Jason Frankl is Senior Managing Director and Brian G. Kushner is Senior Managing Director and Leader of Private Capital Advisory Services at FTI Consulting. This post is based on their FTI Consulting memorandum. Related research from the Program on Corporate Governance includes The Long-Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav, and Wei Jiang (discussed on the Forum here); Dancing with Activists by Lucian Bebchuk, Alon Brav, Wei Jiang, and Thomas Keusch (discussed on the Forum here); and Who Bleeds When the Wolves Bite? A Flesh-and-Blood Perspective on Hedge Fund Activism and Our Strange Corporate Governance System by Leo E. Strine, Jr. (discussed on the Forum here).

Market Update

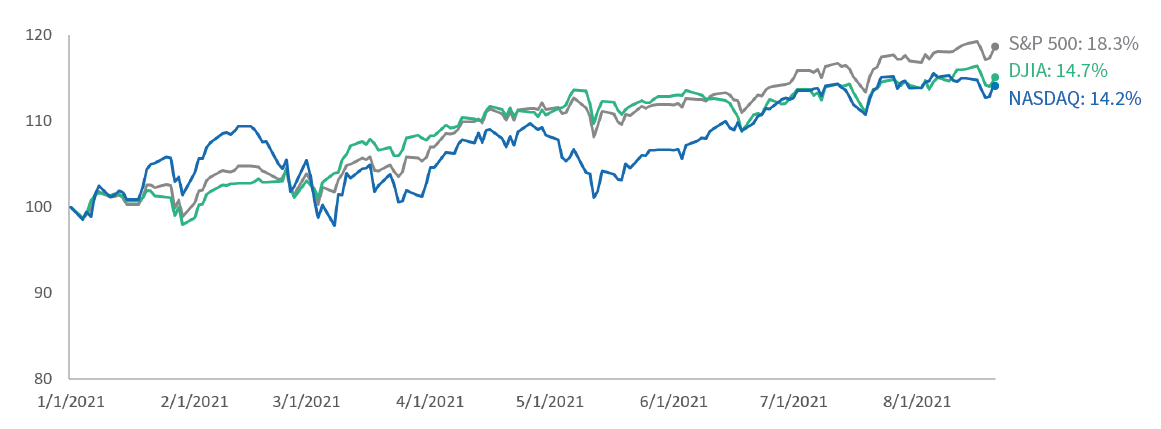

The more things change, the more they stay the same. Although COVID-19 remained a global concern, U.S. equity markets continued to push higher in Q2 2021. For the year, the S&P 500 Index is up 18.3%, while the Dow Jones Industrial Average has returned 14.7% and the Nasdaq Composite Index has returned 14.2%. [1]

Year-to-Date Performance (2021) [2]

While value stocks outperformed growth stocks in the Q1 2021, that style rotation appears to have been short-lived, and the longer-term trend of growth stock outperformance has continued so far in 2021. Year-to-Date, the S&P 500 Growth Index has returned 20.6% compared to the S&P 500 Value Index, which has returned 17.9%. [3]