review: Shareholder Proposals on Environmental Matters (harvard.edu).(go back)

13Trends for operations of 2021 AGMs in Japan, Sumitomo Mitsui Trust Bank, 2021.(go back)

14https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement(go back)

15Status of Shareholder Proposals and Proxy Voting Trends at the June 2021 Annual General Shareholders’ Meetings in Japan, Sumitomo Mitsui Trust Bank, 2021.(go back)

16Japan’s banks face rising climate activism despite vetoed motions, S&P Global: Market Intelligence, June 2021.(go back)

17Climate change: China aims for ‘carbon neutrality by 2060’, https://www.bbc.com/news/science-environment-54256826.(go back)

18https://www.unpri.org/signatories/signatory-resources/signatory-directory(go back)

19https://www.fidelityinstitutional.com/en-fi/articles/pages/building-solid-foundations-fidelity-international-china-stewardship-report-2020-a8f6d7(go back)

20https://corpgov.law.harvard.edu/2021/08/11/2021-proxy-season-review-shareholder-proposals-on-environmental-matters/(go back)

21Billionaire Chris Hohn forces first annual investor vote on climate policy, October 2020, FT.(go back)

22Aena shareholders approve action plan against climate change, October 2020, Reuters.(go back)

23Early Insights to 2021 Annual General Meetings Annual Corporate Governance Review (harvard.edu).(go back)

24https://www.sasb.org/implementation-primer/understanding-sasb-standards/(go back)

25Get To Know Us | History & Inception (metoomvmt.org).(go back)

26The EEO-1 Component 1 report is a mandatory annual data collection that requires all private sector employers with 100 or more employees, and federal contractors with 50 or more employees meeting certain criteria, to submit demographic workforce data, including data by race/ethnicity, sex and job categories.(EEO-1 Data Collection, U.S. Equal Employment Opportunity Commission).(go back)

272021 Proxy Season Review (harvard.edu).(go back)

28Social resolutions in Canada were related to human rights risks, indigenous people and living wage related, and therefore rather different from that in the US. Insightia_PMAug2021.pdf (proxyinsight.com).(go back)

29Reported via FT, ‘Investors increase pressure on companies over racial issues’, July 2021.(go back)

302021 Proxy Season Review (harvard.edu).(go back)

31Ethnic diversity enriching business leadership: 2020 update report from The Parker Review, UK Government, February 2020.(go back)

32Shareholder Priorities for 2021: Supporting Long Term Value in UK Listed Companies, The Investment Association, January 2021.(go back)

33Proxy Season: Early Highlights and Emerging Themes (harvard.edu).(go back)

34Georgeson‘s Indian AGM Season Review 2020, Georgeson, 2021.(go back)

35Georgeson’s 2020 AGM Season Review, Georgeson, September 2021.(go back)

36US Securities and Exchange Commission introduce law on Say-on-Pay in 2011, implementing Section 951 of the Dodd-Frank Wall Street Reform and Consumer Protection Act. In the UK, shareholder voting on pay is in Companies Act 2006, which was further enhanced by The Large and Medium-sized Companies and Groups (Accounts and Reports) (Amendment) Regulations 2013. In the EU, shareholder rights on directors’ pay is defined in Directive (EU) 2017/828 (Shareholder Rights Directive, amending Directive 2007/36/EC). In Canada, where Say-on-Pay is voluntary, public consultations on proposed Say-on-Pay regulations under the Canada Business Corporations Act was concluded in March 2021 and further change may be on the horizon.(go back)

372021 Proxy Season Review: Say on Pay Votes and Equity Compensation (harvard.edu).(go back)

382021 Proxy Season Review (harvard.edu).(go back)

392021 Proxy Season Review: Say on Pay Votes and Equity Compensation (harvard.edu).(go back)

402021 Proxy Season Review: Say on Pay Votes and Equity Compensation (harvard.edu).(go back)

41Georgeson’s 2020 AGM Season Review, Georgeson, September 2021.(go back)

42Status of Shareholder Proposals and Proxy Voting Trends at the June 2021 Annual General Shareholders’ Meetings in Japan, Sumitomo Mitsui Trust Bank, 2021.(go back)

Print

Print