Jim Woolery is Founding Partner at Woolery & Co. This post is based on his Woolery & Co. memorandum. Related research from the Program on Corporate Governance includes Dancing with Activists (discussed on the Forum here) and The Long-Term Effects of Hedge Fund Activism (discussed on the Forum here) both by Lucian A. Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch; and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System (discussed on the Forum here) by Leo E. Strine, Jr.

- The case before Vice Chancellor Travis Laster is Theodore B. Miller, Jr., et al. v. P. Robert

Bartolo, et al. C.A. No. 2024-0176-JTL [Excerpt Attached] - On February 23rd, Vice Chancellor Laster issued his decision in Moelis and warned that an activist settlement agreement which binds the decisions of directors irrespective of future events, specifically with respect to director recommendations and the size of the board/committees, may violate Section 141(a) of the Delaware Code

- On March 8th, Vice Chancellor Laster further held in the Miller case that Elliott’s substantial use of derivatives in its Crown Castle position, combined with the fact that the Crown settlement agreement was struck prior to the window for shareholder proposals, presents a colorable claim under Unocal

What do Moelis and Miller mean for boards and activists going forward?

A ‘REASONABLE’ APPROACH TO ACTIVIST SETTLEMENT AGREEMENTS

Under Unocal, the response to an activist threat needs to be reasonable and proportional to the threat that the activist presents to the corporation. If unreasonable and disproportionate, the board’s response may be subject to enhanced scrutiny in Delaware.

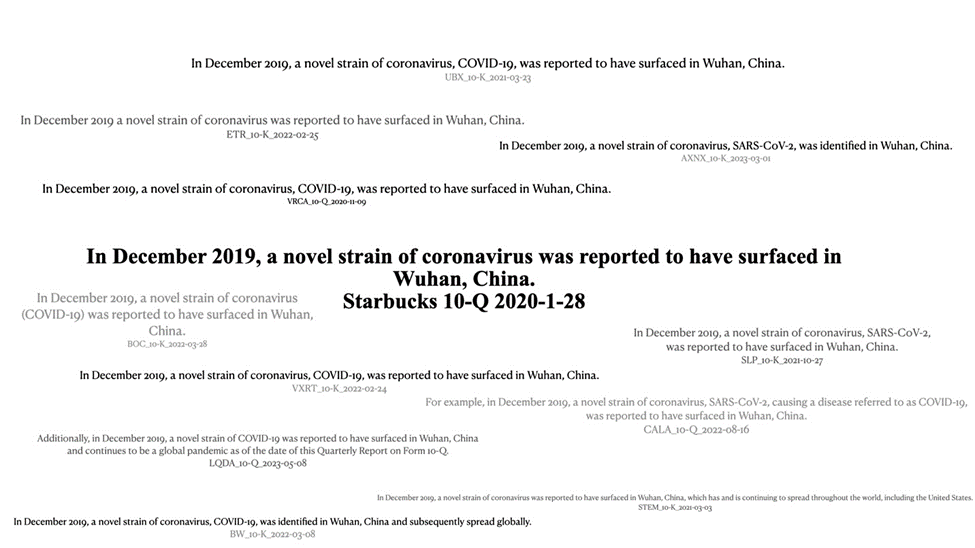

* This illustration depicts the widespread adoption of a boilerplate sentence concerning the outbreak of COVID-19 in Wuhan by various firms in their 10-Ks and 10-Qs. The sentence originates with Starbucks’ January 2020 10-Q.

* This illustration depicts the widespread adoption of a boilerplate sentence concerning the outbreak of COVID-19 in Wuhan by various firms in their 10-Ks and 10-Qs. The sentence originates with Starbucks’ January 2020 10-Q.