Mike Kesner and Tara Tays are Partners, and Jonah Saraceno is a Consultant at Pay Governance LLC. This post is based on their Pay Governance memorandum.

Introduction

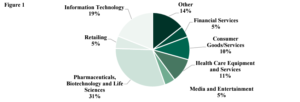

As we continue our IPO-related Viewpoint series, we note the marked reduction in the number of traditional or SPAC-related initial public offerings (IPO) in 2022 when compared to 2021 IPO-activity. For a variety of reasons, 2022 has been a challenging year in the market and particularly within the industries that are traditionally heaviest in terms of public offerings ¾ biotech and high tech. This article focuses on understanding practices related to equity awards made at or around IPO. More specifically, we examined the prevalence and timing of IPO grants, the type of equity vehicles used, and the size of IPO award pool among 400+ IPOs from January 1, 2021 through December 31, 2021. Further, we analyzed the data for notable differences based on industry. See Figure 1 for a breakdown of the types of industries included in our review.

Our research indicates that ~60% of companies that went public in 2021 granted equity to employees within the three months leading up to and including their IPO (for purposes of this Viewpoint, we refer to this group as “IPO awards”). Granting IPO awards can be beneficial to the company, equity recipients, and the new broader shareholder base. For the company, equity grants help facilitate the motivation and retention of key talent through a time of exciting considerable change. Such awards are also essential when a company seeks to hire key talent who will be critical to the future success of the newly public company. For employees, in addition to providing recognition for contributions toward a significant milestone and celebrating the private-to-public transition, they provide an initial or increased opportunity to become owners in the company. For shareholders, they provide direct alignment between management and shareholders, as the IPO price serves as a common baseline for aligning management’s rewards and shareholder returns.