Pension funds and institutional investors around the world have been allocating an increasing fraction of their assets under management to private equity (PE), venture capital (VC), and other types of private funds. Public pension funds tracked by Preqin, for example, have steadily increased their allocations to this asset class over the past decade, with the median allocation rising from 18.1% in 2010 to 30.3% in 2020, and 79% of investors stating that they expect to allocate a larger proportion of their funds to private equity by 2025.

In our paper, Private Equity and Venture Capital Fund Performance: Evidence from a Large Sample of Israeli Limited Partners, publicly available on SSRN, we study the performance of non-US based limited partners. The performance of non-US limited partners may differ from what has been documented for US limited partners for various reasons, such as differences in access to top performing funds, differences in skill or ability to select successful PE or VC fund general partners, and differences in fees.

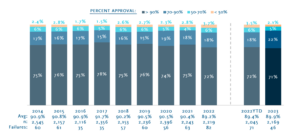

Our study relies on a unique and comprehensive data set of on all capital calls and distributions associated with investments in PE, VC, and other types of private funds for a 20-year period ending in December 2019 by the eight largest institutional investors in Israel, managing 76% of all retirement savings. This cash flow data constitutes part of the information that the institutions managing retirement savings are mandated to report to the Capital Market, Insurance, and Savings Authority at the Ministry of Finance. The data set is therefore free of survivorship and other biases documented in the literature in the context of some commercial data sources on PE and VC fund performance. Much like their peers elsewhere, institutional investors in Israel, including pension funds, life insurance plans, and other forms of long-term savings known as provident funds, have increased their allocations to illiquid assets from 12% of assets under management in 2010 to 17% in 2020. Their investments in PE, VC, and other types of private funds have increased from a mere 1% of their assets under management in 2010 to 5% in 2020. This increase in the allocation of funds to PE and other funds coincided with a dramatic increase of 250% in the total value of assets under management during this time period, driven by the introduction of mandatory retirement savings. As a result, the volume of investment by Israeli LPs in PE and other types of private funds has become economically large in absolute, not only relative, terms.

READ MORE »